Bank Of Canada Interest Rate Outlook: Job Losses And The Potential For Further Cuts

Table of Contents

Current Economic Situation and Rising Unemployment

The Canadian economy is facing headwinds. Recent job loss figures reveal a troubling trend, with significant declines across several key sectors. The Canadian unemployment rate has increased, signaling a weakening labour market. This economic slowdown Canada is driven by a confluence of factors, including the lingering effects of global economic uncertainty, persistent inflation, and sector-specific challenges. The economic slowdown Canada is impacting various sectors, while inflation Canada continues to put pressure on household budgets.

- Manufacturing sector: Saw a 2% decline in employment in the last quarter.

- Construction sector: Experienced a 1.5% decrease in jobs, reflecting reduced investment in new projects.

- The unemployment rate: Increased by 0.7% in the last quarter, reaching a level of 5.5%.

- Regional impact: Atlantic Canada and Ontario experienced the most significant job losses.

These job losses in Canada are not isolated incidents but rather symptoms of a broader economic slowdown. Understanding the depth and breadth of this job losses Canada situation is crucial in assessing the need for further monetary policy intervention.

The Bank of Canada's Mandate and Policy Tools

The Bank of Canada operates under a dual mandate: maintaining price stability and fostering full employment. Achieving full employment target is a key objective, and the current rise in unemployment directly challenges this goal. The Bank utilizes various monetary policy tools, with interest rate cuts being a primary mechanism to stimulate economic activity during periods of low growth and high unemployment. Lowering interest rates aims to encourage borrowing, investment, and consumer spending, ultimately boosting economic output and reducing Canadian unemployment rate.

However, interest rate cuts are not a panacea. The Bank of Canada must carefully consider the potential side effects, primarily the risk of increased inflation. The Bank of Canada monetary policy requires a delicate balance between stimulating growth and controlling inflation. The inflation target set by the Bank acts as a constraint on the extent to which interest rates can be lowered.

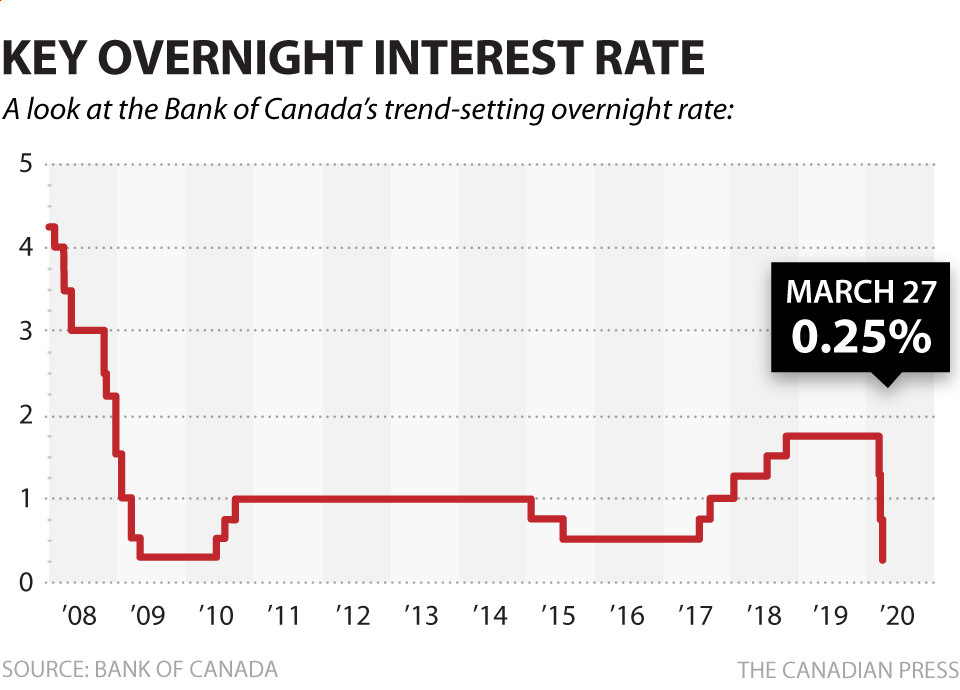

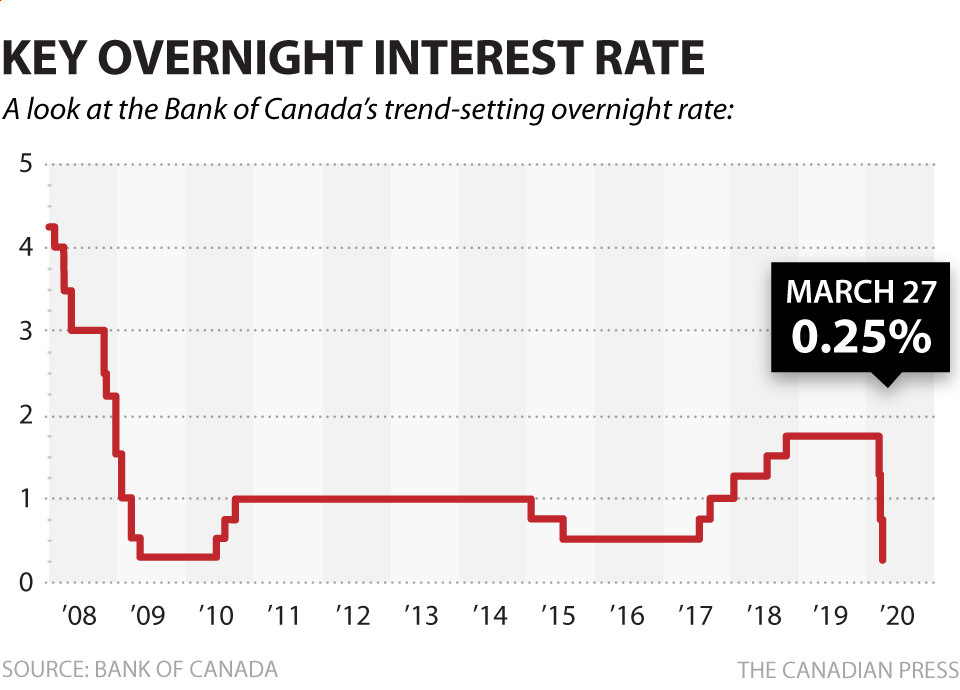

Historical Precedents: Interest Rate Responses to Recessions

History offers valuable insights into the Bank of Canada's response to economic downturns. During previous recessions, such as the 2008-2009 financial crisis, the Bank significantly lowered interest rates to mitigate the impact on employment and stimulate economic recovery. Examining the Bank of Canada interest rate history during these periods reveals the effectiveness of rate cuts in promoting economic growth following a period of recession Canada. Analyzing the effectiveness of these past interventions provides valuable insights for assessing the current situation and potential future policy decisions, particularly as the country tries to recover from the period of economic recovery.

Market Predictions and Analyst Opinions on Future Interest Rate Changes

Financial analysts and economists offer diverse opinions on the likelihood of further Bank of Canada interest rate cuts. Some believe that given the rising unemployment and economic slowdown, further reductions are necessary to avert a deeper recession. Others are more cautious, citing concerns about potential inflationary pressures. This divergence in opinion highlights the complexity of the situation and the uncertainties inherent in economic forecasting. The Bank of Canada interest rate forecast remains uncertain, and analyzing the range of predictions helps to understand the potential scenarios. Several economists predict further rate cuts, while others are more concerned about inflation and its effect on the economic outlook Canada. Analyzing reputable sources and predictions provides a balanced view of the situation.

Potential Impacts of Further Interest Rate Cuts

Further interest rate cuts could have both positive and negative consequences.

Potential Positive Impacts:

- Increased consumer spending due to lower borrowing costs.

- Potential for increased investment and business activity.

- Stimulation of the housing market, potentially increasing construction employment.

Potential Negative Impacts:

- Risk of fueling inflation, eroding purchasing power.

- Risk of creating unsustainable asset bubbles in the housing or stock markets.

- Potential devaluation of the Canadian dollar.

The Bank of Canada will need to carefully weigh these competing risks when deciding on its next move. The impact on economic stimulus needs to be carefully weighed against inflation risks and the potential creation of asset price inflation.

Conclusion: The Bank of Canada Interest Rate Outlook: What to Expect Next

The current economic climate, marked by rising unemployment and a slowing economy, puts significant pressure on the Bank of Canada to consider further interest rate cuts. However, the decision will be complex, balancing the need to stimulate growth and reduce job losses against the risk of increased inflation. The Bank of Canada interest rate outlook remains uncertain, with varying predictions from market analysts. Staying informed about the Bank's decisions and monitoring key economic indicators like employment and inflation is crucial. To stay updated on the Bank of Canada interest rate outlook and its implications for the Canadian economy, regularly check our site for the latest analysis and insights on potential interest rate cuts and their impact on the Canadian economy. [Link to relevant resource]

Featured Posts

-

Barry Bonds Takes A Shot At Shohei Ohtani Analyzing The Criticism

May 14, 2025

Barry Bonds Takes A Shot At Shohei Ohtani Analyzing The Criticism

May 14, 2025 -

England Stars Brother Set For Man Utd Impact

May 14, 2025

England Stars Brother Set For Man Utd Impact

May 14, 2025 -

Analyzing A Failed Snow White Themed Birthday Party In Spain

May 14, 2025

Analyzing A Failed Snow White Themed Birthday Party In Spain

May 14, 2025 -

Digital Release Of Captain America Brave New World Streaming Options And Physical Media

May 14, 2025

Digital Release Of Captain America Brave New World Streaming Options And Physical Media

May 14, 2025 -

Disney Streaming Release Captain America Brave New World

May 14, 2025

Disney Streaming Release Captain America Brave New World

May 14, 2025

Latest Posts

-

E Toros 500 Million Ipo Push A Deep Dive

May 14, 2025

E Toros 500 Million Ipo Push A Deep Dive

May 14, 2025 -

Klarna Seeks 1 Billion In Funding Before Potential Ipo Next Week

May 14, 2025

Klarna Seeks 1 Billion In Funding Before Potential Ipo Next Week

May 14, 2025 -

Affirm Afrm Ipo Delay A Case Study Of The Impact Of Trump Tariffs On Fintech

May 14, 2025

Affirm Afrm Ipo Delay A Case Study Of The Impact Of Trump Tariffs On Fintech

May 14, 2025 -

Klarna Ipo 1 Billion Funding And Next Weeks Potential Listing

May 14, 2025

Klarna Ipo 1 Billion Funding And Next Weeks Potential Listing

May 14, 2025 -

The Trump Tariff Effect A Deep Dive Into The Delayed Affirm Afrm Ipo

May 14, 2025

The Trump Tariff Effect A Deep Dive Into The Delayed Affirm Afrm Ipo

May 14, 2025