Posthaste: Understanding The Implications Of Bond Market Instability

Table of Contents

Causes of Bond Market Instability

Several factors contribute to the instability observed in the bond market. Understanding these root causes is the first step towards mitigating their impact.

Rising Interest Rates

Central bank policy decisions significantly influence bond yields and prices. Increased interest rates, a common tool to combat inflation, directly impact bond values.

- Increased borrowing costs: Higher rates make borrowing more expensive for governments and corporations, impacting their ability to issue new bonds.

- Decreased bond values: Existing bonds become less attractive when newer bonds offer higher yields, leading to a decrease in their market price. This is because bond prices and interest rates have an inverse relationship. A rise in interest rates means a fall in bond prices.

- Impact on fixed-income investments: Investors holding fixed-income bonds experience capital losses as the value of their holdings declines.

The attractiveness of bonds diminishes as interest rate hikes make alternative investments, such as high-yield savings accounts or short-term certificates of deposit, more appealing. This shift in investor preference creates selling pressure, further depressing bond prices.

Inflationary Pressures

High inflation erodes the purchasing power of fixed-income investments, impacting investor confidence and bond yields.

- Erosion of purchasing power: Inflation reduces the real return on bonds, meaning investors receive less in terms of actual goods and services.

- Increased demand for higher-yielding bonds: Investors seek bonds offering higher yields to compensate for inflation's impact on their returns, driving up demand for such instruments.

- Potential for higher inflation expectations: If inflation is perceived to be persistent, investors may demand even higher yields, further fueling instability in the bond market.

The fear of inflation erodes the perceived safety of bonds, a critical component of their appeal. This shift leads to increased volatility and uncertainty within the bond market.

Geopolitical Uncertainty

Global events and political instability significantly influence bond market sentiment, often leading to increased volatility.

- Flight to safety: During times of geopolitical uncertainty, investors often seek safe haven assets, like government bonds of stable economies, leading to increased demand and higher prices for these securities.

- Increased risk aversion: Uncertainty triggers risk aversion, causing investors to sell riskier bonds, including corporate bonds and emerging market debt, creating downward pressure on prices.

- Potential capital outflows: Geopolitical events can prompt capital flight from certain regions, impacting the bond markets in those areas.

Examples include the outbreak of war or significant political upheaval. These events create uncertainty and cause investors to re-evaluate the risks associated with their bond holdings.

Credit Rating Downgrades

Changes in credit ratings directly impact bond yields and investor confidence, creating ripples within the market.

- Increased borrowing costs for issuers: A credit downgrade signals increased risk to potential lenders, making it more expensive for the issuer to borrow money.

- Decreased demand for downgraded bonds: Investors are less willing to purchase bonds from downgraded issuers, leading to lower prices and higher yields to attract buyers.

- Potential contagion effects: A downgrade of one issuer could trigger concerns about other similar entities, potentially creating a domino effect across the market.

Credit rating agencies play a significant role in shaping investor perception of risk. A negative assessment can swiftly lead to a decline in bond prices and increased borrowing costs.

Consequences of Bond Market Instability

Instability in the bond market has far-reaching consequences, impacting various aspects of the global economy.

Impact on Economic Growth

Bond market instability can significantly affect investment and overall economic activity.

- Higher borrowing costs for businesses: Increased bond yields translate to higher borrowing costs for companies, hindering investment and expansion plans.

- Reduced investment spending: Businesses may postpone or cancel investment projects due to the increased cost of capital, slowing economic growth.

- Potential recessionary pressures: A sustained period of bond market instability can create a ripple effect throughout the economy, potentially triggering a recession.

The cost of capital is crucial for businesses, and increases driven by bond market instability can hinder growth and investment.

Increased Volatility in Other Markets

Instability in the bond market often spills over to other asset classes, increasing overall market volatility.

- Market correlations: Bond market movements are often correlated with other markets, such as the stock market. A downturn in the bond market can negatively impact equity valuations.

- Contagion effects: Instability in one market can trigger sell-offs in others, creating a contagious effect across the financial system.

- Potential for systemic risk: Severe bond market instability can pose a systemic risk to the entire financial system, threatening global economic stability.

The interconnectedness of financial markets means that instability in one area is likely to spread, triggering wider market volatility.

Impact on Pension Funds and Insurance Companies

Institutions with large bond holdings are particularly vulnerable to bond market instability.

- Decreased asset values: A decline in bond prices directly reduces the value of assets held by these institutions.

- Potential liquidity issues: If bond prices fall sharply, these institutions might face liquidity problems if they need to sell assets quickly to meet obligations.

- Implications for benefit payments: Reduced asset values could impact the ability of pension funds to pay out benefits and insurance companies to meet claims.

Pension funds and insurance companies often rely heavily on bonds for their investment strategies. Significant losses in their bond portfolios can jeopardize their financial stability.

Mitigating Bond Market Instability

Several strategies can be employed to mitigate the risks associated with bond market instability.

Diversification

Diversifying investments across different asset classes is crucial for reducing risk exposure.

- Reducing risk exposure: Spreading investments across various asset classes, such as stocks, real estate, and commodities, reduces reliance on any single asset class.

- Improving portfolio resilience: A diversified portfolio is better equipped to withstand shocks in any one market, offering greater resilience.

- Mitigating losses: Losses in one asset class can be offset by gains in another, reducing the overall impact on the portfolio.

Diversification is a fundamental principle of risk management and is particularly important during times of market instability.

Active Management

Active investment strategies can help navigate market volatility and exploit potential opportunities.

- Identifying undervalued bonds: Active managers can identify bonds that are undervalued due to temporary market fluctuations.

- Adjusting portfolio allocations: They can adjust portfolio allocations based on changing market conditions, shifting towards safer assets during periods of instability.

- Exploiting market inefficiencies: Active managers can potentially profit from market inefficiencies by identifying and capitalizing on mispricing opportunities.

While passive strategies have their merits, active management offers the potential to navigate volatility more effectively, particularly during periods of instability.

Regulatory Oversight

Robust regulatory frameworks are essential for maintaining market stability and preventing excessive risk-taking.

- Preventing excessive risk-taking: Regulations can limit excessive leverage and risky investment practices that can amplify market volatility.

- Improving transparency: Enhanced transparency in the financial system can help to identify and mitigate risks early on.

- Enhancing market integrity: Strong regulations help to maintain the integrity of the market and reduce the potential for manipulation or fraud.

Effective regulation plays a crucial role in fostering a stable and efficient bond market, reducing systemic risks.

Conclusion

Understanding the implications of bond market instability is crucial for navigating the complexities of the global financial landscape. Factors such as rising interest rates, inflation, geopolitical uncertainty, and credit rating downgrades contribute to this instability, which can have significant consequences for economic growth, other asset classes, and financial institutions. However, through diversification, active management, and strong regulatory oversight, investors and policymakers can work towards mitigating the risks associated with bond market instability. Staying informed about market trends and proactively managing your investments is key to navigating the challenges posed by bond market volatility. Consult with a financial advisor to develop a strategy that aligns with your risk tolerance and investment objectives.

Featured Posts

-

Beurzenherstel Na Trump Uitstel Aex Fondsen Boeken Winsten

May 24, 2025

Beurzenherstel Na Trump Uitstel Aex Fondsen Boeken Winsten

May 24, 2025 -

Mercato Azionario Europeo Analisi Borsa Italiana Focus Su Italgas E Banche

May 24, 2025

Mercato Azionario Europeo Analisi Borsa Italiana Focus Su Italgas E Banche

May 24, 2025 -

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 24, 2025

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 24, 2025 -

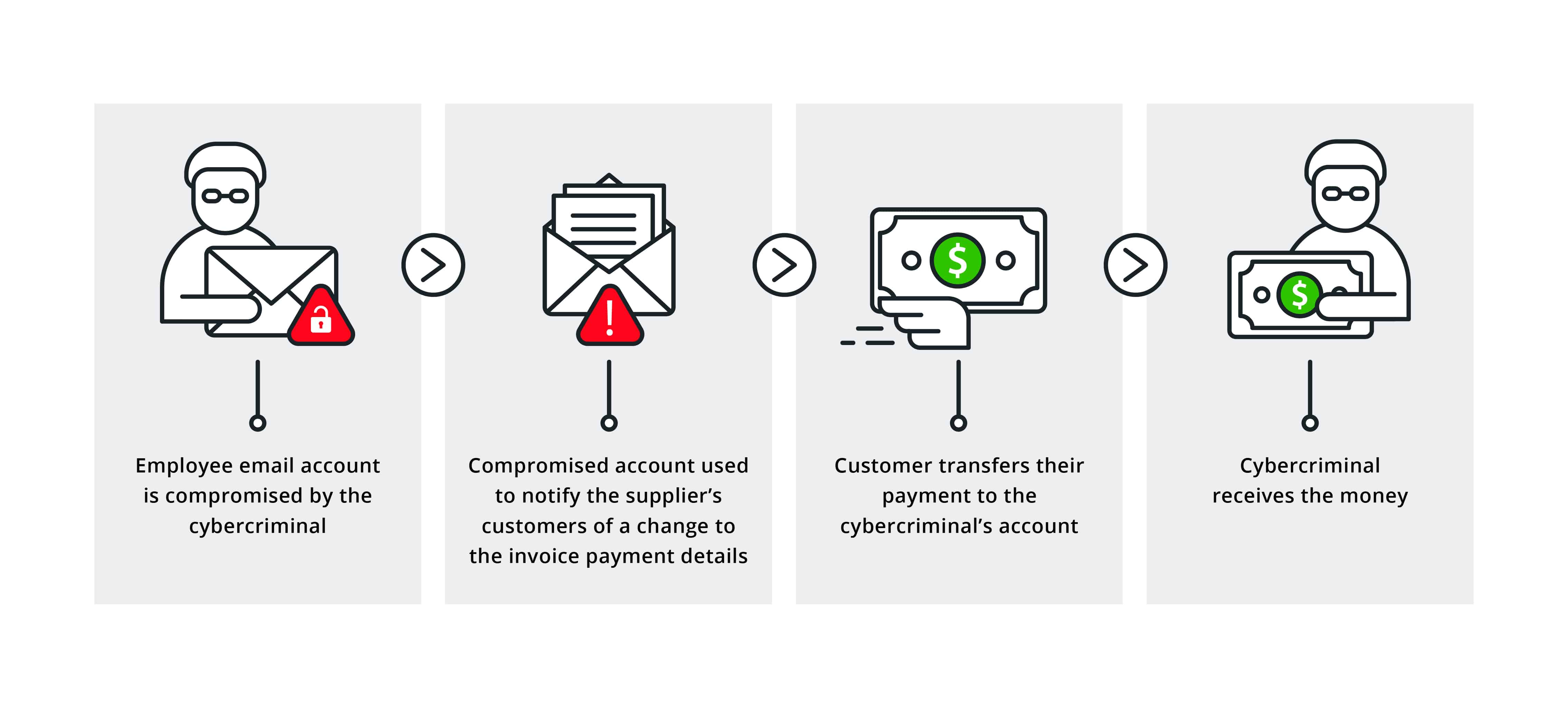

Cybercriminals Millions The Office365 Executive Email Compromise

May 24, 2025

Cybercriminals Millions The Office365 Executive Email Compromise

May 24, 2025 -

Your Escape To The Country A Step By Step Relocation Plan

May 24, 2025

Your Escape To The Country A Step By Step Relocation Plan

May 24, 2025

Latest Posts

-

The Last Rodeo A Critical Review Of The Bull Riding Film

May 24, 2025

The Last Rodeo A Critical Review Of The Bull Riding Film

May 24, 2025 -

Behind The Scenes Neal Mc Donoughs Bull Riding Video Training Regime

May 24, 2025

Behind The Scenes Neal Mc Donoughs Bull Riding Video Training Regime

May 24, 2025 -

The Last Rodeo Review A Heartfelt Bull Riding Drama

May 24, 2025

The Last Rodeo Review A Heartfelt Bull Riding Drama

May 24, 2025 -

Memorial Day 2025 Florida Store Operating Hours Publix And Others

May 24, 2025

Memorial Day 2025 Florida Store Operating Hours Publix And Others

May 24, 2025 -

Boise Sighting Neal Mc Donough At Acero Boards And Bottles

May 24, 2025

Boise Sighting Neal Mc Donough At Acero Boards And Bottles

May 24, 2025