Apple Stock: Navigating The Pre-Q2 Market Volatility

Table of Contents

Analyzing Pre-Q2 Market Sentiment Towards Apple Stock

The price of Apple stock (AAPL) before Q2 earnings is heavily influenced by a confluence of factors. Let's dissect the key elements shaping investor sentiment.

Impact of Analyst Predictions and Ratings

Analyst ratings and price target adjustments significantly sway investor sentiment and trading activity. Major investment banks and financial institutions constantly issue reports, altering their price targets and ratings based on various factors including projected sales, new product launches, and competitive landscapes. For example, a positive upgrade from a prominent analyst like those at Morgan Stanley or Goldman Sachs can trigger a buying spree, boosting the Apple stock price. Conversely, a downgrade can initiate sell-offs, pushing the price down.

- Positive ratings boost confidence: Upward revisions in price targets signal strong belief in the company's future performance, encouraging investors to buy or hold.

- Negative ratings cause sell-offs: Downgrades often lead to investors taking profits or reducing their holdings, driving down the Apple stock price.

- Importance of diverse analyst opinions: It's crucial to consider a range of opinions, not just relying on a single analyst's prediction. Compare ratings and justifications from multiple sources for a well-rounded perspective on Apple stock forecast.

Influence of Macroeconomic Factors

Broader economic conditions significantly impact tech stocks like Apple. Inflation, interest rate hikes, and recessionary fears all play a role. A strong correlation exists between overall market performance and Apple's stock price. When the broader stock market performs poorly, Apple stock often suffers, even if the company's fundamentals remain strong. Geopolitical events and supply chain disruptions can also significantly impact Apple's performance.

- Inflation impacts consumer spending: High inflation reduces consumer disposable income, potentially affecting demand for Apple products, influencing the Apple stock price.

- Interest rate hikes affect borrowing costs: Higher interest rates increase borrowing costs for companies, impacting Apple's profitability and potentially lowering its stock valuation.

- Global uncertainties create market instability: Geopolitical tensions or unexpected global events can trigger market volatility, affecting Apple stock as a prominent tech stock.

Examining Recent News and Developments

News surrounding Apple leading up to Q2 earnings significantly impacts investor perception and the Apple stock price. New product launches generate considerable hype, often boosting the stock price. Conversely, supply chain disruptions, legal battles, or negative media coverage can negatively affect the Apple stock price.

- Product launch hype: The anticipation surrounding new iPhones, iPads, or MacBooks can drive significant interest and increase Apple stock price.

- Supply chain disruptions: Any news concerning manufacturing delays or component shortages can negatively affect investor confidence and the Apple stock price.

- Regulatory challenges: Antitrust investigations or other legal battles can create uncertainty and potentially impact the Apple stock price.

- Positive or negative media coverage: Favorable reviews of new products or positive news about the company can boost investor sentiment, while negative coverage can have the opposite effect.

Strategies for Managing Apple Stock During Pre-Q2 Volatility

Navigating pre-Q2 volatility requires a well-defined strategy focused on managing risk and capitalizing on potential opportunities.

Diversification and Risk Management

Diversification is paramount. Don't put all your investment eggs in one basket. A diversified portfolio, including assets beyond just Apple stock and even beyond the tech sector, helps mitigate risks associated with market fluctuations. Your risk tolerance should inform your investment decisions. Are you comfortable with potentially higher returns that come with higher risk? Or do you prefer a more conservative approach?

- Don't put all eggs in one basket: Diversify your investments across different asset classes and sectors to reduce risk.

- Assess your risk profile: Understand your risk tolerance before making investment decisions.

- Consider diversification beyond tech stocks: Explore other sectors (e.g., healthcare, consumer staples) to balance your portfolio.

Utilizing Technical and Fundamental Analysis

Combining technical and fundamental analysis offers a holistic view of Apple stock. Technical analysis uses chart patterns and indicators to predict short-term price movements, while fundamental analysis focuses on the company's financial health and long-term prospects.

- Technical analysis helps identify trends: Chart patterns and indicators can provide insights into potential price movements.

- Fundamental analysis reveals company health: Examining financial statements gives a picture of Apple's financial strength and future earnings potential.

- Combine both for a holistic view: A blend of both provides a comprehensive understanding to support your investment strategy.

Developing a Long-Term Investment Plan

A long-term investment strategy is crucial for navigating short-term volatility. Avoid impulsive trading decisions based on daily price fluctuations. Focus on Apple's long-term growth potential, its strong brand, and its innovative product pipeline.

- Avoid emotional investing: Don't panic sell during market downturns. Stick to your investment plan.

- Focus on long-term growth potential: Apple has a history of strong performance, suggesting future growth potential.

- Have a clear investment plan: Define your investment goals, risk tolerance, and investment timeline before making any decisions.

Conclusion

Navigating the pre-Q2 volatility in Apple stock requires careful analysis and a well-defined strategy. By understanding the influences on market sentiment, employing effective risk management techniques, and adopting a long-term perspective, investors can better position themselves to manage risk and potentially capitalize on opportunities within the Apple stock market. Remember to conduct your own thorough research and consider consulting a financial advisor before making any investment decisions regarding Apple stock or any other security. Stay informed about the latest news and developments impacting Apple stock to make the most informed decisions. Investing wisely in Apple stock requires understanding its pre-earnings volatility and having a clear plan.

Featured Posts

-

Dutch Economy Suffers As Us Trade Dispute Deepens

May 25, 2025

Dutch Economy Suffers As Us Trade Dispute Deepens

May 25, 2025 -

Analyzing Demnas Role As Guccis New Designer

May 25, 2025

Analyzing Demnas Role As Guccis New Designer

May 25, 2025 -

The Case For News Corp An Undervalued Investment Opportunity

May 25, 2025

The Case For News Corp An Undervalued Investment Opportunity

May 25, 2025 -

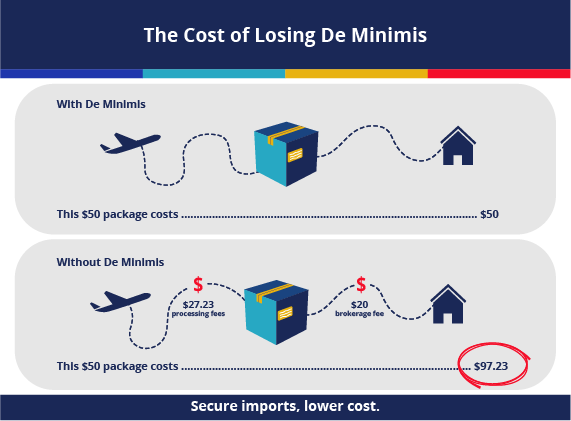

G 7 To Discuss De Minimis Tariff Thresholds For Chinese Goods

May 25, 2025

G 7 To Discuss De Minimis Tariff Thresholds For Chinese Goods

May 25, 2025 -

Jazda Probna Porsche Cayenne Gts Coupe Plusy I Minusy

May 25, 2025

Jazda Probna Porsche Cayenne Gts Coupe Plusy I Minusy

May 25, 2025

Latest Posts

-

Their Dc Love Story A Journey Cut Short

May 25, 2025

Their Dc Love Story A Journey Cut Short

May 25, 2025 -

Tim Cooks Leadership Under Scrutiny Analyzing Apples 2023 Performance

May 25, 2025

Tim Cooks Leadership Under Scrutiny Analyzing Apples 2023 Performance

May 25, 2025 -

Dc Love Story From Miles Apart To Heartbreak

May 25, 2025

Dc Love Story From Miles Apart To Heartbreak

May 25, 2025 -

Fujifilm X H2 Hands On Review Whimsical Refreshing And Fun

May 25, 2025

Fujifilm X H2 Hands On Review Whimsical Refreshing And Fun

May 25, 2025 -

Is This Tim Cooks Worst Year Yet Examining Apples Recent Challenges

May 25, 2025

Is This Tim Cooks Worst Year Yet Examining Apples Recent Challenges

May 25, 2025