Analyzing BigBear.ai Stock: Is It Worth Buying?

Table of Contents

BigBear.ai's Business Model and Competitive Landscape

BigBear.ai provides AI-driven solutions for national security and commercial clients. Understanding their business model is crucial to assessing BigBear.ai stock.

Revenue Streams and Growth Potential

BigBear.ai's revenue streams are primarily derived from government contracts and commercial partnerships. Analyzing recent financial reports reveals fluctuating revenue, reflecting the nature of government contracting cycles. Growth projections often depend on securing new contracts and expanding commercial partnerships.

- Key Revenue Sources: Government contracts (defense, intelligence), commercial partnerships (various industries).

- Contract Wins: Tracking recent contract wins and their value is vital for assessing BigBear.ai's short-term and long-term revenue potential. Analyzing the types of contracts secured (long-term vs. short-term) is also essential.

- Projected Growth Rates: Analyst predictions for BigBear.ai's revenue growth vary widely, reflecting the inherent uncertainty in the AI sector and government contracting.

- Market Share Analysis: BigBear.ai's market share within the AI solutions market needs careful evaluation. Determining their position relative to established competitors is essential.

Competitive Advantages and Challenges

BigBear.ai differentiates itself through its specialized AI capabilities, particularly in the national security sector. However, competition in the AI market is intense.

- Key Competitors: Identifying key competitors, such as other AI companies offering similar solutions, is vital for understanding BigBear.ai's competitive landscape.

- Competitive Advantages: BigBear.ai’s proprietary technologies, experienced workforce with deep domain expertise, and strong government partnerships are key advantages.

- Market Challenges: Competition, securing and maintaining government contracts, and the rapid pace of technological change pose significant challenges.

- Potential Disruptive Technologies: The emergence of new AI technologies could disrupt BigBear.ai's market position, posing a long-term risk.

Financial Performance and Valuation

A comprehensive evaluation of BigBear.ai's financial health is vital before considering an investment in BigBear.ai stock.

Key Financial Metrics

Analyzing key financial metrics such as revenue growth, profit margins, debt levels, and cash flow provides insights into BigBear.ai's financial stability.

- Revenue Growth: Consistent revenue growth is crucial for long-term investor confidence in BigBear.ai stock. Analyzing trends in revenue growth over several quarters or years is insightful.

- Profit Margins: Evaluating profit margins reveals the company's profitability and efficiency.

- Debt Levels: High debt levels could indicate increased financial risk, affecting the attractiveness of BigBear.ai stock.

- Cash Flow: Positive cash flow suggests financial health and ability to invest in growth.

- Key Financial Ratios: Analyzing ratios like the Price-to-Earnings (P/E) ratio and debt-to-equity ratio helps evaluate BigBear.ai's valuation and financial risk compared to competitors.

Valuation and Investment Risk

BigBear.ai's current market capitalization and valuation multiples are crucial factors in assessing whether BigBear.ai stock is currently overvalued or undervalued.

- Market Capitalization: The market capitalization reflects the total value of BigBear.ai's outstanding shares.

- P/E Ratio: The P/E ratio helps gauge the market's valuation of BigBear.ai's earnings relative to its share price.

- Price-to-Sales Ratio: This ratio compares BigBear.ai's market capitalization to its revenue, providing another perspective on valuation.

- Risk Factors: Investing in BigBear.ai stock carries significant risk due to its volatility and dependence on government contracts. The competitive landscape and technological changes also contribute to investment risk.

Future Outlook and Growth Prospects

The future prospects of BigBear.ai and its stock price depend on several factors.

AI Market Trends and BigBear.ai's Position

The rapid growth of the AI market presents opportunities for BigBear.ai. Understanding BigBear.ai's position within this growing market is essential.

- Market Size Projections: Analyzing projected growth of the AI market provides context for BigBear.ai's potential growth.

- Growth Drivers: Identifying key growth drivers in the AI market can help assess BigBear.ai's potential for expansion.

- BigBear.ai's Market Positioning: Evaluating BigBear.ai's competitive advantage and market share will reveal its future growth potential.

- Potential for Expansion: Analyzing potential expansion into new markets and applications can predict future revenue streams.

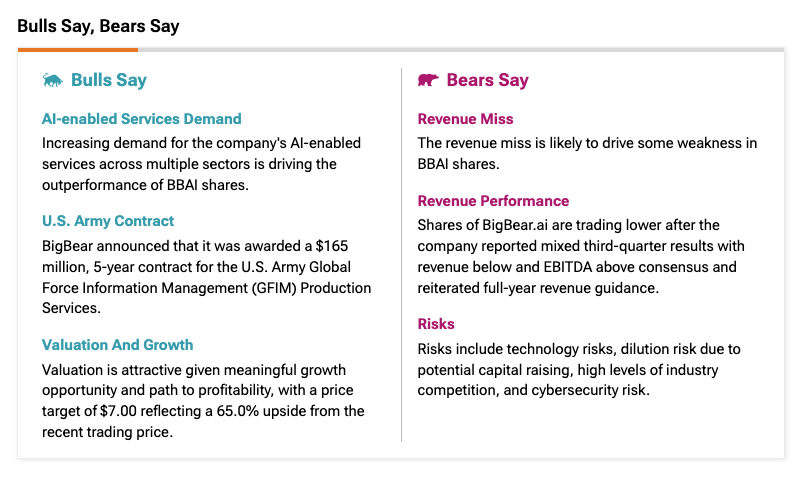

Potential Catalysts and Risks

Several factors could positively or negatively affect BigBear.ai's stock price.

- Potential Catalysts: Securing significant new contracts, launching new products, or achieving technological breakthroughs could positively impact BigBear.ai stock.

- Downside Risks: Economic downturns, increased competition, regulatory changes, or failure to secure new contracts pose considerable risks.

- Geopolitical Factors: Geopolitical events can significantly affect government spending on national security, impacting BigBear.ai's revenue.

Conclusion

Analyzing BigBear.ai stock reveals a company with significant potential in the rapidly growing AI market, particularly within the national security sector. However, the company also faces challenges, including intense competition and reliance on government contracts, introducing considerable risk. While the growth potential is enticing, investors should carefully consider the financial metrics, valuation, and inherent risks before investing in BigBear.ai shares. The fluctuating revenue, dependence on large contracts, and competitive AI market all necessitate a cautious approach.

Investment Recommendation: Based on the analysis, investing in BigBear.ai stock requires a high-risk tolerance. While the long-term growth potential is substantial, the short-term volatility and uncertainty warrant careful consideration. A diversified portfolio and thorough due diligence are crucial before considering a BigBear.ai investment.

Call to Action: While this analysis provides valuable insights into BigBear.ai stock, remember to conduct thorough due diligence before making any investment decisions. Learn more about investing in BigBear.ai stock and other AI companies, and always consult with a qualified financial advisor before making any investment decisions. Understanding the risks associated with BigBear.ai shares is paramount to responsible investing.

Featured Posts

-

Benjamin Kaellman Huuhkajien Tulevaisuuden Taehti

May 21, 2025

Benjamin Kaellman Huuhkajien Tulevaisuuden Taehti

May 21, 2025 -

Paris Prochaine Etape Pour La Chanteuse Suisse Stephane

May 21, 2025

Paris Prochaine Etape Pour La Chanteuse Suisse Stephane

May 21, 2025 -

D Wave Quantum Qbts Stock Market Performance A Detailed Analysis Of Recent Gains

May 21, 2025

D Wave Quantum Qbts Stock Market Performance A Detailed Analysis Of Recent Gains

May 21, 2025 -

Match Report Fsv Mainz 05 Vs Bayer Leverkusen Matchday 34 Bundesliga

May 21, 2025

Match Report Fsv Mainz 05 Vs Bayer Leverkusen Matchday 34 Bundesliga

May 21, 2025 -

Half Dome Secures Abn Group Victorias Media Business

May 21, 2025

Half Dome Secures Abn Group Victorias Media Business

May 21, 2025

Latest Posts

-

Ing Groups 2024 Financial Performance Insights From The Form 20 F Report

May 22, 2025

Ing Groups 2024 Financial Performance Insights From The Form 20 F Report

May 22, 2025 -

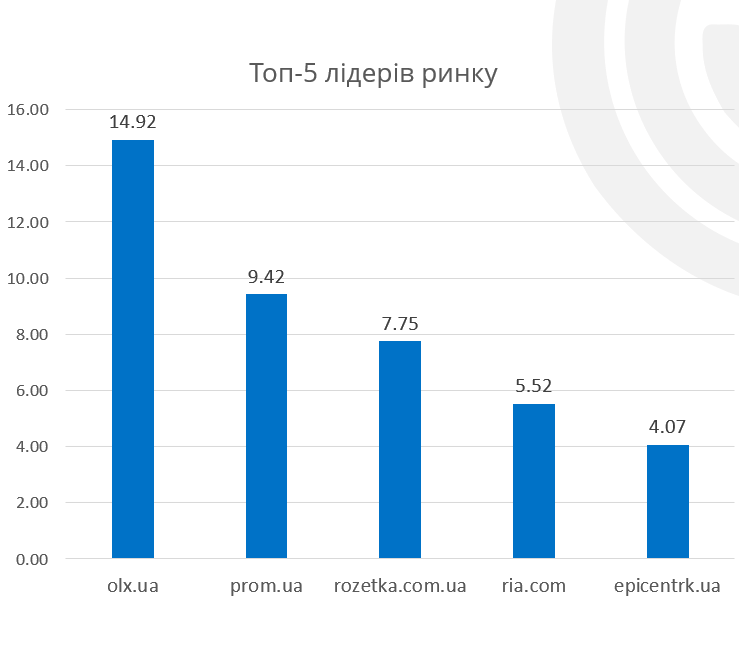

Naybilshi Finansovi Kompaniyi Ukrayini Za Obsyagom Dokhodiv U 2024 Rotsi

May 22, 2025

Naybilshi Finansovi Kompaniyi Ukrayini Za Obsyagom Dokhodiv U 2024 Rotsi

May 22, 2025 -

Analysis Of Ing Groups 2024 Annual Report Form 20 F

May 22, 2025

Analysis Of Ing Groups 2024 Annual Report Form 20 F

May 22, 2025 -

Stephane Du C Ur De La Suisse Romande Aux Scenes Parisiennes

May 22, 2025

Stephane Du C Ur De La Suisse Romande Aux Scenes Parisiennes

May 22, 2025 -

Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lideri Finansovogo Rinku Ukrayini 2024

May 22, 2025

Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lideri Finansovogo Rinku Ukrayini 2024

May 22, 2025