BigBear.ai (BBAI): Analyzing The Reasons Behind The Significant Stock Decline

Table of Contents

Financial Performance and Revenue Shortfalls

BigBear.ai's recent financial reports paint a picture of significant struggles, directly contributing to the BBAI stock decline. Missed earnings expectations and a high debt load have eroded investor confidence.

Missed Earnings Expectations

BigBear.ai has consistently missed its earnings projections in recent quarters. This failure to meet expectations has severely impacted investor sentiment and led to a significant BBAI stock price drop.

- Q[Insert Quarter]: Reported EPS of $[Insert EPS], significantly below the projected $[Insert Projected EPS]. Revenue also fell short of projections by $[Insert Percentage]%. [Link to Financial Report]

- Q[Insert Quarter]: Similar underperformance was observed, with EPS at $[Insert EPS] against a projected $[Insert Projected EPS]. This continued trend fueled further negative sentiment regarding the BBAI stock. [Link to Financial News Article]

- These consistent shortfalls demonstrate a worrying trend in BigBear.ai's ability to translate its technological capabilities into consistent financial success, impacting the BBAI stock value.

High Debt Levels and Cash Burn Rate

BBAI's high debt levels and a substantial cash burn rate are further factors contributing to the stock decline. This unsustainable financial model raises serious concerns about the company's long-term viability.

- Debt-to-Equity Ratio: BBAI's debt-to-equity ratio is currently [Insert Ratio], indicating a high level of financial leverage and increased vulnerability to economic downturns.

- Cash Flow Statement: Negative cash flow from operations highlights the company's inability to generate sufficient cash to cover its expenses, further fueling the BBAI stock price drop. [Link to relevant financial data source]

- Cash Burn Rate: The company is burning through cash at an alarming rate, raising concerns about its ability to continue operations without further financing or significant cost-cutting measures. Understanding cash burn rate is crucial; it's the speed at which a company spends its cash reserves, and a high rate indicates potential financial instability.

Market Sentiment and Investor Concerns

Beyond the internal financial issues, external market factors and negative sentiment have also significantly impacted BBAI's stock price.

Negative News and Media Coverage

Negative news articles and media coverage have played a significant role in the BBAI stock decline. Negative press, often focusing on missed earnings and financial instability, has eroded investor confidence.

- [Link to Negative News Article 1]: This article highlighted [brief description of negative news], directly influencing investor perception of BBAI and the stock's performance.

- [Link to Negative News Article 2]: This report focused on [brief description of negative news], further contributing to the negative sentiment surrounding BBAI.

- The cumulative effect of these negative news stories has created a cycle of fear and uncertainty, driving down the BBAI stock price.

Increased Competition and Market Saturation

The increasing competition within the AI sector and market saturation are also significant challenges. BigBear.ai faces pressure from established industry giants and emerging startups.

- Key Competitors: Companies such as [List Key Competitors] present stiff competition, offering similar services and technologies.

- Market Share: BBAI's market share is [Insert Market Share Percentage], indicating a need for stronger differentiation and market penetration strategies.

- Rapid technological advancements in the AI field require continuous innovation and adaptation; failure to do so can lead to a loss of market share and impact the BBAI stock price negatively.

Internal Management and Strategic Issues

Internal management and strategic issues have also contributed to the BBAI stock decline. Leadership changes and operational inefficiencies have hampered the company's ability to execute its strategy effectively.

Leadership Changes and Strategic Shifts

Recent leadership changes and strategic shifts have created uncertainty and instability, negatively impacting investor confidence and the BBAI stock price.

- [Description of leadership changes and their impact].

- [Description of strategic shifts and their consequences].

- The lack of clear direction and consistent leadership has created further uncertainty for investors.

Operational Inefficiencies and Cost Management

Operational inefficiencies and challenges related to cost management are further contributing factors to the BBAI stock decline.

- [Specific examples of operational inefficiencies].

- [Analysis of cost structures and areas for improvement].

- Addressing these inefficiencies and improving cost management are crucial for restoring investor confidence and stabilizing the BBAI stock price.

Conclusion: Understanding and Navigating the BigBear.ai (BBAI) Stock Decline

BigBear.ai's (BBAI) stock decline is a result of a confluence of factors. Missed earnings, high debt levels, negative media coverage, increased competition, leadership changes, and operational inefficiencies have all played a significant role. The future outlook for BBAI remains uncertain, with potential for further decline depending on the company's ability to address these fundamental issues. However, successful strategic pivots and improved financial performance could serve as catalysts for recovery.

While the reasons behind BigBear.ai's (BBAI) stock decline are complex, understanding these factors is crucial for making informed investment choices. Continue your due diligence and carefully assess the risk before making any decisions related to BBAI stock. Monitoring the company's financial reports, news coverage, and competitive landscape will be vital in navigating the volatility surrounding the BBAI stock price drop.

Featured Posts

-

Bribery Scandal Rocks The Navy Retired Admirals Fall From Grace

May 21, 2025

Bribery Scandal Rocks The Navy Retired Admirals Fall From Grace

May 21, 2025 -

Open Ai Faces Ftc Investigation Analyzing The Potential Fallout For Chat Gpt And Ai

May 21, 2025

Open Ai Faces Ftc Investigation Analyzing The Potential Fallout For Chat Gpt And Ai

May 21, 2025 -

Giorgos Giakoumakis And Mls Understanding His Current Market Position

May 21, 2025

Giorgos Giakoumakis And Mls Understanding His Current Market Position

May 21, 2025 -

April 26 2025 Nyt Mini Crossword Puzzle Hints

May 21, 2025

April 26 2025 Nyt Mini Crossword Puzzle Hints

May 21, 2025 -

Juergen Klopp Anfield Return Before Liverpools Final Game

May 21, 2025

Juergen Klopp Anfield Return Before Liverpools Final Game

May 21, 2025

Latest Posts

-

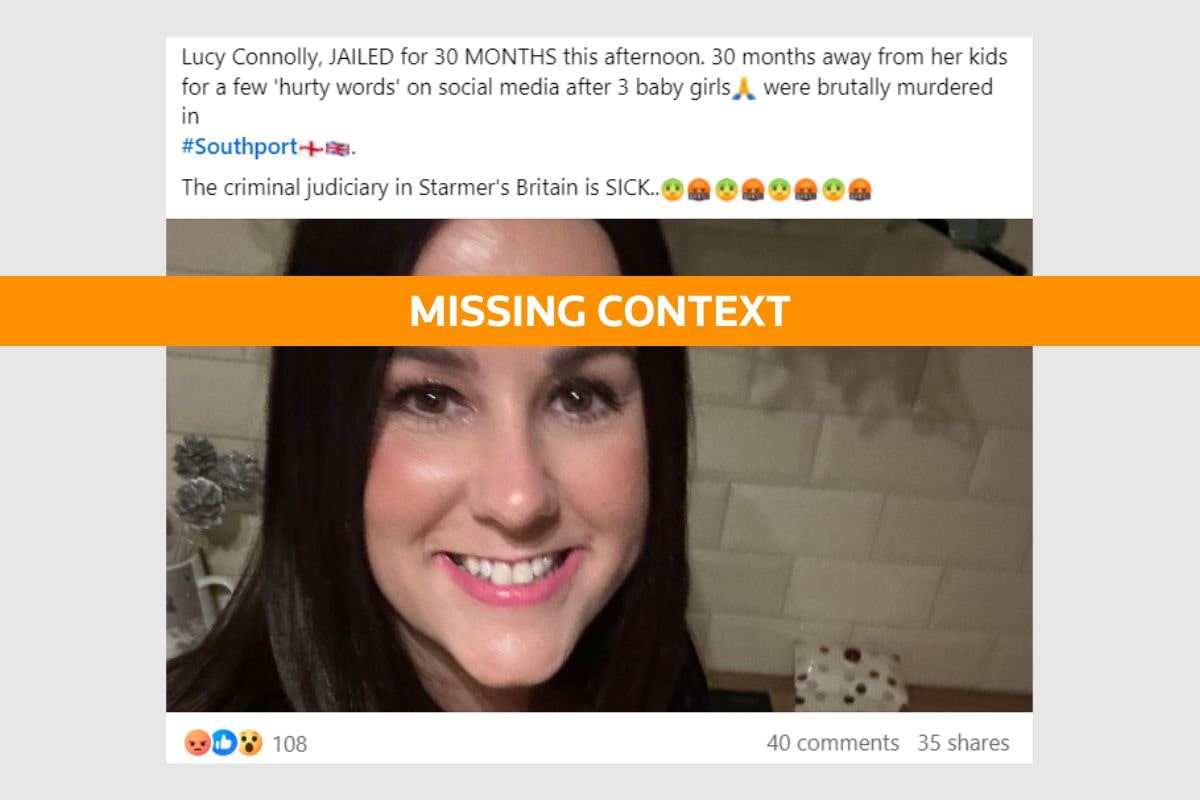

Lucy Connolly Loses Appeal In Racial Hatred Case

May 22, 2025

Lucy Connolly Loses Appeal In Racial Hatred Case

May 22, 2025 -

Jail Time And Homelessness For Mother After Southport Stabbing Tweet

May 22, 2025

Jail Time And Homelessness For Mother After Southport Stabbing Tweet

May 22, 2025 -

Detroit Tigers Impressive 8 6 Win Against The Rockies

May 22, 2025

Detroit Tigers Impressive 8 6 Win Against The Rockies

May 22, 2025 -

Update Ex Tory Councillors Wifes Appeal In Racial Hatred Tweet Case

May 22, 2025

Update Ex Tory Councillors Wifes Appeal In Racial Hatred Tweet Case

May 22, 2025 -

Tigers 8 Rockies 6 Analyzing The Upset

May 22, 2025

Tigers 8 Rockies 6 Analyzing The Upset

May 22, 2025