Dow Jones Index: Cautious Climb Continues After PMI Surprise

Table of Contents

- Understanding the PMI Surprise and its Impact on the Dow Jones

- What is the PMI and why is it important?

- Analyzing the Dow Jones' Reaction to the PMI Data

- Factors Contributing to the Cautious Climb of the Dow Jones Index

- Geopolitical Influences and Market Sentiment

- Inflation Concerns and Interest Rate Expectations

- Strategic Implications for Investors: Navigating the Dow Jones' Uncertain Path

- Risk Assessment and Portfolio Diversification

- Opportunities and Potential Challenges for Dow Jones Investors

- Conclusion

Understanding the PMI Surprise and its Impact on the Dow Jones

What is the PMI and why is it important?

The Purchasing Managers' Index (PMI) is a leading economic indicator that gauges the health of the manufacturing and service sectors. It's a composite index calculated from surveys of purchasing managers in various industries, providing insights into business activity, new orders, employment, and supplier deliveries. A higher PMI reading generally suggests economic expansion, while a lower reading indicates contraction. This makes it a crucial tool for investors seeking to understand the direction of the economy and its potential effects on the stock market, including the Dow Jones.

- Industries impacted by PMI changes: Manufacturing, technology, retail, healthcare, finance.

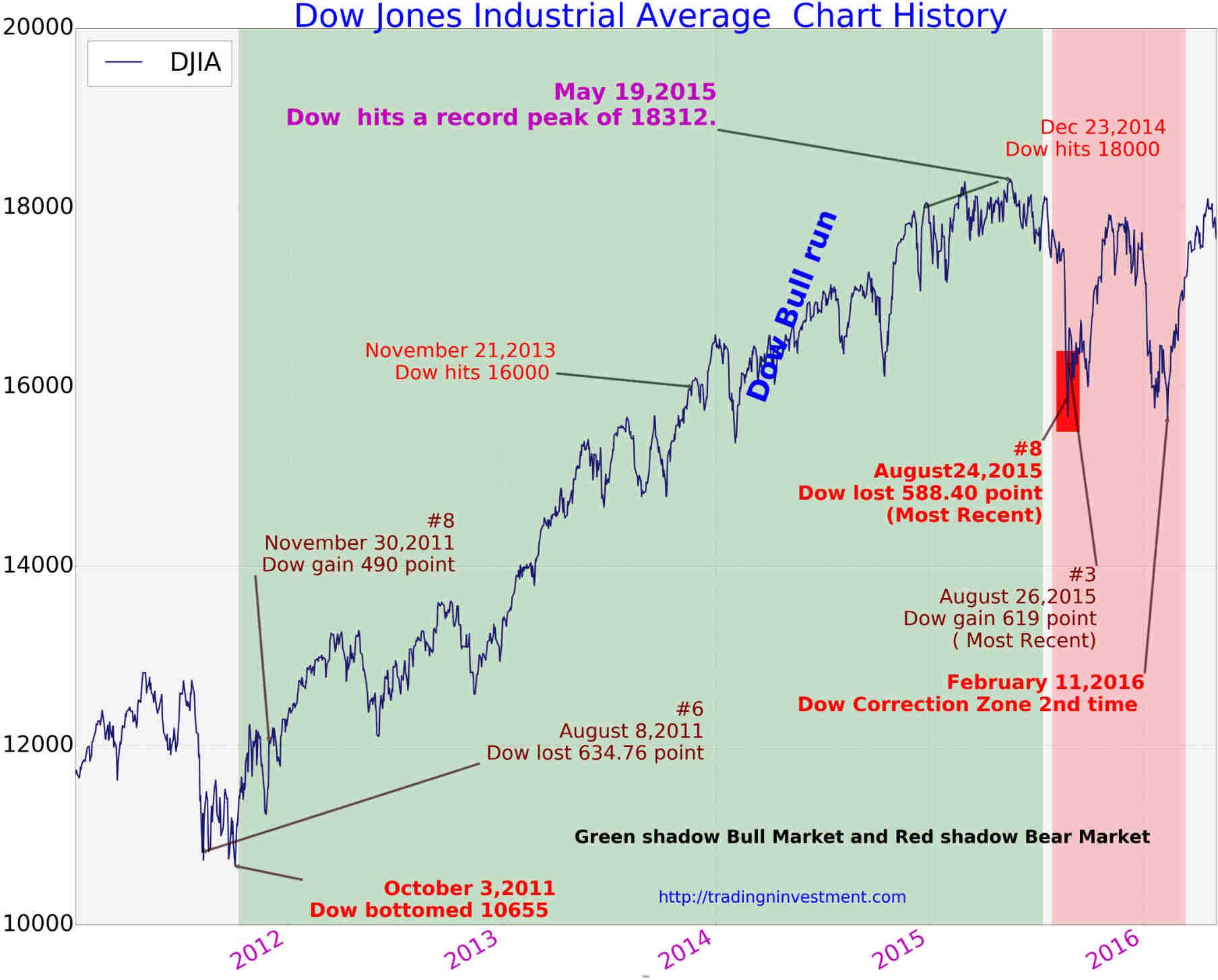

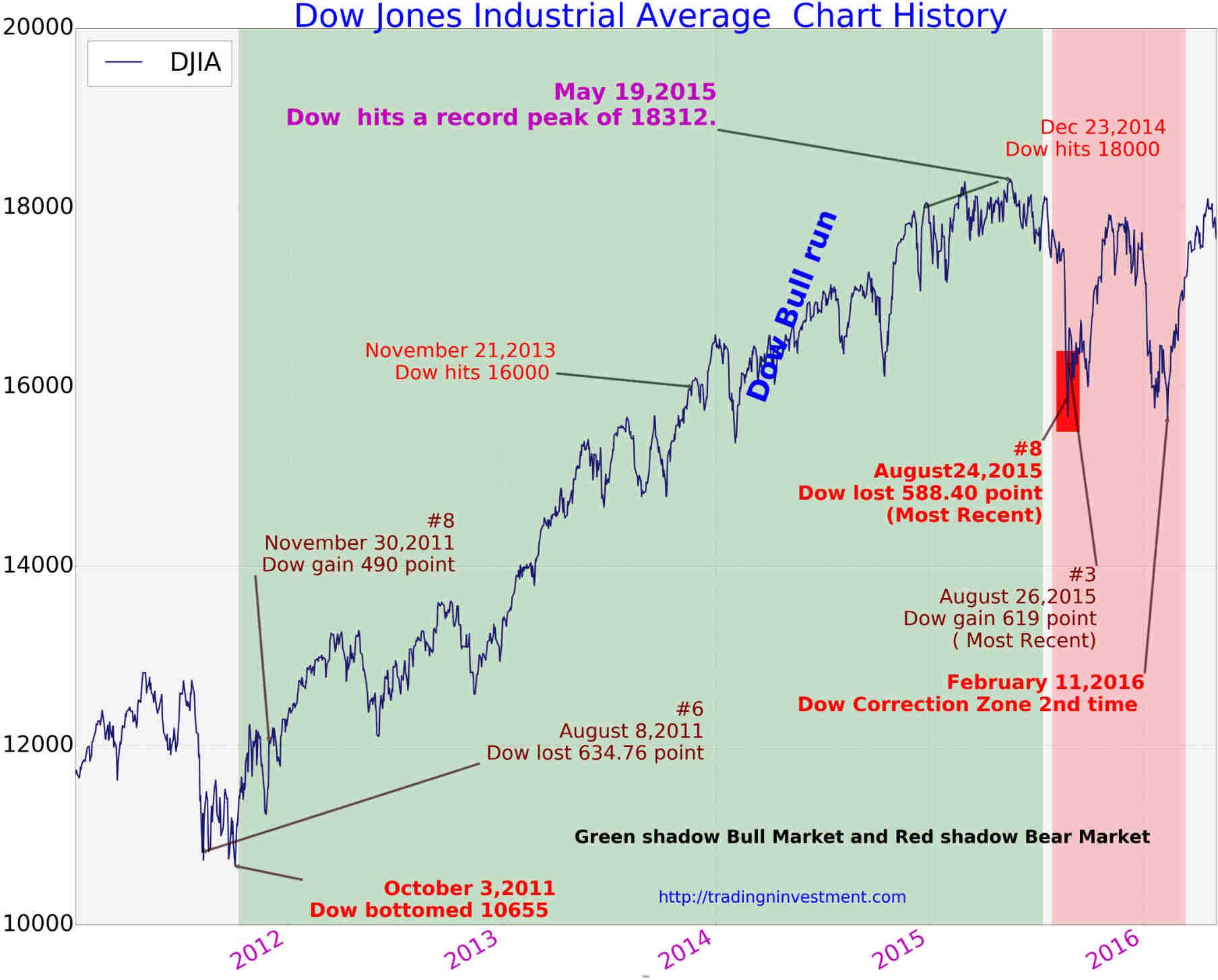

- Historical PMI data correlation with Dow Jones performance: Historically, a strong positive correlation exists between rising PMI readings and upward trends in the Dow Jones Index, though this correlation isn't always perfect and other factors play a significant role.

Analyzing the Dow Jones' Reaction to the PMI Data

The unexpected positive PMI data release on [Insert Date] triggered a noticeable, albeit cautious, rally in the Dow Jones Index. The index experienced a [Insert Percentage]% increase in the hours following the announcement, with trading volume significantly higher than the previous day's average. While the initial reaction was positive, the climb remained relatively subdued, reflecting investor apprehension about lingering economic uncertainties.

- Specific date and time of PMI release: [Insert Date and Time]

- Percentage changes in the Dow Jones: [Insert Percentage Change]

- Key sectors driving the movement: [Insert Key Sectors, e.g., Technology, Financials]

Factors Contributing to the Cautious Climb of the Dow Jones Index

Geopolitical Influences and Market Sentiment

Geopolitical events continue to cast a shadow over market sentiment. Ongoing [Insert specific geopolitical event, e.g., tensions in Eastern Europe] and persistent [Insert specific geopolitical concern, e.g., trade disputes] create an environment of uncertainty, tempering investor enthusiasm. News headlines regarding these events directly impact investor confidence, leading to periods of market volatility.

- Specific geopolitical events and their impact: [Elaborate on specific events and their effects on market sentiment]

- Investor sentiment surveys and indices: [Cite relevant indices like the VIX volatility index and explain their relevance]

Inflation Concerns and Interest Rate Expectations

Inflation remains a significant concern, influencing the Federal Reserve's monetary policy and impacting interest rate expectations. The Fed's commitment to controlling inflation through interest rate hikes could dampen economic growth and potentially impact corporate earnings, putting downward pressure on the Dow Jones. The delicate balance between curbing inflation and avoiding a recession is a key factor driving the cautious market climb.

- Current inflation rates: [State current inflation figures and their trajectory]

- Predicted interest rate changes: [Discuss predictions for future interest rate adjustments by the Federal Reserve]

- Historical data on inflation and Dow Jones correlation: [Mention historical relationships and any observed patterns]

Strategic Implications for Investors: Navigating the Dow Jones' Uncertain Path

Risk Assessment and Portfolio Diversification

Given the current market conditions, investors should prioritize risk assessment and portfolio diversification. A well-diversified portfolio reduces exposure to significant losses from any single asset class. Determining your risk tolerance is crucial for making appropriate investment decisions.

- Examples of low-risk, medium-risk, and high-risk investments: [Provide clear examples, e.g., government bonds, real estate, growth stocks]

- Benefits of a diversified portfolio: [Highlight the importance of reducing risk and potential for stable returns]

Opportunities and Potential Challenges for Dow Jones Investors

Despite the uncertainties, opportunities exist within the Dow Jones. Sectors showing resilience during periods of economic uncertainty, such as [Insert Sector Examples e.g., consumer staples, utilities], may present attractive investment prospects. However, investors should also be aware of potential downside risks, such as further interest rate hikes or escalating geopolitical tensions.

- Specific stocks or sectors showing promise: [Suggest specific examples and justify your recommendations]

- Potential downside risks to consider: [Clearly outline potential negative scenarios and their impact]

Conclusion

The unexpected rise in the PMI has given the Dow Jones Index a boost, but its cautious climb reflects lingering uncertainties stemming from geopolitical tensions, inflation concerns, and interest rate expectations. Investors need to carefully assess their risk tolerance and implement robust diversification strategies. Monitoring the Dow Jones Index closely, staying updated on PMI data, and understanding the interplay of economic and geopolitical factors is critical for navigating the current market environment. To develop a robust investment strategy for the Dow Jones and effectively manage your portfolio within this dynamic landscape, consult with a financial expert for personalized Dow Jones investment advice.

Jymypaukku Saako Tuukka Taponen F1 Paikan Jo Taenae Vuonna

Jymypaukku Saako Tuukka Taponen F1 Paikan Jo Taenae Vuonna

Young Hawaiian Artists Shine Sewn Lei Designs For Memorial Day Poster Contest

Young Hawaiian Artists Shine Sewn Lei Designs For Memorial Day Poster Contest

The Nfls War On Butts The Tush Push Lives On

The Nfls War On Butts The Tush Push Lives On

Vash Personalniy Goroskop I Predskazaniya

Vash Personalniy Goroskop I Predskazaniya