Negative Inflation In Thailand: A Boon For Monetary Policy Easing

Table of Contents

Thailand's recent experience with negative inflation presents a complex economic scenario. While seemingly alarming, this "negative inflation Thailand" phenomenon, also known as deflation, offers unique opportunities for the central bank to implement further monetary policy easing. This article will delve into the implications of negative inflation in Thailand, analyzing its causes, risks, and the potential strategies for mitigating its negative effects.

Understanding Negative Inflation in Thailand

Defining Deflation

Negative inflation, or deflation, is a sustained decrease in the general price level of goods and services in an economy. This is distinct from disinflation, which refers to a slowing of the rate of inflation, not a decline in the price level itself.

- Deflation vs. Disinflation: Deflation represents a negative inflation rate (e.g., -1%), while disinflation indicates a reduction in the positive inflation rate (e.g., from 3% to 1%).

- Causes of Deflation: Several factors can contribute to deflation. Reduced consumer demand, leading to decreased spending, is a key driver. Increased productivity, enabling businesses to produce goods at lower costs, can also contribute. External factors, such as a strong currency or falling global commodity prices (like oil), exert significant downward pressure on prices.

- Deflationary Pressures in Thailand: Thailand's economy has experienced deflationary pressures stemming from various sources. Falling oil prices have reduced import costs, while subdued consumer spending following the pandemic has dampened demand. The strong Thai Baht has also contributed to cheaper imports, further adding to deflationary pressures.

The Current State of Thailand's Economy

Analyzing Thailand's current economic indicators is crucial to understanding the extent and impact of deflation. Key data points include:

- CPI (Consumer Price Index): A consistently negative CPI indicates sustained deflation. Monitoring CPI changes is vital for assessing the severity and duration of deflationary trends.

- GDP Growth: Slow or negative GDP growth often accompanies deflation, indicating weak economic activity. Analyzing GDP growth helps understand the overall health of the Thai economy.

- Unemployment Rates: Rising unemployment can signal decreased consumer spending and further exacerbate deflationary pressures.

- Exchange Rate (Thai Baht): A strong baht can make imports cheaper, putting downward pressure on domestic prices.

- Global Economic Conditions: Global economic downturns and weakening global demand significantly impact Thailand's export-oriented economy, contributing to deflationary trends.

Implications of Negative Inflation for Monetary Policy

Challenges of Deflation

Deflation poses significant risks to economic stability:

- Deflationary Spiral: Falling prices encourage consumers to delay purchases, anticipating further price drops. This reduced demand leads to lower production, job losses, and even lower prices, creating a vicious cycle.

- Impact on Consumer Spending & Investment: Deflation discourages spending and investment as consumers and businesses expect prices to fall further. This can lead to economic stagnation.

- Challenges for Debt Repayment: Deflation increases the real value of debt, making it more difficult for borrowers to repay loans, potentially leading to increased defaults.

- Economic Stagnation: Prolonged deflation can lead to prolonged periods of slow economic growth or even recession.

Opportunities for Monetary Policy Easing

Negative inflation provides the Bank of Thailand with an opportunity to stimulate the economy:

- Interest Rate Cuts: Lowering interest rates makes borrowing cheaper, encouraging businesses to invest and consumers to spend, countering deflationary pressures.

- Quantitative Easing (QE): The Bank of Thailand could consider QE, injecting liquidity into the financial system by purchasing government bonds or other assets, stimulating lending and boosting economic activity.

- Other Monetary Policy Tools: Other tools, such as reserve requirement adjustments, can be employed to influence the money supply and support economic growth. Lower interest rates help combat the risks of deflation by stimulating demand and encouraging investment.

Alternative Policy Responses Beyond Monetary Policy Easing

While monetary policy easing is crucial, it's not the only solution:

Fiscal Policy Interventions

Government intervention through fiscal policy can bolster demand:

- Fiscal Stimulus Packages: Government spending on infrastructure projects, social programs, or tax cuts can increase aggregate demand and stimulate economic activity.

- Infrastructure Projects: Investing in infrastructure boosts employment and stimulates related industries, indirectly boosting consumer spending.

- Tax Cuts: Reducing taxes increases disposable income, encouraging consumption and investment.

Structural Reforms

Addressing the underlying causes of deflation requires structural reforms:

- Productivity Improvements: Enhancing productivity reduces production costs, mitigating deflationary pressures.

- Enhanced Competitiveness: Improving the competitiveness of Thai businesses, for example through trade liberalization, can boost exports and economic activity.

- Stimulating Innovation: Investing in research and development fosters innovation and creates new opportunities for growth.

Conclusion

Negative inflation in Thailand presents both challenges and opportunities. While the risks of a deflationary spiral, reduced consumer spending, and increased debt burdens are significant, the current situation offers the Bank of Thailand room for monetary policy easing through interest rate cuts and potentially quantitative easing. However, a multifaceted approach is crucial. Fiscal policy interventions, such as targeted stimulus packages and infrastructure investments, alongside structural reforms focused on improving productivity and competitiveness, are essential complements to monetary policy easing. The Bank of Thailand must carefully consider these elements to strategically combat negative inflation in Thailand and promote sustainable economic growth. Further research and a deep understanding of the specific causes of negative inflation Thailand are crucial for designing effective and targeted policies to navigate this complex economic landscape.

Featured Posts

-

Wholesome Moment Between Kelsey Plum And Kate Martin Wins Over Fans

May 07, 2025

Wholesome Moment Between Kelsey Plum And Kate Martin Wins Over Fans

May 07, 2025 -

De Bussers Comeback Bosses Shoot Out Secures Go Ahead Cup Final

May 07, 2025

De Bussers Comeback Bosses Shoot Out Secures Go Ahead Cup Final

May 07, 2025 -

China Market Headwinds Bmw Porsche And The Future Of Premium Auto Sales

May 07, 2025

China Market Headwinds Bmw Porsche And The Future Of Premium Auto Sales

May 07, 2025 -

Find The Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2

May 07, 2025

Find The Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2

May 07, 2025 -

Understanding The Conclave Selection Of The Head Of The Catholic Church

May 07, 2025

Understanding The Conclave Selection Of The Head Of The Catholic Church

May 07, 2025

Latest Posts

-

Canadas Trade Deficit Narrows To 506 Million Amidst New Tariffs

May 08, 2025

Canadas Trade Deficit Narrows To 506 Million Amidst New Tariffs

May 08, 2025 -

Canadas Trade Overtures A Positive Signal For Washington

May 08, 2025

Canadas Trade Overtures A Positive Signal For Washington

May 08, 2025 -

Hot Toys Japan Exclusive 1 6 Scale Galen Erso Rogue One Figure Unveiled

May 08, 2025

Hot Toys Japan Exclusive 1 6 Scale Galen Erso Rogue One Figure Unveiled

May 08, 2025 -

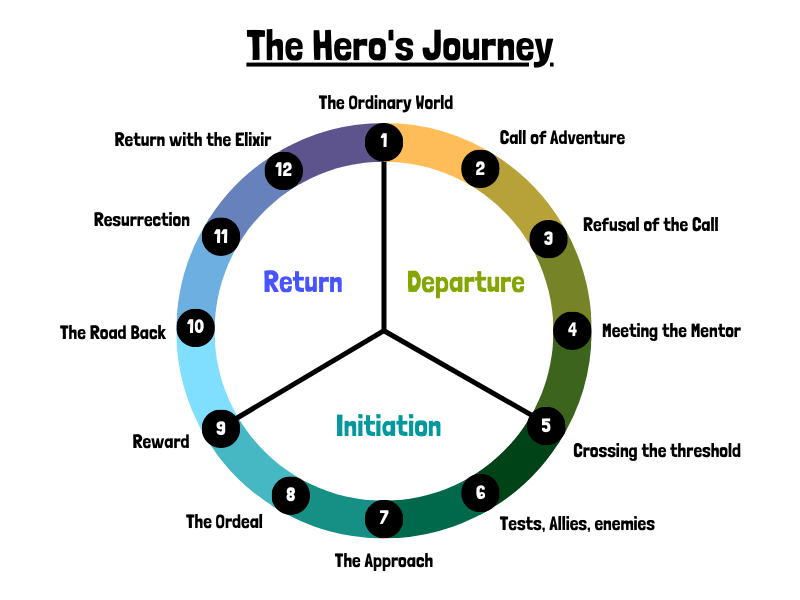

Unveiling The Past A Rogue One Heros Journey In The New Star Wars Series

May 08, 2025

Unveiling The Past A Rogue One Heros Journey In The New Star Wars Series

May 08, 2025 -

Canadas Trade Deficit Shrinks 506 Million In Latest Figures

May 08, 2025

Canadas Trade Deficit Shrinks 506 Million In Latest Figures

May 08, 2025