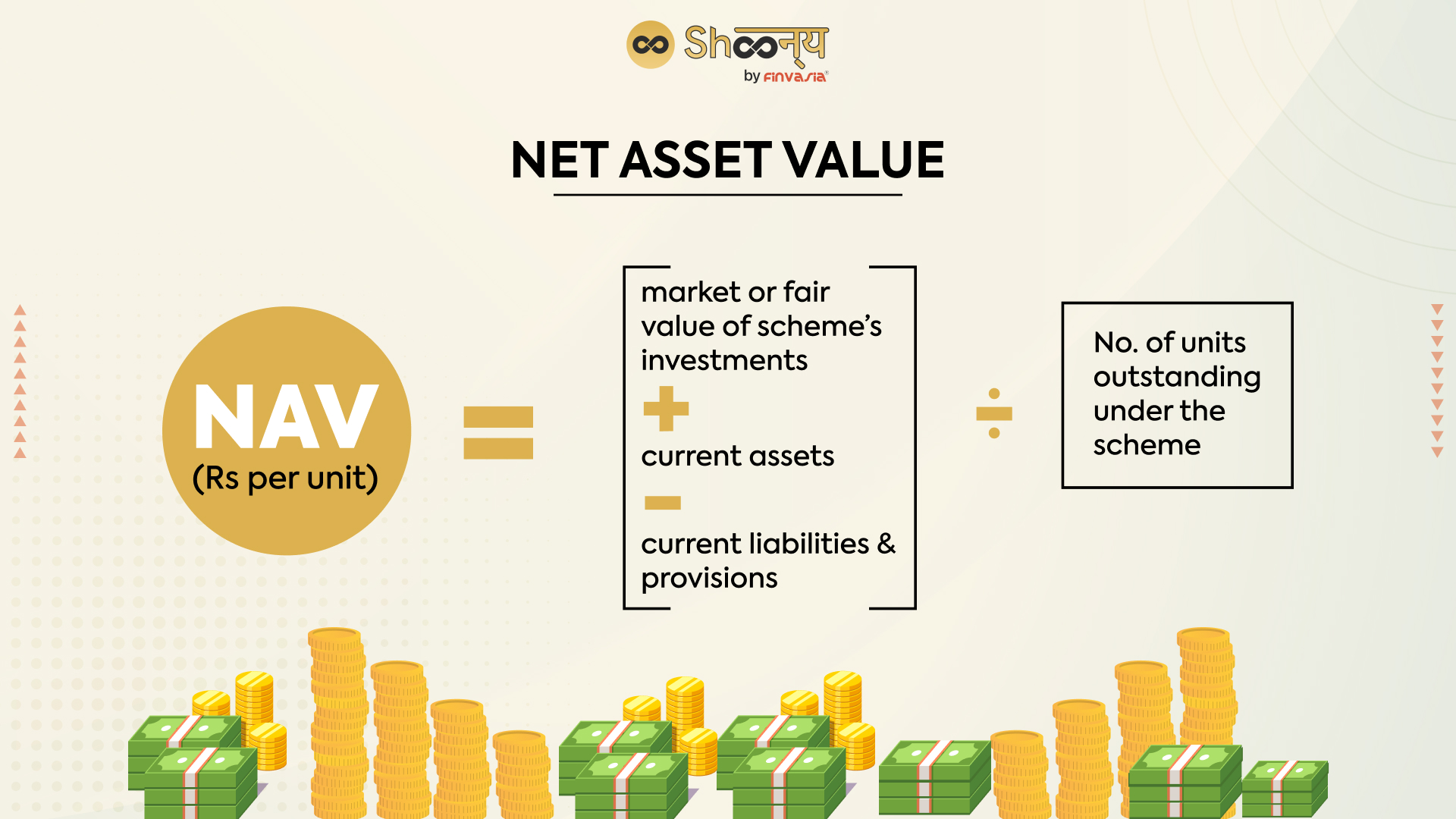

Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist: Analysis And Interpretation

Table of Contents

Analyzing the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Factors Influencing NAV Fluctuations:

The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist, like any ETF, is dynamic and reflects the underlying asset values. Several factors contribute to its fluctuations:

-

Global Stock Market Movements: The primary driver of NAV changes is the performance of the global stock markets represented in the ETF's underlying index, the MSCI World Index. A strong performance in these markets leads to a higher NAV, while a downturn results in a lower NAV.

-

Currency Exchange Rates: The "USD Hedged" aspect of this ETF aims to minimize the impact of currency fluctuations between the USD and other currencies represented in the underlying holdings. However, the effectiveness of the hedge isn't perfect and some currency exposure remains. Changes in exchange rates can still subtly affect the NAV.

-

Dividend Distributions: When the companies within the MSCI World Index pay dividends, the ETF receives these payments. Before the distribution, the NAV reflects the accrued dividend. After the distribution, the NAV typically adjusts downwards, reflecting the payment made to shareholders.

-

Specific Examples:

- A rise in US technology stocks would likely increase the ETF's NAV.

- A strengthening Euro against the US dollar might slightly decrease the NAV (despite the hedge).

- Dividend payments from constituent companies will result in a temporary dip in NAV followed by a period of potential growth.

Keywords: NAV fluctuations, currency exchange rates, USD hedging, dividend reinvestment, market volatility, global stock market

Interpreting NAV Trends:

Understanding NAV trends requires a holistic perspective:

-

Upward Trends: Generally indicate positive performance of the underlying assets and a potential increase in investment value.

-

Downward Trends: Suggest underperformance of the underlying assets; however, short-term dips are normal and shouldn't automatically trigger panic selling.

-

Long-term vs. Short-term: Focus on long-term trends rather than reacting to daily or weekly fluctuations. Short-term volatility is inherent in the market.

-

Visualizing Performance: Charts and graphs are invaluable tools for visualizing NAV performance over time, allowing for easy identification of trends and patterns.

-

Benchmark Comparison: Regularly compare the ETF's NAV performance to the MSCI World Index to assess its effectiveness in tracking the benchmark.

Keywords: NAV trends, long-term investment, short-term volatility, benchmark comparison, MSCI World Index, ETF performance

Accessing and Utilizing NAV Data:

Reliable NAV data for the Amundi MSCI World II UCITS ETF USD Hedged Dist is readily available from various sources:

-

Amundi Website: The ETF provider's official website is the most reliable source for real-time and historical NAV data.

-

Financial News Websites: Reputable financial news sources often provide up-to-date ETF information, including NAVs.

-

Brokerage Platforms: Your brokerage account will display the NAV alongside your holdings.

-

Frequency: NAVs are typically updated daily, reflecting the closing prices of the underlying assets.

-

Tracking Methods: You can use spreadsheets, dedicated investment tracking apps, or portfolio management software to monitor NAV changes efficiently.

Keywords: NAV data, real-time NAV, historical NAV, ETF data providers, investment tracking software

Practical Applications and Considerations

NAV and Investment Decisions:

NAV analysis is a crucial part of informed investment decision-making:

-

Buy/Sell Signals: While not the sole indicator, a consistently rising NAV can be a positive signal, while a persistent decline might warrant review of the investment.

-

Other Metrics: Consider the ETF's expense ratio, trading volume, and other relevant metrics alongside NAV for a complete picture.

-

Return on Investment: Tracking NAV changes helps in calculating your return on investment (ROI).

Keywords: investment strategy, buy signals, sell signals, ETF expense ratio, return on investment, portfolio diversification

Risks Associated with NAV Fluctuations:

While NAV is informative, relying solely on it is risky:

-

Market Risk: The global equity market is inherently volatile, exposing investors to potential losses.

-

Investment Risk: No investment is without risk. Understand your risk tolerance before investing.

-

Diversification: Diversifying your portfolio reduces your reliance on any single investment's performance, including its NAV.

Keywords: market risk, investment risk, risk tolerance, volatility, global equity market

Conclusion: Making Informed Decisions Using Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is essential for effective investment management. Analyzing NAV fluctuations, considering various influencing factors, and utilizing readily available data sources empower you to make informed investment decisions. While NAV is a critical metric, remember to consider it alongside other investment factors and your personal risk tolerance. Learn more about monitoring the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist and enhance your investment strategy today! Keywords: Amundi MSCI World II UCITS ETF USD Hedged Dist NAV, informed investment decisions, ETF investment, investment strategy

Featured Posts

-

Alsltat Alalmanyt Wmdahmat Mshjey Krt Alqdm

May 24, 2025

Alsltat Alalmanyt Wmdahmat Mshjey Krt Alqdm

May 24, 2025 -

Glastonbury 2025 Full Lineup Revealed After Leak Get Your Tickets Now

May 24, 2025

Glastonbury 2025 Full Lineup Revealed After Leak Get Your Tickets Now

May 24, 2025 -

Porsche Cayenne Gts Coupe Moje Doswiadczenia Z Suv Em

May 24, 2025

Porsche Cayenne Gts Coupe Moje Doswiadczenia Z Suv Em

May 24, 2025 -

Ferraris Inaugural Service Center In Bengaluru What To Expect

May 24, 2025

Ferraris Inaugural Service Center In Bengaluru What To Expect

May 24, 2025 -

Evrovidenie 2025 Prognoz Konchity Vurst Na Chetyrekh Pobediteley

May 24, 2025

Evrovidenie 2025 Prognoz Konchity Vurst Na Chetyrekh Pobediteley

May 24, 2025

Latest Posts

-

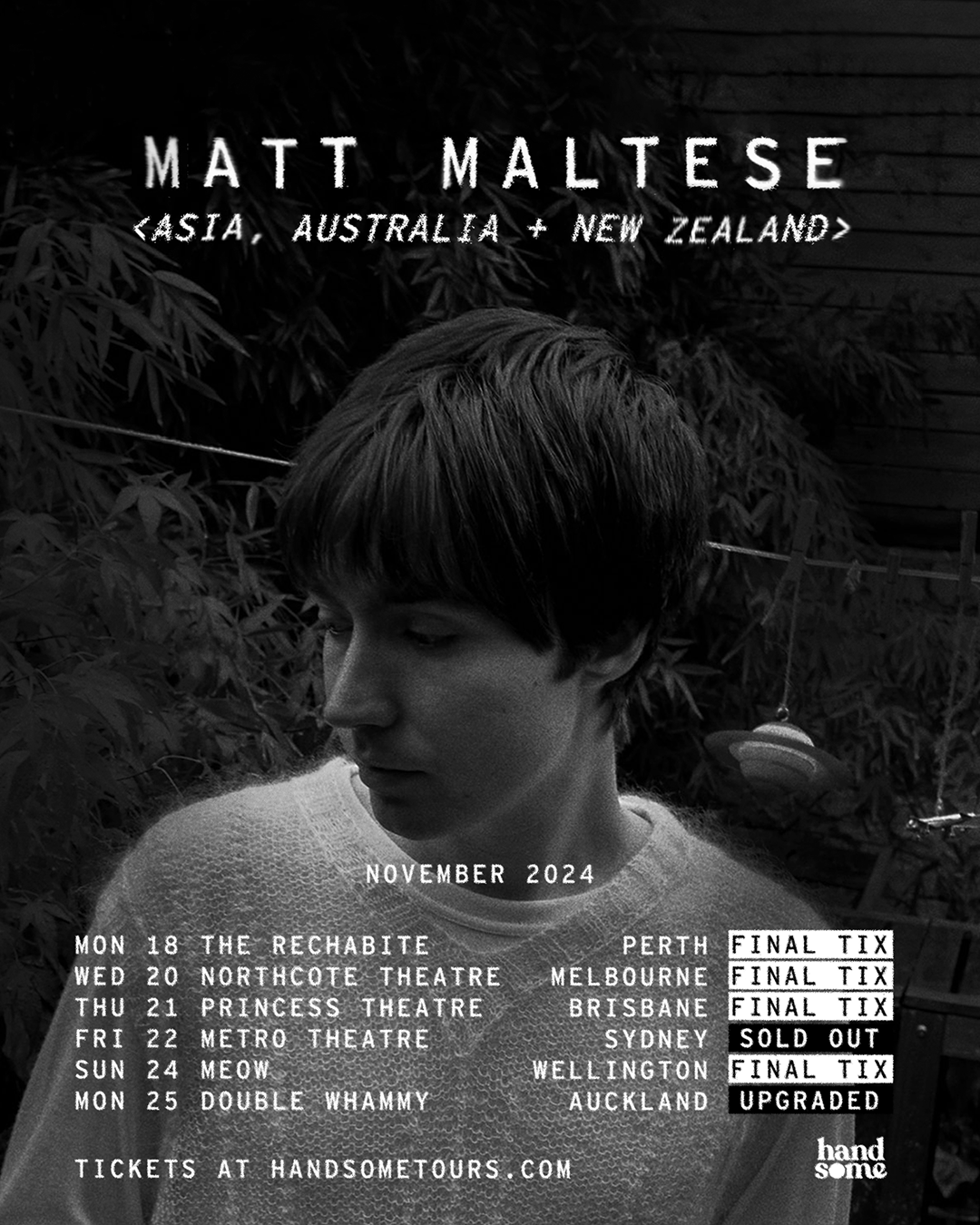

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025 -

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025 -

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025 -

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025 -

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025