Dow Jones Steady Ascent: Positive PMI Data Fuels Growth

Table of Contents

Positive PMI Data: A Key Driver

Understanding the PMI

The Purchasing Managers' Index (PMI) is a leading economic indicator that tracks the activity levels of purchasing managers within the manufacturing and services sectors. It's a diffusion index, meaning it reflects the proportion of respondents reporting increases versus decreases in various business activities. A PMI above 50 indicates expansion, while a reading below 50 suggests contraction. Understanding the PMI is vital for gauging the health of the economy and anticipating market movements.

- Definition of PMI: A monthly survey-based index measuring the rate of change in business activity.

- How it's calculated: Based on weighted averages of responses from purchasing managers across various sectors.

- Different PMI indices: Manufacturing PMI focuses on industrial production, while Services PMI tracks the service sector's performance. Composite PMI combines both manufacturing and services data for a broader economic overview.

- Predictive power: PMI data often serves as an early warning system for economic trends, preceding GDP reports and other lagging indicators.

Recent PMI Numbers and Their Impact

Recent PMI data releases have been overwhelmingly positive, contributing significantly to the Dow Jones's upward trajectory. For example, the August 2024 Manufacturing PMI registered 55.2, exceeding expectations and indicating robust growth in the sector. Similarly, the Services PMI reached 56.5, signifying strong expansion in the service sector. This positive data strongly correlates with the rise in the Dow Jones.

- Specific PMI figures: Include the most recent data and compare it to previous months and years. (Note: Replace these with actual data at the time of publication).

- Comparison to previous periods: Show a clear trend of improvement.

- Sector-specific PMI data: Highlight any significant disparities between manufacturing and services PMI.

- Expert opinions: Quote analysts and economists who have commented on the significance of the recent PMI data.

Investor Confidence and Market Reaction

The positive PMI data has significantly boosted investor confidence, leading to increased buying activity and pushing the Dow Jones higher. Investors see the strong PMI numbers as a sign of a healthy and expanding economy, reducing risk aversion and encouraging investment in equities.

- Examples of investor actions: Cite increased investment in the stock market, increased mergers and acquisitions activity, and decreased demand for safe-haven assets like gold.

- Analysis of stock market performance: Show a clear link between PMI releases and subsequent Dow Jones movement.

- Commentary on investor sentiment surveys: Refer to reputable surveys that measure investor confidence.

Other Factors Contributing to the Dow Jones's Ascent

Strong Corporate Earnings

Strong corporate earnings reports have played a significant role in the Dow Jones's ascent. Many major companies have exceeded earnings expectations, demonstrating the resilience and profitability of the US corporate sector. These positive results fuel investor confidence and drive up stock prices.

- Examples of companies reporting strong earnings: Cite specific companies and sectors that have delivered strong results.

- Impact on their stock prices: Show how strong earnings translate into higher stock prices.

- Overall trend in corporate earnings: Analyze the overall trend in earnings reports to confirm the positive momentum.

Easing Inflation Concerns

Easing inflation concerns are also contributing to the positive market sentiment. Recent data suggests a slowdown in inflation, reducing pressure on the Federal Reserve to aggressively raise interest rates. This provides a more favorable environment for investment and contributes to the Dow Jones's growth.

- Analysis of recent inflation data: Present recent inflation figures and show a trend of deceleration.

- Federal Reserve policy and its influence: Discuss the impact of the Fed's actions (or inaction) on inflation and investor confidence.

- Impact of inflation on investor behavior: Explain how lower inflation reduces uncertainty and encourages investment.

Geopolitical Factors

While generally positive, geopolitical factors can still influence the Dow Jones. Any major geopolitical events, whether positive or negative, can impact market sentiment. It is crucial to monitor these factors closely.

- Mention specific events: Briefly discuss any relevant geopolitical events and their impact, positive or negative.

- Explain their influence on the market: Show how these events affected market sentiment and investor behavior.

- Potential future risks: Acknowledge potential future geopolitical risks and their potential impact.

Future Outlook and Investment Strategies

Sustained Growth Potential

Based on current trends and projections, the potential for sustained growth in the Dow Jones remains promising. However, challenges remain, including potential economic slowdowns, geopolitical uncertainties, and unexpected market volatility.

- Expert forecasts: Cite forecasts from reputable financial institutions and analysts.

- Potential risks and challenges: Discuss potential headwinds that could impact the Dow Jones's growth.

- Long-term growth outlook: Offer a balanced assessment of the long-term prospects.

Investment Strategies

Given the current market conditions, investors should consider a balanced approach to their investment strategies. Diversification across various asset classes, including stocks and bonds, is crucial to mitigate risk. Careful consideration of risk tolerance is also necessary.

- Types of investments: Discuss diverse investment options suitable for the current environment.

- Risk management strategies: Emphasize the importance of managing risk appropriately.

- Diversification strategies: Advocate for spreading investments across different asset classes and sectors.

Conclusion:

The Dow Jones's steady ascent is largely fueled by positive PMI data, reflecting robust economic growth and increased investor confidence. Strong corporate earnings and easing inflation concerns further contribute to this positive market trend. While geopolitical factors remain a consideration, the current outlook suggests continued potential for growth. However, investors should always adopt a balanced approach and consider diversification strategies. Stay informed about future PMI releases and economic indicators to make informed decisions regarding your Dow Jones investments and capitalize on this period of stock market growth. Understanding the PMI and its implications is crucial for navigating this dynamic market environment.

Featured Posts

-

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025 -

Sewn Lei Designs Hawaii Keiki Memorial Day Poster Contest Highlights Artistic Talent

May 24, 2025

Sewn Lei Designs Hawaii Keiki Memorial Day Poster Contest Highlights Artistic Talent

May 24, 2025 -

I Phone Ai

May 24, 2025

I Phone Ai

May 24, 2025 -

Escape To The Country Investing In A Peaceful Future

May 24, 2025

Escape To The Country Investing In A Peaceful Future

May 24, 2025 -

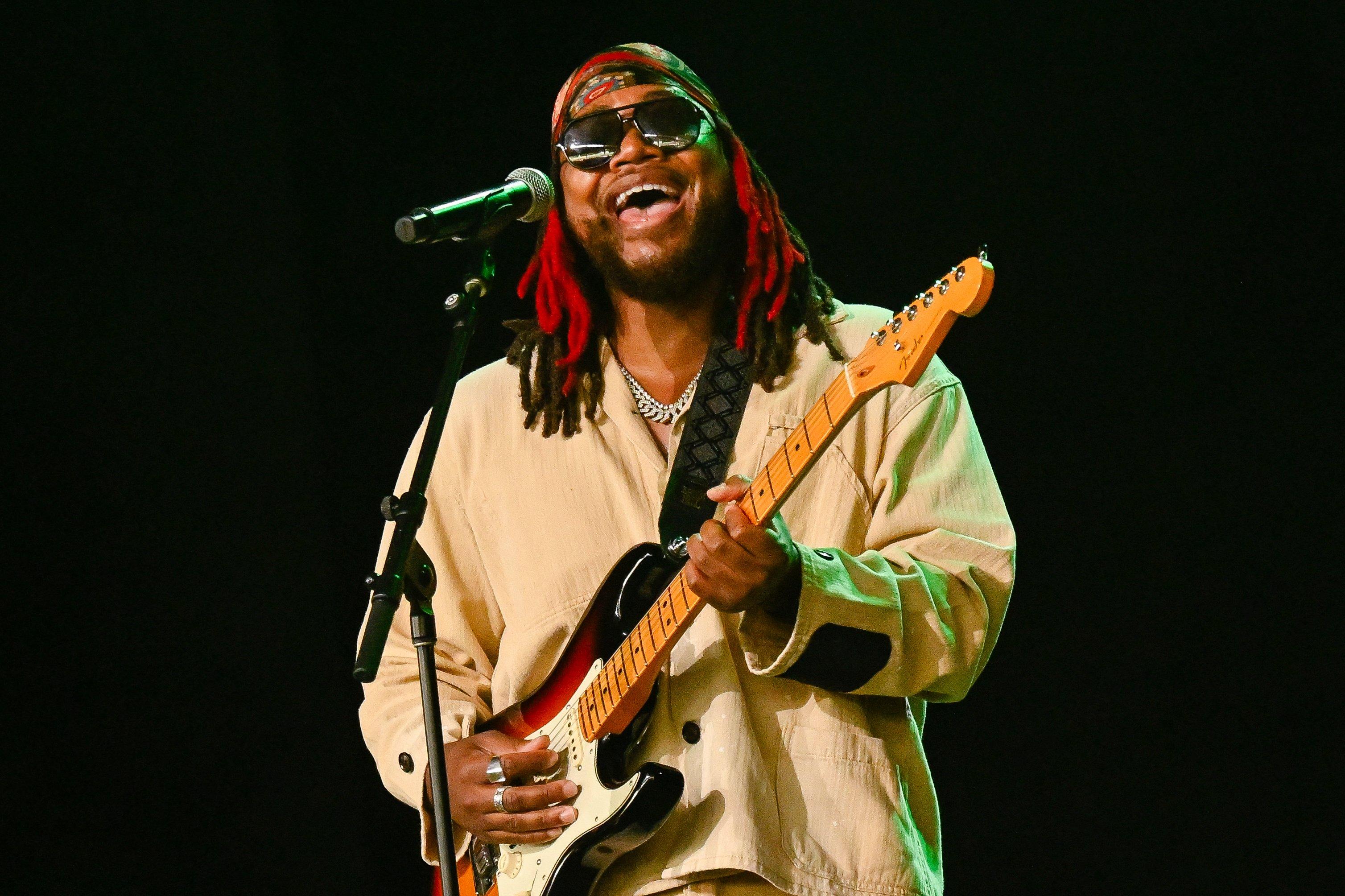

Top R And B Songs Leon Thomas And Flos Must Hear Releases

May 24, 2025

Top R And B Songs Leon Thomas And Flos Must Hear Releases

May 24, 2025

Latest Posts

-

Is Sean Penns Support Of Woody Allen A Me Too Blind Spot A Critical Analysis

May 24, 2025

Is Sean Penns Support Of Woody Allen A Me Too Blind Spot A Critical Analysis

May 24, 2025 -

Sean Penn And Woody Allen Examining A Continued Me Too Blind Spot

May 24, 2025

Sean Penn And Woody Allen Examining A Continued Me Too Blind Spot

May 24, 2025 -

Sean Penns Support For Woody Allen A Me Too Blind Spot

May 24, 2025

Sean Penns Support For Woody Allen A Me Too Blind Spot

May 24, 2025 -

Mia Farrows Comeback A Look At Ronan Farrows Influence

May 24, 2025

Mia Farrows Comeback A Look At Ronan Farrows Influence

May 24, 2025 -

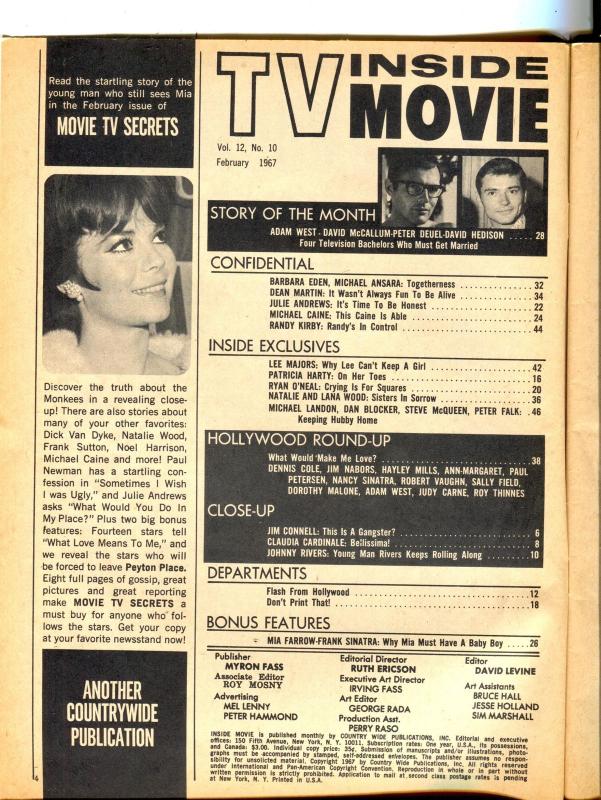

Michael Caine Mia Farrow Sex Scene And An Ex Husbands Surprise

May 24, 2025

Michael Caine Mia Farrow Sex Scene And An Ex Husbands Surprise

May 24, 2025