Bill Ackman: Time Favors The US, Hurts China In Trade Dispute

Table of Contents

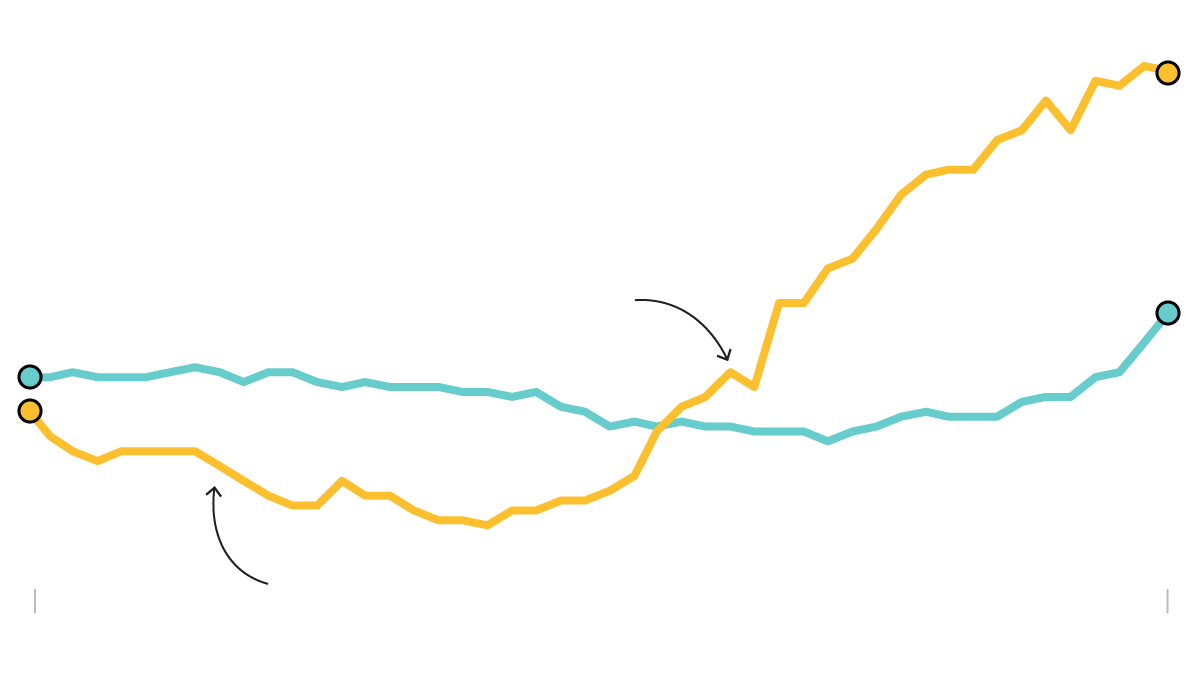

Billionaire investor Bill Ackman has weighed in on the escalating US-China trade dispute, arguing that time is on America's side. His analysis paints a compelling picture, suggesting that the US possesses inherent strengths that will ultimately prevail in this protracted conflict. This article will delve into Ackman's perspective, examining the underlying reasons behind his bullish stance on the US and exploring the implications for investors navigating this complex geopolitical landscape.

Ackman's Core Argument: Long-Term Strategic Advantages for the US

Ackman's central thesis posits that the US possesses inherent strengths that will ultimately give it the upper hand in the trade conflict with China. This isn't a short-term prediction, but rather a long-term strategic assessment based on fundamental differences between the two economies. He highlights several key factors contributing to this assessment:

-

Superior technological innovation and dominance in crucial sectors: The US maintains a significant lead in critical technologies like semiconductors, artificial intelligence (AI), and biotechnology. This technological edge provides a considerable advantage in the global marketplace and strengthens national security. China's efforts to catch up, while significant, face significant hurdles.

-

Stronger alliance networks and geopolitical influence: The US benefits from a vast network of allies and a strong global presence. This allows for greater coordination on trade policies and broader geopolitical strategies, giving it more leverage in negotiations and disputes. China's global influence, while growing, remains comparatively less established and often faces skepticism.

-

Deeper and more liquid capital markets: The US boasts the world's deepest and most liquid capital markets, providing access to vast amounts of capital for innovation and investment. This financial strength allows US companies to weather economic storms and invest aggressively in research and development. China's capital markets, while expanding, are still less developed and subject to greater government control.

-

More robust and resilient domestic economy: The US economy, despite its challenges, exhibits greater resilience and diversity compared to China's export-driven model. This internal strength makes it less vulnerable to external shocks, such as trade wars or global economic downturns.

-

Greater emphasis on free markets and individual liberties: While not directly related to trade, the emphasis on free markets and individual liberties in the US fosters innovation, entrepreneurship, and a more dynamic economic environment. This ultimately contributes to long-term economic competitiveness.

China's Vulnerabilities in the Prolonged Trade War

Conversely, Ackman likely identifies several vulnerabilities in China's position in this prolonged trade conflict:

-

Reliance on export-led growth: China's economy has historically relied heavily on exports. This makes it highly susceptible to trade restrictions imposed by the US and other countries. A prolonged trade war directly threatens this growth model.

-

Growing economic instability and challenges to its growth model: China's economic growth is slowing, and the country faces increasing internal challenges to maintain its previous trajectory. These internal pressures exacerbate its vulnerability to external pressures like trade disputes.

-

Increased capital flight and potential currency devaluation risks: Concerns about economic instability and the trade war have led to capital flight from China, putting pressure on its currency and potentially triggering further economic instability.

-

Concerns over transparency and intellectual property rights: Issues surrounding transparency and the protection of intellectual property rights continue to be major points of contention in US-China trade relations. These concerns undermine confidence and hinder foreign investment in China.

-

Challenges in maintaining social stability amidst economic slowdown: Economic slowdown can create social unrest, posing a significant challenge for the Chinese government. Maintaining stability amid these pressures adds another layer of complexity to its strategy in the trade war.

Investment Implications Based on Ackman's Analysis

Ackman's analysis suggests several investment implications:

-

Opportunities in US technology and innovation sectors: Companies in US technology and innovation sectors, particularly those less reliant on exports to China, are likely to benefit from this trade dispute.

-

Potential for defensive investment strategies in stable, domestically focused US companies: Investors might consider defensive strategies focused on stable, domestically focused US companies less exposed to the vagaries of global trade.

-

The need for diversification and careful risk management: Geopolitical uncertainty necessitates diversification and careful risk management. Investors shouldn't put all their eggs in one basket, regardless of their outlook on the trade war.

-

Analyzing the impact on specific industries: The impact of the trade war varies across industries. A detailed analysis is needed to understand the specific effects on sectors like manufacturing, agriculture, and technology.

-

Considering the potential for increased volatility in global markets: The US-China trade war has already increased market volatility, and this trend is likely to continue. Investors need to be prepared for this increased volatility.

Risks and Considerations: Not a Guaranteed Victory

While Ackman's perspective is compelling, it's crucial to acknowledge potential downsides:

-

Unexpected escalation of the trade conflict: The trade war could escalate unexpectedly, leading to unforeseen consequences for both economies.

-

Unforeseen economic shocks in either the US or China: Unforeseen economic shocks in either country could disrupt the predicted outcomes and create new challenges.

-

The possibility of unforeseen technological breakthroughs in China: While unlikely in the short term, significant technological breakthroughs in China could alter the balance of power.

-

Political instability and policy changes impacting the trade environment: Political instability or significant policy changes in either country could impact the trade environment and alter the trajectory of the dispute.

-

The need for continuous monitoring and adaptation of investment strategies: The situation is dynamic, requiring continuous monitoring and adjustments to investment strategies.

Conclusion

Bill Ackman's assessment of the US-China trade dispute underscores the long-term strategic advantages of the United States, highlighting China's vulnerabilities in a prolonged conflict. While acknowledging inherent risks, his analysis suggests opportunities for investors focused on US innovation and domestically-driven companies. However, navigating this complex landscape requires careful consideration of the potential for increased market volatility and the need for diversification.

Call to Action: Understanding Bill Ackman's perspective on the US-China trade war is crucial for informed investment decisions. Stay updated on this dynamic situation and refine your investment strategy based on the evolving geopolitical landscape. Consider seeking professional financial advice to navigate the complexities of this ongoing trade dispute.

Featured Posts

-

Licencia De Maternidad De Un Ano Para Tenistas Wta Un Avance Historico

Apr 27, 2025

Licencia De Maternidad De Un Ano Para Tenistas Wta Un Avance Historico

Apr 27, 2025 -

Ariana Grandes Dramatic Hair Transformation And Tattoo Reveal

Apr 27, 2025

Ariana Grandes Dramatic Hair Transformation And Tattoo Reveal

Apr 27, 2025 -

Albertas Oil Industry And The Anti Trump Divide In Canada

Apr 27, 2025

Albertas Oil Industry And The Anti Trump Divide In Canada

Apr 27, 2025 -

Thueringens Amphibien Und Reptilien Der Neue Atlas Ist Da

Apr 27, 2025

Thueringens Amphibien Und Reptilien Der Neue Atlas Ist Da

Apr 27, 2025 -

Jannik Sinners Doping Case Concludes

Apr 27, 2025

Jannik Sinners Doping Case Concludes

Apr 27, 2025

Latest Posts

-

The U S Dollar And Presidential Economic Policy A Case Study Of The Nixon Administration And Beyond

Apr 28, 2025

The U S Dollar And Presidential Economic Policy A Case Study Of The Nixon Administration And Beyond

Apr 28, 2025 -

Could The U S Dollar Experience Its Worst Start Since Nixon An Economic Assessment

Apr 28, 2025

Could The U S Dollar Experience Its Worst Start Since Nixon An Economic Assessment

Apr 28, 2025 -

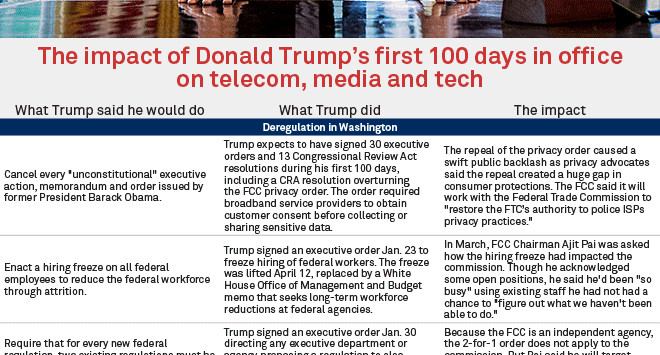

U S Dollars First 100 Days A Historical Perspective And Economic Forecast

Apr 28, 2025

U S Dollars First 100 Days A Historical Perspective And Economic Forecast

Apr 28, 2025 -

Analyzing The U S Dollars Performance A Comparison To The Nixon Presidency

Apr 28, 2025

Analyzing The U S Dollars Performance A Comparison To The Nixon Presidency

Apr 28, 2025 -

The U S Dollar A Troubled First 100 Days Under The Current Presidency

Apr 28, 2025

The U S Dollar A Troubled First 100 Days Under The Current Presidency

Apr 28, 2025