Apple Stock (AAPL) Price Targets: A Technical Analysis

Table of Contents

Understanding Technical Analysis and its Application to AAPL

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. It differs from fundamental analysis, which focuses on a company's financial health. In the context of Apple stock, technical analysis helps us predict future price movements by identifying trends and patterns in historical AAPL price data. Key indicators used for Apple stock technical analysis include moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD).

-

Moving Averages: These smooth out price fluctuations, revealing underlying trends. Simple moving averages (SMA) calculate the average price over a specific period, while exponential moving averages (EMA) give more weight to recent prices. For AAPL, observing the 50-day and 200-day SMAs can signal potential buy or sell opportunities. A bullish crossover occurs when the shorter-term SMA crosses above the longer-term SMA, suggesting upward momentum.

-

RSI and MACD: The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 suggests AAPL might be overbought, while below 30 indicates it could be oversold. The MACD identifies changes in the strength, direction, momentum, and duration of a trend in AAPL's price. Divergence between the MACD and the price can signal a potential trend reversal.

-

Support and Resistance Levels: These are price levels where the stock has historically struggled to break through. Support levels represent prices where buying pressure is strong, preventing further declines. Resistance levels represent prices where selling pressure is strong, hindering further increases. Identifying these levels on the AAPL stock chart is crucial for setting stop-loss orders and potential entry/exit points. Analyzing historical support and resistance can give insight into future price movements.

Current Apple Stock (AAPL) Price Targets from Leading Analysts

Several reputable financial analysts and firms offer price targets for AAPL stock. These targets vary depending on the analyst's methodology and outlook. It's important to note that these are just predictions and not guarantees of future performance.

-

High Price Targets: Some analysts predict AAPL could reach significantly higher prices, citing factors like strong product innovation and growing market share. These bullish predictions often reflect optimistic outlooks for the company's long-term growth.

-

Low Price Targets: Conversely, some analysts express caution, suggesting lower price targets due to potential economic headwinds or increased competition. These bearish predictions highlight potential risks associated with investing in AAPL.

-

Average Price Target: By averaging the price targets from various analysts, investors can get a more balanced view of the potential range of AAPL's future price. However, it is essential to understand the rationale behind each individual prediction. For example, consider the source's historical accuracy and their methodology.

(Note: Specific price targets and sources should be included here, properly cited, and updated regularly to maintain accuracy.)

Factors Influencing Apple Stock (AAPL) Price Targets

Numerous factors impact Apple stock (AAPL) price targets. Understanding these factors is essential for informed investment decisions.

-

Macroeconomic Factors: Global economic conditions like inflation and interest rates significantly influence investor sentiment and market performance. Economic uncertainty can lead to decreased investment in riskier assets like AAPL.

-

Industry-Specific Factors: Competition within the tech sector plays a crucial role. The performance of competitors like Samsung and Google directly affects Apple's market share and growth potential. Technological advancements also influence Apple's ability to innovate and maintain its competitive edge.

-

Company-Specific Factors: Apple's financial performance, new product launches, and management decisions directly affect the stock price. Successful product launches like the iPhone 14 generally boost investor confidence and drive up the stock price. Conversely, supply chain disruptions or disappointing earnings reports can lead to price declines.

Risk Assessment and Investment Strategies for AAPL

Investing in Apple stock carries inherent risks. Before investing, it's crucial to understand these risks and develop an appropriate investment strategy.

-

Market Volatility: The stock market is inherently volatile. AAPL's price can fluctuate significantly due to various factors, leading to potential losses.

-

Competition: Intense competition from other tech companies can impact Apple's market share and profitability.

-

Investment Strategies: Consider your risk tolerance when choosing an investment strategy. Long-term investors might be less affected by short-term price fluctuations, while short-term traders require a more cautious approach. Diversification across different asset classes is crucial to mitigate risk. Never invest more than you can afford to lose.

Conclusion

This technical analysis of Apple Stock (AAPL) price targets reveals a range of predictions, influenced by various macroeconomic, industry, and company-specific factors. Understanding these factors and employing a suitable investment strategy is crucial for navigating the complexities of the Apple stock market. Remember that all investments carry risk.

Call to Action: Stay informed about the latest developments affecting Apple Stock (AAPL) price targets to make informed investment decisions. Continue researching and conducting your own due diligence before investing in AAPL or any other stock. Remember, this analysis is for informational purposes only and doesn't constitute financial advice. Learn more about Apple stock outlook and develop a robust AAPL investment strategy.

Featured Posts

-

Open Ai And Jony Ive The Potential For A Strategic Partnership In Ai Hardware

May 24, 2025

Open Ai And Jony Ive The Potential For A Strategic Partnership In Ai Hardware

May 24, 2025 -

Zodiac Predictions For April 14 2025 5 Signs To Watch

May 24, 2025

Zodiac Predictions For April 14 2025 5 Signs To Watch

May 24, 2025 -

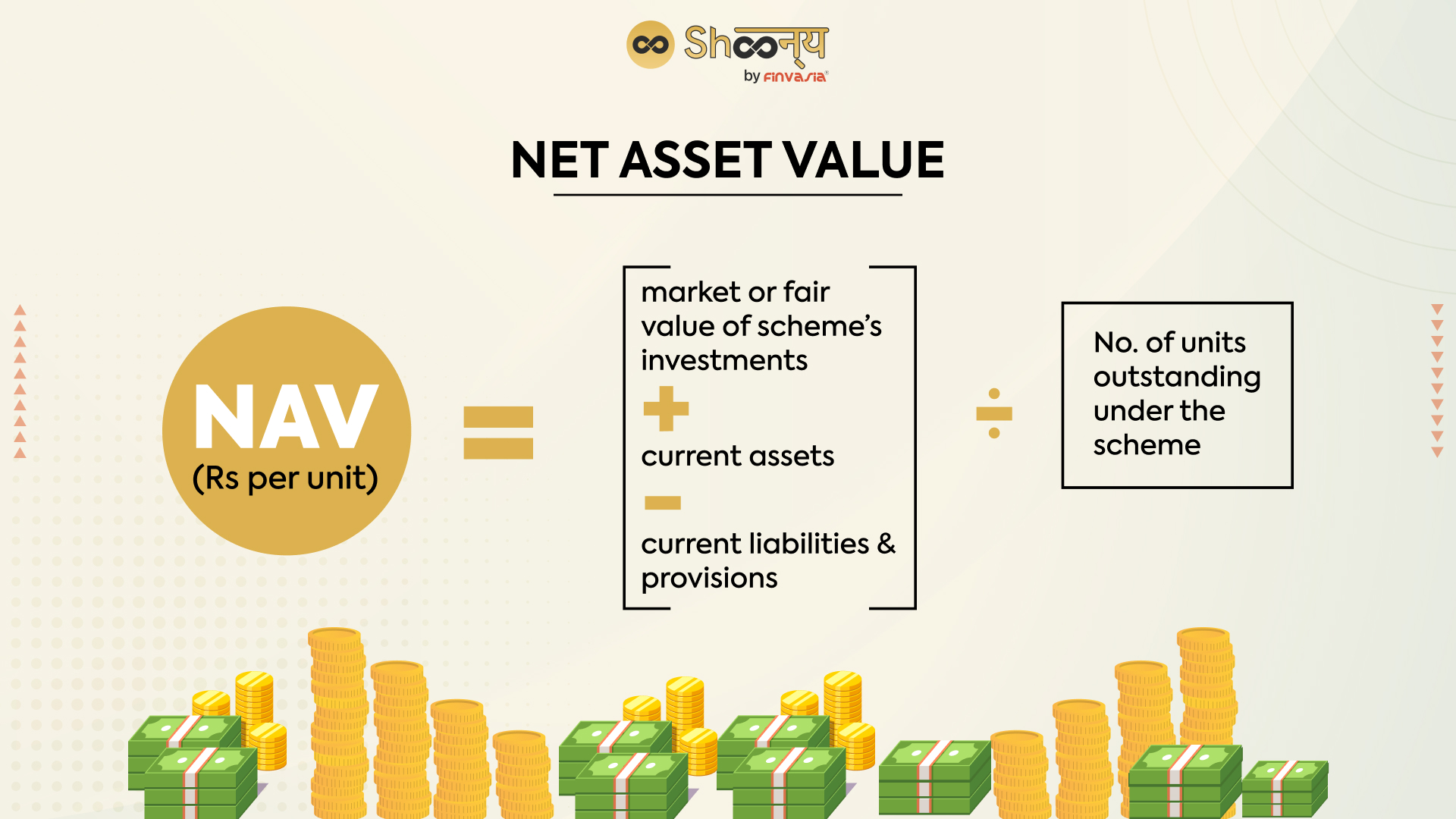

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Analysis And Interpretation

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Analysis And Interpretation

May 24, 2025 -

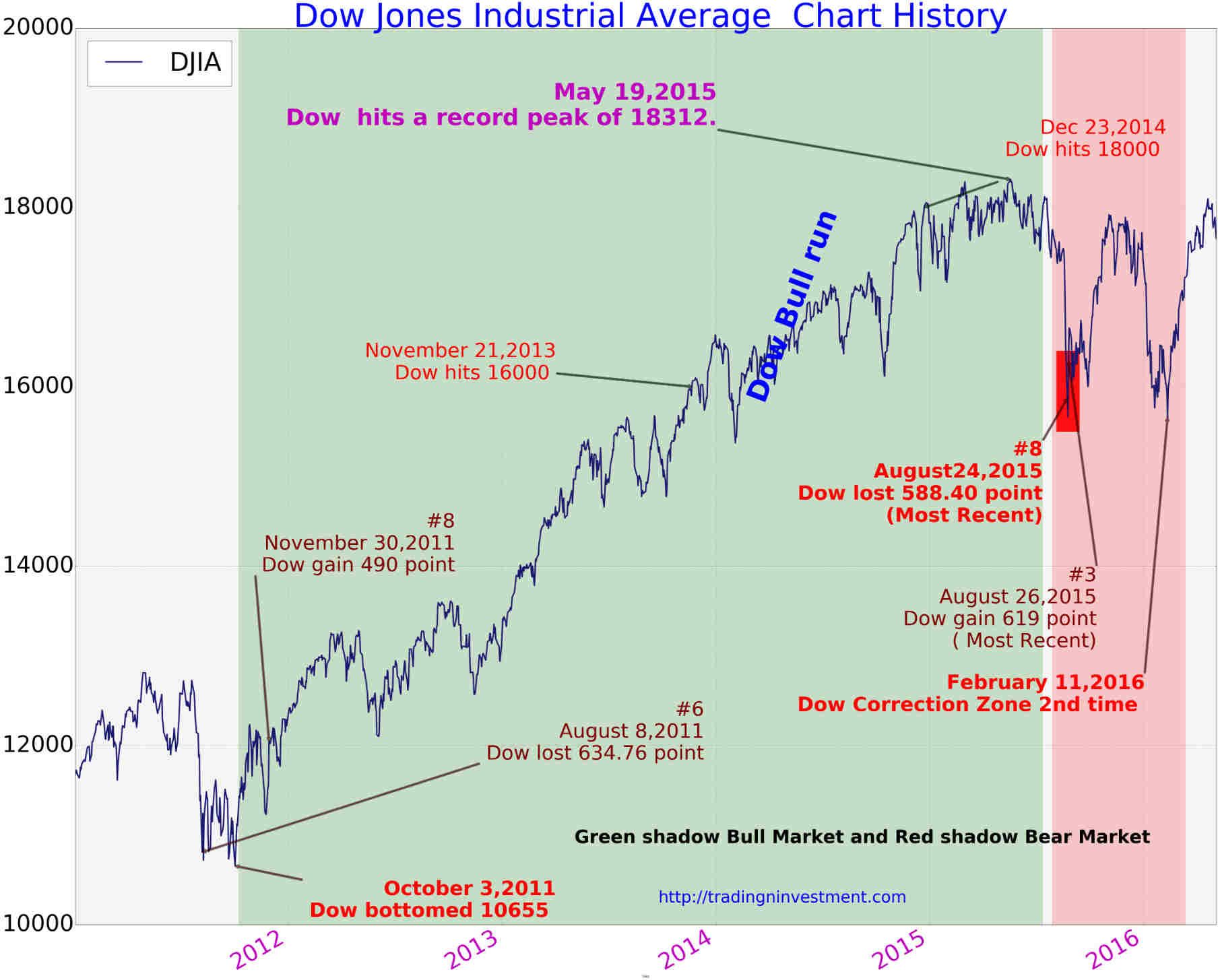

Dow Jones Index Cautious Climb Continues After Pmi Surprise

May 24, 2025

Dow Jones Index Cautious Climb Continues After Pmi Surprise

May 24, 2025 -

Ferrari 296 Speciale Potencia Hibrida De 880 Cv Revelada

May 24, 2025

Ferrari 296 Speciale Potencia Hibrida De 880 Cv Revelada

May 24, 2025

Latest Posts

-

Luchshie Goroskopy I Predskazaniya Dlya Vsekh Znakov

May 24, 2025

Luchshie Goroskopy I Predskazaniya Dlya Vsekh Znakov

May 24, 2025 -

Savannah Guthries Absence Meet Her Temporary Today Show Partner

May 24, 2025

Savannah Guthries Absence Meet Her Temporary Today Show Partner

May 24, 2025 -

Vash Personalniy Goroskop I Predskazaniya

May 24, 2025

Vash Personalniy Goroskop I Predskazaniya

May 24, 2025 -

Unexpected Today Show Change Savannah Guthries Co Host Swap

May 24, 2025

Unexpected Today Show Change Savannah Guthries Co Host Swap

May 24, 2025 -

Tochnye Goroskopy I Predskazaniya Na Nedelyu

May 24, 2025

Tochnye Goroskopy I Predskazaniya Na Nedelyu

May 24, 2025