Pakistan Economic Crisis: IMF's $1.3 Billion Package Under Review

Table of Contents

- Root Causes of Pakistan's Economic Crisis

- Political Instability and Governance Issues

- External Debt Burden

- Depleting Foreign Exchange Reserves

- The IMF's $1.3 Billion Package: Conditions and Implications

- Conditions Attached to the Bailout

- Potential Benefits of the IMF Loan

- Risks and Challenges

- Alternative Solutions and Long-Term Strategies

- Diversification of the Economy

- Improving Governance and Transparency

- Conclusion

Root Causes of Pakistan's Economic Crisis

The current Pakistan economic crisis is the culmination of several interconnected factors, making a comprehensive solution complex and challenging.

Political Instability and Governance Issues

Frequent changes in government and inconsistent policy implementation have significantly eroded investor confidence and hampered economic stability. This political instability creates uncertainty, discouraging both domestic and foreign investment, crucial for economic growth.

- Examples of policy shifts: Sudden changes in energy policy, taxation, and trade regulations have created unpredictability, harming businesses and hindering long-term planning.

- Corruption allegations: Widespread allegations of corruption divert resources away from essential public services and infrastructure projects, exacerbating the crisis.

- Lack of transparency: Opaque governance practices hinder accountability and erode public trust, further hindering economic progress.

These factors have created a vicious cycle, where political instability leads to economic uncertainty, discouraging investment and further deepening the crisis. The lack of consistent, well-defined economic policies has undermined efforts to address the underlying issues.

External Debt Burden

Pakistan's massive external debt is a significant contributor to the current economic crisis. The unsustainable nature of this debt significantly limits the government's ability to invest in vital sectors and implement necessary reforms.

- Breakdown of debt: A significant portion is owed to China under the China-Pakistan Economic Corridor (CPEC) initiative, along with substantial debts to the IMF, World Bank, and other international lenders.

- Debt-to-GDP ratio: Pakistan's debt-to-GDP ratio is alarmingly high, indicating a severe vulnerability to economic shocks and a limited capacity to service its debt obligations.

The high debt servicing costs consume a large portion of the national budget, leaving limited resources for crucial social programs, infrastructure development, and other essential investments needed for economic growth and stability. This situation severely restricts the government's capacity to respond effectively to the ongoing crisis.

Depleting Foreign Exchange Reserves

The dwindling foreign exchange reserves represent a critical threat to Pakistan's economy. This shortage severely limits the country's ability to import essential goods and services, further fueling inflation and impacting the value of the Pakistani Rupee.

- Declining reserves trend: The foreign exchange reserves have shown a sharp decline over the past few years, reaching critically low levels.

- Impact on essential imports: The shortage affects imports of fuel, food, and vital medicines, creating supply chain disruptions and escalating prices for consumers.

This situation has led to significant economic hardship for businesses and individuals alike, causing widespread uncertainty and potentially leading to social unrest if not addressed effectively. The depreciation of the Pakistani Rupee further exacerbates the situation, making imports even more expensive.

The IMF's $1.3 Billion Package: Conditions and Implications

The IMF's proposed $1.3 billion bailout package is crucial for Pakistan, offering a potential pathway to economic stabilization. However, it comes with stringent conditions that have significant implications.

Conditions Attached to the Bailout

The IMF typically attaches conditions to its loan programs, requiring recipient countries to implement specific economic reforms. These conditions aim to address the underlying causes of the economic crisis and ensure the long-term sustainability of the loan.

- Key reforms: These typically include fiscal consolidation measures (reducing government spending and increasing taxes), structural reforms to improve governance and transparency, and monetary policy adjustments to control inflation.

These reforms, while necessary for long-term stability, can lead to short-term economic hardship, potentially affecting various sectors of the Pakistani economy. The implementation of these reforms will require careful management and social safety nets to mitigate potential negative impacts on the most vulnerable populations.

Potential Benefits of the IMF Loan

If approved, the IMF loan could provide several significant benefits to Pakistan.

- Currency stabilization: The injection of funds could help stabilize the Pakistani Rupee, reducing inflation and making imports less expensive.

- Improved investor confidence: The IMF's involvement could signal a commitment to economic reform, potentially attracting foreign investment.

- Access to further funding: Securing the IMF loan could unlock access to additional funding from other international financial institutions.

These benefits could alleviate the immediate crisis and pave the way for more sustainable economic growth in the long term. However, the success of the loan hinges on the effective implementation of the required reforms.

Risks and Challenges

Failure to secure the loan or difficulties in meeting the IMF's conditions could have severe consequences for Pakistan.

- Increased poverty: Austerity measures could exacerbate poverty and inequality.

- Social unrest: Economic hardship and lack of progress could lead to social unrest and instability.

- Debt default: Failure to meet debt obligations could lead to a sovereign debt default, further isolating Pakistan from international financial markets.

These risks underscore the importance of careful planning and effective implementation of the IMF's recommendations, along with a comprehensive strategy to address the underlying causes of the economic crisis.

Alternative Solutions and Long-Term Strategies

Addressing the Pakistan economic crisis requires a multifaceted approach that goes beyond the immediate financial assistance provided by the IMF. Long-term solutions focus on structural reforms and sustainable economic diversification.

Diversification of the Economy

Pakistan's over-reliance on specific sectors (agriculture and remittances) makes it vulnerable to external shocks. Diversifying the economy is crucial for long-term sustainability.

- Potential sectors for diversification: The technology sector, manufacturing, and tourism offer promising avenues for growth and job creation.

This requires strategic investments in education, infrastructure, and technological advancements, along with supportive government policies to attract investment in these sectors.

Improving Governance and Transparency

Tackling corruption and improving the efficiency of public institutions is essential for attracting foreign investment and fostering sustainable economic growth.

- Measures to enhance governance: Strengthening anti-corruption agencies, improving tax collection mechanisms, and increasing transparency in government operations are crucial steps.

Improved governance and transparency will build trust among investors and the public, contributing to a more stable and predictable investment climate.

Conclusion

The Pakistan economic crisis is a complex challenge requiring immediate and long-term solutions. The IMF's $1.3 billion package is a crucial, albeit potentially difficult, step toward stabilization. While the bailout offers temporary relief, addressing the underlying issues of political instability, unsustainable debt, and the lack of economic diversification is vital for sustainable recovery. Pakistan needs comprehensive reforms and long-term strategies to build a more resilient and prosperous economy. Continued monitoring of the Pakistan economic crisis and the progress of the IMF negotiations is crucial for understanding the country's future trajectory. Stay informed about further developments related to the Pakistan economic crisis and its implications.

Family Support For Dakota Johnson At Materialist Film Screening

Family Support For Dakota Johnson At Materialist Film Screening

Family Devastated Unprovoked Racist Murder Leaves Loved Ones Broken

Family Devastated Unprovoked Racist Murder Leaves Loved Ones Broken

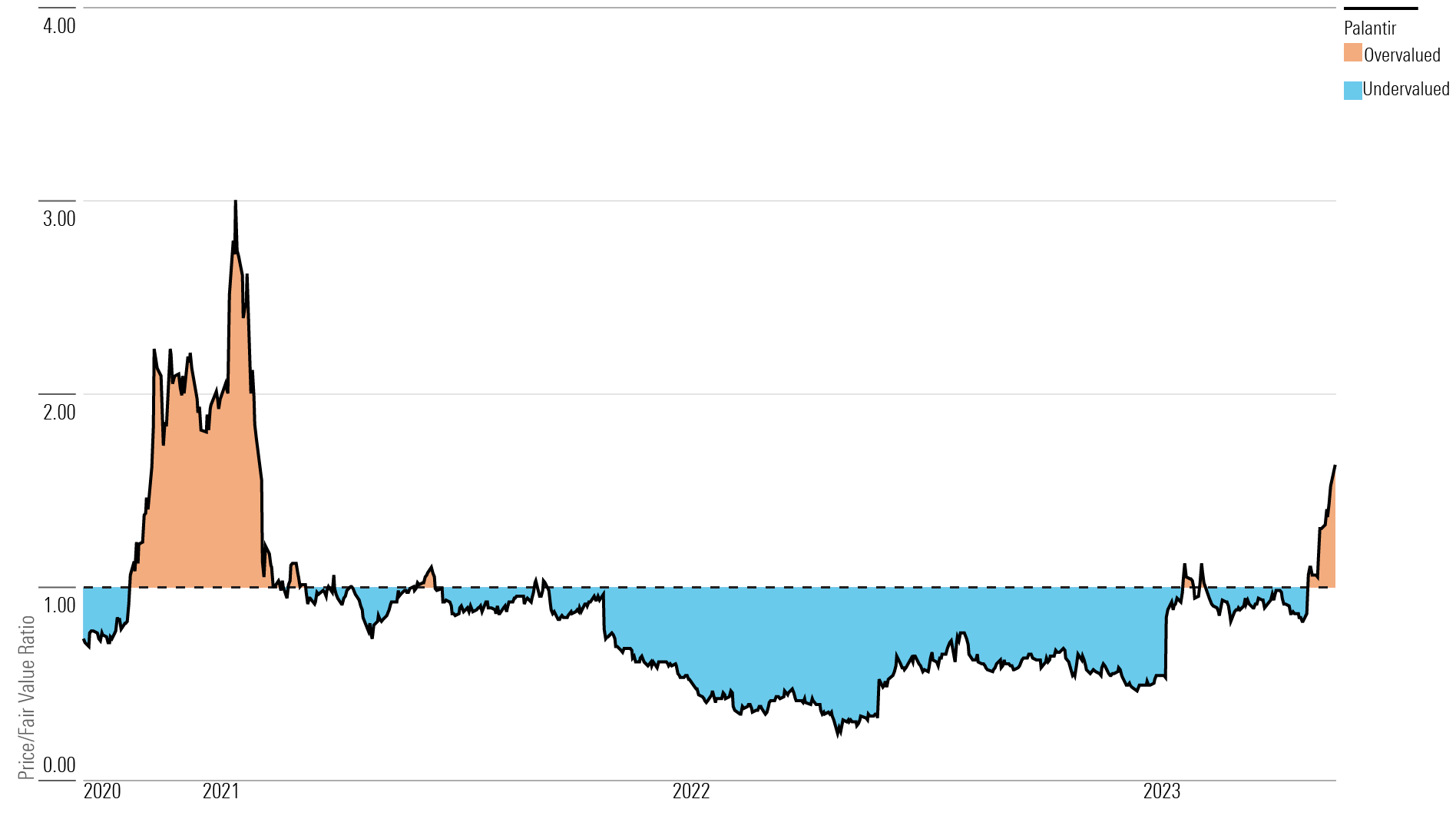

Palantir Stock Rally New Analyst Forecasts And Future Outlook

Palantir Stock Rally New Analyst Forecasts And Future Outlook

Tramway Dijon Concertation Sur Le Projet De 3e Ligne

Tramway Dijon Concertation Sur Le Projet De 3e Ligne

Punjabs Skill Development Program For Transgender Individuals

Punjabs Skill Development Program For Transgender Individuals