Apple Stock Performance: Ahead Of Q2 Earnings Announcement

Table of Contents

Analyzing Apple's Q1 2024 Performance and its Implications for Q2

Apple's Q1 2024 earnings report offered a mixed bag. While the company exceeded expectations in certain areas, others showed signs of slowing growth. Understanding these nuances is crucial for predicting Apple stock performance in Q2.

-

Q1 Results: Apple reported [Insert Actual Q1 Revenue and EPS figures here]. This compared to [Insert Analyst Expectations for Q1]. While revenue showed [growth/decline percentage], EPS demonstrated [growth/decline percentage]. Key Performance Indicators (KPIs) like iPhone sales and Services revenue growth were particularly important in shaping the overall narrative.

-

Market Reaction: The market reacted to Q1 earnings with [describe the market's reaction – e.g., a slight dip, a surge, or relatively flat performance]. This indicates [explain the market sentiment based on the reaction].

-

Trends for Q2: Several trends observed in Q1 could influence Q2 performance. For example, [mention a specific trend like strong growth in a particular product segment or weakening sales in another]. This suggests that [explain how the trend might impact Q2 performance].

-

Specific Q1 Metrics:

- iPhone Sales: [Insert data on iPhone sales growth or decline]

- Services Revenue Growth: [Insert data on Services revenue growth or decline]

- Mac Sales: [Insert data on Mac sales growth or decline]

- Wearables Sales: [Insert data on Wearables sales growth or decline]

- Impact of Macroeconomic Factors: [Discuss the impact of inflation, interest rates, or other macroeconomic factors on Q1 performance.]

Key Factors Influencing Apple Stock Price Before Q2 Earnings

Several key factors are likely to influence Apple stock performance leading up to and following the Q2 earnings announcement.

-

Anticipated Product Launches: The launch of new iPhones, Apple Watches, or other products will significantly impact investor sentiment. The expected market reception of these products, along with any innovative features, will be key determinants of stock price movement.

-

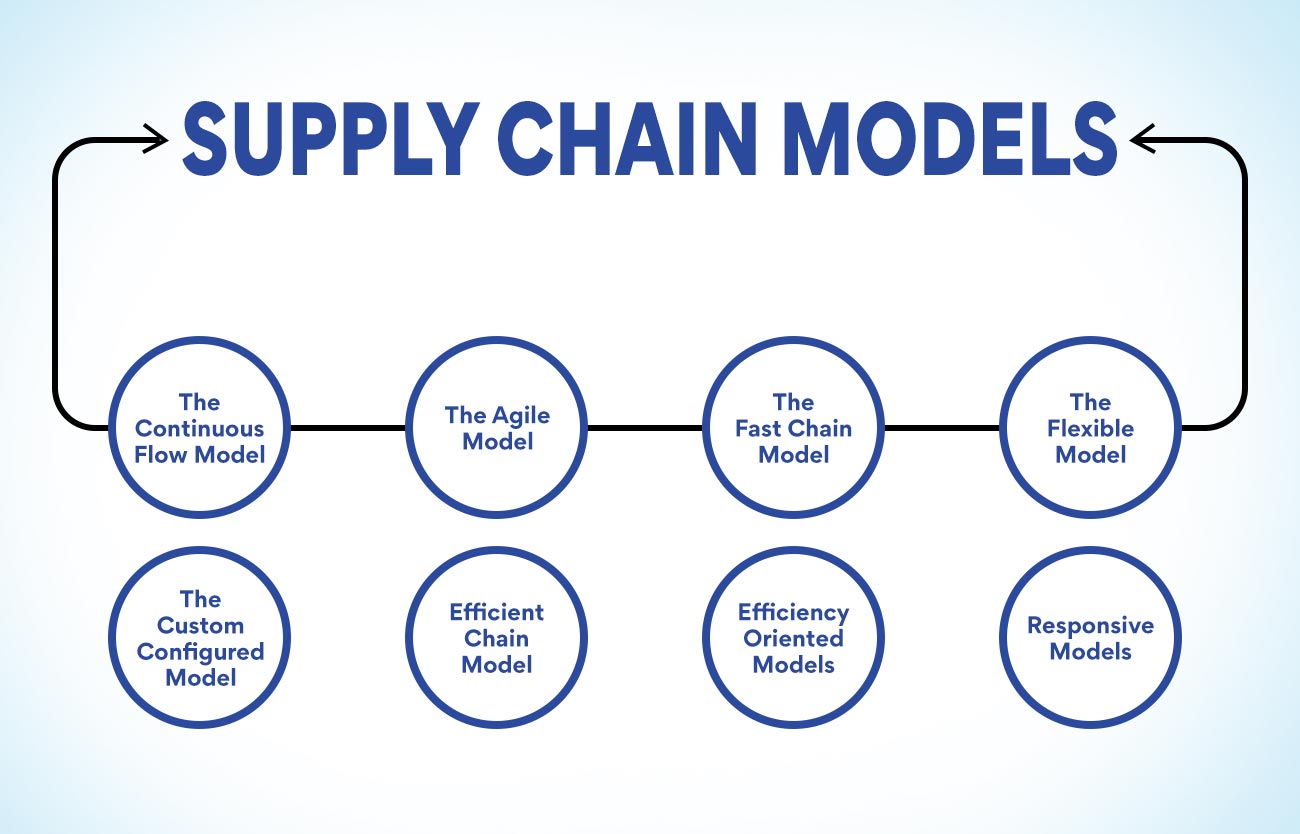

Supply Chain Concerns: Ongoing supply chain disruptions could impact production and sales, affecting Apple's ability to meet demand. Any potential easing or worsening of these concerns will directly impact investor confidence.

-

Economic Climate: The overall economic climate plays a crucial role. Factors such as inflation, interest rates, and consumer spending directly affect demand for Apple's products. A robust economy generally supports higher stock valuations, while a downturn can lead to a decline.

-

Competitive Landscape: Competitors' strategies and market share gains or losses could affect Apple's position. Analyzing the performance of key players in the smartphone and technology sector provides vital context for evaluating Apple stock performance.

-

Specific Factors:

- Upcoming Product Releases: [Mention specific products and their expected impact.]

- Supply Chain Disruptions: [Discuss potential disruptions and their likely effects.]

- Economic Indicators: [Analyze relevant indicators like inflation and interest rates.]

- Competitive Analysis: [Compare Apple's performance against key competitors.]

Analyst Predictions and Expectations for Apple's Q2 Earnings

Financial analysts offer a range of predictions for Apple's Q2 earnings. Understanding this consensus and the range of expectations is crucial for assessing potential stock price movements.

-

Consensus Estimates: The average EPS estimate for Q2 is [Insert Average EPS Estimate], with revenue projected at [Insert Average Revenue Estimate].

-

Range of Estimates: Estimates vary widely, with the highest EPS projection at [Insert High EPS Estimate] and the lowest at [Insert Low EPS Estimate]. This reflects the uncertainty surrounding several key factors discussed above.

-

Divergence in Opinions: Analysts differ in their opinions due to varying assessments of factors such as supply chain issues, consumer demand, and the impact of new product launches.

-

Revisions to Expectations: Keep an eye out for any upward or downward revisions to analyst expectations as new information emerges.

-

Analyst Reports: [Mention any notable analyst reports and their key takeaways.]

Strategies for Investors Considering Apple Stock

Investors considering Apple stock should formulate strategies aligned with their risk tolerance and investment goals.

-

Investment Strategies:

- Buy-and-hold: A long-term strategy suitable for risk-averse investors.

- Short-term trading: A higher-risk strategy aiming for quick profits based on short-term price fluctuations.

-

Risk Management: Diversifying investments across various asset classes is crucial to mitigate risk.

-

Due Diligence: Thorough research is essential before making any investment decisions. Consult reputable financial news websites, access SEC filings, and consult with financial advisors.

-

Informed Decision-Making: Avoid speculation and make investment decisions based on thorough analysis of financial data and market trends.

-

Investment Strategy Examples:

- Buy-and-hold: Invest in Apple stock with a long-term perspective, weathering market fluctuations.

- Short-term trading: Buy and sell Apple stock based on short-term price movements, aiming for quick profits.

Conclusion: Monitoring Apple Stock Performance After Q2 Earnings

The Apple stock performance leading up to and following the Q2 earnings announcement will depend on a complex interplay of factors, including Q1 results, product launches, supply chain dynamics, economic conditions, and competitive pressures. Continuously monitoring relevant news, financial data, and analyst reports is crucial for informed decision-making. While predicting the precise trajectory of Apple's stock price is impossible, understanding these factors can help investors make more informed choices.

To stay informed about future earnings reports, market trends, and Apple stock performance, subscribe to our newsletter [insert link] or follow us on [insert social media link]. Stay tuned for further analysis following the Q2 announcement!

Featured Posts

-

Demna Gvasalias First Gucci Collection Review And Analysis

May 24, 2025

Demna Gvasalias First Gucci Collection Review And Analysis

May 24, 2025 -

Le Controle Chinois En France Les Dissidents Dans Le Viseur

May 24, 2025

Le Controle Chinois En France Les Dissidents Dans Le Viseur

May 24, 2025 -

Gucci Industrial And Supply Chain Leadership Change Vians Exit

May 24, 2025

Gucci Industrial And Supply Chain Leadership Change Vians Exit

May 24, 2025 -

Dow Jones Steady Ascent Positive Pmi Data Fuels Growth

May 24, 2025

Dow Jones Steady Ascent Positive Pmi Data Fuels Growth

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Interpreting And Using Nav Data

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Interpreting And Using Nav Data

May 24, 2025

Latest Posts

-

Auto Dealers Push Back Against Mandatory Ev Quotas

May 24, 2025

Auto Dealers Push Back Against Mandatory Ev Quotas

May 24, 2025 -

Bipartisan Senate Resolution Celebrates Canada U S Partnership

May 24, 2025

Bipartisan Senate Resolution Celebrates Canada U S Partnership

May 24, 2025 -

Voice Assistant Development Revolutionized Open Ais Latest Tools

May 24, 2025

Voice Assistant Development Revolutionized Open Ais Latest Tools

May 24, 2025 -

Three Years Of Data Breaches Cost T Mobile 16 Million

May 24, 2025

Three Years Of Data Breaches Cost T Mobile 16 Million

May 24, 2025 -

The Future Of Museum Programs Post Trump Budget Reductions

May 24, 2025

The Future Of Museum Programs Post Trump Budget Reductions

May 24, 2025