Analyzing Buffett's Apple Strategy: A Case Study In Long-Term Investing

Table of Contents

The Rationale Behind Buffett's Apple Investment

Buffett's Apple investment, a departure from some of his more traditional value plays, was based on a thorough understanding of Apple's business model and its alignment with Berkshire Hathaway's investment philosophy. Key factors driving this decision included:

-

Apple's Unrivaled Brand Loyalty and Recognition: Apple boasts unparalleled brand recognition and fiercely loyal customers, willing to pay a premium for its products and services. This strong brand loyalty translates into predictable demand and pricing power, a cornerstone of a successful, long-term investment. This customer stickiness is a vital component of Apple's sustainable competitive advantage.

-

Consistent Profitability and Strong Cash Flow Generation: Apple consistently generates substantial profits and robust free cash flow. This financial strength allows the company to reinvest in research and development, return value to shareholders through buybacks and dividends, and weather economic downturns more effectively. This predictability is a key element of value investing, providing a strong foundation for long-term growth.

-

Innovative Products and Services: A Sustainable Competitive Advantage: Apple's history of innovation, from the iPod to the iPhone and beyond, has created a powerful, sustainable competitive advantage. The company's ecosystem of interconnected devices and services strengthens customer loyalty and creates recurring revenue streams. This consistent innovation ensures that Apple maintains a leading position in the tech market.

-

Alignment with Buffett's Value Investing Principles: The investment in Apple, despite its high valuation compared to some of Buffett's other holdings, ultimately aligned with his core value investing principles. Buffett recognized Apple's exceptional fundamentals and its potential for long-term growth, even if its price reflected a portion of that future growth. He focused on the intrinsic value, going beyond short-term market fluctuations.

-

Assessment of Apple's Intrinsic Value: While the exact details of Buffett's valuation process remain private, it's clear he saw an undervalued opportunity in Apple considering its strong brand, exceptional cash flow, and massive market opportunity. This underscores the importance of understanding a company’s underlying value – beyond the stock price – for long-term success.

Growth and Returns of Berkshire Hathaway's Apple Holdings

Berkshire Hathaway's Apple investment has been remarkably successful, significantly boosting the company's overall portfolio performance.

-

Exceptional Stock Price Performance: Since Berkshire Hathaway began accumulating Apple stock, the share price has appreciated significantly. This capital appreciation has been a major contributor to the overall return.

-

High Return on Investment (ROI): The ROI on Berkshire Hathaway's Apple investment has been exceptionally high, exceeding expectations and contributing substantially to the company's overall investment returns.

-

Portfolio Performance Contribution: Apple's strong performance has significantly enhanced Berkshire Hathaway's portfolio diversification and overall returns, lessening reliance on other holdings.

-

Impact of Dividend Income: While not a primary driver of the overall return, Apple's dividend payments have provided additional income to Berkshire Hathaway. This recurring income stream further adds to the investment's value.

-

Comparison to Other Investments: Compared to other investments within Berkshire Hathaway's portfolio, Apple's performance stands out, showcasing the potential of identifying and investing in exceptionally strong businesses.

Lessons Learned from Buffett's Apple Strategy for Long-Term Investors

Buffett's Apple strategy offers several invaluable lessons for long-term investors:

-

Thorough Due Diligence is Essential: The success of the Apple investment highlights the crucial role of conducting comprehensive due diligence before investing. Understanding a company’s business model, competitive advantages, and financial health is critical.

-

Embrace a Long-Term Investment Horizon: A long-term perspective minimizes the impact of short-term market volatility and allows investors to focus on the company's fundamental growth prospects. Patient investing is key to long-term success.

-

Invest in High-Quality Companies: Buffett's Apple investment demonstrates the significant benefits of investing in established, high-quality companies with durable competitive advantages. These companies can withstand economic downturns and continue delivering long-term value.

-

Patience and Discipline are Rewarding: The success of the Apple investment highlights the importance of patience and discipline in sticking to a well-researched investment strategy, even during market fluctuations.

-

Portfolio Diversification is Crucial: While the Apple investment was significant, Berkshire Hathaway's portfolio remains diversified, mitigating overall risk. A diversified portfolio helps to cushion the impact of underperforming investments.

Conclusion

Buffett's Apple investment showcases the power of long-term investing, emphasizing the importance of identifying fundamentally strong companies with enduring competitive advantages. By focusing on intrinsic value and exercising patience, Berkshire Hathaway has reaped significant rewards from its Apple holdings. This case study provides valuable lessons for investors of all levels, highlighting the strategic benefits of a disciplined, long-term approach. Learn more about applying the principles of Buffett's Apple strategy to your own portfolio and embark on your journey towards successful long-term investing. Analyze your current investment approach and discover how to benefit from effective long-term investment strategies.

Featured Posts

-

Kato Rejects Using Us Treasury Sales As Trade Leverage

May 06, 2025

Kato Rejects Using Us Treasury Sales As Trade Leverage

May 06, 2025 -

Will Australian Assets Rise After The Election Expert Analysis

May 06, 2025

Will Australian Assets Rise After The Election Expert Analysis

May 06, 2025 -

Us China Trade Uncertainty Drives Copper Market Volatility

May 06, 2025

Us China Trade Uncertainty Drives Copper Market Volatility

May 06, 2025 -

Is Shotgun Cop Man Worth Playing A Platformer Review

May 06, 2025

Is Shotgun Cop Man Worth Playing A Platformer Review

May 06, 2025 -

Budget Friendly Products You Ll Love

May 06, 2025

Budget Friendly Products You Ll Love

May 06, 2025

Latest Posts

-

Arnold Schwarzenegger Bueszke Joseph Baenara Egy Peldamutato Kapcsolat

May 06, 2025

Arnold Schwarzenegger Bueszke Joseph Baenara Egy Peldamutato Kapcsolat

May 06, 2025 -

Arnold Schwarzenegger Es Joseph Baena Kapcsolata Apa Es Fia

May 06, 2025

Arnold Schwarzenegger Es Joseph Baena Kapcsolata Apa Es Fia

May 06, 2025 -

Arnold Schwarzenegger Bueszke Fiara Joseph Baena Sikertoertenete

May 06, 2025

Arnold Schwarzenegger Bueszke Fiara Joseph Baena Sikertoertenete

May 06, 2025 -

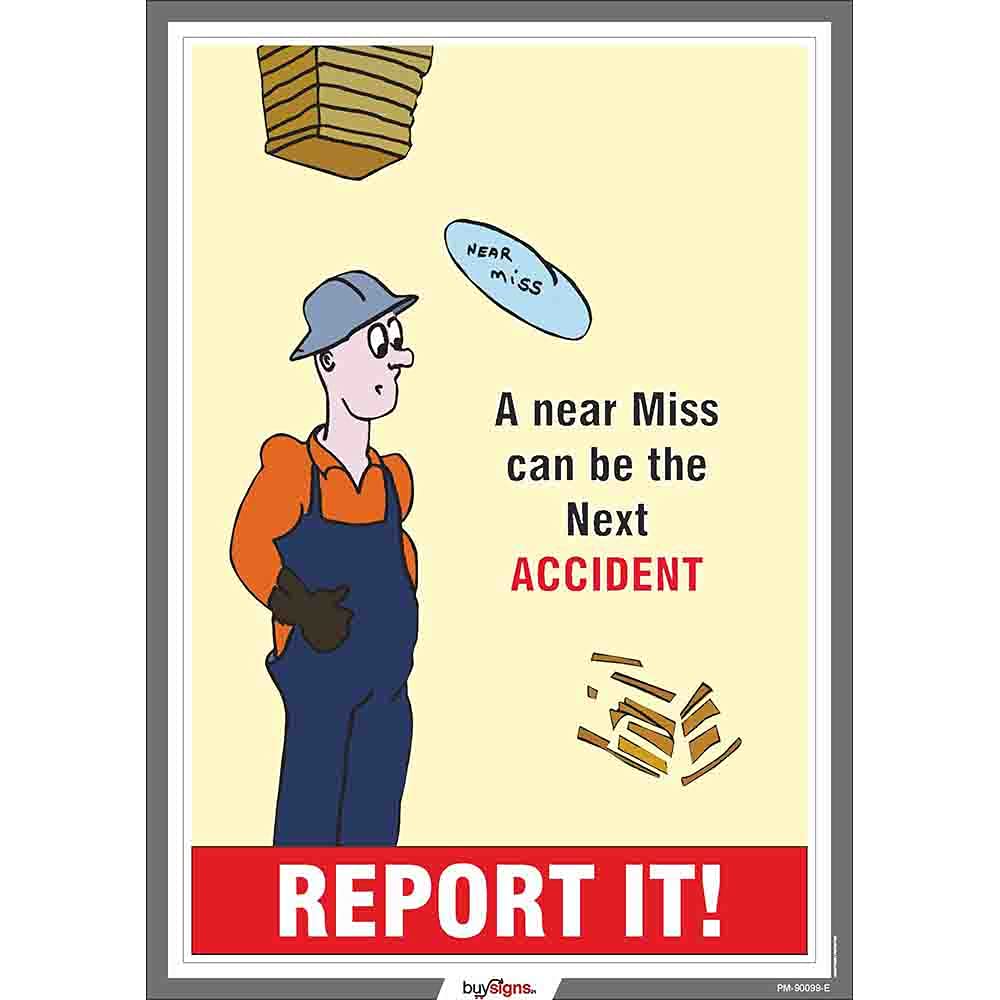

Superman Casting Patrick Schwarzeneggers Near Miss

May 06, 2025

Superman Casting Patrick Schwarzeneggers Near Miss

May 06, 2025 -

Schwarzeneggers Superman Audition What Went Wrong

May 06, 2025

Schwarzeneggers Superman Audition What Went Wrong

May 06, 2025