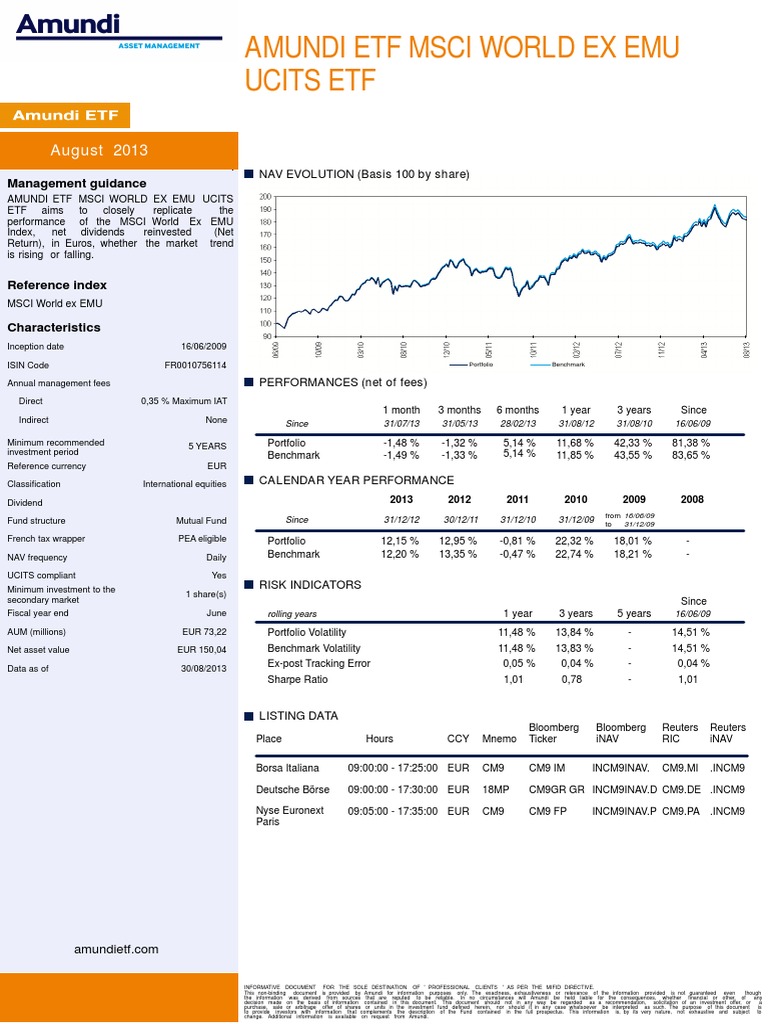

Analyzing The Net Asset Value Of The Amundi MSCI World Ex-US UCITS ETF Acc

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. Simply put, it's the price of a single share if the ETF were to be liquidated. The NAV is a critical component in determining the ETF's price, providing a benchmark for assessing its value. Calculating the NAV involves totaling the market value of all the underlying assets (in this case, primarily stocks within the MSCI World ex-US Index), subtracting any liabilities (like management fees and expenses), and then dividing by the total number of outstanding shares. This calculation is usually performed daily, offering investors an updated view of the ETF's underlying value. Understanding ETF NAV, particularly for the Amundi MSCI World ex-US UCITS ETF Acc, is key to making informed trading decisions.

The Amundi MSCI World ex-US UCITS ETF Acc tracks the MSCI World ex-US Index, offering exposure to a diversified portfolio of developed market equities outside of the United States. This UCITS ETF is designed for investors seeking international diversification and exposure to a broad range of global companies.

Factors Influencing the Amundi MSCI World ex-US UCITS ETF Acc NAV

Several factors influence the daily NAV of the Amundi MSCI World ex-US UCITS ETF Acc:

2.1.1 Market Performance

The performance of the underlying stocks within the MSCI World ex-US Index is the primary driver of the ETF's NAV. A rise in the value of these stocks directly translates to a higher NAV, and vice versa. Market fluctuations, economic news, and company-specific events all impact the underlying asset values, thus influencing the ETF NAV.

2.1.2 Currency Fluctuations

Because the Amundi MSCI World ex-US UCITS ETF Acc invests in companies outside the US, currency fluctuations between the ETF's base currency (likely EUR) and the currencies of the underlying assets can significantly impact the NAV. For instance, a strengthening of the Euro against other currencies could increase the NAV, while a weakening Euro would have the opposite effect.

2.1.3 Dividend Distributions

Dividends paid by the underlying companies affect the Amundi MSCI World ex-US UCITS ETF Acc NAV. Before the ex-dividend date, the NAV reflects the accrued dividends. After the ex-dividend date, the NAV will typically adjust downwards to reflect the distribution of dividends to shareholders.

- Before Ex-Dividend Date: NAV includes the value of upcoming dividends.

- After Ex-Dividend Date: NAV is adjusted to reflect the distribution of dividends.

2.1.4 Expense Ratio and Management Fees

The ETF's expense ratio and management fees gradually impact the NAV over time. These fees are deducted from the ETF's assets, leading to a slight reduction in the NAV. A lower expense ratio generally translates to a higher NAV over the long term, making it a critical factor to consider when comparing ETFs.

Analyzing Historical NAV Data for the Amundi MSCI World ex-US UCITS ETF Acc

Analyzing historical NAV data is essential for understanding the ETF's past performance and potential future trends.

2.2.1 Data Sources

You can find historical Amundi MSCI World ex-US UCITS ETF Acc NAV data from several reputable sources:

- Amundi Website: The official website is a primary source for accurate and up-to-date information.

- Financial News Platforms: Major financial news websites and data providers (like Bloomberg, Yahoo Finance) offer historical NAV data for various ETFs.

- Brokerage Platforms: Your brokerage account should provide access to detailed ETF information, including historical NAV charts.

2.2.2 Charting and Visualization

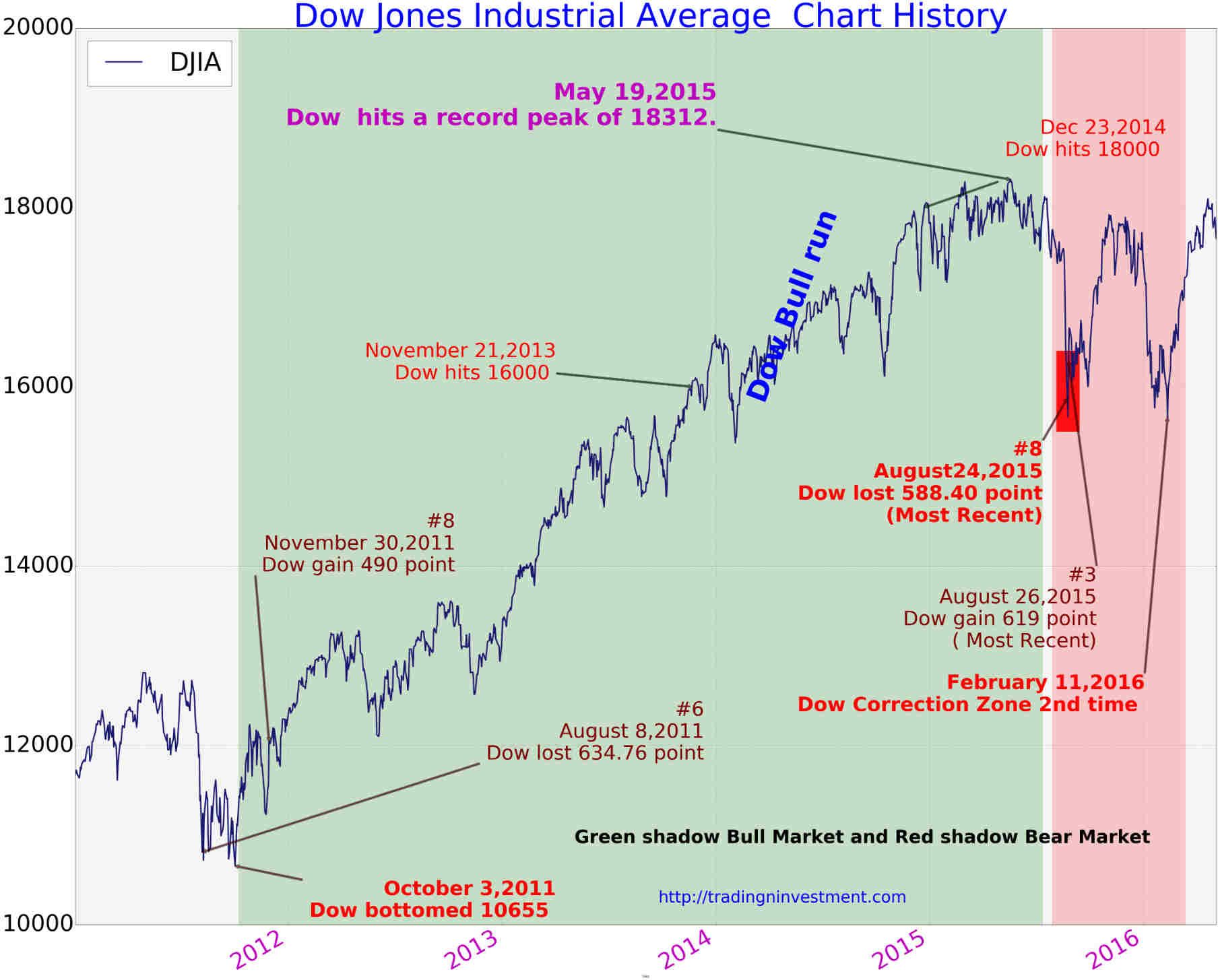

Visualizing the historical NAV data through charts and graphs (line charts are particularly useful) allows you to easily identify periods of high and low performance, growth trends, and volatility.

2.2.3 Benchmarking

Comparing the ETF's NAV performance to its benchmark index (MSCI World ex-US Index) is crucial for evaluating its tracking efficiency. This comparison helps determine if the ETF is effectively mirroring the performance of its underlying index.

2.2.4 Key Performance Indicators (KPIs)

Consider these KPIs when analyzing the NAV performance:

- Annualized Return: Measures the average annual growth of the NAV.

- Volatility: Indicates the fluctuation of the NAV over time.

- Sharpe Ratio: Measures risk-adjusted return.

Practical Applications of Understanding Amundi MSCI World ex-US UCITS ETF Acc NAV

Understanding the Amundi MSCI World ex-US UCITS ETF Acc NAV has several practical applications:

2.3.1 Investment Decisions

NAV analysis helps you decide when to buy or sell the ETF. A lower NAV might present a buying opportunity, while a high NAV might suggest considering a sale, depending on your investment strategy and risk tolerance.

2.3.2 Portfolio Management

Tracking NAV changes is essential for effective portfolio diversification and risk management. You can use this information to rebalance your portfolio to maintain your desired asset allocation.

2.3.3 Performance Evaluation

By regularly monitoring the NAV, you can assess the ETF's performance against your investment goals. This helps you determine if the ETF is meeting your expectations.

2.3.4 Tax Implications

Changes in the Amundi MSCI World ex-US UCITS ETF Acc NAV affect your capital gains or losses, which are relevant for tax purposes. Consult with a financial advisor for detailed tax advice.

Conclusion: Making Informed Decisions with Amundi MSCI World ex-US UCITS ETF Acc NAV Analysis

Understanding the Amundi MSCI World ex-US UCITS ETF Acc NAV is essential for making informed investment decisions. By considering factors like market performance, currency fluctuations, dividends, and expense ratios, and by analyzing historical NAV data, you can gain valuable insights into the ETF's performance and potential. Regularly monitoring the Amundi MSCI World ex-US UCITS ETF Acc NAV and conducting thorough research are key to optimizing your investment strategy. Stay informed about the Amundi MSCI World ex-US UCITS ETF Acc NAV and make strategic investment choices. To learn more about this ETF, visit [Link to Amundi's website or relevant resource].

Featured Posts

-

Glastonbury 2025 Lineup Leak Confirmed Performers And Ticket Info

May 24, 2025

Glastonbury 2025 Lineup Leak Confirmed Performers And Ticket Info

May 24, 2025 -

Severe M6 Crash Delays And Diversions For Motorists

May 24, 2025

Severe M6 Crash Delays And Diversions For Motorists

May 24, 2025 -

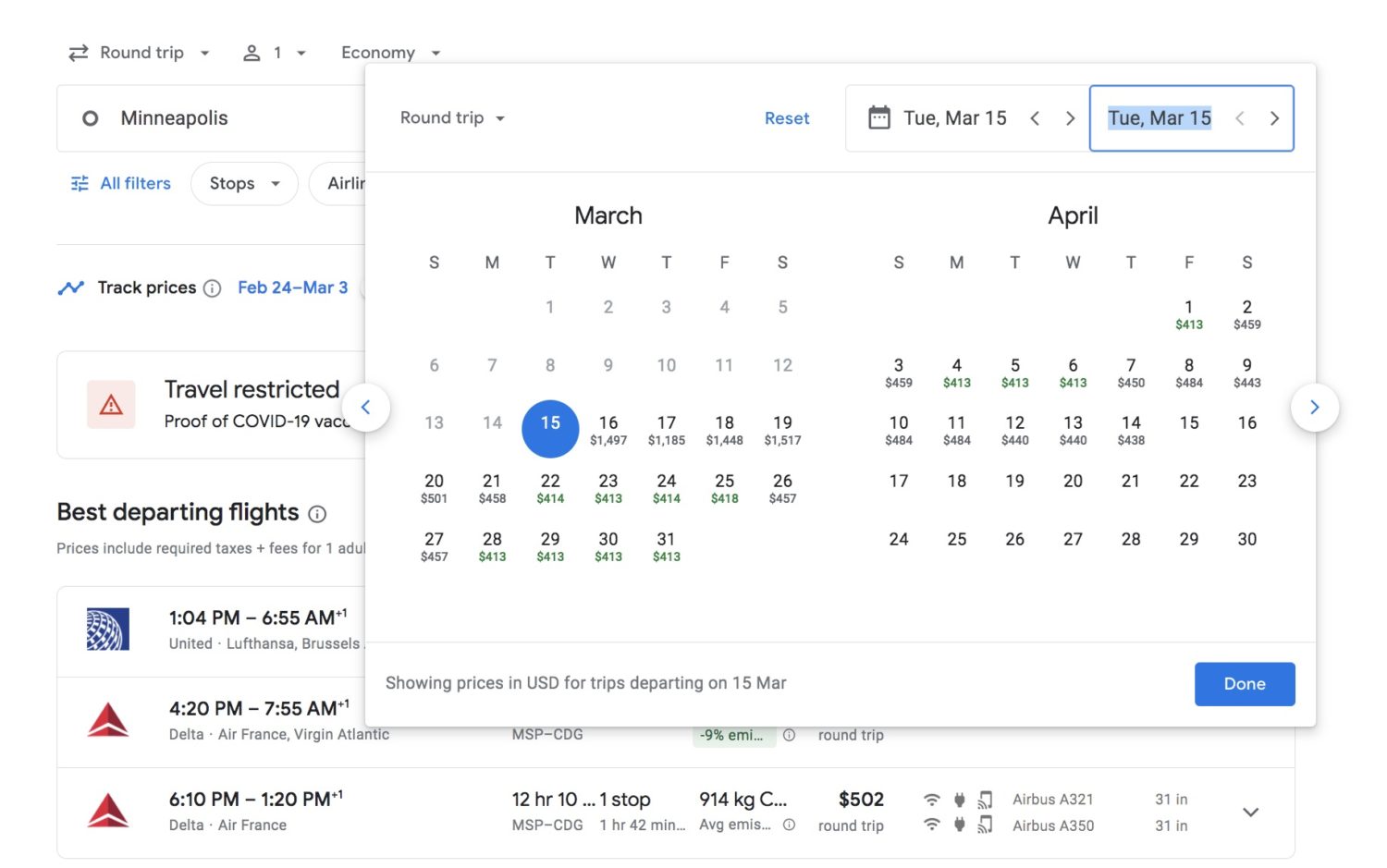

Memorial Day Flights 2025 When To Book For The Best Prices And Least Crowds

May 24, 2025

Memorial Day Flights 2025 When To Book For The Best Prices And Least Crowds

May 24, 2025 -

How To Get Tickets For Bbc Radio 1s Big Weekend

May 24, 2025

How To Get Tickets For Bbc Radio 1s Big Weekend

May 24, 2025 -

Escape To The Country Practical Considerations For A Successful Move

May 24, 2025

Escape To The Country Practical Considerations For A Successful Move

May 24, 2025

Latest Posts

-

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Dist

May 24, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Dist

May 24, 2025 -

Dow Jones Steady Ascent Positive Pmi Data Fuels Growth

May 24, 2025

Dow Jones Steady Ascent Positive Pmi Data Fuels Growth

May 24, 2025 -

Dow Jones Index Cautious Climb Continues After Pmi Surprise

May 24, 2025

Dow Jones Index Cautious Climb Continues After Pmi Surprise

May 24, 2025 -

Unanswered Calls The Agony Of Waiting By The Phone

May 24, 2025

Unanswered Calls The Agony Of Waiting By The Phone

May 24, 2025 -

The Endless Wait Reflections On A Silent Phone

May 24, 2025

The Endless Wait Reflections On A Silent Phone

May 24, 2025