Avoid Unforced Errors: Warren Buffett's Leadership Strategies For Success

Table of Contents

- Long-Term Vision and Patient Investment (as a Leadership Strategy)

- Resisting Short-Term Pressures

- Strategic Planning and Calculated Risks

- Building a Strong and Talented Team

- Delegation and Empowerment

- Importance of Culture and Values

- Mastering the Art of Effective Communication and Decision-Making

- Clear and Concise Communication

- Rational Decision-Making Based on Facts

- Conclusion

Long-Term Vision and Patient Investment (as a Leadership Strategy)

Effective leadership isn't about quick wins; it's about building sustainable value. Buffett's success is a testament to this principle. He masterfully avoids the common trap of short-term thinking, a crucial element of his leadership.

Resisting Short-Term Pressures

Buffett famously ignores market fluctuations, focusing instead on fundamental analysis and long-term growth. He prioritizes intrinsic value over short-term market noise.

- Example: During market crashes, while others panic-sell, Buffett often buys, capitalizing on undervalued assets. This showcases his patience and long-term vision.

- Patience in leadership: Cultivating patience is crucial for building trust with stakeholders. Consistent, long-term performance fosters confidence and loyalty among employees, investors, and customers. This patient approach reduces the likelihood of making rash decisions under pressure.

Strategic Planning and Calculated Risks

Buffett's investment decisions are far from impulsive. His meticulous approach is a blueprint for strategic leadership.

- Due diligence: His team conducts thorough research and risk assessment before making any significant investment. This rigorous process minimizes unforeseen problems.

- Long-term vision: Having a clear, long-term vision is paramount. All strategic decisions are aligned with this overarching goal, ensuring coherence and minimizing costly deviations. This proactive strategy prevents reactive, short-sighted decision-making.

Building a Strong and Talented Team

Buffett understands that exceptional leaders surround themselves with exceptional people. Building a high-performing team is a cornerstone of his leadership philosophy.

Delegation and Empowerment

Buffett empowers his managers, trusting them with significant autonomy. This fosters a culture of responsibility and initiative.

- Trust in managers: He delegates responsibilities based on individual strengths, promoting a sense of ownership and accountability.

- Positive work environment: This approach cultivates a positive and supportive work environment, encouraging creativity and innovation, while reducing the risk of errors stemming from micromanagement.

Importance of Culture and Values

Berkshire Hathaway's culture is a reflection of Buffett's values: integrity, honesty, and long-term focus. This shared vision strengthens the organization from within.

- Trust and respect: This strong culture fosters trust and mutual respect, minimizing conflicts and maximizing efficiency.

- Ethical behavior: A strong ethical foundation minimizes unforced errors arising from internal conflicts or unethical behavior. This is a key component of sustainable business success.

Mastering the Art of Effective Communication and Decision-Making

Effective communication and rational decision-making are crucial aspects of Buffett's leadership style, minimizing misunderstandings and poor judgment.

Clear and Concise Communication

Buffett's straightforward communication style promotes transparency and understanding.

- Annual shareholder letters: His renowned annual shareholder letters are a model of clear, concise communication, accessible to a broad audience. This transparency is key to maintaining trust and alignment.

- Open communication: Open and honest communication prevents misunderstandings that could lead to costly errors.

Rational Decision-Making Based on Facts

Buffett’s decisions are rooted in rigorous financial analysis, not emotion.

- Data-driven approach: He emphasizes data and analysis over gut feelings, reducing the likelihood of making emotionally driven mistakes.

- Avoiding biases: A conscious effort to avoid cognitive biases ensures rational, objective decision-making. This is crucial for long-term success.

Conclusion

By implementing Warren Buffett's leadership strategies, you can significantly improve your decision-making process, foster a strong and talented team, and cultivate a culture of transparency and accountability. By embracing a long-term vision, empowering your team, and prioritizing clear communication and rational decision-making, you can avoid many common leadership pitfalls and build a successful and enduring organization. Learn from Warren Buffett's approach and implement these strategies to avoid unforced errors and achieve greater success. Start analyzing your leadership style today and discover how to apply these powerful principles to your own organization. Don’t let unforced errors derail your journey – master Warren Buffett's leadership strategies and build a legacy of success.

The Extreme Cost Of Broadcoms V Mware Acquisition A 1 050 Price Jump

The Extreme Cost Of Broadcoms V Mware Acquisition A 1 050 Price Jump

Nba Playoffs Cavaliers Vs Heat Game 2 Live Stream Tv Channel And Start Time

Nba Playoffs Cavaliers Vs Heat Game 2 Live Stream Tv Channel And Start Time

Negative Inflation In Thailand A Boon For Monetary Policy Easing

Negative Inflation In Thailand A Boon For Monetary Policy Easing

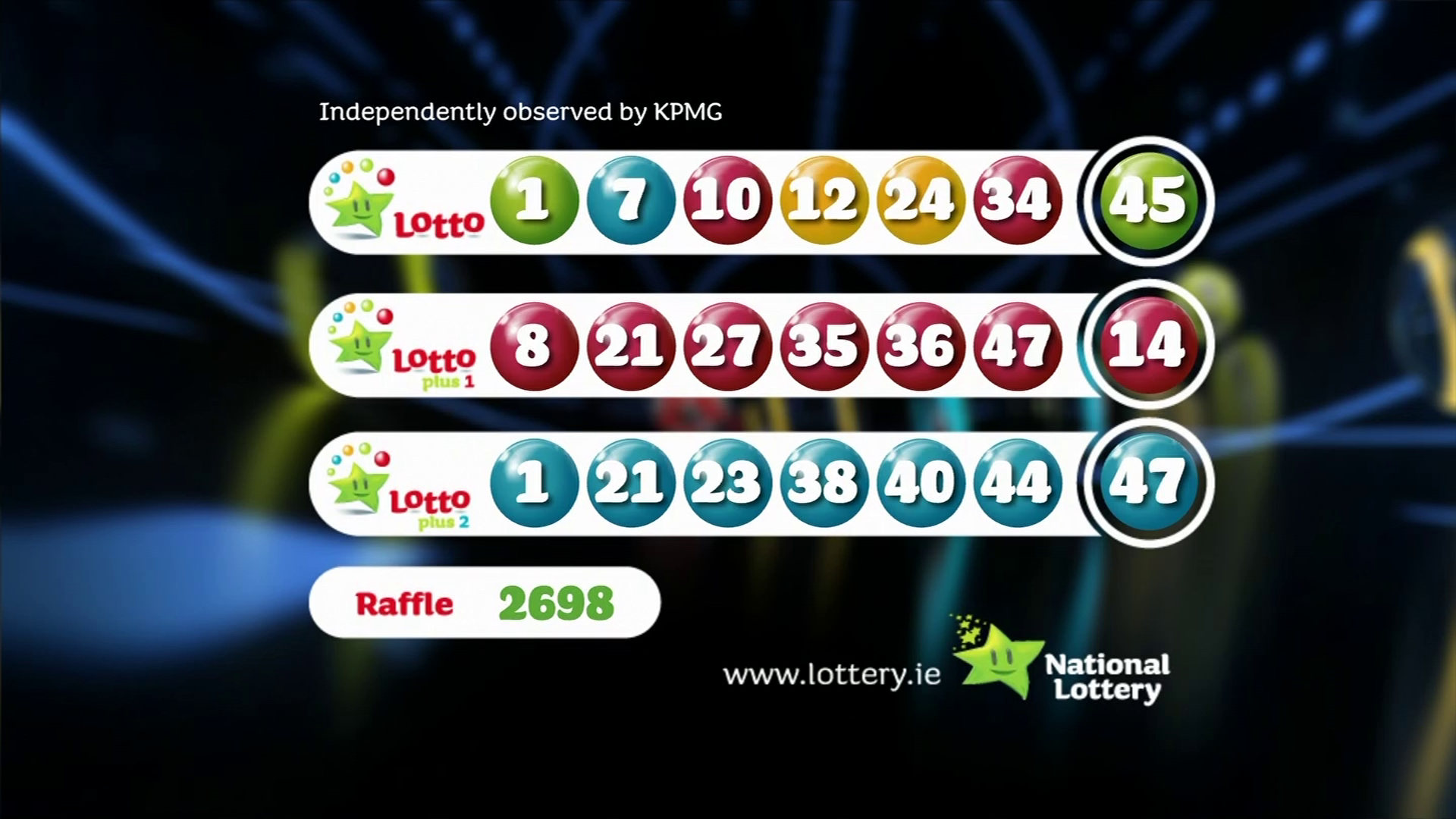

The Official Lotto Results Wednesday April 16th 2025

The Official Lotto Results Wednesday April 16th 2025

Washington Capitals Stars Ovechkin And Orlov Enjoy Miami Break Spot Dolphins

Washington Capitals Stars Ovechkin And Orlov Enjoy Miami Break Spot Dolphins