D-Wave Quantum (QBTS) Stock Market Performance: A Detailed Analysis Of Recent Gains

Table of Contents

- Analyzing QBTS Stock Price Fluctuations

- Recent Price Movements and Volatility

- Comparison to Competitor Performance

- Key Financial Indicators and Metrics

- Factors Driving Recent Gains in QBTS Stock

- Technological Advancements and Product Launches

- Growing Investor Interest in Quantum Computing

- Market Sentiment and Speculative Trading

- Assessing the Risks and Potential of Investing in QBTS

- Market Risks and Volatility

- Competitive Landscape and Future Outlook

- Conclusion

Analyzing QBTS Stock Price Fluctuations

Recent Price Movements and Volatility

D-Wave Quantum's (QBTS) stock price has experienced significant fluctuations in recent months. For instance, between [Insert Start Date] and [Insert End Date], the QBTS stock price increased by [Insert Percentage]%. However, this upward trend wasn't linear. Several periods of volatility were observed, with [Insert Percentage]% drops occurring on [Insert Date(s)] likely due to [mention specific news or market events]. This volatility is characteristic of the quantum computing sector, which is still in its early stages of development. Investment in QBTS, therefore, requires a high risk tolerance.

- Chart 1: [Insert a chart showing QBTS stock price movements over the relevant period. Clearly label axes and highlight key dates/events.]

- Chart 2: [Insert a chart comparing the volatility of QBTS to the volatility of the broader market or other tech stocks.]

The inherent uncertainty in technological advancements and the competitive landscape contributes significantly to QBTS's price fluctuations. Positive news regarding technological breakthroughs often leads to short-term price spikes, while negative news or delays can trigger sharp declines.

Comparison to Competitor Performance

Direct comparisons with other publicly traded pure-play quantum computing companies are currently limited due to the nascent nature of the industry. However, comparing QBTS to broader technology indices allows for a contextual understanding of its performance. [Insert comparison data, e.g., "Compared to the Nasdaq Composite, QBTS has shown [higher/lower] volatility and [higher/lower] returns over the past [time period]."] This comparison highlights the unique risk-reward profile of investing in a quantum computing company like D-Wave.

- Key Differences: Factors contributing to differences in stock performance among tech companies include market capitalization, revenue streams, technological maturity, and investor sentiment.

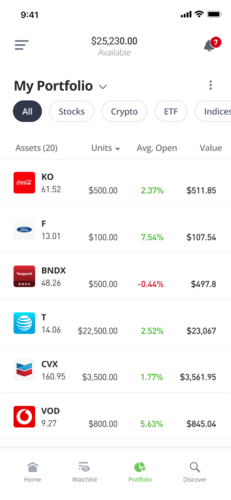

Key Financial Indicators and Metrics

Analyzing QBTS's financial performance is crucial for understanding its stock price movements. While profitability remains a challenge for many companies in the early stages of quantum computing, key metrics such as revenue growth, research and development (R&D) spending, and partnerships can provide insights into the company's future prospects. [Insert data on revenue growth, R&D spending, debt levels etc., citing sources where applicable]. High R&D spending, while initially impacting profitability, signals a commitment to innovation which is crucial in this rapidly developing sector. The relationship between these financial metrics and QBTS's stock price should be carefully analyzed to identify potential correlations.

Factors Driving Recent Gains in QBTS Stock

Technological Advancements and Product Launches

D-Wave's recent progress in quantum computing technology has played a significant role in driving investor interest and stock price appreciation. Specific advancements, such as [mention specific technological achievements e.g., improved qubit coherence, new algorithms, or increased system scale], have demonstrated tangible progress towards commercially viable quantum computing applications. The launch of new products or services, and partnerships with major companies that utilize D-Wave's technology are positive indicators for future growth.

- Partnerships: [List key partnerships and collaborations that have impacted QBTS stock positively]

Growing Investor Interest in Quantum Computing

The quantum computing sector is attracting substantial investment, fueled by the potential for transformative applications across various industries, including drug discovery, materials science, and financial modeling. This increased investor interest, combined with positive media coverage and governmental support, creates a favorable environment for QBTS's stock performance.

- Government Funding: Government initiatives and research grants are playing an important role in driving innovation within the quantum computing sector, ultimately benefiting companies like D-Wave.

Market Sentiment and Speculative Trading

Market sentiment, news coverage, and social media discussions significantly influence QBTS's stock price. Positive news, even if not directly related to D-Wave's financials, can create a wave of optimism, leading to price increases. Conversely, negative news or concerns about the competitive landscape could trigger sell-offs. The speculative nature of the quantum computing market, characterized by high volatility, can amplify these effects.

- Risk Assessment: Investors should be aware of the inherent risks associated with speculative trading and the impact of market sentiment on QBTS's stock price.

Assessing the Risks and Potential of Investing in QBTS

Market Risks and Volatility

Investing in QBTS carries significant risks due to the volatility of the quantum computing market and the early stage of the company's development. Significant price fluctuations should be expected. Unforeseen technical challenges, slower-than-expected adoption of quantum computing, or increased competition could negatively impact QBTS's stock price.

- Risk Mitigation: Diversification within a broader investment portfolio is a crucial strategy to mitigate the risks associated with investing in QBTS.

Competitive Landscape and Future Outlook

The quantum computing industry is highly competitive, with several major players vying for market share. D-Wave faces competition from both established tech giants and emerging startups. The long-term success of QBTS will depend on factors such as its ability to continue innovating, attract and retain talent, secure funding, and successfully commercialize its technology. The future outlook for QBTS remains uncertain, but its potential within the expanding quantum computing market warrants careful consideration.

Conclusion

The recent gains in D-Wave Quantum (QBTS) stock are driven by a confluence of factors, including technological advancements, growing investor interest in the quantum computing sector, and market sentiment. However, investing in QBTS involves significant risk due to the inherent volatility of the market and the competitive landscape. While the potential rewards are substantial, investors must conduct thorough due diligence and carefully assess their risk tolerance before making any investment decisions. Understanding the intricacies of the quantum computing market and the specific factors driving QBTS's performance is crucial for making informed investment choices. Continue your research into D-Wave Quantum (QBTS) and its place within the rapidly evolving quantum computing landscape to make informed investment decisions.

Explaining The D Wave Quantum Inc Qbts Stock Surge

Explaining The D Wave Quantum Inc Qbts Stock Surge

Novelistes A L Espace Julien Avant Le Hellfest Une Ambiance Unique

Novelistes A L Espace Julien Avant Le Hellfest Une Ambiance Unique

Southport Tory Councillors Wife Imprisoned For Inciting Racial Hatred

Southport Tory Councillors Wife Imprisoned For Inciting Racial Hatred

Jalkapallo Huuhkajien Avauskokoonpanossa Yllaetyksiae Kaellman Penkillae

Jalkapallo Huuhkajien Avauskokoonpanossa Yllaetyksiae Kaellman Penkillae

Apples Strategy For Llm Siris Market Share

Apples Strategy For Llm Siris Market Share