EToro's $500 Million IPO Push: A Deep Dive

Table of Contents

eToro's Market Position and Competitive Landscape

eToro occupies a prominent position in the social trading and investment space, though defining precise market share is challenging due to the fragmented nature of the industry. Key competitors include established players like Robinhood, Interactive Brokers, and Trading 212, each with its own strengths and weaknesses. eToro's competitive advantages lie in its innovative copy trading feature, which allows less experienced investors to mirror the trades of successful traders. Its comprehensive educational resources and diverse asset offerings, including cryptocurrencies, also contribute to its appeal.

- Market leadership in specific regions: eToro enjoys significant market share in certain European and emerging markets.

- Unique features compared to competitors: Copy trading remains a key differentiator, setting eToro apart from many competitors.

- Strengths and weaknesses in its market strategy: While its social trading aspect is a strength, its expansion into new markets might face challenges from established local players.

- Potential for market disruption or consolidation: The fintech landscape is dynamic, with potential for mergers, acquisitions, and disruptive innovations constantly reshaping the competitive landscape. The success of eToro's IPO could influence future consolidation within the social trading sector.

eToro's Financial Performance and Projections

eToro's recent financial performance is crucial to assessing the viability of its IPO. While specific figures are often kept private before an IPO, publicly available information will need to demonstrate robust revenue growth, increasing user numbers, and ideally, profitability. Market volatility and regulatory changes are significant factors influencing their financial health. For instance, periods of high market volatility can increase trading activity but may also lead to increased risk for both the platform and its users.

- Key financial metrics (revenue growth, net income, user acquisition costs): Investors will scrutinize these metrics to gauge the platform's long-term sustainability and profitability.

- Analysis of profitability margins: High user acquisition costs can negatively impact profitability, a factor that investors will carefully consider.

- Impact of regulatory compliance on financial performance: Meeting regulatory requirements, especially concerning anti-money laundering and know-your-customer (KYC) regulations, impacts operational costs.

- Growth potential based on market expansion plans: eToro's future growth hinges on its ability to expand into new markets and attract new user segments.

Regulatory Environment and Potential Challenges

The regulatory landscape for fintech companies is complex and ever-evolving. eToro operates in multiple jurisdictions, each with its unique set of regulations. Navigating these complexities, and demonstrating compliance, is paramount for a successful IPO. Non-compliance can lead to significant financial penalties and reputational damage.

- Key regulatory bodies and their impact: Agencies like the FCA (UK), CySEC (Cyprus), and ASIC (Australia) have significant influence on eToro's operations.

- Potential legal and compliance challenges: Data privacy regulations (GDPR), anti-money laundering (AML) rules, and other compliance requirements present ongoing challenges.

- Risk assessment and mitigation strategies: eToro needs to demonstrate robust risk management protocols to address potential legal and regulatory issues.

- Impact of changing regulatory frameworks on future growth: Future regulatory changes could affect eToro's business model and profitability, posing risks to investors.

Investor Sentiment and Market Conditions

Investor sentiment towards fintech IPOs is highly volatile, influenced by broader macroeconomic factors like interest rates, inflation, and overall market confidence. A strong, positive investor sentiment is essential for a successful IPO. Market volatility can significantly impact the IPO valuation, potentially reducing the amount of capital raised.

- Current market trends affecting investor confidence: Geopolitical events, economic downturns, and changes in investor risk appetite all influence the IPO market.

- Valuation considerations and comparisons to similar IPOs: eToro's valuation will be compared to similar companies that have gone public recently.

- Potential impact of economic downturns: Recessions or economic slowdowns can significantly reduce investor interest in high-growth, high-risk investments.

- Factors driving investor demand or reluctance: Strong financial performance, a clear growth strategy, and a robust regulatory compliance record will attract investor interest.

Conclusion

The success of eToro's $500 million IPO push depends on a delicate interplay of factors. While eToro benefits from a strong brand, innovative features, and a presence in a rapidly growing market, challenges remain. These include intense competition, regulatory hurdles, and the inherent volatility of the fintech investment landscape. A strong financial performance, positive investor sentiment, and effective navigation of the regulatory environment are crucial for a successful IPO. The potential for significant returns attracts attention, but the inherent risks need careful consideration.

Call to Action: Stay informed about the developments surrounding eToro's IPO and the future of social trading. Follow our blog for updates on the eToro IPO and other significant events in the fintech industry. Keep up-to-date on all things related to the eToro $500 million IPO.

Featured Posts

-

Dubai Tennis Championships Raducanus Early Exit

May 14, 2025

Dubai Tennis Championships Raducanus Early Exit

May 14, 2025 -

Michigan Great Value Recall What You Need To Know

May 14, 2025

Michigan Great Value Recall What You Need To Know

May 14, 2025 -

Bahnverbindungen Ab Oschatz Direkt In Die Saechsische Schweiz

May 14, 2025

Bahnverbindungen Ab Oschatz Direkt In Die Saechsische Schweiz

May 14, 2025 -

Tommy Furys Risky Stage Appearance A Look At The Fallout With Molly Mae

May 14, 2025

Tommy Furys Risky Stage Appearance A Look At The Fallout With Molly Mae

May 14, 2025 -

Federers Honorary Role At The Le Mans Race

May 14, 2025

Federers Honorary Role At The Le Mans Race

May 14, 2025

Latest Posts

-

Wynonna And Ashley Judd Open Up About Family Life In Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up About Family Life In Docuseries

May 14, 2025 -

Wynonna And Ashley Judd Share Intimate Family Details In New Documentary

May 14, 2025

Wynonna And Ashley Judd Share Intimate Family Details In New Documentary

May 14, 2025 -

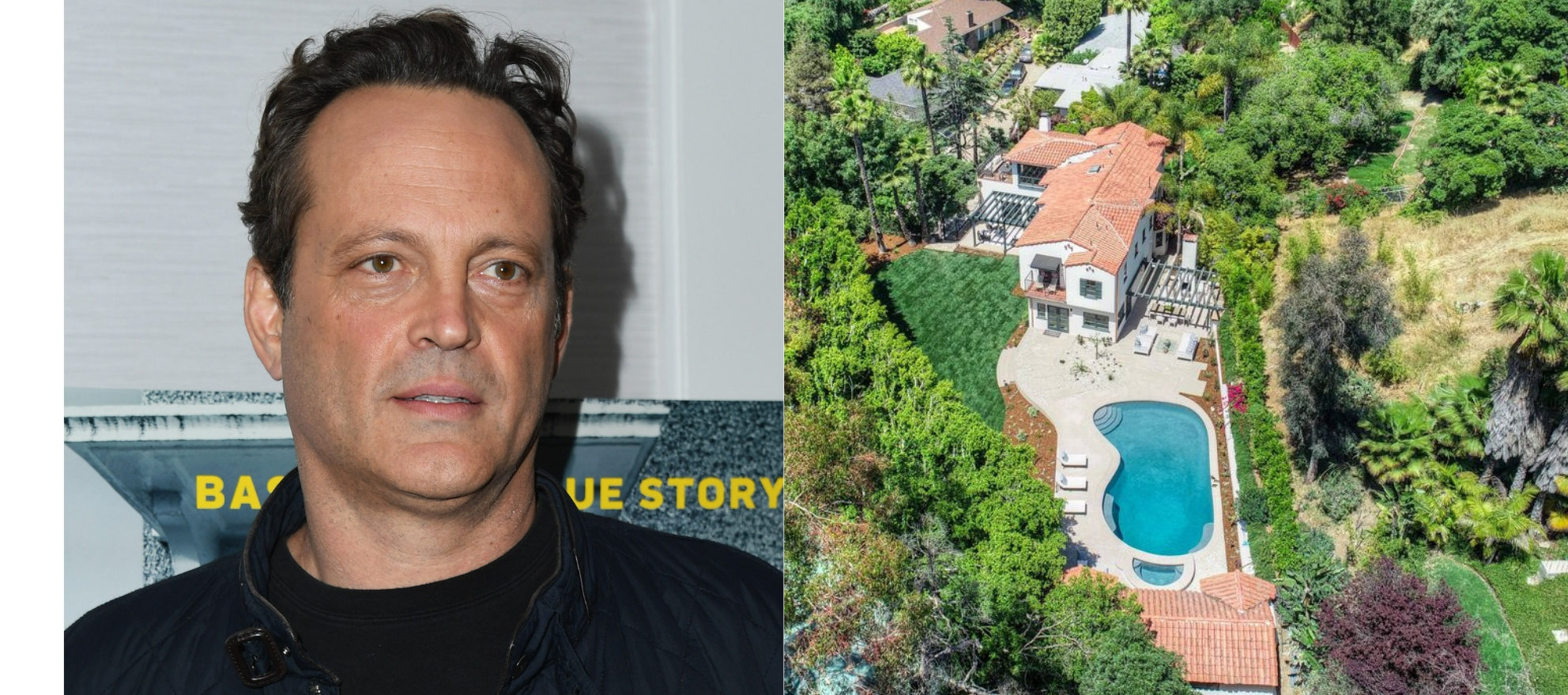

The Reality Of Vince Vaughns Italian Ancestry

May 14, 2025

The Reality Of Vince Vaughns Italian Ancestry

May 14, 2025 -

Judd Sisters Docuseries Uncovering Family History And Challenges

May 14, 2025

Judd Sisters Docuseries Uncovering Family History And Challenges

May 14, 2025 -

Exploring Vince Vaughns Family Roots And Ethnicity

May 14, 2025

Exploring Vince Vaughns Family Roots And Ethnicity

May 14, 2025