BOE Rate Cut Probabilities Fall As UK Inflation Surprises, Boosting Pound

Table of Contents

Unexpected UK Inflation Data Fuels BOE Rate Cut Concerns

The latest UK inflation figures have sent shockwaves through the financial markets. The data, released on [Insert Date and Source of Data], revealed an inflation rate of [Insert Inflation Percentage]% – significantly higher than the market consensus forecast of [Insert Forecast Percentage]%. This substantial overshoot throws a significant wrench into the BOE's aim of achieving its 2% inflation target. The persistent inflationary pressures indicate that the UK economy is far from cooling down, raising concerns about the BOE's ability to curb rising prices without triggering a significant economic downturn.

Several factors contributed to this inflationary surge:

- Energy Prices: Sustained high energy prices continue to exert upward pressure on the cost of living, impacting numerous sectors of the economy.

- Supply Chain Issues: Lingering supply chain disruptions, although easing, continue to contribute to elevated prices for certain goods.

- Wage Growth: Strong wage growth, while positive for workers, adds further fuel to the inflationary fire by increasing production costs for businesses.

Bullet Points:

- The UK inflation rate in [Month, Year] reached [Percentage]%, compared to [Percentage]% in [Previous Month/Year].

- Core inflation (excluding volatile energy and food prices) also rose to [Percentage]%, indicating broader inflationary pressures.

- The largest contributions to inflation came from [List Sectors e.g., energy (X%), food (Y%), transportation (Z%)].

Impact on BOE Rate Cut Probabilities and Market Sentiment

The higher-than-expected inflation data has significantly reduced the probability of a BOE rate cut in the near future. Before the data release, market analysts predicted a [Percentage]% chance of a rate cut in [Timeframe]. However, following the announcement, this probability plummeted to [Percentage]%, reflecting a dramatic shift in market sentiment.

This change in expectation has had a noticeable impact on financial markets:

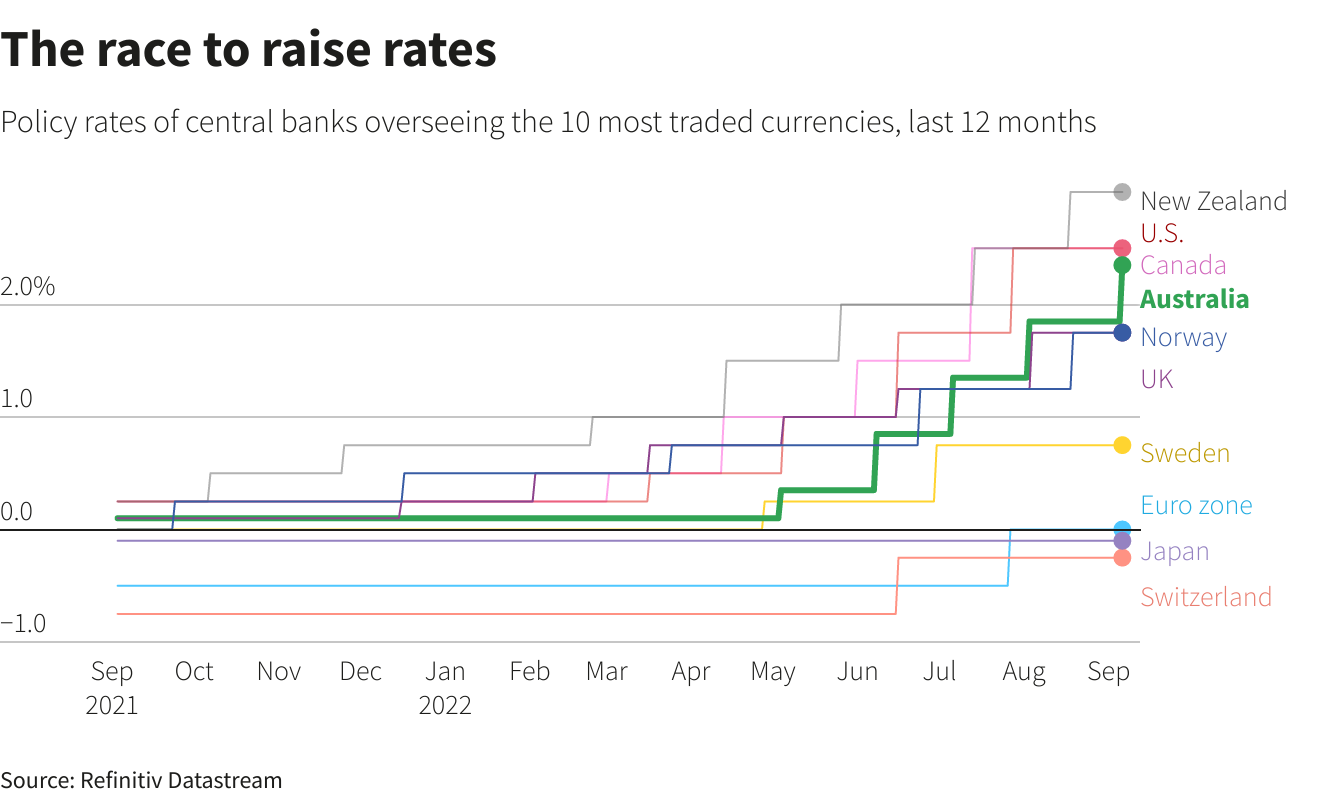

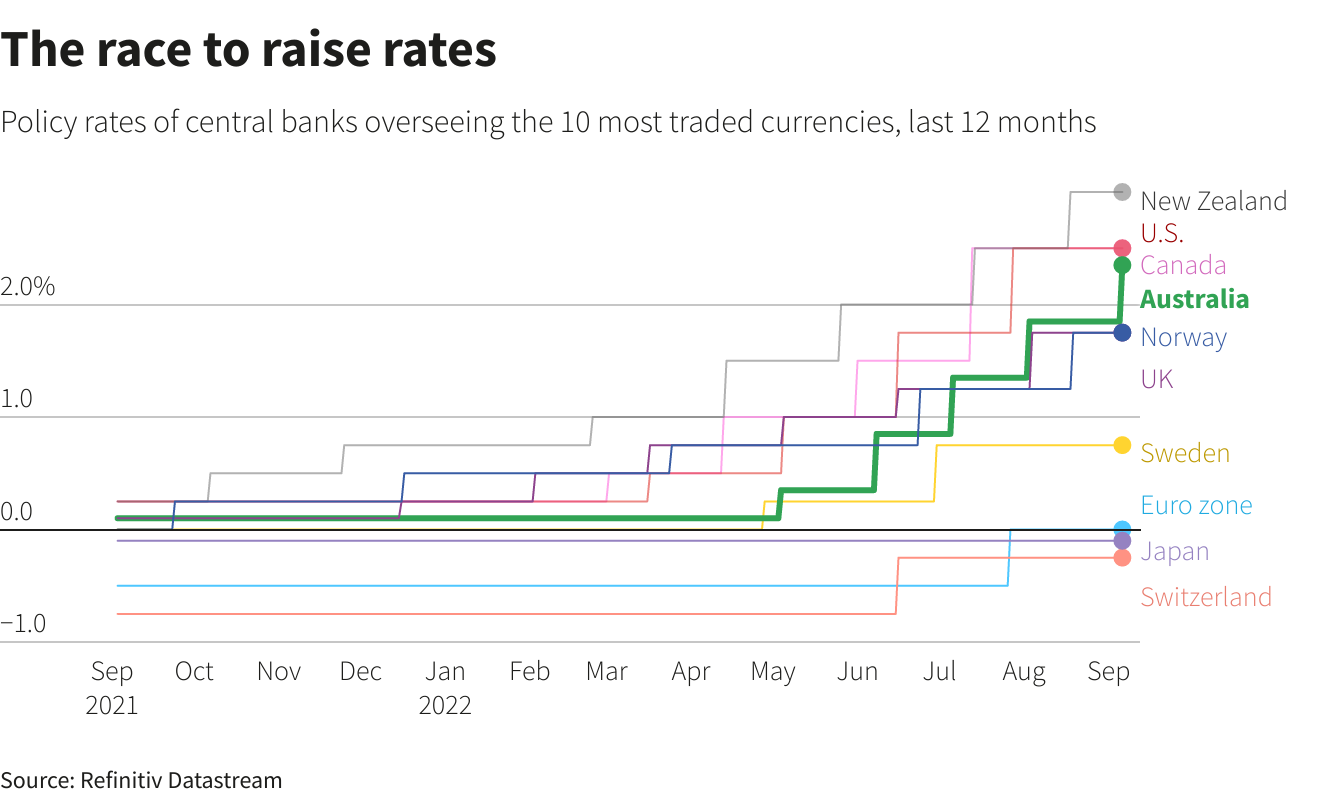

- Bond Yields: Government bond yields have risen, reflecting investor concerns about higher inflation and the potential for further interest rate hikes.

- Stock Prices: Stock prices have shown mixed reactions, with some sectors experiencing declines due to the increased uncertainty surrounding future economic growth.

Bullet Points:

- Before the inflation data release, several leading financial institutions predicted a [Number]% probability of a BOE rate cut by [Date].

- Post-data, these probabilities have fallen to as low as [Number]%, according to [Source].

- The yield on 10-year UK government bonds increased from [Percentage]% to [Percentage]% following the inflation announcement.

Strengthening Pound: A Reflection of Increased BOE Rate Expectations

The decreased likelihood of a BOE rate cut is directly correlated with the strengthening of the pound sterling. Investors are increasingly viewing the pound as a more attractive asset, given the reduced expectation of monetary easing. A stronger pound reflects increased confidence in the UK economy’s resilience against inflationary pressures and the BOE's commitment to maintaining price stability. This also makes the UK a more attractive destination for foreign investment.

Bullet Points:

- The GBP/USD exchange rate has appreciated from [Value] to [Value] since the inflation data release.

- Compared to other major currencies like the Euro and the Yen, the pound has shown relatively strong performance.

- The strengthening pound could negatively impact UK exporters, making their goods more expensive in international markets.

Alternative Scenarios and Future Outlook for BOE Rate Decisions

While the current outlook points towards a less likely BOE rate cut, several alternative scenarios could still play out. A significant economic slowdown, for instance, might force the BOE to reconsider its monetary policy stance. The level of uncertainty surrounding future inflation and economic growth forecasts is significant.

Bullet Points:

- Potential risks to the UK economy include a sharp decline in consumer spending and a potential housing market correction.

- The BOE's future decisions will depend heavily on incoming economic data and the evolution of inflationary pressures.

- Expert opinions remain divided, with some predicting further interest rate hikes, while others anticipate a pause or even a future rate cut if economic growth slows considerably.

Conclusion: Navigating the Shifting Landscape of BOE Rate Cut Probabilities

In summary, the unexpected rise in UK inflation has dramatically decreased the probability of an imminent BOE rate cut, leading to a strengthening pound. This shift reflects a change in market sentiment and increased uncertainty surrounding the UK's economic outlook. The BOE’s future decisions remain contingent upon upcoming economic data and the evolving inflationary landscape. Staying informed about further developments in UK inflation and BOE monetary policy is crucial for making informed financial decisions relating to BOE rate cuts, the pound sterling, and investments sensitive to interest rate changes. Understanding these dynamics is key to navigating the evolving landscape of UK monetary policy and its impact on your financial portfolio.

Featured Posts

-

60 Minute Delays On M6 Southbound Due To Crash

May 24, 2025

60 Minute Delays On M6 Southbound Due To Crash

May 24, 2025 -

Escape To The Country Living Sustainably In Rural Areas

May 24, 2025

Escape To The Country Living Sustainably In Rural Areas

May 24, 2025 -

Annie Kilners Diamond Ring Confirmation Of Engagement With Kyle Walker

May 24, 2025

Annie Kilners Diamond Ring Confirmation Of Engagement With Kyle Walker

May 24, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025 -

Porsche Isplecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025

Porsche Isplecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025

Latest Posts

-

Tretiy Final Kubka Billi Dzhin King Dlya Kazakhstana

May 24, 2025

Tretiy Final Kubka Billi Dzhin King Dlya Kazakhstana

May 24, 2025 -

Aleksandrova Pobezhdaet Samsonovu V Pervom Raunde Shtutgartskogo Turnira

May 24, 2025

Aleksandrova Pobezhdaet Samsonovu V Pervom Raunde Shtutgartskogo Turnira

May 24, 2025 -

Bjk Cup Kazakhstan Through To Final After Victory Over Australia

May 24, 2025

Bjk Cup Kazakhstan Through To Final After Victory Over Australia

May 24, 2025 -

Smooth Sailing For Andreescu In Madrid Open Second Round

May 24, 2025

Smooth Sailing For Andreescu In Madrid Open Second Round

May 24, 2025 -

Rybakina Eks Tretya Raketka Mira Pryamaya Translyatsiya Matcha

May 24, 2025

Rybakina Eks Tretya Raketka Mira Pryamaya Translyatsiya Matcha

May 24, 2025