Kato Rejects Using US Treasury Sales As Trade Leverage

Table of Contents

Economic Implications of Weaponizing US Treasuries

Impact on Global Financial Markets

If a major holder like Japan were to significantly sell off its US Treasury holdings, the impact on global financial markets would be substantial. The interconnected nature of these markets ensures a ripple effect from such actions.

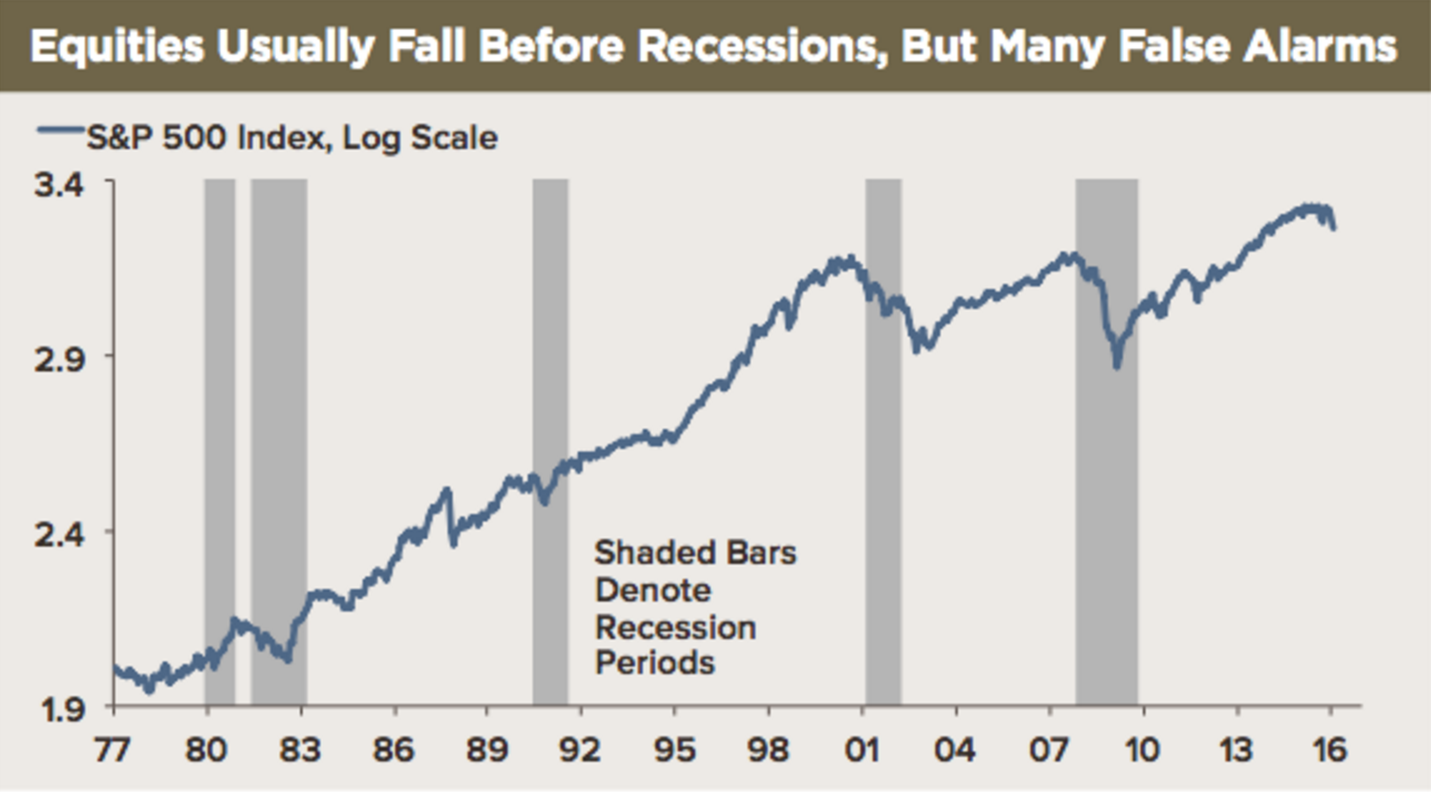

- Increased Volatility: A mass selloff would likely cause increased volatility in the bond market, leading to uncertainty and potentially impacting other asset classes.

- Potential for Interest Rate Hikes: Increased supply of US Treasuries could drive down their prices, pushing interest rates upward. This could have knock-on effects on borrowing costs for businesses and consumers globally.

- Decreased Investor Confidence in US Debt: A significant selloff could damage investor confidence in the US dollar and US debt, potentially leading to higher borrowing costs for the US government.

The interconnectedness of global finance means that instability in one market can quickly spread to others. A major event like a large-scale sale of US Treasuries by Japan could trigger a domino effect, creating a global financial crisis.

Damage to US-Japan Relations

Using US Treasury sales as a trade weapon would severely damage the already delicate US-Japan relationship.

- Strained Political Ties: Such a move would likely be viewed as a hostile act, leading to significant diplomatic fallout.

- Potential for Retaliatory Measures: The US might respond with retaliatory measures, further escalating tensions and harming trade between the two countries.

- Impact on Trade Agreements: Existing trade agreements could be jeopardized, undermining decades of cooperation and economic integration.

The US-Japan alliance is crucial for regional stability and global security. Undermining this alliance through aggressive economic actions carries significant risks.

Kato's Stance and Justification

Official Statements and Press Releases

Kato has consistently rejected the idea of using Japan's US Treasury holdings as leverage in trade disputes. While specific statements need to be sourced from official government press releases and statements, his position emphasizes a commitment to diplomatic solutions and the stability of global financial markets.

- [Insert links to relevant news articles and official government statements here]

- [Insert key quotes directly addressing the use of US Treasury holdings as a trade weapon here]

Kato’s approach prioritizes maintaining a stable and predictable economic environment.

Alternative Approaches to Trade Disputes

Instead of resorting to aggressive economic measures, Kato and the Japanese government favor alternative strategies for resolving trade disagreements:

- Negotiation: Open and constructive dialogue between the two governments is seen as the most effective path to resolving trade issues.

- Diplomacy: Engaging in diplomatic channels to address concerns and find mutually agreeable solutions is preferred over coercive tactics.

- WTO Dispute Resolution: Utilizing the World Trade Organization’s mechanisms for resolving trade disputes offers a fair and impartial framework for addressing disagreements.

Maintaining constructive dialogue and working within established international frameworks is deemed crucial to maintaining a healthy economic relationship.

Analysis of Japan's US Treasury Holdings

The Scale of Japanese Holdings

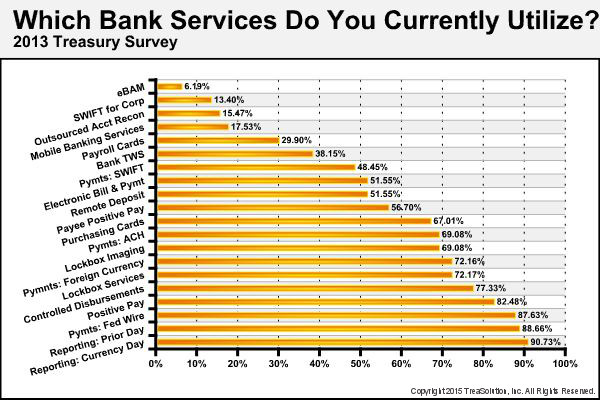

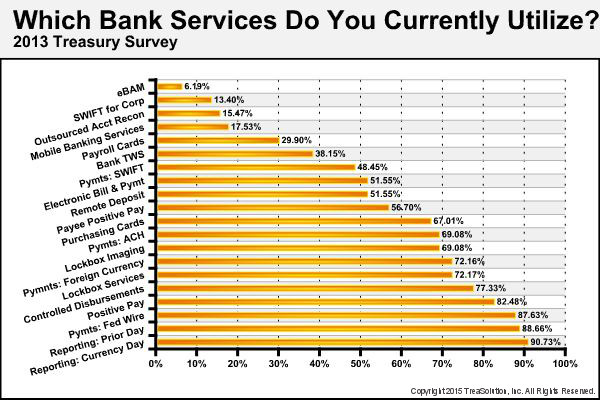

Japan holds a substantial amount of US Treasury securities, placing it among the top holders globally.

- [Insert statistical data on the amount of US Treasuries held by Japan here]

- [Provide context by comparing Japan's holdings to those of other countries here]

The sheer scale of these holdings underscores the potential impact of any decision to sell them off.

Strategic Importance of US Treasury Investments

Japan's investment in US Treasuries is driven by factors beyond trade considerations:

- Safe Haven Asset: US Treasuries are considered a safe and low-risk investment, providing stability to Japan's investment portfolio.

- Diversification of Investment Portfolio: Holding US Treasuries helps diversify Japan's investments and reduce overall risk.

- Supportive of US Economic Stability: By investing in US Treasuries, Japan indirectly supports the stability of the US economy, benefiting both countries.

Altering this long-standing investment strategy could have unforeseen and potentially negative long-term consequences.

Conclusion: Kato's Rejection and the Future of US-Japan Economic Ties

Kato's steadfast rejection of using US Treasury sales as a trade weapon is a critical element in maintaining stable US-Japan economic relations. The potential for market instability and damage to the bilateral relationship from such a move is substantial. Alternative dispute resolution methods, prioritizing negotiation, diplomacy, and adherence to international frameworks are crucial. Understanding Kato's rejection of using US Treasury sales as trade leverage is crucial for analyzing the future trajectory of US-Japan economic relations. Continue the conversation and explore alternative approaches to resolving trade disputes, focusing on Japan's Treasury holdings and the broader implications for US-Japan trade relations and Kato's economic policy.

Featured Posts

-

The Growing Trend Of Betting On The Los Angeles Wildfires

May 06, 2025

The Growing Trend Of Betting On The Los Angeles Wildfires

May 06, 2025 -

Mindy Kalings Shows A Deep Dive Into Fascinating Female Characters

May 06, 2025

Mindy Kalings Shows A Deep Dive Into Fascinating Female Characters

May 06, 2025 -

Sex Lives Of College Girls Cancelled Why The Show Wont Return

May 06, 2025

Sex Lives Of College Girls Cancelled Why The Show Wont Return

May 06, 2025 -

Lady Gaga Converse And The Economy Social Media As A Recession Predictor

May 06, 2025

Lady Gaga Converse And The Economy Social Media As A Recession Predictor

May 06, 2025 -

Patrik Svarceneger Borba Za Uspeh Izvan Senke Oca

May 06, 2025

Patrik Svarceneger Borba Za Uspeh Izvan Senke Oca

May 06, 2025

Latest Posts

-

Duze Zamowienie Trotylu Polska Na Swiatowym Rynku Materialow Wybuchowych

May 06, 2025

Duze Zamowienie Trotylu Polska Na Swiatowym Rynku Materialow Wybuchowych

May 06, 2025 -

Polska I Eksport Trotylu Rzut Oka Na Duze Zamowienie

May 06, 2025

Polska I Eksport Trotylu Rzut Oka Na Duze Zamowienie

May 06, 2025 -

Zamowienie Na Trotyl Z Polski Implikacje Dla Bezpieczenstwa

May 06, 2025

Zamowienie Na Trotyl Z Polski Implikacje Dla Bezpieczenstwa

May 06, 2025 -

Analyzing The Popularity Of Leon Thomas And Halle Baileys Rather Be Alone

May 06, 2025

Analyzing The Popularity Of Leon Thomas And Halle Baileys Rather Be Alone

May 06, 2025 -

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025