Analysis: XRP Whale's 20M Token Buy And Market Implications

Table of Contents

The Significance of the 20M XRP Purchase

The sheer scale of this 20M XRP purchase is undeniably significant. Understanding its impact requires examining various aspects.

Identifying the Whale

Pinpointing the identity of the whale responsible for this massive XRP acquisition is challenging. The decentralized and often pseudonymous nature of cryptocurrency transactions makes tracing the source difficult. This anonymity, however, adds to the intrigue and speculation surrounding the purchase.

- Speculation on the whale's identity: The buyer could be a large institutional investor, a high-net-worth individual, or even a group of coordinated traders.

- Analysis of the transaction details: Determining the timing, the exchange used, and the precise price paid for the 20 million XRP would provide valuable insights into the whale's strategy. Analyzing on-chain data is crucial for understanding these details.

- Comparison to previous large XRP transactions: Comparing this 20M XRP buy to past large transactions helps establish context and gauge its relative significance within the overall trading volume of XRP. Historical data on large XRP transactions can offer valuable comparative analysis.

The volume itself is significant relative to XRP's daily trading volume and market capitalization. A purchase of this magnitude, especially if executed at a price significantly below the current market value, indicates strong conviction in the future potential of XRP.

Potential Motivations Behind the Purchase

Several factors could explain this whale's decision to acquire such a significant amount of XRP.

Anticipation of Positive Developments

The whale might be anticipating positive developments that could significantly boost XRP's price.

- Upcoming Ripple court case developments: The ongoing legal battle between Ripple and the SEC heavily influences XRP's price. A favorable ruling could trigger a substantial price increase, making this a strategic preemptive move.

- Potential partnerships or integrations: New partnerships or integrations of XRP into existing financial systems could dramatically increase demand and drive up its price.

- Positive regulatory news for XRP: Positive regulatory developments in key jurisdictions could significantly impact the price of XRP, making it a more attractive investment.

Strategic Accumulation

The whale's goal might be long-term accumulation rather than short-term profit.

- Discussion of potential price targets: The whale may have a long-term price target in mind, accumulating XRP at what they perceive as a discount.

- Consideration of market manipulation possibilities: While ethically questionable, the possibility of the whale manipulating the market cannot be entirely dismissed. Responsible analysis requires acknowledging this possibility without promoting harmful speculation.

- Analysis of the whale's historical trading activity: Investigating past trading activity of this or similar accounts may reveal patterns and strategies providing clues about the current motivation.

Various plausible explanations exist, each supported by market analysis and reasonable speculation. Further investigation is needed to determine the whale's actual intent.

Market Implications of the Whale's Actions

This significant XRP whale buy has considerable implications for the market.

Impact on XRP Price

The 20M XRP buy could have both short-term and long-term effects on XRP's value.

- Analysis of price movement before, during, and after the purchase: Studying the price fluctuations surrounding the purchase reveals its immediate impact on market sentiment.

- Impact on trading volume and market liquidity: The purchase could increase trading volume and potentially improve market liquidity for XRP.

- Potential for a price pump and dump: While unlikely given the scale, the possibility of a price manipulation scheme should be considered.

Influence on Market Sentiment

Large transactions like this significantly impact investor psychology and market confidence.

- Increased bullish sentiment among some investors: The move could signal growing confidence in XRP's future, driving further investment.

- Potential for FOMO (Fear Of Missing Out) driving further buying: The whale's actions may trigger a wave of FOMO, amplifying price increases.

- Counterarguments considering potential for a bear market rebound: However, this could also be seen as a buy-the-dip scenario, with a potential bear market rebound already being priced in.

The ripple effect extends beyond XRP, influencing other cryptocurrencies and the broader market sentiment.

Conclusion

The 20M XRP buy by an anonymous whale is a significant event with far-reaching potential implications. The sheer volume of the transaction, the challenges in identifying the buyer, and the myriad potential motivations highlight the complexities of the cryptocurrency market. The impact on XRP's price and overall market sentiment remains to be seen, but this massive XRP purchase has undoubtedly stirred considerable interest and speculation. What are your thoughts on this significant XRP whale buy and its potential market implications? Share your predictions and analysis in the comments below! Keep an eye out for further developments in the XRP market and continue your research into XRP whale activity.

Featured Posts

-

Japan Trading Houses See Share Price Increase Following Berkshire Investment

May 08, 2025

Japan Trading Houses See Share Price Increase Following Berkshire Investment

May 08, 2025 -

Path Of Exile 2 Who Are The Rogue Exiles

May 08, 2025

Path Of Exile 2 Who Are The Rogue Exiles

May 08, 2025 -

Kripto Varliklar Icin Bakan Simsek Ten Oenemli Aciklama Ve Yeni Kurallar

May 08, 2025

Kripto Varliklar Icin Bakan Simsek Ten Oenemli Aciklama Ve Yeni Kurallar

May 08, 2025 -

Inter Milan Contracts 2026 Four Players Facing Uncertain Futures

May 08, 2025

Inter Milan Contracts 2026 Four Players Facing Uncertain Futures

May 08, 2025 -

Surge In Dwp Home Visits Impact On Benefit Claimants

May 08, 2025

Surge In Dwp Home Visits Impact On Benefit Claimants

May 08, 2025

Latest Posts

-

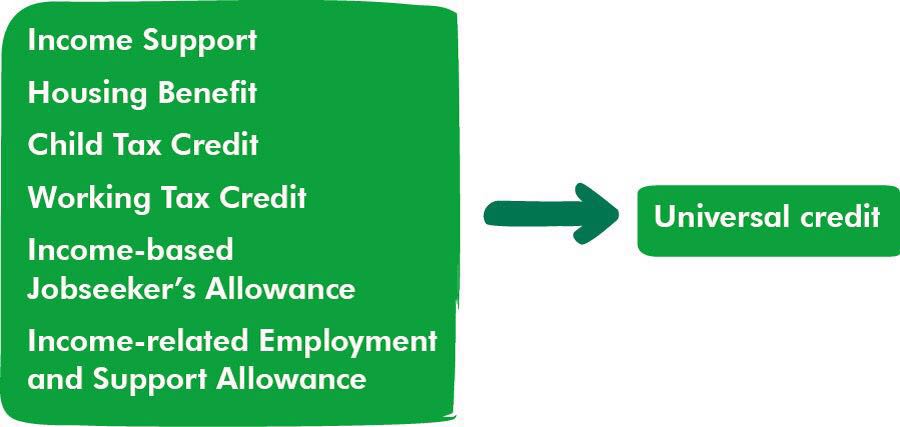

Dwp Could Owe You Money Reclaiming Universal Credit Hardship Payments

May 08, 2025

Dwp Could Owe You Money Reclaiming Universal Credit Hardship Payments

May 08, 2025 -

Have You Missed Out On Universal Credit Back Payments

May 08, 2025

Have You Missed Out On Universal Credit Back Payments

May 08, 2025 -

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025 -

Universal Credit Overpayment Reclaiming Money From The Dwp

May 08, 2025

Universal Credit Overpayment Reclaiming Money From The Dwp

May 08, 2025 -

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025