Post-Intervention Analysis: HKD/USD And The Fall In Hong Kong Interest Rates

Table of Contents

The HKMA's Intervention and its Mechanisms

The Hong Kong Monetary Authority (HKMA) maintains the Hong Kong dollar (HKD) at a fixed exchange rate against the US dollar (USD) through a Linked Exchange Rate System (LERS). This system, a cornerstone of Hong Kong's monetary policy, operates within a narrow band against the USD. When the HKD weakens significantly, the HKMA intervenes to maintain the peg. This intervention typically involves buying US dollars in the market, injecting liquidity into the system.

The HKMA employs several tools for intervention:

- Buying/Selling US Dollars: The primary mechanism is buying US dollars to increase demand and support the HKD, and conversely selling USD to reduce HKD strength if needed.

- Impact of large-scale USD purchases on Hong Kong's monetary base: Large-scale purchases of USD increase Hong Kong's monetary base, leading to increased liquidity in the banking system.

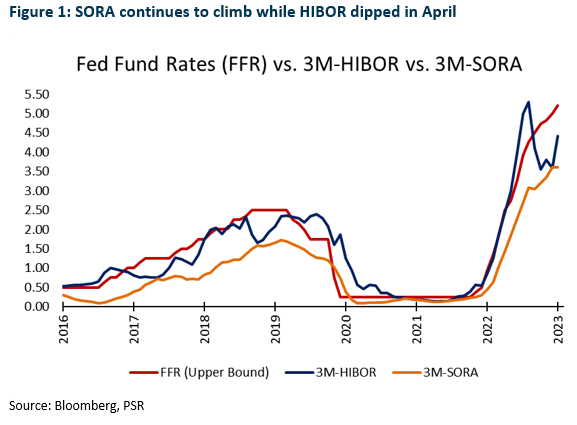

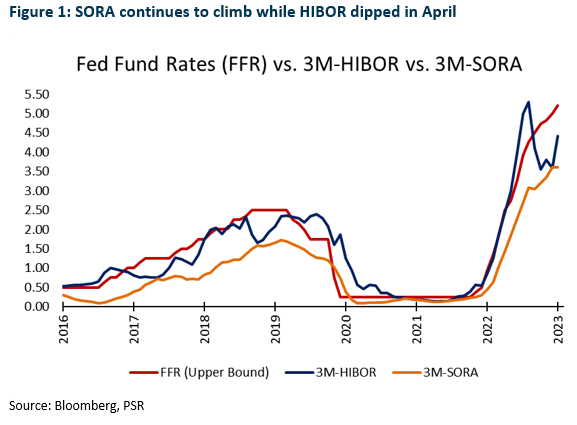

- Mechanism for influencing Hong Kong Interbank Offered Rate (HIBOR): This increased liquidity directly affects the Hong Kong Interbank Offered Rate (HIBOR), a key benchmark interest rate.

- Consequences of increased liquidity on lending rates: Lower HIBOR typically translates into lower lending rates for businesses and consumers.

Analysis of the HKD/USD Exchange Rate Movement

[Insert Chart showing HKD/USD exchange rate fluctuations during the relevant period]

The recent pressure on the HKD can be attributed to several factors:

- US interest rate hikes: Higher US interest rates make USD-denominated assets more attractive, potentially leading to capital outflows from Hong Kong and downward pressure on the HKD.

- Capital outflows: Global economic uncertainty or changes in investor sentiment can trigger capital flight, further weakening the HKD.

Analyzing the effectiveness of the HKMA's intervention requires examining:

- Effectiveness of the HKMA's intervention in stabilizing the HKD: The HKMA's actions aim to stabilize the HKD within the LERS band. The success is measured by how effectively the exchange rate is maintained.

- Potential short-term and long-term effects on the exchange rate: Short-term impacts may involve temporary volatility, while long-term effects could depend on sustained global economic conditions and investor confidence.

- Comparison with past interventions and their outcomes: Analyzing historical interventions helps gauge the current response's efficacy and potential future implications.

Impact on Hong Kong Interest Rates

The HKD/USD exchange rate and Hong Kong interest rates are intrinsically linked. When the HKMA intervenes to support the HKD, it increases the monetary base, leading to a decline in HIBOR and other benchmark interest rates. This fall in interest rates has significant implications:

- Impact on borrowing costs for businesses and consumers: Lower interest rates reduce borrowing costs, potentially stimulating investment and consumer spending.

- Consequences for the Hong Kong banking sector's profitability: Lower interest rates can squeeze the profitability of Hong Kong's banking sector, impacting net interest margins.

- Potential effects on investment and economic growth: Lower borrowing costs can spur economic activity, but excessive liquidity could also fuel inflation.

Economic Implications and Future Outlook

The HKMA's intervention has broad implications for the Hong Kong economy:

- Assessment of the impact on inflation: Increased liquidity can be inflationary, requiring careful monitoring by the HKMA.

- Potential effects on property prices and the real estate market: Low interest rates tend to support property prices, potentially exacerbating existing concerns about affordability.

- Predictions for future monetary policy decisions by the HKMA: The HKMA's future actions will depend on the evolving economic landscape, inflation pressures, and global monetary policy trends. Further analysis of the HKD/USD exchange rate and Hong Kong interest rate trajectories is crucial for predicting future HKMA decisions.

Conclusion: Post-Intervention Analysis: Key Takeaways and Future Directions

This post-intervention analysis highlights the complex interplay between the HKMA's actions, the HKD/USD exchange rate, and Hong Kong interest rates. Understanding this dynamic is critical for comprehending the implications for the Hong Kong economy and its integration within the global financial system. The effectiveness of the HKMA’s intervention in stabilizing the HKD and managing interest rates remains a subject for ongoing scrutiny.

To stay informed about future developments, we encourage you to continuously monitor the HKD/USD exchange rate and Hong Kong interest rates. Conduct further in-depth post-intervention analysis, follow the HKMA's official announcements, and subscribe to reputable financial news sources to gain a deeper understanding of future monetary policy decisions and their impact. Proactive monitoring of HKD/USD exchange rate analysis and the dynamics of the Hong Kong interest rate decline is key to navigating this evolving economic landscape.

Featured Posts

-

Another Aircraft Lost Second Us Navy Jet Goes Down Near Truman Carrier

May 08, 2025

Another Aircraft Lost Second Us Navy Jet Goes Down Near Truman Carrier

May 08, 2025 -

Angels Lose Despite Mike Trouts Two Home Runs

May 08, 2025

Angels Lose Despite Mike Trouts Two Home Runs

May 08, 2025 -

Vesprem Zapisha Desetta Po Red Pobeda So Triumf Nad Ps Zh

May 08, 2025

Vesprem Zapisha Desetta Po Red Pobeda So Triumf Nad Ps Zh

May 08, 2025 -

Path Of Exile 2 A Guide To Rogue Exiles

May 08, 2025

Path Of Exile 2 A Guide To Rogue Exiles

May 08, 2025 -

0 4

May 08, 2025

0 4

May 08, 2025

Latest Posts

-

A Whistle For Krypto Supermans Summer Special Next Week

May 08, 2025

A Whistle For Krypto Supermans Summer Special Next Week

May 08, 2025 -

Dc Comics July 2025 Superman Battles Darkseids Powerful Legion

May 08, 2025

Dc Comics July 2025 Superman Battles Darkseids Powerful Legion

May 08, 2025 -

Injured Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025

Injured Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025 -

Supermans Summer Special Kryptos Cameo Next Week

May 08, 2025

Supermans Summer Special Kryptos Cameo Next Week

May 08, 2025 -

Superman Vs Darkseids Legion Dc Comics July 2025 Solicitations

May 08, 2025

Superman Vs Darkseids Legion Dc Comics July 2025 Solicitations

May 08, 2025