Analyst Sees Apple Reaching $254: Investment Analysis At $200

Table of Contents

Apple's Strong Financial Performance and Future Growth Potential

Revenue Growth and Profitability

Apple has demonstrated remarkable consistency in its financial performance, reporting robust revenue growth and high profit margins for years. Recent financial reports showcase continued growth across various segments. For example, [Insert data: cite specific financial reports and include relevant statistics and charts showing revenue growth percentage and profit margins for the last few quarters]. Key revenue drivers remain the iPhone, Services (including iCloud, App Store, and Apple Music), and Wearables (Apple Watch and AirPods). The continued expansion of the Services segment, with its recurring revenue streams, promises a stable foundation for future growth. Analysts predict [cite source and percentage] growth in revenue over the next [time period] based on [reasoning, e.g., new product launches and increased market penetration].

Innovation and Product Pipeline

Apple's commitment to research and development fuels its continuous innovation, driving future revenue growth. The upcoming launch of [mention specific products, e.g., new iPhone models, the highly anticipated AR/VR headset, and advancements in Apple Silicon technology] is expected to significantly boost sales and strengthen Apple's position across various tech markets. Market analysis indicates [cite sources and data] strong consumer demand for these products, pointing towards substantial market share gains. Apple’s consistent track record of disruptive innovation further enhances its long-term growth prospects.

Market Dominance and Competitive Advantage

Apple's Brand Strength and Customer Loyalty

Apple’s unparalleled brand strength and fiercely loyal customer base form a formidable competitive advantage. The powerful Apple ecosystem, encompassing iCloud, the App Store, and various integrated services, encourages user retention and fosters brand loyalty. Data consistently shows [cite sources: mention customer satisfaction surveys, brand perception studies, and user retention rates] high customer satisfaction and strong brand preference. This ecosystem lock-in effect makes switching to competing brands difficult, ensuring a recurring revenue stream and a resilient customer base.

Competitive Landscape

While competitors like Samsung and Google challenge Apple in specific areas, Apple consistently maintains its dominant market position in smartphones and wearables. Its superior brand image, user-friendly interfaces, and strong ecosystem provide strategic advantages. However, increasing competition in the smartphone market and the potential for disruption in the wearables segment represent potential challenges. Analyzing these competitive threats, and Apple's strategies to counter them, is crucial for a comprehensive assessment.

Risk Assessment and Potential Downsides

Economic Headwinds and Global Uncertainty

Global macroeconomic factors, such as inflation, recessionary fears, and supply chain disruptions, present potential risks to Apple's performance. Economic downturns can decrease consumer spending, impacting sales, particularly for high-priced products like iPhones. Geopolitical instability and trade tensions further complicate the picture and could impact Apple’s global supply chain.

Competition and Market Saturation

Market saturation in some product categories, coupled with intensified competition, could limit Apple's future growth. Competitors continue to refine their offerings, potentially eroding Apple's market share in specific segments. The ability to consistently innovate and introduce new, highly sought-after products will be key to navigating this competitive landscape.

Investment Strategies and Recommendations Based on the $200 Price Point

Buy, Hold, or Sell Recommendation

Based on our analysis of Apple’s robust financial performance, strong brand, and promising product pipeline, we recommend a buy rating for Apple stock at the $200 price point. This recommendation considers the potential for reaching the $254 target, factoring in the potential risks identified. This is a long-term recommendation, suitable for investors with a higher risk tolerance and a longer investment horizon.

Diversification and Risk Management

It's crucial to remember that no investment is without risk. Diversifying your investment portfolio is essential to mitigate risk. Apple stock, while promising, should be part of a broader investment strategy. Consult a financial advisor to determine an appropriate asset allocation strategy based on your personal risk tolerance and investment goals.

Conclusion: Is Apple Stock a Buy at $200 Towards the $254 Target?

Our analysis suggests that Apple stock, currently priced around $200, presents a compelling investment opportunity, given the potential to reach the $254 target predicted by some analysts. Apple's strong financial performance, dominant market position, and innovative product pipeline support this positive outlook. However, potential economic headwinds and increased competition must be considered. While we recommend a buy rating at this price point, we emphasize the importance of conducting your own thorough research and considering your personal risk tolerance. Explore the potential of Apple stock reaching $254 by carefully evaluating your investment strategy and consulting a financial professional. Capitalize on the potential of Apple reaching its $254 target with informed and responsible investing.

Featured Posts

-

Thames Waters Executive Pay Scrutiny And Public Outrage

May 25, 2025

Thames Waters Executive Pay Scrutiny And Public Outrage

May 25, 2025 -

Porsche 956 Nin Havada Asili Durumunun Aciklamasi

May 25, 2025

Porsche 956 Nin Havada Asili Durumunun Aciklamasi

May 25, 2025 -

Escape To The Country Balancing Rural Life With Modern Comforts

May 25, 2025

Escape To The Country Balancing Rural Life With Modern Comforts

May 25, 2025 -

Annie Kilners Social Media Activity Examining The Claims Against Kyle Walker

May 25, 2025

Annie Kilners Social Media Activity Examining The Claims Against Kyle Walker

May 25, 2025 -

Volatiliteit Op Wall Street Aex Toont Veerkracht

May 25, 2025

Volatiliteit Op Wall Street Aex Toont Veerkracht

May 25, 2025

Latest Posts

-

Gold Price Surge Trumps Eu Threats Fuel Trade War Fears

May 25, 2025

Gold Price Surge Trumps Eu Threats Fuel Trade War Fears

May 25, 2025 -

Retail Sales Surge Pushes Back Bank Of Canada Rate Cut

May 25, 2025

Retail Sales Surge Pushes Back Bank Of Canada Rate Cut

May 25, 2025 -

B C Billionaires Pursuit Of Hudsons Bay Leases A Real Estate Power Play

May 25, 2025

B C Billionaires Pursuit Of Hudsons Bay Leases A Real Estate Power Play

May 25, 2025 -

B C Billionaire Targets Hudsons Bay Leases For Shopping Mall Expansion

May 25, 2025

B C Billionaire Targets Hudsons Bay Leases For Shopping Mall Expansion

May 25, 2025 -

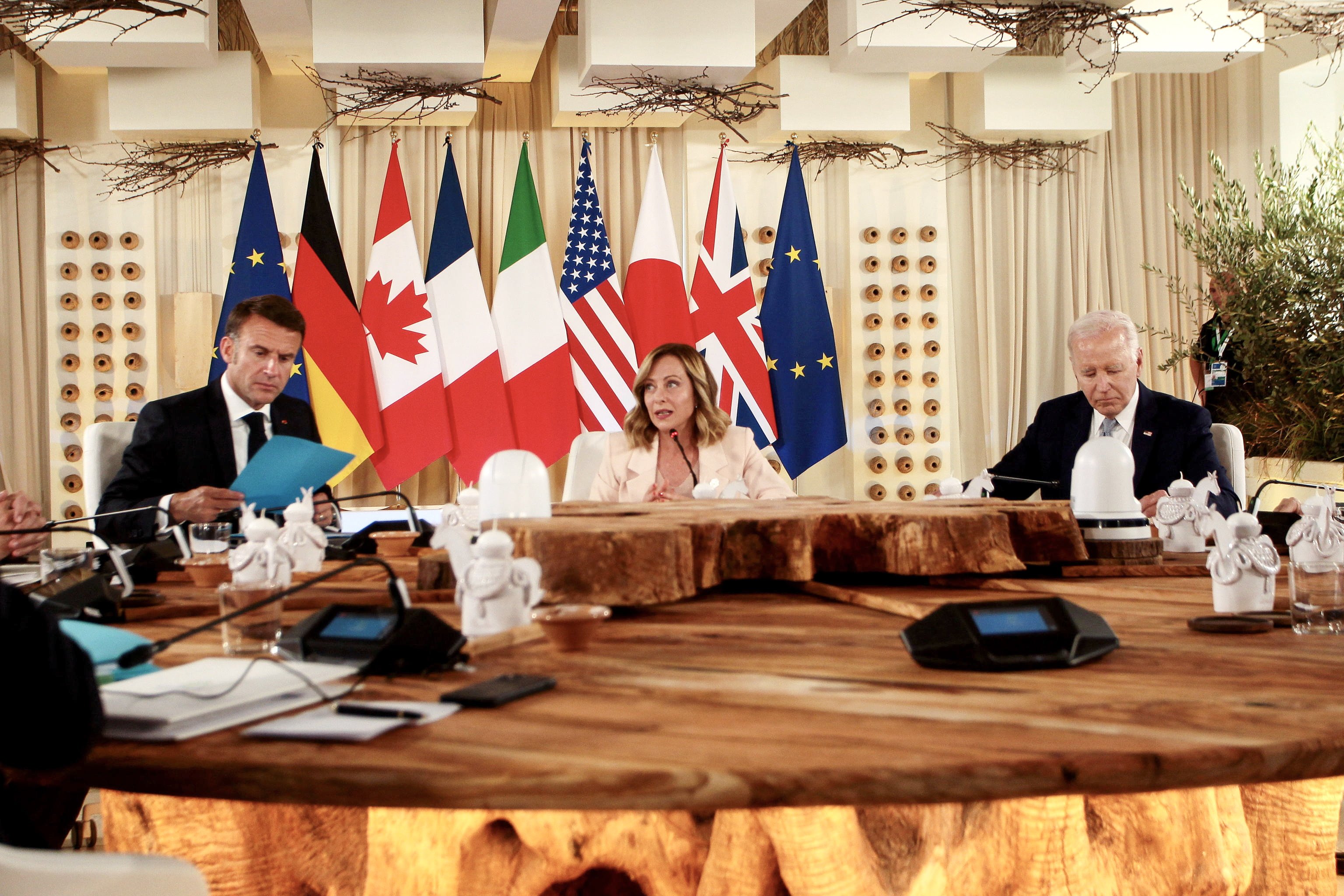

G7 Fails To Address Tariff Concerns In Latest Meeting

May 25, 2025

G7 Fails To Address Tariff Concerns In Latest Meeting

May 25, 2025