Apple Stock: Key Levels Breached Before Q2 Report

Table of Contents

Technical Analysis: Key Levels Breached

Support and Resistance Levels

Apple stock has notably broken through several crucial support and resistance levels in recent weeks. For instance, the $150 level, a previously strong support point, has been decisively breached. Similarly, the $160 mark, which acted as resistance in the past, has now been surpassed. These breaches carry significant weight in technical analysis.

- Historical Performance: Historically, the $150 level has acted as a reliable support, with the stock bouncing back from this price point on several occasions. The breach suggests a potential weakening of this support, potentially indicating further downward pressure. Similarly, the breakout above $160 suggests increased bullish sentiment.

- Moving Averages: Analysis of moving averages, such as the 50-day and 200-day moving averages, further supports this interpretation. A break below the 50-day moving average often signals short-term weakness, while a sustained break above the 200-day moving average signifies long-term bullish momentum. Currently, the relationship between these moving averages offers clues to interpret the ongoing price action of Apple stock.

Chart Patterns

Analyzing the Apple stock chart reveals potential chart patterns that might offer clues about future price movements. While interpreting chart patterns is not an exact science, certain formations could suggest potential short-term and long-term trends.

- Image of Relevant Charts: [Insert chart image showing relevant patterns – e.g., a potential head and shoulders pattern or a triangle formation].

- Implications: The presence of [specific chart pattern identified] suggests [interpretation of the pattern – e.g., potential for further price decline or a breakout to higher levels]. It's vital to remember that chart patterns alone should not dictate investment strategies; they should be viewed in conjunction with other fundamental and macroeconomic factors.

Factors Influencing Apple Stock Price

Q2 Earnings Expectations

The market is keenly anticipating Apple's Q2 earnings report. Expectations are high, but there's always a possibility of surprises, both positive and negative. Meeting or exceeding these expectations could propel the Apple stock price higher, while falling short could trigger further selling pressure.

- Key Performance Metrics: Investors are particularly focused on iPhone sales figures, services revenue growth, and overall profitability margins. Any significant deviation from analyst predictions in these areas will likely influence the stock's price.

- Analyst Predictions: The consensus among analysts currently points towards [Insert summary of consensus analyst predictions]. However, individual analyst opinions vary, highlighting the uncertainty surrounding the actual results and their impact on Apple stock.

Macroeconomic Factors

Broader macroeconomic conditions significantly impact Apple's stock price. Factors like inflation, interest rates, and global economic growth directly affect consumer spending and investor sentiment.

- Correlation with Apple Performance: Historically, Apple stock has shown a [positive/negative] correlation with [specific macroeconomic factors]. For example, rising inflation might impact consumer discretionary spending, impacting iPhone sales and ultimately the Apple stock price.

- Impact on Investor Sentiment: Periods of economic uncertainty tend to make investors more risk-averse, leading to reduced demand for even blue-chip stocks like Apple. Conversely, periods of robust economic growth often drive investor confidence and increased demand for growth stocks.

Competition and Market Share

Apple faces stiff competition in the tech market. The competitive landscape constantly evolves, posing potential threats to Apple's market share and, consequently, its stock price.

- Key Competitors: Companies like Samsung, Google, and other emerging Chinese smartphone manufacturers relentlessly compete for market share. These companies’ strategies and technological advancements impact Apple’s market position.

- Impact of Competitive Pressures: Intense competition can pressure Apple's pricing strategies and profit margins, potentially impacting its stock performance. Innovation and maintaining a competitive edge are crucial for Apple to sustain its current market position.

Investor Strategies for Apple Stock

Buy, Sell, or Hold?

The recent price movements present a complex scenario for investors. The decision to buy, sell, or hold Apple stock depends heavily on individual circumstances and risk tolerance.

- Risk Tolerance: Conservative investors might choose to hold their existing positions or potentially reduce exposure given the recent volatility. More aggressive investors might view the recent dip as a buying opportunity, anticipating a rebound post-Q2 earnings.

- Long-Term vs. Short-Term Goals: Long-term investors might focus less on short-term fluctuations and maintain their holdings, viewing them as part of a diversified portfolio. Short-term traders, however, might use the recent volatility to execute short-term trading strategies.

Diversification

Regardless of the decision regarding Apple stock, it's crucial to remember the importance of diversification. Don't put all your eggs in one basket.

- Other Investment Options: Diversification includes investing across different asset classes, such as bonds, real estate, and other stocks, to mitigate risk.

- Benefits of Diversification: Diversification helps to reduce overall portfolio volatility and protects against significant losses in any single investment.

Conclusion

The recent breach of key levels in Apple stock ahead of the Q2 earnings report presents a significant moment for investors. Several factors, including Q2 earnings expectations, macroeconomic conditions, and competitive pressures, will influence the stock's future trajectory. The decision to buy, sell, or hold should be made carefully, considering individual risk tolerance, investment goals, and a well-diversified portfolio. Remember to conduct thorough research and potentially consult a financial advisor before making any investment decisions. Stay informed on Apple stock movements and the Q2 report release to make the most informed decisions about your Apple stock investments. Continue your research on Apple Stock and make informed investment decisions based on your own risk tolerance and financial goals. Consider consulting with a financial advisor before making any major investment decisions regarding Apple stock or any other security.

Featured Posts

-

Dylan Farrows Accusations Against Woody Allen Sean Penns Skepticism

May 25, 2025

Dylan Farrows Accusations Against Woody Allen Sean Penns Skepticism

May 25, 2025 -

The Value Of Middle Management How They Benefit Companies And Employees

May 25, 2025

The Value Of Middle Management How They Benefit Companies And Employees

May 25, 2025 -

H Nonline Sk Prepustanie V Nemecku Analyza Dopadu Na Ekonomiku

May 25, 2025

H Nonline Sk Prepustanie V Nemecku Analyza Dopadu Na Ekonomiku

May 25, 2025 -

Severe Traffic Disruption On M56 Cheshire Deeside Area

May 25, 2025

Severe Traffic Disruption On M56 Cheshire Deeside Area

May 25, 2025 -

Lady Gaga And Michael Polansky Arrive Hand In Hand At Snl Afterparty

May 25, 2025

Lady Gaga And Michael Polansky Arrive Hand In Hand At Snl Afterparty

May 25, 2025

Latest Posts

-

Wifes Murder Georgia Man Charged After 19 Year Manhunt Nannys Role Investigated

May 25, 2025

Wifes Murder Georgia Man Charged After 19 Year Manhunt Nannys Role Investigated

May 25, 2025 -

Buy And Hold Investing The Long Games Gut Wrenching Truth

May 25, 2025

Buy And Hold Investing The Long Games Gut Wrenching Truth

May 25, 2025 -

Cold Case Solved Georgia Man Charged With Wifes Murder After 19 Year Flight With Nanny

May 25, 2025

Cold Case Solved Georgia Man Charged With Wifes Murder After 19 Year Flight With Nanny

May 25, 2025 -

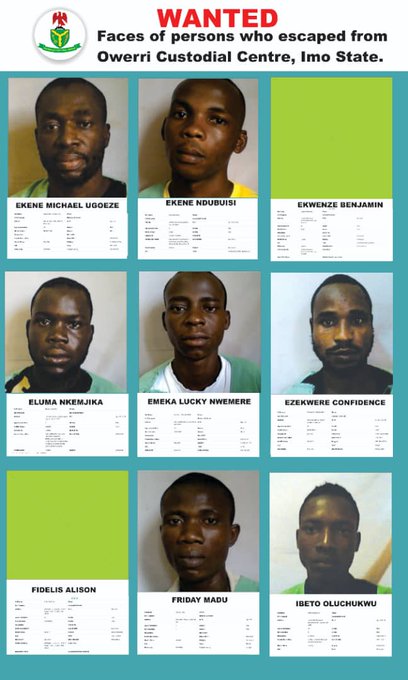

The Great New Orleans Jailbreak How 10 Inmates Escaped

May 25, 2025

The Great New Orleans Jailbreak How 10 Inmates Escaped

May 25, 2025 -

Georgia Man Arrested For Murder 19 Years After Crime Nanny Involved

May 25, 2025

Georgia Man Arrested For Murder 19 Years After Crime Nanny Involved

May 25, 2025