Gold Price Surge: Trump's EU Threats Fuel Trade War Fears

Table of Contents

The Rise of Gold as a Safe-Haven Asset

Gold has historically served as a reliable safe-haven asset during periods of economic uncertainty and geopolitical instability. When investors perceive heightened risk – whether from trade wars, political turmoil, or economic downturns – they often turn to gold as a store of value, seeking to protect their portfolios from potential losses. This flight to safety is a fundamental driver of gold price increases.

Investors flock to gold because it’s considered a non-correlated asset, meaning its price doesn't always move in tandem with other markets. This makes it a valuable hedge against market volatility. Historically, major crises, such as the 2008 financial crisis and the European debt crisis, have seen significant gold price increases fueled by increased safe-haven demand.

- Gold's inherent value and lack of counterparty risk: Gold's value is largely intrinsic, unlike fiat currencies or stocks which are subject to credit risk.

- Increased demand from central banks and institutional investors: Central banks globally have been increasing their gold reserves, further driving up demand.

- Hedge against inflation and currency devaluation: Gold is often viewed as a hedge against inflation, maintaining its purchasing power even during periods of currency depreciation.

Trump's Trade Policies and their Impact on Global Markets

President Trump's trade policies, particularly his threats and actions against the European Union, have significantly contributed to the current market uncertainty. The imposition of tariffs on European goods, coupled with retaliatory measures from the EU, has created a climate of fear and unpredictability in the global marketplace. This uncertainty fuels market volatility, pushing investors to seek safer investment options.

The market reaction to these trade threats has been swift and pronounced. Investor sentiment has soured, leading to increased volatility in stock markets and a weakening of the US dollar. The potential for an escalating trade war between the US and the EU, disrupting global supply chains and hindering economic growth, further amplifies the risk aversion driving investors towards gold.

- Tariffs imposed on European goods: These tariffs increase the cost of European goods in the US, impacting businesses and consumers.

- Retaliatory measures from the EU: The EU has responded with its own tariffs on US goods, escalating the trade conflict.

- Uncertainty surrounding future trade relations: The lack of clarity regarding future trade agreements between the US and the EU adds to the market's anxiety.

Analyzing the Correlation Between Trade War Fears and Gold Prices

The correlation between escalating trade war fears and the gold price surge is undeniable. As uncertainty grows and market volatility increases, investors' risk aversion intensifies, leading to a surge in demand for safe-haven assets like gold. This increased demand directly translates into higher gold prices.

Several factors contribute to this correlation:

- Risk aversion: Investors seek to preserve capital in uncertain times, shifting their assets to perceived safe havens.

- Increased demand for safe-haven assets: Gold’s traditional role as a safe-haven asset makes it a natural choice during periods of heightened risk.

However, it's crucial to acknowledge that other factors might also have contributed to the gold price increase, such as the weakening US dollar. A weaker dollar makes gold cheaper for holders of other currencies, boosting demand.

- (Include charts and graphs illustrating gold price movements. This would be best added visually in an actual article.) Visual representations clearly demonstrate the upward trend in gold prices correlating with escalating trade tensions.

- (Market sentiment indicators analysis would need to be researched and included here. This section should include links to reputable sources supporting the data.) Data from market sentiment surveys and indices could further solidify the link between trade war anxiety and investor behavior.

- (Discussion of competing economic factors would require research and data. Sources should be cited.) Factors such as interest rates, inflation expectations, and global economic growth should be considered for a comprehensive analysis.

The Future of Gold Prices and the Trade War Outlook

Predicting the future direction of gold prices hinges significantly on the trajectory of the ongoing trade war. Several scenarios are possible: a de-escalation of tensions, a prolonged stalemate, or a further escalation.

- Short-term price projections: In a scenario of continued trade war escalation, further gold price increases are likely. If tensions ease, the gold price might stabilize or even slightly decline.

- Long-term price projections: The long-term outlook for gold depends on various factors including global economic growth, inflation rates, and geopolitical stability.

- Factors that could influence future gold prices: These factors include changes in monetary policy, global economic growth, and the overall investor sentiment towards risk.

- Investment strategies for navigating trade war uncertainty: Diversification is key. Consider gold as part of a broader portfolio strategy to manage risk.

Gold Price Surge: Understanding the Trade War Impact

In conclusion, the recent surge in gold prices is strongly linked to the market uncertainty created by President Trump's trade threats against the European Union. The resulting fear of a global trade war has driven increased demand for gold as a safe-haven asset. The correlation between escalating trade tensions and the rising gold price is evident in market data and investor behavior. The future direction of gold prices will largely depend on the resolution (or lack thereof) of the trade conflict.

The importance of gold as a safe-haven asset during times of geopolitical and economic instability remains paramount. Staying informed about the evolving trade war situation is critical for investors. Consider the role of gold in your investment portfolio to navigate the fluctuating gold price effectively. For more information on incorporating gold into your investment strategy, [link to relevant resource on gold investment].

Featured Posts

-

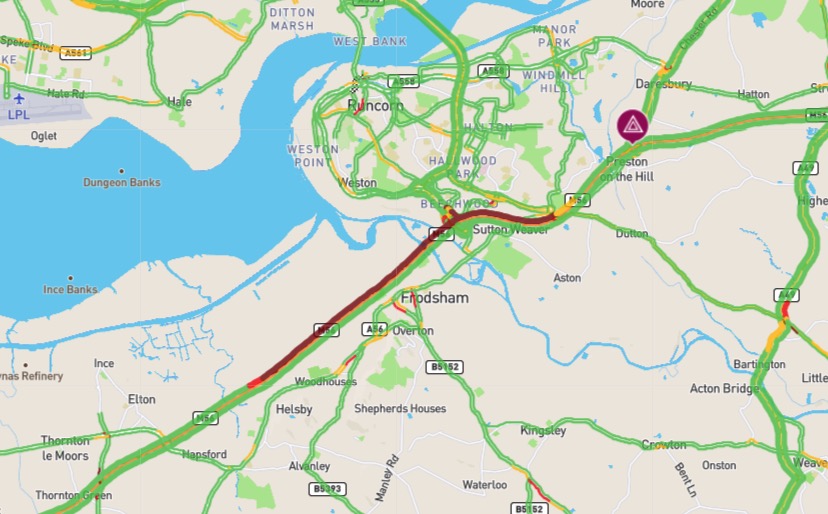

Delays On M56 Near Cheshire Deeside Border Due To Collision

May 25, 2025

Delays On M56 Near Cheshire Deeside Border Due To Collision

May 25, 2025 -

Zhengs Italian Open Run Ends In Semifinal Loss To Gauff

May 25, 2025

Zhengs Italian Open Run Ends In Semifinal Loss To Gauff

May 25, 2025 -

Elegantna Naomi Kempbell Noviy Obraz Na Zakhodi V Londoni

May 25, 2025

Elegantna Naomi Kempbell Noviy Obraz Na Zakhodi V Londoni

May 25, 2025 -

Beyond Bmw And Porsche The Broader Implications Of The Chinese Auto Market Shift

May 25, 2025

Beyond Bmw And Porsche The Broader Implications Of The Chinese Auto Market Shift

May 25, 2025 -

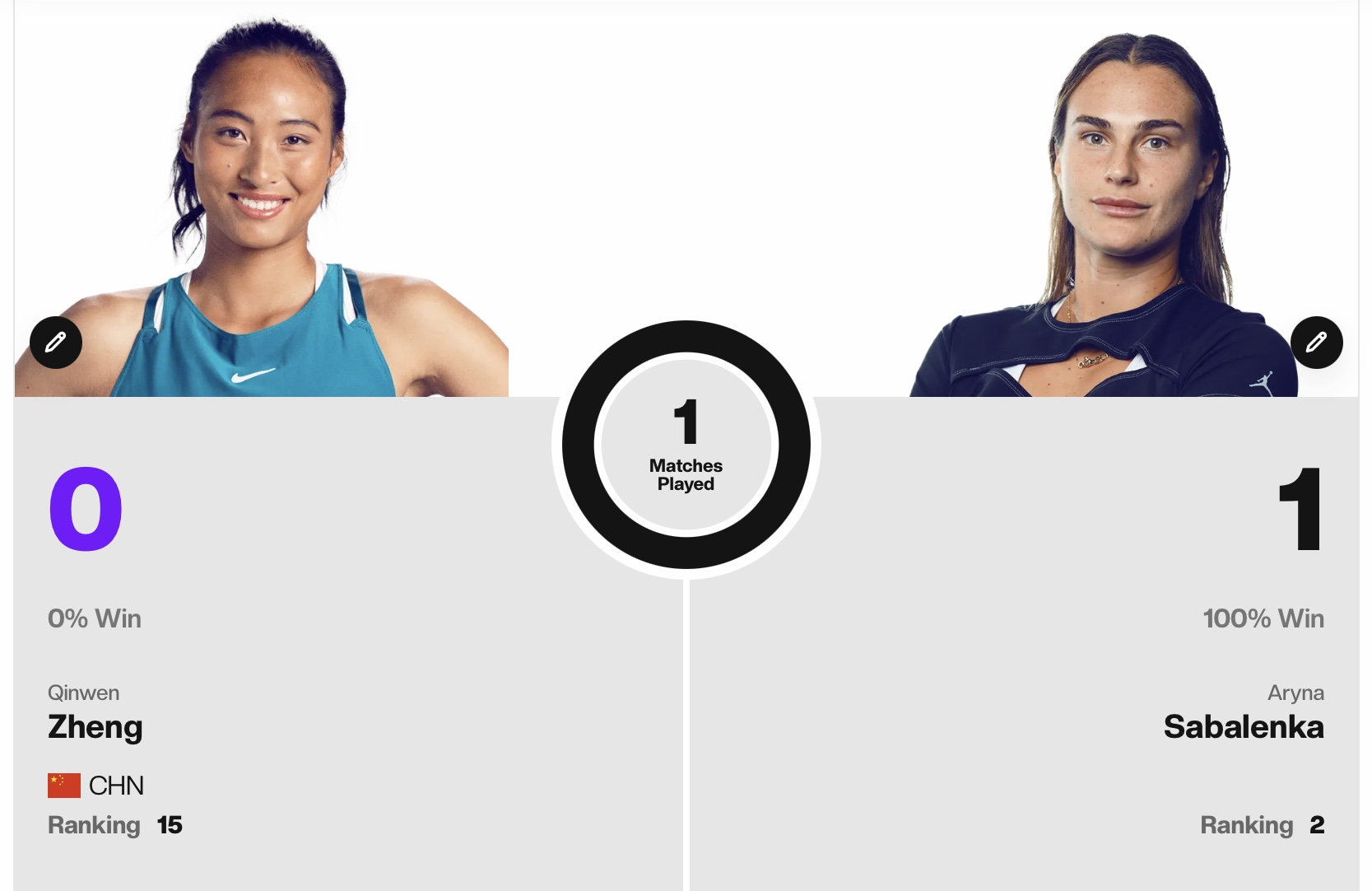

Zheng Defeats Sabalenka In Rome Advances To Play Gauff

May 25, 2025

Zheng Defeats Sabalenka In Rome Advances To Play Gauff

May 25, 2025

Latest Posts

-

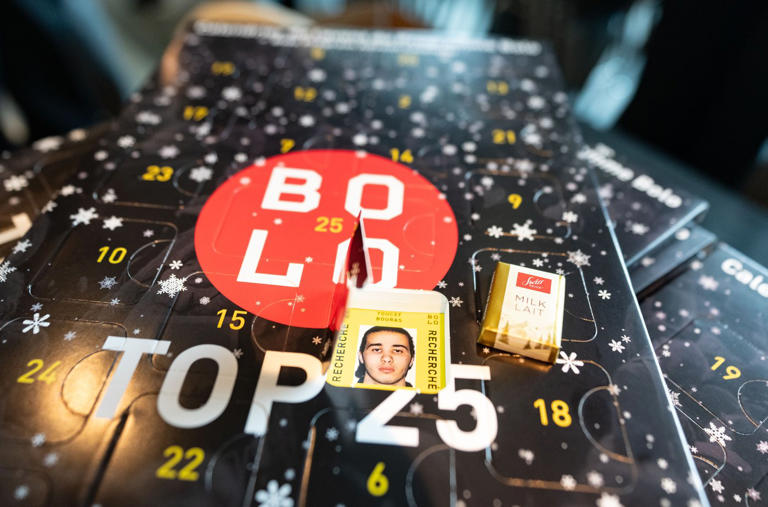

Arrest Of Dave Turmel Canadas Most Wanted In Italy

May 25, 2025

Arrest Of Dave Turmel Canadas Most Wanted In Italy

May 25, 2025 -

Alcaraz And Sabalenka Triumph In Rome Strong Start At Italian Open

May 25, 2025

Alcaraz And Sabalenka Triumph In Rome Strong Start At Italian Open

May 25, 2025 -

Canadas Most Wanted Fugitive Dave Turmel Captured In Italy

May 25, 2025

Canadas Most Wanted Fugitive Dave Turmel Captured In Italy

May 25, 2025 -

Dave Turmel Canadas Most Wanted Arrested In Italy

May 25, 2025

Dave Turmel Canadas Most Wanted Arrested In Italy

May 25, 2025 -

Hells Angels Adaptability Analyzing The Implications Of The Mandarin Killing

May 25, 2025

Hells Angels Adaptability Analyzing The Implications Of The Mandarin Killing

May 25, 2025