Apple Stock Slumps: $900 Million Tariff Impact

Table of Contents

The $900 Million Tariff Impact: A Deep Dive

The $900 million figure represents the estimated cost to Apple resulting from new tariffs imposed on various products imported from China. These tariffs specifically target several key Apple products, significantly impacting its bottom line. The calculation of this figure involves considering the tariff rates applied to different product categories, the volume of goods imported, and the resulting increase in production costs.

- Specific Tariffs and Affected Products: The tariffs primarily impact iPhones, AirPods, Apple Watches, and other components sourced from China.

- Tariff Rates and Calculations: Sources suggest tariff rates ranging from 15% to 25% on various components and finished products. (Detailed breakdown from reputable financial news sources would be inserted here with proper citations). This percentage increase, multiplied by the volume of imports, results in the substantial $900 million loss.

- Geographical Impact: The tariffs highlight the complexities of Apple's global supply chain, with a significant reliance on manufacturing based in China. Disruptions to these established trade routes directly contribute to increased costs.

Market Reaction and Stock Price Volatility

The news of the $900 million tariff impact immediately sent shockwaves through the market. Apple's stock price experienced a noticeable drop, reflecting investor concern. The degree of stock price volatility can be seen in the following (insert chart or graph showing Apple stock price fluctuations in the period following the tariff announcement).

- Investor Sentiment: Investor sentiment shifted negatively, with many expressing concern about Apple's future profitability and its ability to absorb these increased costs.

- Trading Volume: Trading volume for Apple stock increased significantly following the announcement, indicating heightened investor activity and uncertainty.

- Key Stock Price Changes:

- Day 1: [Insert percentage change]

- Week 1: [Insert percentage change]

- Month 1: [Insert percentage change] (Data needs to be filled in from reliable sources)

Long-Term Implications for Apple and its Consumers

The long-term implications of these tariffs are multifaceted and could significantly impact Apple's future. The increased production costs could force Apple to adjust its pricing strategies, potentially leading to higher prices for consumers.

- Impact on Profitability: Reduced profit margins are a significant concern, potentially affecting Apple's overall financial performance and investor returns.

- Supply Chain Disruptions: Apple may need to re-evaluate its supply chain, potentially diversifying manufacturing locations to mitigate future tariff risks. This could be a costly and time-consuming process.

- Consumer Impact: Higher prices for Apple products could reduce consumer demand, particularly in price-sensitive markets. Product shortages are another potential consequence of supply chain disruptions.

Strategies Apple Might Employ to Mitigate Tariff Impacts

Apple is likely exploring several strategies to counter the negative effects of these tariffs. These strategies aim to reduce the impact on profitability and maintain its competitive edge.

- Production Shifts: Relocating some manufacturing operations to countries with more favorable trade agreements is a viable option, although this requires significant investment and time.

- Price Adjustments: Increasing product prices is a possibility, but this carries the risk of decreased consumer demand. Finding the right balance is crucial.

- Lobbying Efforts: Apple might engage in lobbying efforts to influence trade policy and potentially secure tariff reductions or exemptions.

- Risk Management: Diversifying suppliers and optimizing inventory management could help reduce vulnerability to future tariff increases.

Conclusion: Understanding the Apple Stock Slumps and Looking Ahead

The $900 million tariff impact has significantly contributed to the recent "Apple Stock Slumps," causing volatility in the market and raising concerns about long-term implications. The market's reaction reflects the severity of this event, highlighting the importance of understanding the complex interplay between global trade policies and corporate performance. Apple's response, involving potential production shifts, price adjustments, and lobbying efforts, will be crucial in mitigating these challenges. To stay informed about Apple's stock performance, its financial outlook, and the ongoing impact of tariffs, follow reputable financial news sources and industry analysts. Understanding the dynamics of "Apple Stock Slumps" is vital for investors and consumers alike. Stay informed, stay ahead.

Featured Posts

-

Philips Future Health Index 2025 Urgent Call To Action On Ai In Healthcare

May 25, 2025

Philips Future Health Index 2025 Urgent Call To Action On Ai In Healthcare

May 25, 2025 -

Analysis Trumps Decision On The Proposed Nippon U S Steel Merger

May 25, 2025

Analysis Trumps Decision On The Proposed Nippon U S Steel Merger

May 25, 2025 -

Apple Stock Key Levels Breached Before Q2 Report

May 25, 2025

Apple Stock Key Levels Breached Before Q2 Report

May 25, 2025 -

A Realistic Look At Escaping To The Country Challenges And Rewards

May 25, 2025

A Realistic Look At Escaping To The Country Challenges And Rewards

May 25, 2025 -

New Ferrari Hot Wheels Sets A Mamma Mia Moment For Collectors

May 25, 2025

New Ferrari Hot Wheels Sets A Mamma Mia Moment For Collectors

May 25, 2025

Latest Posts

-

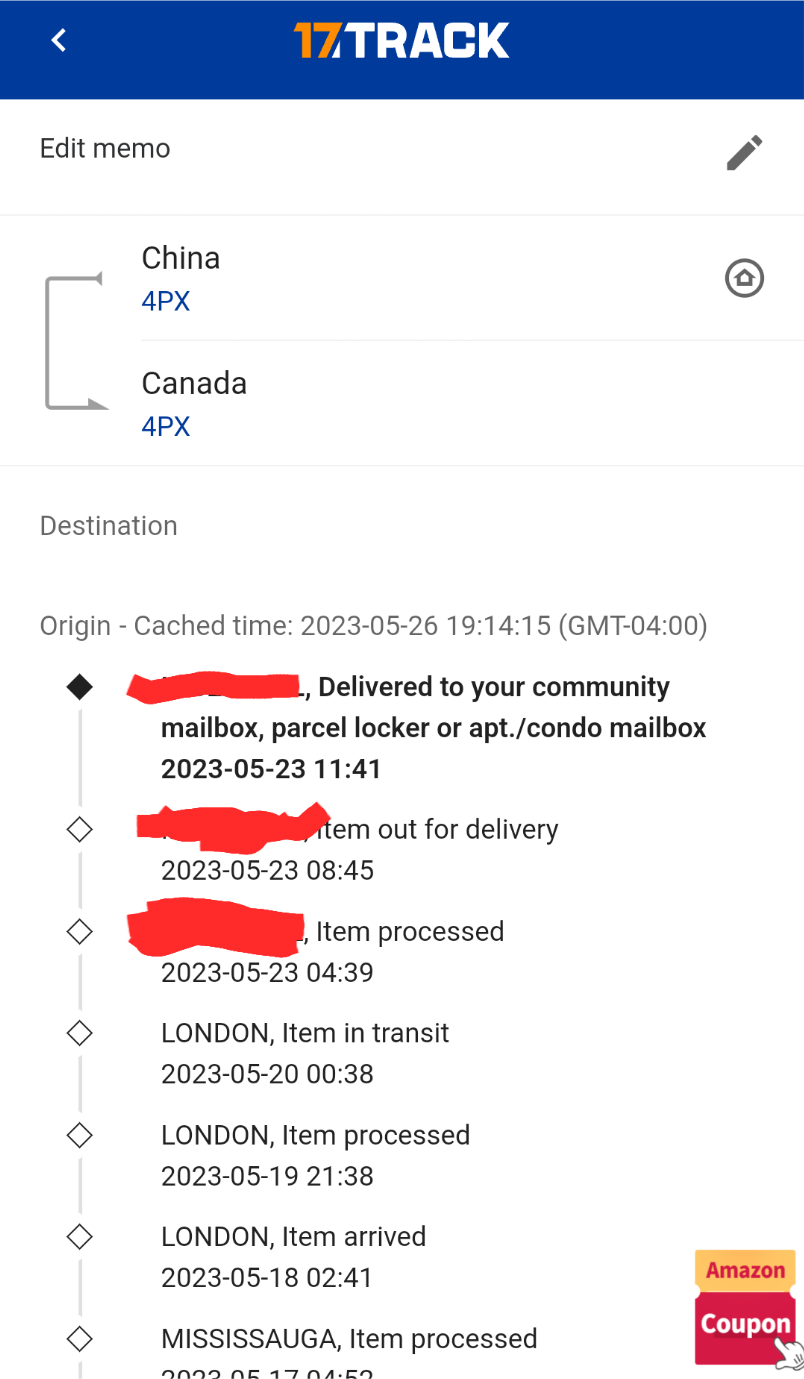

The Shifting Landscape Of Delivery Services Canada Post And The Competition

May 25, 2025

The Shifting Landscape Of Delivery Services Canada Post And The Competition

May 25, 2025 -

Is Canada Posts Decline Creating A Boom For Alternative Delivery Companies

May 25, 2025

Is Canada Posts Decline Creating A Boom For Alternative Delivery Companies

May 25, 2025 -

Analyzing The Growth Of Alternative Delivery Services In Relation To Canada Post

May 25, 2025

Analyzing The Growth Of Alternative Delivery Services In Relation To Canada Post

May 25, 2025 -

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025 -

Increased Competition Canada Posts Challenges And The Growth Of Alternatives

May 25, 2025

Increased Competition Canada Posts Challenges And The Growth Of Alternatives

May 25, 2025