Klarna Seeks $1 Billion In Funding Before Potential IPO Next Week

Table of Contents

The Urgency Behind Klarna's Funding Round

Klarna's pursuit of this substantial funding round so close to a potential IPO raises several key questions about the company's strategy and the current market conditions. The keywords here are Klarna funding, IPO timing, market conditions, and investor confidence.

-

Bolstering the Balance Sheet: The need for additional capital before the IPO likely reflects a strategic decision to significantly strengthen Klarna's balance sheet. This demonstrates financial resilience to potential investors, thereby increasing confidence in the company's stability and long-term prospects. A robust balance sheet is crucial in navigating market fluctuations and potential economic downturns.

-

Navigating Market Volatility: Current market volatility and economic uncertainty are undoubtedly influencing the timing of this funding round. Securing significant funding beforehand mitigates the risk of unfavorable market conditions impacting the IPO valuation and overall success. This proactive approach aims to attract investors even amidst a potentially challenging economic climate.

-

Enhancing Valuation and Attracting Investors: Securing a billion-dollar funding round before the IPO could dramatically enhance Klarna's valuation. A higher valuation attracts more investors and potentially commands a higher share price during the IPO. This pre-IPO funding acts as a powerful signal of market confidence in the company's future growth.

-

Fueling Future Growth and Expansion: The substantial capital injection can be strategically utilized to further expand Klarna's operations globally, invest in cutting-edge technology to improve its platform and services, and potentially acquire smaller competitors to consolidate its market share in the burgeoning BNPL sector.

Potential Investors and Investment Terms

Identifying the specific investors participating in this funding round is crucial for understanding the dynamics at play. Key terms here include Klarna investors, investment terms, valuation, private equity, and venture capital.

-

Potential Investor Profiles: While specifics remain undisclosed, potential investors are likely to include a mix of established venture capital firms, private equity investors, and possibly even strategic investors within the fintech or retail sectors. These investors possess the financial capacity and industry expertise to contribute significantly to Klarna's growth.

-

Investment Terms and Valuation: The investment terms will likely involve a substantial equity stake offered in exchange for the $1 billion investment. The valuation placed on Klarna will be a key indicator of investor confidence and market perception of the company’s future potential. A high valuation would demonstrate strong investor belief in Klarna's long-term growth.

-

Implications for Future Growth and Profitability: The terms of this funding round will have a direct impact on Klarna’s future trajectory. The equity dilution will need to be balanced against the benefits of the additional capital. The successful management of this balance will be crucial for sustaining profitable growth.

-

Existing Investor Involvement: Existing investors in Klarna are expected to participate in this funding round to maintain their equity stake and demonstrate continued confidence in the company's future performance.

Implications of the Funding for Klarna's IPO

The successful completion of this funding round will have a profound impact on Klarna's impending IPO. Keywords here include Klarna IPO, stock market, valuation, market performance, and BNPL sector.

-

Impact on IPO Valuation: The influx of capital will undoubtedly boost Klarna's valuation ahead of the IPO, potentially leading to a higher initial share price. This increased valuation reflects investor confidence and the company's improved financial position.

-

Influence on IPO Timing: The timing of the IPO might be influenced by the successful completion of this funding round. A successful round strengthens the argument for a timely IPO, allowing Klarna to capitalize on market momentum.

-

Market Conditions and BNPL Sector Performance: The broader market conditions, especially the performance of other BNPL companies, will play a significant role in determining the success of Klarna's IPO. The success of comparable IPOs in the sector will set the tone for investor sentiment toward Klarna.

-

Potential Risks and Challenges: Despite the positive aspects, economic uncertainty and regulatory changes within the BNPL sector pose potential risks to Klarna's IPO. These challenges will need to be addressed in the IPO prospectus and considered by potential investors.

The Future of Klarna and the BNPL Market

Looking ahead, Klarna's future within the dynamic BNPL market is intertwined with broader industry trends and its own strategic decisions. Keywords here include Klarna future, BNPL growth, competition, market trends, and fintech innovation.

-

Long-Term Prospects in the BNPL Market: The BNPL market is experiencing rapid growth, presenting significant opportunities for Klarna. However, maintaining a leading position requires continuous innovation and strategic adaptation.

-

Competitive Landscape: Klarna faces intense competition from other established and emerging BNPL providers. Maintaining a competitive edge requires continued investment in technology and a focus on customer experience.

-

Regulatory Changes: The regulatory landscape for BNPL services is evolving globally. Klarna needs to navigate these changes effectively to ensure long-term compliance and sustainability.

-

Future Innovation and Growth: Klarna’s future success depends on its ability to innovate and expand its service offerings, potentially exploring new markets and integrating with other financial services.

Conclusion

Klarna's pursuit of a $1 billion funding round ahead of its anticipated IPO underscores the company's strategic ambition and the considerable financial stakes involved. While this move strengthens its position, it also highlights the challenges and uncertainties in the current market environment for fintech companies. The success of this funding round and the subsequent IPO will be closely watched by investors and industry analysts alike.

Call to Action: Stay informed about the latest developments in Klarna's funding and IPO journey. Follow us for continuous updates on Klarna and the ever-evolving BNPL market. Learn more about Klarna's financial performance and investment prospects.

Featured Posts

-

Sinner Advances To Italian Open Round Of 16 Osaka Exits

May 14, 2025

Sinner Advances To Italian Open Round Of 16 Osaka Exits

May 14, 2025 -

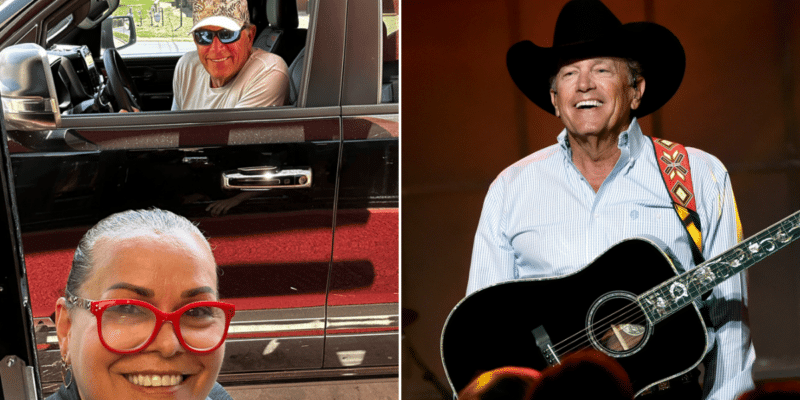

George Straits Drive Thru Selfie A Fans Unforgettable Encounter

May 14, 2025

George Straits Drive Thru Selfie A Fans Unforgettable Encounter

May 14, 2025 -

Klarna Ipo 1 Billion Funding And Next Weeks Potential Listing

May 14, 2025

Klarna Ipo 1 Billion Funding And Next Weeks Potential Listing

May 14, 2025 -

El Sevilla Fc Despide A Garcia Pimienta Y Nombra A Joaquin Caparros

May 14, 2025

El Sevilla Fc Despide A Garcia Pimienta Y Nombra A Joaquin Caparros

May 14, 2025 -

Madrid Open Potapova Defeats Zheng Qinwen In Surprise Result

May 14, 2025

Madrid Open Potapova Defeats Zheng Qinwen In Surprise Result

May 14, 2025

Latest Posts

-

Gary Linekers Ruben Dias Joke Sparks Maya Jamas Fury

May 14, 2025

Gary Linekers Ruben Dias Joke Sparks Maya Jamas Fury

May 14, 2025 -

Understanding Maya Jamas Perspective On Past Relationship Issues

May 14, 2025

Understanding Maya Jamas Perspective On Past Relationship Issues

May 14, 2025 -

Maya Jamas Simple Skincare Fresh Face Busy Schedule

May 14, 2025

Maya Jamas Simple Skincare Fresh Face Busy Schedule

May 14, 2025 -

Confirmation Maya Jama Dating Ruben Dias

May 14, 2025

Confirmation Maya Jama Dating Ruben Dias

May 14, 2025 -

Maya Jamas Angry Reaction To Gary Linekers Ruben Dias Comment

May 14, 2025

Maya Jamas Angry Reaction To Gary Linekers Ruben Dias Comment

May 14, 2025