BBAI Stock: Analyst Downgrade Signals Growth Challenges For BigBear.ai

Table of Contents

Analyst Downgrade: Reasons and Implications

Specific Reasons for Downgrade

The analyst downgrade of BBAI stock cites several key concerns impacting the company's projected growth. These include:

-

Slower-than-anticipated revenue growth: The analyst report highlights a shortfall in revenue projections, suggesting that BigBear.ai is struggling to meet its financial targets. This could be attributed to various factors, including delays in contract awards and challenges in securing new business.

-

Decreased contract wins: The number of new contracts secured by BBAI has reportedly slowed, indicating a potential struggle to compete effectively in a rapidly evolving AI market. This could be due to increased competition, pricing pressures, or difficulties in demonstrating a clear return on investment for potential clients.

-

Intensified competition in the AI market: The AI sector is characterized by intense competition, with numerous established players and emerging startups vying for market share. BigBear.ai faces pressure from both large technology corporations and smaller, more agile competitors, potentially impacting its ability to secure and retain contracts.

-

Scaling challenges: As BigBear.ai aims to expand its operations and cater to a growing client base, it faces challenges in effectively scaling its infrastructure and resources. This could involve difficulties in recruiting and retaining talent, managing complex projects, and ensuring consistent service delivery.

Impact on BBAI Stock Price

The analyst downgrade has had a significant impact on BBAI's stock price. Following the announcement, the stock experienced a substantial percentage drop (insert percentage if available), reflecting a negative shift in investor sentiment. Trading volume also increased, suggesting heightened activity as investors reacted to the news. (Insert relevant chart or graph if available). The long-term impact remains uncertain and will depend on BigBear.ai's ability to address the concerns raised in the downgrade.

Comparison to Competitor Performance

To gain perspective, it's crucial to compare BBAI's performance and stock price movements to those of its competitors in the AI sector. (Insert comparison data and analysis here. For example, mention if competitors experienced similar downturns or if BBAI's decline was more pronounced). This comparative analysis provides valuable context for understanding the specific challenges facing BBAI and the broader trends within the AI market.

BigBear.ai's Growth Strategy and Future Outlook

Current Business Model and Strengths

BigBear.ai's business model centers around providing AI-powered solutions for national security and commercial clients. Its strengths lie in its expertise in specific AI applications, such as (list specific applications, e.g., data analytics, cybersecurity, predictive modeling), and its established relationships with key government and commercial partners. (Mention specific successful projects or contracts to showcase its capabilities and achievements).

Addressing Analyst Concerns

BigBear.ai will likely need to implement strategies to address the concerns raised in the analyst downgrade. This could involve:

-

Launching new products and services: Expanding its product portfolio to cater to evolving market demands and enhance its competitiveness.

-

Entering new markets or customer segments: Diversifying its client base to reduce reliance on a few key contracts and mitigate risks.

-

Improving operational efficiency: Implementing cost-cutting measures and streamlining processes to improve profitability.

-

Revising growth targets: Adjusting its growth strategies and targets to reflect the current market realities and address the concerns of investors.

Long-Term Potential and Risks

Despite the challenges, BigBear.ai still possesses significant long-term potential. The continued growth of the AI market presents substantial opportunities for expansion. However, risks remain, including:

-

Technological disruption: Rapid advancements in AI technology could render existing solutions obsolete.

-

Increased competition: The competitive landscape is dynamic, and new players may emerge, intensifying the pressure on BBAI.

-

Geopolitical factors: National security contracts are often subject to geopolitical influences which could impact revenue streams.

Investing in BBAI Stock: A Risk Assessment

Buy, Sell, or Hold Recommendation

Given the recent analyst downgrade and the challenges facing BigBear.ai, a cautious approach is warranted. (State a balanced perspective, such as "Hold" or "Accumulate cautiously," emphasizing that this is not financial advice). The decision to buy, sell, or hold BBAI stock should be based on a thorough assessment of the information presented, along with individual risk tolerance and investment goals.

Risk Tolerance and Investment Strategy

Investing in BBAI stock involves significant risk. Potential investors should carefully evaluate their risk tolerance and investment strategy before making any decisions. BBAI is a growth stock, inherently more volatile than established, mature companies.

Diversification and Portfolio Management

Diversification is crucial for managing risk in any investment portfolio. Investing in BBAI stock should be part of a broader strategy and not constitute a significant portion of an investor’s portfolio.

Conclusion: BBAI Stock: Navigating Uncertainty and Future Growth

The analyst downgrade of BBAI stock highlights significant challenges facing BigBear.ai, including slower revenue growth and increased competition. While the company possesses long-term potential in the growing AI market, investors must carefully weigh the potential risks and rewards before investing in BBAI Stock. Thorough research and professional financial advice are essential before making any investment decisions related to BBAI Stock Investment. Conduct your own due diligence and consult with a qualified financial advisor to determine if BBAI aligns with your investment strategy and risk tolerance. Remember, investing in BBAI stock involves substantial risk.

Featured Posts

-

Teletoon S Spring Lineup Jellystone And Pinata Smashling Highlight New Shows

May 21, 2025

Teletoon S Spring Lineup Jellystone And Pinata Smashling Highlight New Shows

May 21, 2025 -

Ea Fc 25 Fut Birthday Comprehensive Tier List And Card Analysis For Ultimate Team

May 21, 2025

Ea Fc 25 Fut Birthday Comprehensive Tier List And Card Analysis For Ultimate Team

May 21, 2025 -

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025 -

Big Bear Ai Bbai Analyzing The Reasons Behind The Significant Stock Decline

May 21, 2025

Big Bear Ai Bbai Analyzing The Reasons Behind The Significant Stock Decline

May 21, 2025 -

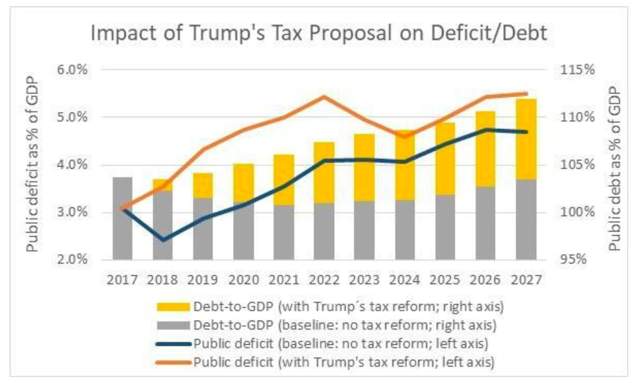

The Numbers Dont Lie Evaluating The Gop Tax Plans Impact On The Deficit

May 21, 2025

The Numbers Dont Lie Evaluating The Gop Tax Plans Impact On The Deficit

May 21, 2025

Latest Posts

-

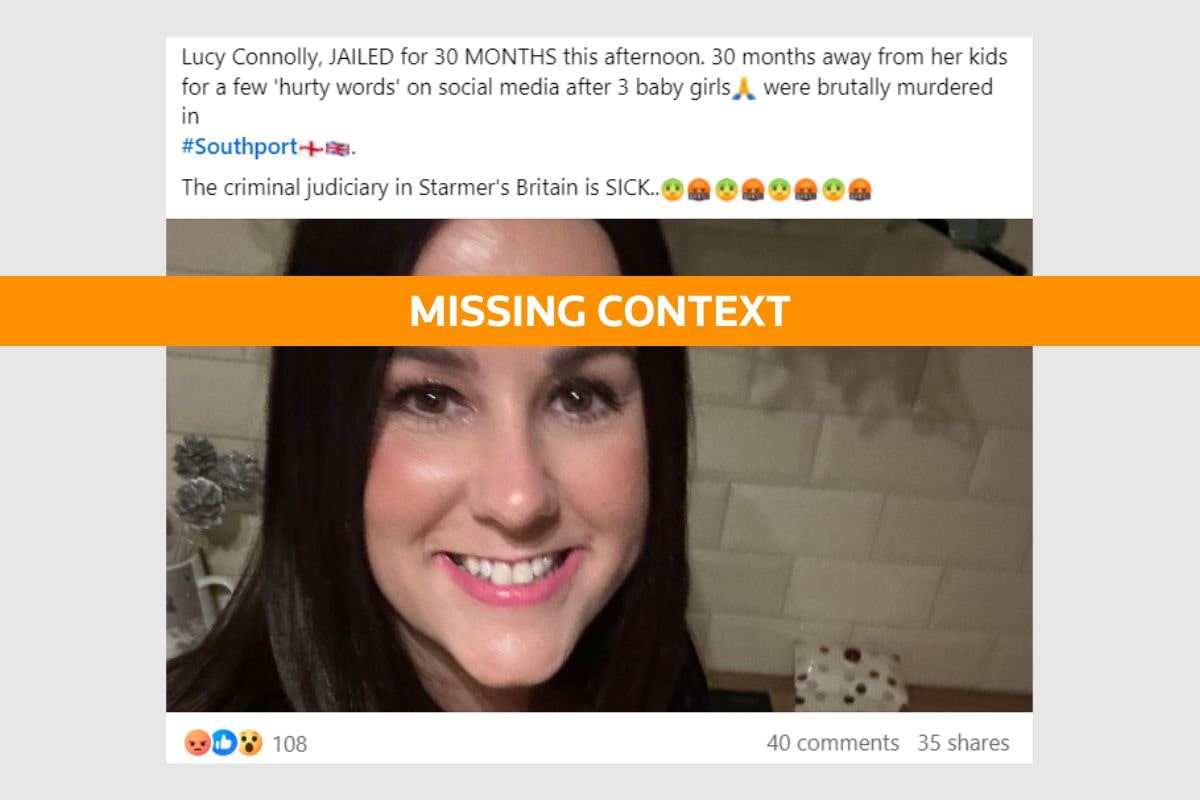

Update Ex Tory Councillors Wifes Appeal For Racial Hatred Tweet

May 22, 2025

Update Ex Tory Councillors Wifes Appeal For Racial Hatred Tweet

May 22, 2025 -

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025 -

Southport Stabbing Mothers Tweet Imprisonment And Housing Struggle

May 22, 2025

Southport Stabbing Mothers Tweet Imprisonment And Housing Struggle

May 22, 2025 -

Lucy Connolly Loses Appeal In Racial Hatred Case

May 22, 2025

Lucy Connolly Loses Appeal In Racial Hatred Case

May 22, 2025 -

Jail Time And Homelessness For Mother After Southport Stabbing Tweet

May 22, 2025

Jail Time And Homelessness For Mother After Southport Stabbing Tweet

May 22, 2025