Retail Sales Surge Pushes Back Bank Of Canada Rate Cut

Table of Contents

Strong Retail Sales Figures Exceed Expectations

Retail sales in Canada experienced a substantial increase in [Insert Month, Year], climbing by [Insert Percentage]% compared to the previous month. This figure significantly exceeded the expectations of most economists, who had predicted a more modest growth rate. Several sectors contributed significantly to this surge. The automotive sector saw a particularly strong rebound, with sales of new vehicles jumping by [Insert Percentage]%, fueled by [Insert Reason, e.g., increased consumer confidence, new vehicle releases]. Similarly, furniture and electronics sales also showed remarkable growth, suggesting a robust level of consumer spending. Data released by Statistics Canada confirms this unexpected jump, further solidifying the impact on the Bank of Canada's rate-setting deliberations.

- July 2024 Retail Sales: Increased by 2.5% compared to June 2024 (seasonally adjusted).

- Year-over-Year Growth: A 4% increase compared to July 2023.

- Key Contributing Factors: Increased consumer confidence following government stimulus measures and a rebound in the housing market.

Inflation Remains a Key Concern for the Bank of Canada

Persistent inflationary pressures remain a major concern for the Bank of Canada. The current inflation rate stands at [Insert Current Inflation Rate]%, which is [Insert Description, e.g., above] the central bank's target range of 1-3%. The robust retail sales figures exacerbate these concerns, as increased consumer demand often translates to higher prices and further inflationary pressures. The Bank of Canada's mandate is to maintain price stability, and the recent retail sales data suggests that a rate cut might jeopardize this goal. Therefore, the central bank is likely to err on the side of caution and maintain interest rates at their current level, or potentially even consider further increases.

- Current Inflation Rate: 3.5% (July 2024)

- Inflation Target Range: 1-3%

- Key Inflationary Pressures: Rising energy prices and persistent supply chain disruptions.

Impact on Consumer Spending and Borrowing Costs

A delayed Bank of Canada rate cut has significant implications for Canadian consumers. Higher interest rates mean increased borrowing costs, impacting everything from mortgages and personal loans to credit card debt. Consumers will face higher monthly payments, potentially reducing their discretionary spending. This could trigger a ripple effect, potentially slowing down economic growth despite the recent surge in retail sales. The housing market, particularly sensitive to interest rate changes, is expected to feel the impact acutely. Already high household debt levels in Canada could further exacerbate the situation.

- Higher Mortgage Payments: Increased monthly mortgage payments could strain household budgets.

- Reduced Consumer Spending: Higher borrowing costs might lead to decreased consumer spending.

- Impact on Housing Market: Higher interest rates might cool down the overheated housing market in some areas.

Alternative Economic Indicators and Their Influence

While retail sales provide a valuable snapshot of consumer spending, the Bank of Canada considers a broader range of economic indicators when setting monetary policy. Employment rates, GDP growth, and housing starts all play crucial roles. For example, strong employment numbers coupled with robust retail sales could reinforce the case for maintaining or even raising interest rates. Conversely, slower GDP growth might lead to a more cautious approach. Analyzing the interplay of these various indicators is vital for understanding the Bank of Canada's decision-making process. Currently, [Insert description of other indicators and their impact].

- Employment Rate: [Insert Current Employment Rate and its trend]

- GDP Growth: [Insert Current GDP Growth and its trend]

- Housing Starts: [Insert Current Housing Starts data and its trend]

Market Reactions and Future Predictions

Financial markets reacted cautiously to the unexpectedly strong retail sales data and the implied delay in a Bank of Canada rate cut. The Canadian dollar [Insert Market Reaction, e.g., strengthened slightly] against other major currencies. Bond yields [Insert Market Reaction, e.g., increased], reflecting investors’ anticipation of higher interest rates for longer. Experts predict a mixed outlook for future interest rate decisions. While some believe the Bank of Canada may maintain its current stance for an extended period, others anticipate a potential for future rate hikes depending on evolving economic data and inflation trends. Uncertainty remains, highlighting the complexity of economic forecasting.

- Stock Market Reaction: [Insert description of stock market performance]

- Expert Predictions: [Summarize expert opinions on future rate changes]

- Uncertainties: [Highlight potential risks and uncertainties].

Conclusion: Retail Sales and the Bank of Canada Rate Cut Outlook

The unexpectedly robust retail sales figures have likely delayed a Bank of Canada rate cut, primarily due to persistent inflation concerns. The Bank's focus remains on maintaining price stability, and a rate cut at this juncture could risk further inflationary pressures. Monitoring inflation, employment rates, GDP growth, and other key economic indicators will be crucial in determining the future trajectory of interest rates. The ongoing uncertainty surrounding future interest rate decisions highlights the need for continuous monitoring of economic data and careful analysis of its implications for both consumers and the broader Canadian economy. Stay tuned for updates on the Bank of Canada rate cut and its impact on the Canadian economy. Follow our coverage for in-depth analysis of retail sales and their effect on interest rates. Learn more about how the Bank of Canada manages interest rates and their impact on the Canadian economy.

Featured Posts

-

Popular Southern Vacation Area Fights Back Against Negative Safety Report Post Shooting

May 25, 2025

Popular Southern Vacation Area Fights Back Against Negative Safety Report Post Shooting

May 25, 2025 -

Kering Sales Dip Demnas Gucci Debut In September

May 25, 2025

Kering Sales Dip Demnas Gucci Debut In September

May 25, 2025 -

Republican Deal Trumps Muscle Flexing Tactics

May 25, 2025

Republican Deal Trumps Muscle Flexing Tactics

May 25, 2025 -

Avrupa Borsalari Ecb Faiz Kararinin Piyasalara Etkisi

May 25, 2025

Avrupa Borsalari Ecb Faiz Kararinin Piyasalara Etkisi

May 25, 2025 -

Tik Tok Tourism Backlash Amsterdam Residents Sue City Over Snack Bar Crowds

May 25, 2025

Tik Tok Tourism Backlash Amsterdam Residents Sue City Over Snack Bar Crowds

May 25, 2025

Latest Posts

-

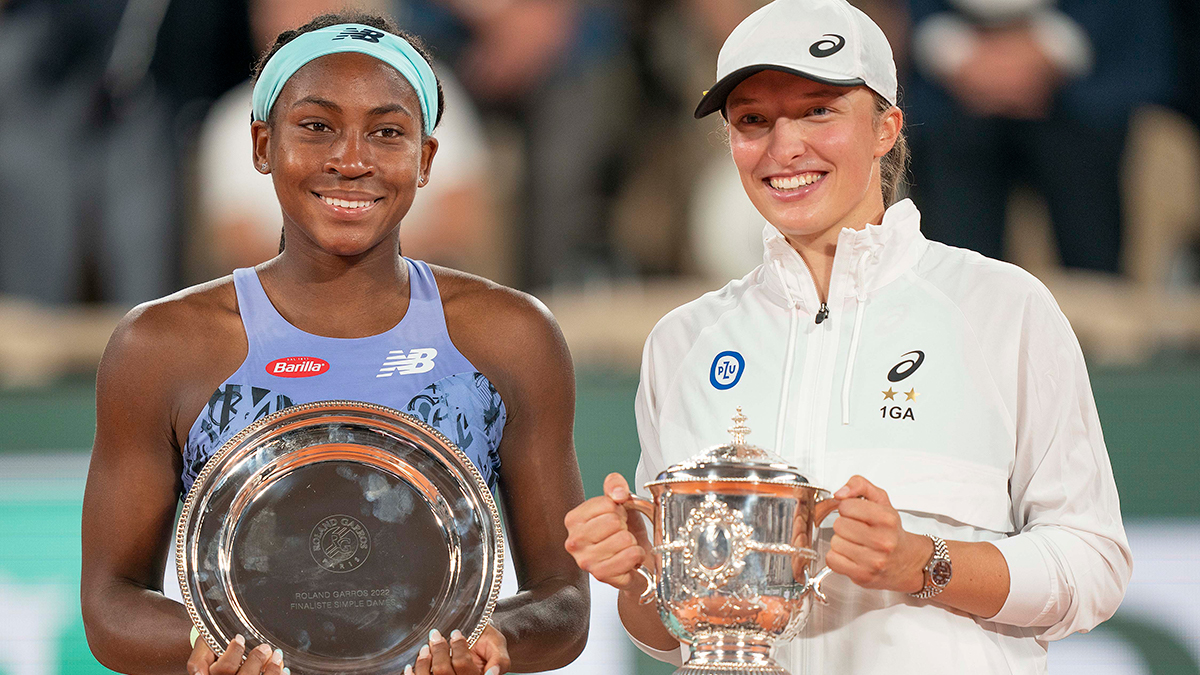

Madrid Open Swiateks Dramatic Victory Sets Up Semifinal With Gauff

May 25, 2025

Madrid Open Swiateks Dramatic Victory Sets Up Semifinal With Gauff

May 25, 2025 -

Could Tariffs Jeopardize The Feds Objectives Powell Weighs In

May 25, 2025

Could Tariffs Jeopardize The Feds Objectives Powell Weighs In

May 25, 2025 -

Iga Swiatek Overcomes Keys Sets Up Gauff Semifinal Clash In Madrid

May 25, 2025

Iga Swiatek Overcomes Keys Sets Up Gauff Semifinal Clash In Madrid

May 25, 2025 -

Powells Warning How Tariffs Could Hinder The Federal Reserve

May 25, 2025

Powells Warning How Tariffs Could Hinder The Federal Reserve

May 25, 2025 -

Swiatek Beats Keys Despite Slow Start Reaches Madrid Semifinal

May 25, 2025

Swiatek Beats Keys Despite Slow Start Reaches Madrid Semifinal

May 25, 2025