The Numbers Don't Lie: Evaluating The GOP Tax Plan's Impact On The Deficit

Table of Contents

Projected Revenue Changes Under the GOP Tax Plan

The GOP tax plan, enacted in 2017, significantly altered the US tax code. Its core feature was a substantial reduction in the corporate tax rate, from 35% to 21%. This, coupled with adjustments to individual income tax brackets and changes to deductions and credits, had a profound effect on projected government revenue.

- Corporate Tax Rate Reductions: The decrease from 35% to 21% was projected to significantly reduce corporate tax revenue.

- Individual Income Tax Bracket Adjustments: Changes to individual tax brackets, including standard deductions, impacted tax liabilities for millions of Americans.

- Changes to Deductions and Credits: Modifications to itemized deductions and various tax credits further influenced the overall revenue picture.

The Congressional Budget Office (CBO)[^1] and the Tax Policy Center[^2] offered varying projections, but both indicated substantial revenue losses in the short-term. These revenue losses, coupled with increased government spending, directly contributed to the widening budget deficit. Keywords like "tax cuts," "revenue projections," "fiscal impact," and "budget deficit" are central to understanding the immediate consequences.

Economic Growth Projections and Their Impact on the Deficit

Proponents of the GOP tax plan argued that the tax cuts would stimulate economic growth, ultimately offsetting the revenue losses through a larger tax base. This argument relies heavily on supply-side economics, suggesting that lower taxes incentivize investment and job creation, leading to increased GDP growth.

However, Keynesian economists presented counterarguments, emphasizing the potential for increased demand to drive inflation without substantial job creation. Different economic models produced varying results, highlighting the uncertainty surrounding the plan's impact on economic growth.

- Supply-side economics arguments: Focused on the idea that lower taxes would boost investment and productivity.

- Keynesian economic perspectives: Emphasized the potential for increased aggregate demand, potentially leading to inflation.

Factors beyond the tax plan itself, such as global economic conditions and interest rate fluctuations, further complicated the prediction of economic growth and its effect on the deficit. Keywords such as "economic growth," "stimulus," "fiscal multiplier," "GDP growth," and "national debt" are key to understanding these complex interactions.

Long-Term Implications of the GOP Tax Plan on the National Debt

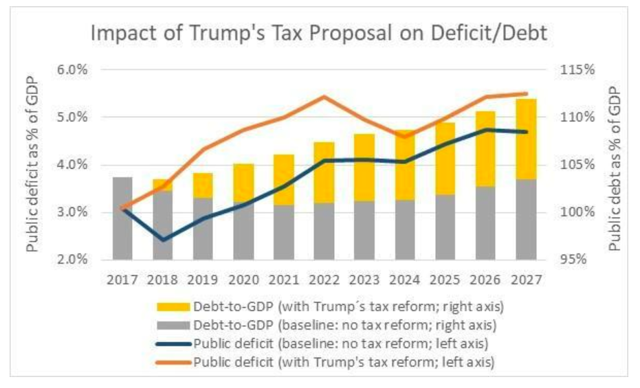

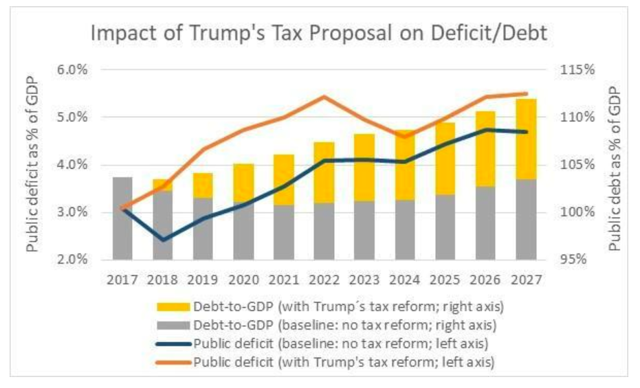

The long-term effects of the GOP tax plan on the national debt are significant and multifaceted. The initial revenue shortfall, coupled with potential long-term consequences of reduced government revenue, painted a concerning picture for fiscal sustainability. While immediate effects were felt quickly, the compounded interest on the growing debt created a snowball effect.

Projected debt levels over time, if charted, would visually demonstrate the escalating national debt. The increased national debt carries several potential risks:

- Increased borrowing costs: Higher debt levels can lead to increased interest rates, further straining the budget.

- Crowding out of private investment: Government borrowing can compete with private sector borrowing, potentially hindering economic growth.

- Reduced government services: Increased debt servicing may necessitate cuts in government spending on essential services.

Keywords like "national debt," "long-term debt," "fiscal sustainability," "debt ceiling," and "credit rating" are critical for understanding these long-term implications.

Comparing the GOP Tax Plan to Previous Tax Legislation

Analyzing the GOP tax plan within the context of historical tax legislation provides valuable perspective. Comparing its projected effects on the deficit with the outcomes of previous tax cuts and increases reveals potential patterns and lessons learned.

Historical data shows a complex relationship between tax policy changes and changes in the deficit. Some past tax cuts stimulated economic growth and led to increased tax revenue, while others resulted in significant increases to the deficit.

- Example 1: [Insert example of previous tax legislation and its effect]

- Example 2: [Insert another example of previous tax legislation and its effect]

The key here is to analyze the historical precedent and use keywords like "tax reform," "historical precedent," "fiscal history," and "tax policy" to contextualize the GOP plan’s impact.

Conclusion: Understanding the GOP Tax Plan's Impact on the Deficit

The GOP tax plan's impact on the national deficit is a complex issue with far-reaching consequences. While proponents argued for economic growth as a counterbalance to revenue losses, independent analyses revealed substantial revenue shortfalls and increased national debt. The long-term implications of increased debt, including higher interest rates and reduced government services, remain a significant concern. Data-driven analysis is crucial for objectively evaluating the economic consequences of such policies. Understanding the intricacies of the GOP tax plan and its potential impact on the national deficit is crucial for informed civic engagement. Continue researching the topic using credible sources to form your own conclusions about this complex issue. Further analysis on the GOP tax plan’s effect on the national deficit is needed to fully grasp its long-term repercussions.

[^1]: Congressional Budget Office. (Insert relevant CBO report link here) [^2]: Tax Policy Center. (Insert relevant Tax Policy Center report link here)

Featured Posts

-

Exploring The Sound Perimeter Music As A Unifying Element

May 21, 2025

Exploring The Sound Perimeter Music As A Unifying Element

May 21, 2025 -

The Rise Of Femicide Causes And Consequences

May 21, 2025

The Rise Of Femicide Causes And Consequences

May 21, 2025 -

Cinq Itineraires Velo Pour Decouvrir La Loire Le Vignoble Nantais Et L Estuaire

May 21, 2025

Cinq Itineraires Velo Pour Decouvrir La Loire Le Vignoble Nantais Et L Estuaire

May 21, 2025 -

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 21, 2025

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 21, 2025 -

Four Star Admirals Corruption Conviction A Deep Dive

May 21, 2025

Four Star Admirals Corruption Conviction A Deep Dive

May 21, 2025

Latest Posts

-

Winter Weather Advisory Planning For School Cancellations And Delays

May 21, 2025

Winter Weather Advisory Planning For School Cancellations And Delays

May 21, 2025 -

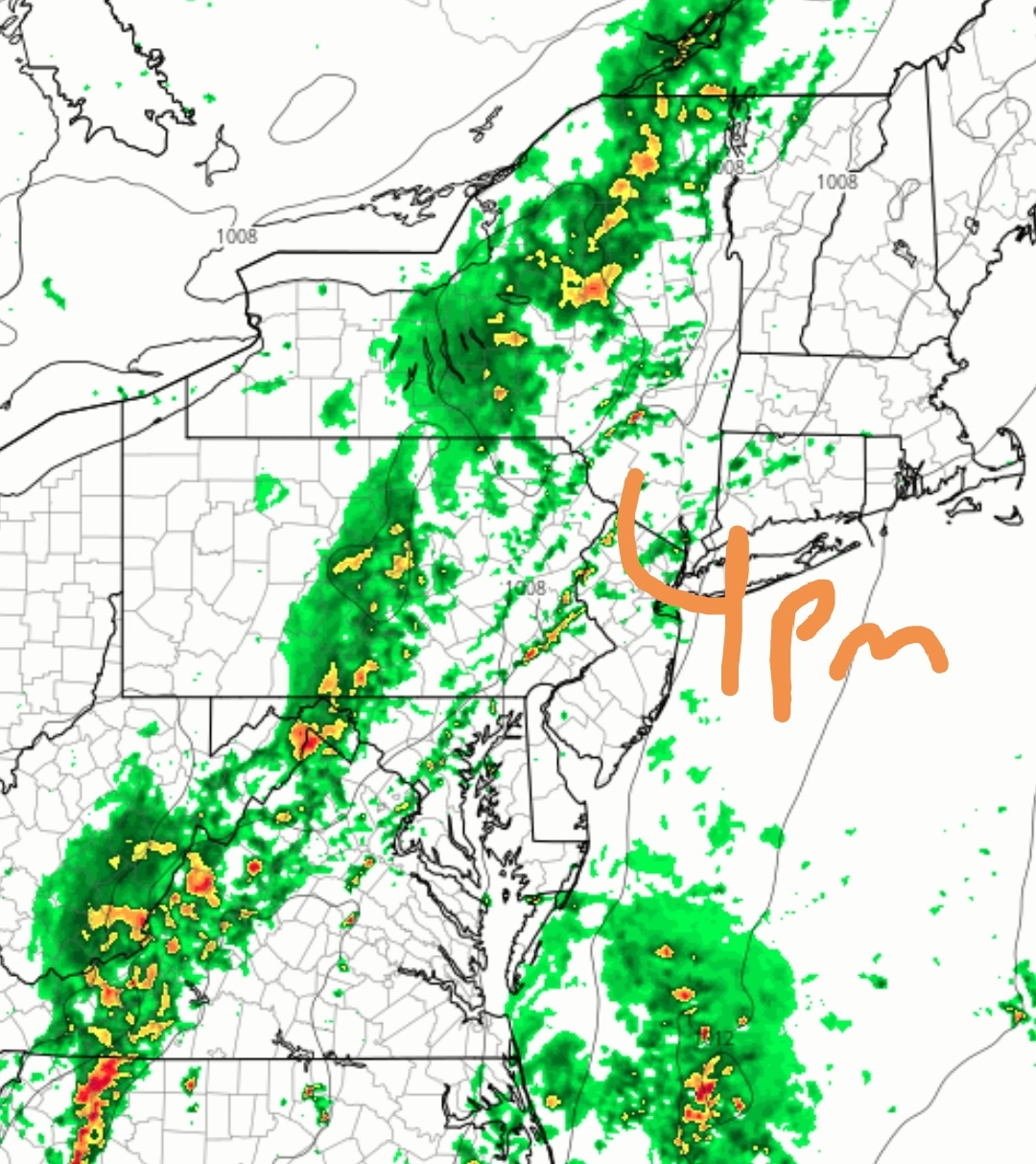

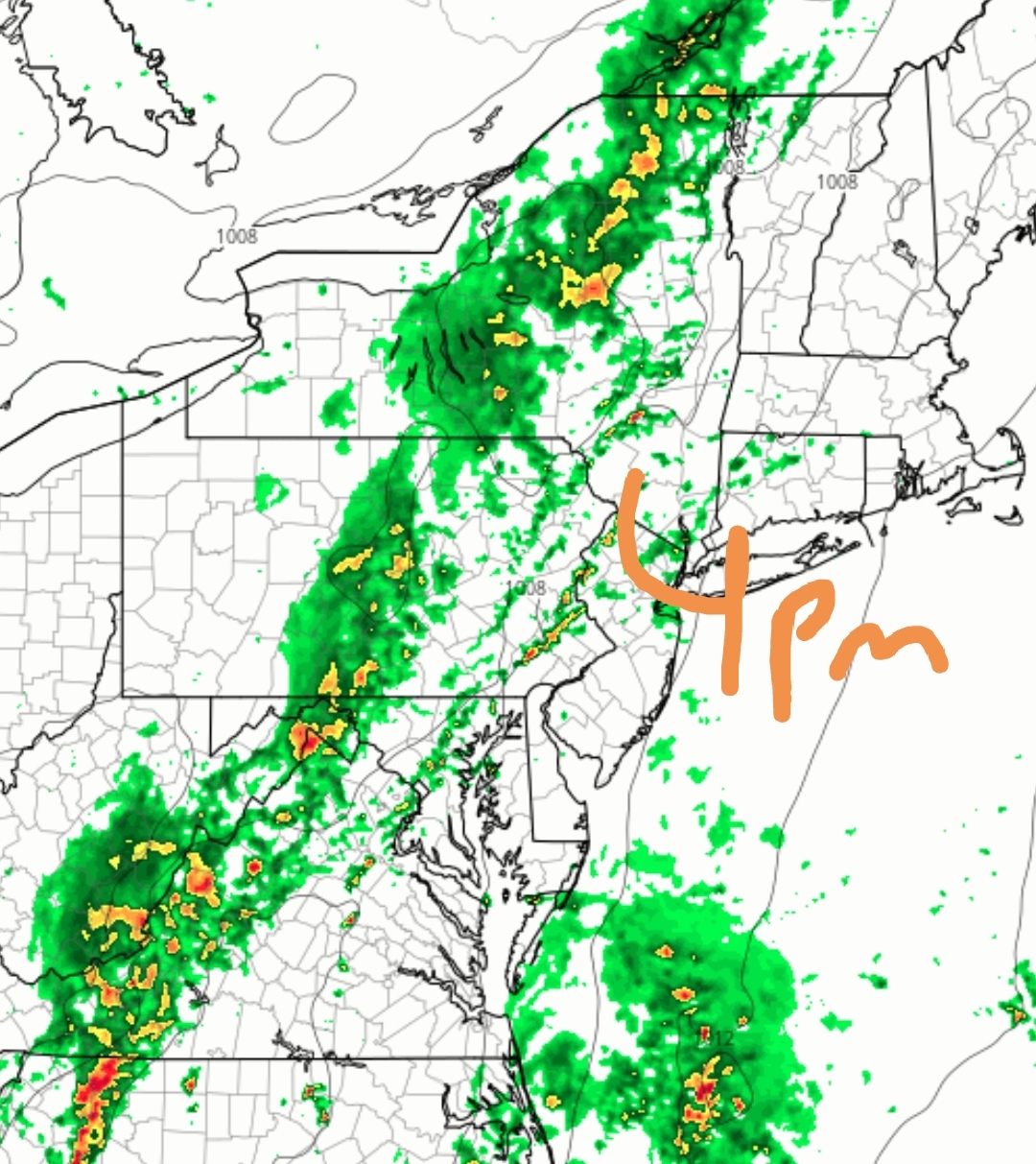

Updated Rain Forecast Precise Timing Of Showers

May 21, 2025

Updated Rain Forecast Precise Timing Of Showers

May 21, 2025 -

How Winter Weather Impacts School Decisions Delays And Closures Explained

May 21, 2025

How Winter Weather Impacts School Decisions Delays And Closures Explained

May 21, 2025 -

The 12 Most Popular Ai Stocks On Reddit A Guide For Investors

May 21, 2025

The 12 Most Popular Ai Stocks On Reddit A Guide For Investors

May 21, 2025 -

Precise Rain Predictions Updated Forecasts For On Off Showers

May 21, 2025

Precise Rain Predictions Updated Forecasts For On Off Showers

May 21, 2025