7% Drop In Amsterdam Stock Market: Trade War Uncertainty Creates Volatility

Table of Contents

The Amsterdam stock market suffered a dramatic 7% drop today, sending shockwaves through the financial community. This sharp decline is largely attributed to the increasing uncertainty surrounding the ongoing global trade war. This article will delve into the specific factors contributing to this volatility, analyzing the impact on Dutch businesses and offering insights into potential future market movements. We'll explore investor reactions, government responses, and provide advice for navigating this turbulent period.

Trade War Uncertainty: The Primary Culprit

The current global trade war, characterized by escalating tariffs and protectionist measures between major economic powers like the US and China, has created significant uncertainty for businesses worldwide. The Netherlands, heavily reliant on international trade, is particularly vulnerable. This uncertainty directly impacts investor confidence, leading to volatility in the Amsterdam stock market.

- Increased tariffs on Dutch exports: Higher tariffs imposed by the US and China on Dutch agricultural products, technology goods, and other exports significantly reduce their competitiveness in these key markets.

- Supply chain disruptions: The trade war disrupts global supply chains, affecting Dutch businesses reliant on imported components or exporting finished goods. Delays and increased costs squeeze profit margins.

- Reduced consumer confidence: The global economic slowdown stemming from trade tensions reduces consumer spending, impacting demand for Dutch products and services, both domestically and internationally.

This uncertainty fuels negative investor sentiment. Fear of further economic fallout prompts investors to sell assets, contributing directly to the 7% market drop. The resulting volatility makes accurate market prediction challenging, increasing risk for all market participants.

Impact on Key Dutch Sectors

The 7% drop in the Amsterdam stock market hasn't impacted all sectors equally. Some industries are more vulnerable to trade war uncertainty than others.

- Technology: Dutch technology companies, heavily reliant on global supply chains and exports, are particularly vulnerable. Increased tariffs and trade restrictions can severely impact their profitability. For example, [Example Company A] saw its share price decline by [percentage] following the market downturn.

- Agriculture: The Netherlands is a major agricultural exporter. Increased tariffs on key agricultural products significantly reduce export revenues for Dutch farmers and agricultural businesses. [Example Company B], a major exporter of [agricultural product], is likely to experience substantial revenue losses.

- Manufacturing: Dutch manufacturing companies face challenges due to supply chain disruptions and decreased global demand. The increased cost of imported materials reduces profitability and competitiveness.

The long-term consequences for these sectors include reduced investment, potential job losses, and a slower economic growth rate for the Netherlands.

Investor Reactions and Market Volatility

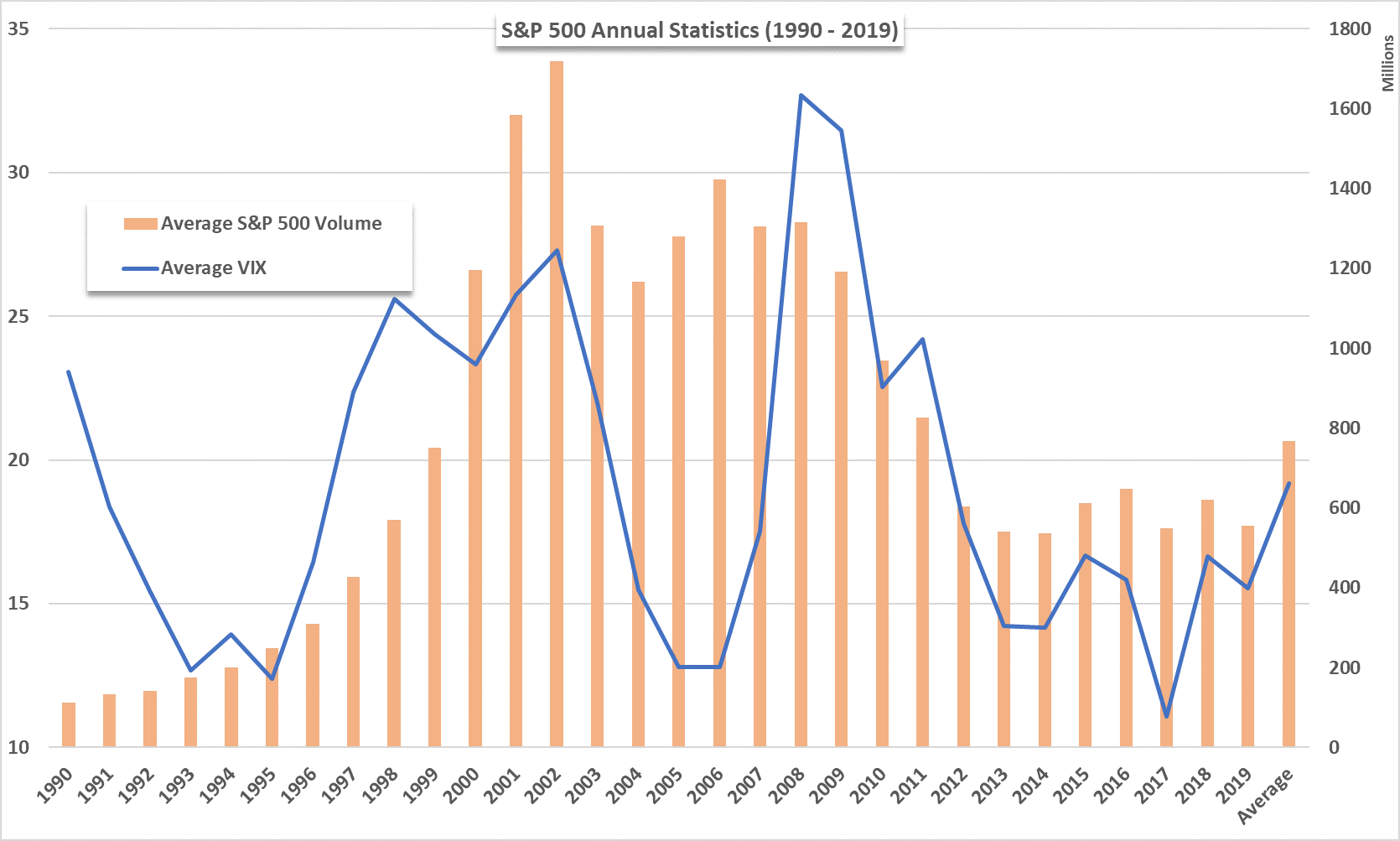

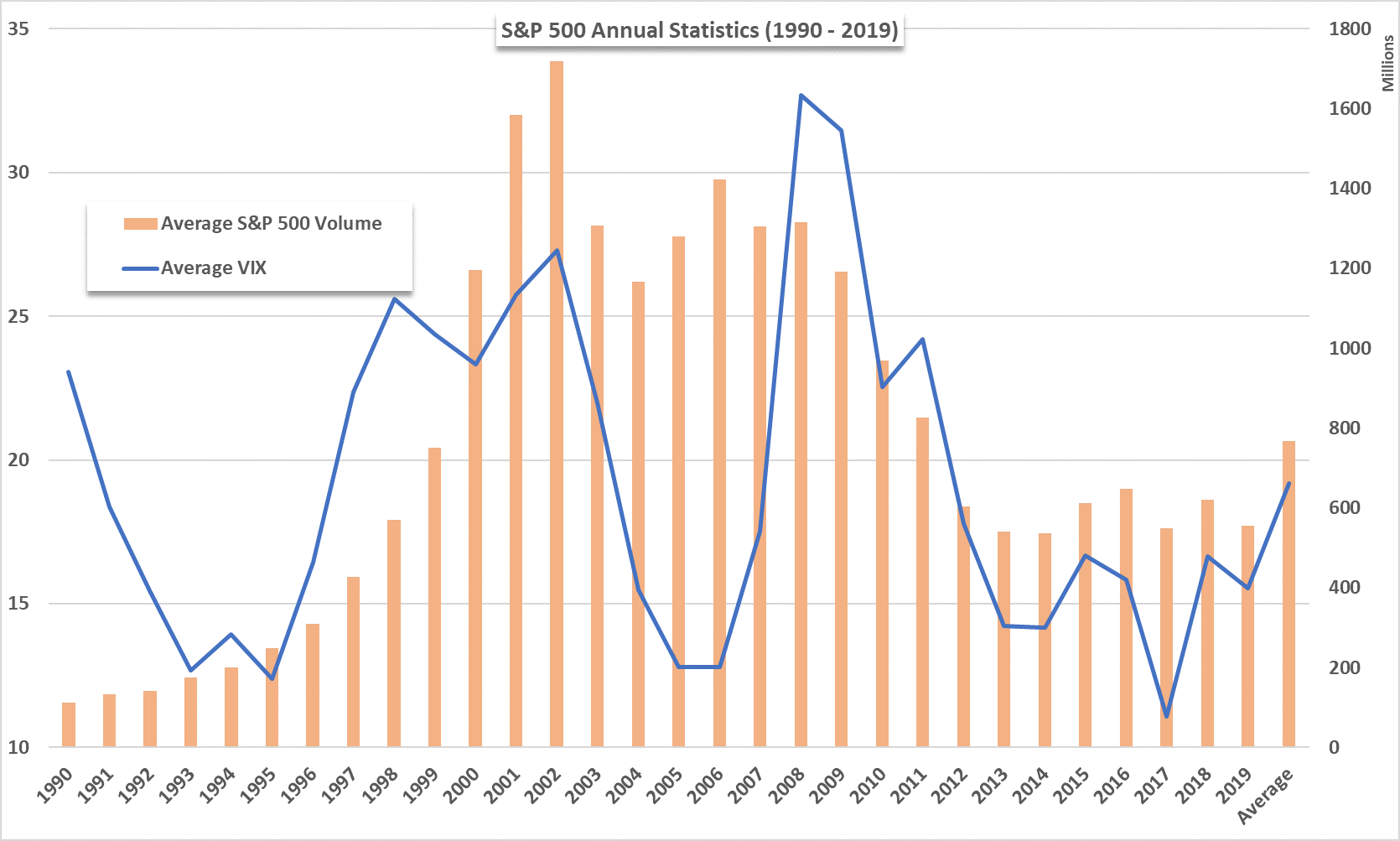

The immediate reaction to the 7% drop was widespread selling, increasing market volatility. Trading volumes surged as investors sought to liquidate assets, further exacerbating the decline. Short-term investment strategies suffered significantly, while long-term investors may reassess their portfolios.

- Flight to safety: We observed a flight to safety, with investors moving towards less risky assets like government bonds and gold. This phenomenon is typical during periods of heightened uncertainty.

- Market indices: The AEX index, the benchmark index of the Amsterdam Stock Exchange, experienced a sharp decline, reflecting the overall market sentiment. [Insert data on AEX performance, trading volume etc.]

This increased volatility highlights the risk associated with investing during times of significant geopolitical uncertainty. Understanding this volatility is crucial for making informed investment decisions.

Government Response and Potential Mitigation Strategies

The Dutch government is likely to implement measures to mitigate the negative impact of the trade war on the economy. These may include:

- Financial support for affected businesses: Government aid packages and subsidies might help businesses navigate the challenges of the trade war and maintain employment.

- Trade diversification strategies: The government could encourage Dutch businesses to diversify their export markets to reduce their reliance on countries involved in trade disputes.

- Investment in innovation and technology: Supporting innovation could enhance competitiveness and resilience against external shocks like trade wars.

Future Outlook and Predictions

Predicting the future of the Amsterdam stock market in this volatile environment is challenging. However, a cautiously optimistic outlook depends on the resolution of the ongoing trade disputes.

- Trade war resolution: A de-escalation of trade tensions could lead to a recovery in investor confidence and a rebound in the Amsterdam stock market.

- Trade war escalation: Further escalation could lead to prolonged market volatility and a deeper economic downturn.

Factors to watch include the progress of trade negotiations between major economic powers, global economic growth, and the resilience of the Dutch economy.

Advice for Investors

Navigating this period of uncertainty requires a careful and informed approach:

- Risk management: Assess your risk tolerance and adjust your investment strategy accordingly. Consider diversifying your portfolio to mitigate risk.

- Portfolio diversification: Spread investments across different asset classes and geographical regions to reduce your exposure to any single market or sector.

- Stay informed: Monitor market developments closely through reputable financial news sources and consult with financial advisors.

Amsterdam Stock Market: Historical Context and Comparison

The Amsterdam stock market has experienced periods of volatility in the past. However, the current 7% drop, driven by trade war uncertainty, is a significant event. Comparing this drop to previous events provides valuable context, highlighting the unique challenges of the current situation. [Insert relevant historical data and analysis here].

Conclusion

The 7% drop in the Amsterdam stock market is a significant event, primarily driven by the uncertainty surrounding the ongoing global trade war. The impact on key Dutch sectors, investor reactions, and government responses all contribute to this volatile situation. Understanding these factors is crucial for navigating the current market conditions.

Call to Action: Stay informed about the evolving situation affecting the Amsterdam stock market and the global trade war. Monitor market trends and adjust your investment strategy accordingly. Understand the risks associated with trade war uncertainty and make informed decisions to protect your investments. Learn more about managing your portfolio in times of volatility.

Featured Posts

-

Green Spaces And Mental Wellbeing A Seattle Pandemic Perspective

May 24, 2025

Green Spaces And Mental Wellbeing A Seattle Pandemic Perspective

May 24, 2025 -

90 Let Sergeyu Yurskomu Pamyati Geniya Paradoksov

May 24, 2025

90 Let Sergeyu Yurskomu Pamyati Geniya Paradoksov

May 24, 2025 -

Ces Unveiled Europe Innovation Et Technologie A Amsterdam

May 24, 2025

Ces Unveiled Europe Innovation Et Technologie A Amsterdam

May 24, 2025 -

Best Of Bangladesh A Netherlands Business And Investment Showcase

May 24, 2025

Best Of Bangladesh A Netherlands Business And Investment Showcase

May 24, 2025 -

Nicki Chapmans Bespoke Chiswick Garden A Glimpse Inside

May 24, 2025

Nicki Chapmans Bespoke Chiswick Garden A Glimpse Inside

May 24, 2025

Latest Posts

-

Price Gouging Allegations Surface After La Fires A Reality Tv Stars Account

May 24, 2025

Price Gouging Allegations Surface After La Fires A Reality Tv Stars Account

May 24, 2025 -

Investment Guide The Countrys Promising New Business Centers

May 24, 2025

Investment Guide The Countrys Promising New Business Centers

May 24, 2025 -

Understanding The Growth Of The Countrys Leading Business Centers

May 24, 2025

Understanding The Growth Of The Countrys Leading Business Centers

May 24, 2025 -

A Data Driven Map Of The Countrys Top Business Hotspots

May 24, 2025

A Data Driven Map Of The Countrys Top Business Hotspots

May 24, 2025 -

The Countrys Business Landscape Unveiling The Hottest New Markets

May 24, 2025

The Countrys Business Landscape Unveiling The Hottest New Markets

May 24, 2025