Auto Analyst Links GM's Decreased Canadian Activity To US Tariffs

Table of Contents

The Impact of US Tariffs on GM's Canadian Operations

The imposition of US tariffs, particularly on steel and aluminum, has dealt a significant blow to GM's Canadian operations. These tariffs, implemented under the guise of national security concerns, increased the cost of production for vehicles manufactured in Canada and subsequently exported to the US. This directly impacted GM's profitability, making Canadian-made vehicles less competitive in the lucrative US market.

-

Increased Production Costs: The tariffs on steel and aluminum, key components in vehicle manufacturing, significantly increased the cost of production for GM's Canadian plants. This price hike made it more expensive to manufacture vehicles in Canada compared to other locations, such as Mexico or the US itself.

-

Reduced Competitiveness: The increased production costs made Canadian-made vehicles less price-competitive in the US market. This resulted in decreased demand for GM vehicles manufactured in Canada, forcing the company to adjust its production levels.

-

Quantifiable Impact: GM's reduced Canadian activity has manifested in several ways, including reduced production at various plants, plant closures, and substantial job losses. For example, [cite specific examples with links to credible news sources or reports showing production cuts, plant closures, or job losses at specific GM Canadian plants]. These actions directly illustrate the devastating impact of US tariffs on the Canadian automotive sector.

-

Supply Chain Disruption: The decrease in GM's Canadian production has had a cascading effect on the Canadian automotive supply chain. Numerous smaller companies that provide parts and services to GM have experienced reduced orders and job losses, amplifying the negative economic impact. The disruption extends beyond GM, impacting the wider Canadian auto industry and its intricate network of suppliers.

Alternative Explanations for GM's Reduced Canadian Presence (Debunking Other Theories)

While some might attribute GM's reduced Canadian presence to other factors, such as global market shifts, automation, or internal restructuring, a thorough analysis demonstrates that US tariffs are the most significant contributing factor.

-

Market Demand Fluctuations: While shifts in global market demand certainly influence automotive production, the timing and scale of GM's cutbacks strongly correlate with the implementation of US tariffs, suggesting a direct causal link.

-

Automation and Restructuring: GM, like other automakers, is embracing automation to improve efficiency. However, automation initiatives are typically long-term strategies and don't fully explain the sudden and dramatic decrease in Canadian production. The impact of tariffs is far more immediate and drastic.

-

Economic Factors: While broader economic conditions certainly play a role, the specific targeting of Canadian auto parts and vehicles by US tariffs provides a more compelling explanation than generalized economic downturns. The impact is targeted and directly attributable to trade policy.

Expert opinions further reinforce this conclusion. [cite quotes or data from industry experts and reports that support the argument that tariffs are the most impactful factor]. These independent voices confirm that while other factors are at play, the impact of US tariffs remains paramount.

The Broader Implications for the Canadian and US Automotive Industries

The consequences of GM's reduced Canadian activity extend far beyond GM itself. The impact resonates throughout the Canadian and US economies, highlighting the intricate interdependence of the North American automotive industry.

-

Canadian Economic Impact: Job losses in the automotive sector have a significant impact on Canada's GDP and overall employment figures. The ripple effect extends to related industries and communities heavily reliant on automotive manufacturing.

-

US Automotive Industry Impact: The US automotive industry is also affected, as the reduced production in Canada disrupts the supply chain and potentially limits the availability of parts and vehicles. This could lead to increased prices and reduced competitiveness for US automakers.

-

USMCA Implications: The USMCA (United States-Mexico-Canada Agreement), designed to replace NAFTA, aimed to streamline trade between the three countries. However, the persistent impact of US tariffs indicates that the agreement hasn't fully addressed the underlying trade tensions, leaving significant challenges for the North American automotive sector. The current situation questions the effectiveness of USMCA in mitigating trade-related risks.

Conclusion

In conclusion, the evidence strongly suggests a direct link between the imposition of US tariffs and GM's decreased activity in Canada. This decline is not simply a result of market forces or internal restructuring; the increased cost of production due to tariffs has significantly hampered GM's competitiveness and necessitated a reduction in its Canadian operations. The ramifications extend beyond GM, creating considerable economic challenges for both Canada and the US. Understanding the impact of US tariffs on the Canadian auto industry is crucial for policymakers and industry stakeholders alike. Learn more about how US trade policies affect GM and the wider North American automotive sector by researching the long-term effects of these tariffs and the importance of fostering strong, mutually beneficial trade relationships between the US and Canada. [Insert links to relevant resources here, such as government reports, news articles, and industry association websites.]

Featured Posts

-

Canadian Dollars Strength A Call For Immediate Economic Strategy

May 08, 2025

Canadian Dollars Strength A Call For Immediate Economic Strategy

May 08, 2025 -

Psg Opens Doha Labs A Global Innovation Expansion Begins

May 08, 2025

Psg Opens Doha Labs A Global Innovation Expansion Begins

May 08, 2025 -

Les Corneilles Un Don Geometrique Surprenant

May 08, 2025

Les Corneilles Un Don Geometrique Surprenant

May 08, 2025 -

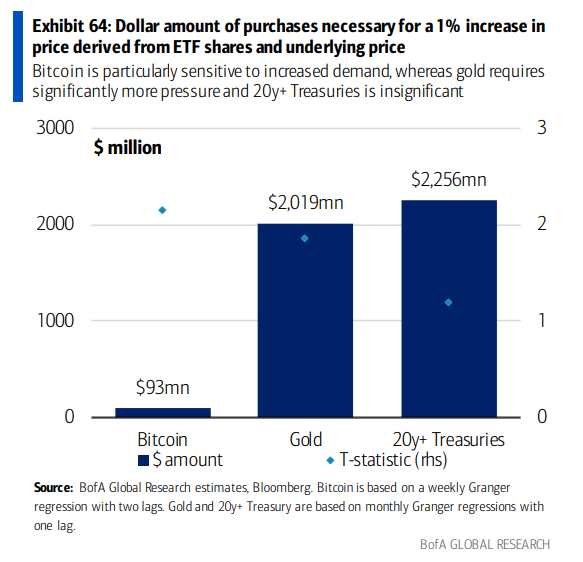

Could A 10x Bitcoin Multiplier Reshape Wall Street

May 08, 2025

Could A 10x Bitcoin Multiplier Reshape Wall Street

May 08, 2025 -

Path Of Exile 2 Who Are The Rogue Exiles

May 08, 2025

Path Of Exile 2 Who Are The Rogue Exiles

May 08, 2025

Latest Posts

-

Kripto Lider Nedir Ve Neden Herkes Bundan Bahsediyor

May 08, 2025

Kripto Lider Nedir Ve Neden Herkes Bundan Bahsediyor

May 08, 2025 -

Kripto Para Piyasasinda Kripto Lider In Yuekselisi Detayli Analiz

May 08, 2025

Kripto Para Piyasasinda Kripto Lider In Yuekselisi Detayli Analiz

May 08, 2025 -

Kripto Para Piyasasinda Riskler Rusya Merkez Bankasi Ndan Oenemli Bir Uyari

May 08, 2025

Kripto Para Piyasasinda Riskler Rusya Merkez Bankasi Ndan Oenemli Bir Uyari

May 08, 2025 -

Kripto Lider Kripto Para Duenyasinin Yeni Yuekselen Yildizi Neden Bu Kadar Popueler

May 08, 2025

Kripto Lider Kripto Para Duenyasinin Yeni Yuekselen Yildizi Neden Bu Kadar Popueler

May 08, 2025 -

Kriptoda Yeni Bir Cag Spk Nin Aciklamalari Ve Analizi

May 08, 2025

Kriptoda Yeni Bir Cag Spk Nin Aciklamalari Ve Analizi

May 08, 2025