Canadian Dollar's Strength: A Call For Immediate Economic Strategy

Table of Contents

Impact of a Strong Canadian Dollar on Canadian Exports

A strong Canadian dollar makes Canadian goods and services more expensive for international buyers, potentially reducing export demand and impacting key sectors like agriculture, manufacturing, and natural resources. This decreased price competitiveness in global markets significantly affects Canada's trade balance. The strength of the CAD directly impacts export competitiveness.

-

Reduced demand for Canadian exports in USD-denominated markets: A stronger CAD means that buyers in the US, a major trading partner, will pay more in their own currency for Canadian products, potentially leading to a decrease in demand. This effect is amplified for commodities priced in USD.

-

Increased difficulty competing with nations with weaker currencies: Canadian exporters face stiffer competition from countries with weaker currencies, as their goods become relatively cheaper in international markets. This makes maintaining market share increasingly challenging.

-

Potential decline in export revenues and job losses in export-oriented industries: Reduced export demand can lead to lower revenues for Canadian businesses, potentially resulting in job losses and economic contraction in export-dependent sectors. This is a significant concern for regions heavily reliant on specific export industries.

-

Need for diversification of export markets to reduce reliance on USD-sensitive markets: To mitigate the risk associated with a strong CAD, Canadian businesses need to diversify their export markets and explore opportunities in regions less sensitive to USD fluctuations. This necessitates strategic planning and investment in market research.

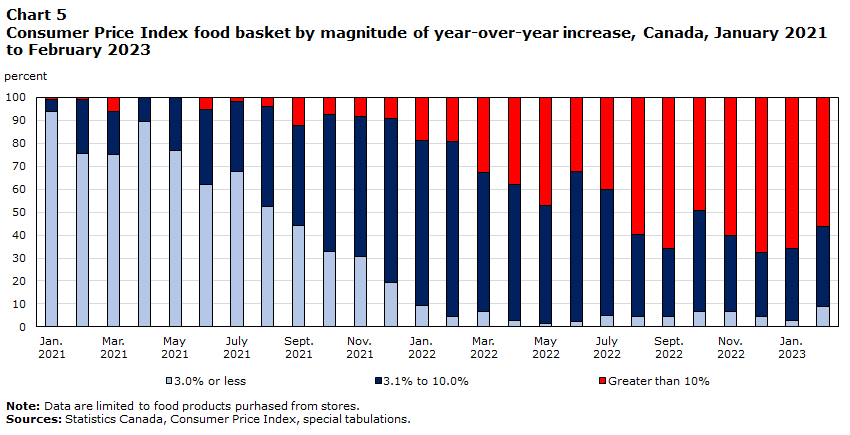

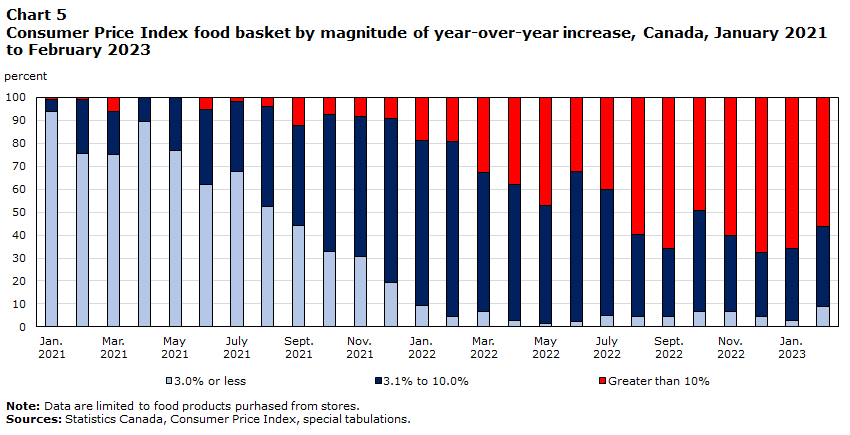

Implications for Import Costs and Inflation

While a strong CAD lowers the cost of imported goods, this benefit may be offset by other factors impacting inflation. The relationship between a strong currency and inflation is complex and requires careful analysis. A strong CAD translates to lower import costs, potentially impacting consumer prices and the cost of living.

-

Lower prices for imported goods, potentially benefiting consumers: Consumers may see lower prices for imported goods, leading to increased purchasing power and a lower cost of living. However, the extent of this benefit depends on the elasticity of demand for imported goods.

-

Reduced inflationary pressure from imported goods: The lower cost of imports can help mitigate inflationary pressures stemming from rising global commodity prices. This counteracts inflationary pressures and contributes to price stability.

-

Potential for increased competition from cheaper imports: A strong CAD makes imports cheaper, potentially increasing competition for domestic producers and putting downward pressure on domestic prices. This can both benefit and harm the Canadian economy.

-

Need to monitor inflation levels and adjust policies accordingly: The government needs to closely monitor inflation levels to ensure that the benefits of a strong CAD are not overshadowed by other inflationary pressures. Proactive policy responses may be needed to maintain price stability.

Government Policy Responses to a Strong Canadian Dollar

The government must implement proactive strategies to address the challenges and opportunities presented by a strong CAD. This might include a mix of monetary and fiscal policies, targeted support for specific sectors, and long-term strategic planning. The response should be multifaceted and adapt to the evolving economic climate.

-

Evaluating the need for monetary policy adjustments by the Bank of Canada: The Bank of Canada might consider adjusting interest rates to influence the exchange rate and manage inflation. However, this must be carefully calibrated to avoid unintended consequences.

-

Implementing fiscal policies to support export-oriented sectors: The government could implement fiscal measures, such as tax breaks or subsidies, to support struggling export-oriented industries and enhance their competitiveness in global markets.

-

Investing in economic diversification initiatives to reduce reliance on specific industries: Diversification is key to reducing vulnerability to fluctuations in the CAD. Investment in new industries and technologies will enhance resilience.

-

Promoting innovation and technological advancements to enhance global competitiveness: Investing in research and development and fostering innovation will make Canadian businesses more competitive even with a strong currency.

-

Exploring strategies to manage exchange rate volatility: Strategies to manage exchange rate volatility are essential to reduce uncertainty for businesses and investors. This might include hedging strategies or exploring alternative currency arrangements.

The Role of the Bank of Canada

The Bank of Canada plays a crucial role in responding to a strong CAD. Interest rate adjustments are a primary tool. Lowering interest rates can weaken the CAD, making exports more competitive. However, this must be balanced against the risk of fueling inflation. The Bank of Canada must carefully monitor economic indicators and adjust its monetary policy accordingly, considering both the exchange rate and inflationary pressures.

Conclusion

The strength of the Canadian dollar presents a complex economic scenario requiring immediate and well-considered strategic responses. Ignoring the potential negative impacts of a strong CAD could have significant repercussions for Canadian businesses and the economy as a whole. The implications for the Canadian economy are substantial and require immediate attention.

Call to Action: The Canadian government and businesses must proactively address the challenges and opportunities presented by the strong Canadian dollar. Developing a robust and adaptable economic strategy is crucial for navigating this period of currency strength and ensuring long-term economic prosperity. Immediate action is needed to mitigate risks and capitalize on potential benefits of the strong CAD. Let's build a resilient and thriving Canadian economy by implementing effective strategies for managing the strong Canadian dollar.

Featured Posts

-

New Movie The Life Of Chuck Gets Stephen Kings Seal Of Approval

May 08, 2025

New Movie The Life Of Chuck Gets Stephen Kings Seal Of Approval

May 08, 2025 -

Istori Ski Tri Umf Segeda Nad Pariz U Ligi Shampiona

May 08, 2025

Istori Ski Tri Umf Segeda Nad Pariz U Ligi Shampiona

May 08, 2025 -

Are Ps 5 Pro Sales Disappointing Compared To The Ps 4 Pro

May 08, 2025

Are Ps 5 Pro Sales Disappointing Compared To The Ps 4 Pro

May 08, 2025 -

Browns Sign Veteran Wide Receiver And Return Specialist Full Report

May 08, 2025

Browns Sign Veteran Wide Receiver And Return Specialist Full Report

May 08, 2025 -

Caruso Makes Nba Playoff History In Thunders Game 1 Win

May 08, 2025

Caruso Makes Nba Playoff History In Thunders Game 1 Win

May 08, 2025

Latest Posts

-

Denver Nuggets Jokic And Starting Lineup Benched Following 2 Ot Loss

May 08, 2025

Denver Nuggets Jokic And Starting Lineup Benched Following 2 Ot Loss

May 08, 2025 -

Nikola Jokic And Most Nuggets Starters To Rest After Double Overtime Loss

May 08, 2025

Nikola Jokic And Most Nuggets Starters To Rest After Double Overtime Loss

May 08, 2025 -

Shreveport Police Announce Arrests In Major Vehicle Theft Case

May 08, 2025

Shreveport Police Announce Arrests In Major Vehicle Theft Case

May 08, 2025 -

Nuggets Player Weighs In On Russell Westbrooks Future

May 08, 2025

Nuggets Player Weighs In On Russell Westbrooks Future

May 08, 2025 -

Raphaels Departure A Blow To Nc State Football

May 08, 2025

Raphaels Departure A Blow To Nc State Football

May 08, 2025