DWP Could Owe You Money: Reclaiming Universal Credit Hardship Payments

Table of Contents

Understanding Universal Credit Hardship Payments

Universal Credit hardship payments are short-term financial aids designed to help claimants cope with unexpected expenses or temporary financial shortfalls. They aren't a regular part of your Universal Credit payment but are available to assist when you face unforeseen difficulties. The purpose is to prevent you from falling into arrears with rent, bills, or other essential costs.

Eligibility for Universal Credit hardship payments hinges on your current financial situation. Generally, you'll need to be receiving Universal Credit and demonstrate a genuine need due to unforeseen circumstances. This could include:

- Low income: Your current Universal Credit payment is insufficient to cover your essential living costs.

- Unexpected expenses: You've faced a sudden, significant expense, such as a boiler repair, unexpected medical bills, or car repair. These are expenses that were not budgeted for and place significant strain on your finances.

- Temporary loss of income: You've experienced a temporary reduction in income due to unforeseen circumstances like a short-term job loss.

Different types of hardship payments exist, including:

-

Advance payments: A payment made in advance of your next regular Universal Credit payment to cover immediate needs. This is repayable over time through deductions from your regular payments.

-

Budgeting support loans: Larger, interest-bearing loans to help manage larger debts or expenses. These loans are repaid over a longer period.

-

Covers unexpected costs like boiler repairs or unexpected medical bills.

-

Provides short-term financial assistance to avoid arrears on essential bills.

-

Offers different payment options based on individual circumstances and the severity of the financial hardship.

Checking Your Eligibility for Backdated Payments

It's possible you were eligible for Universal Credit hardship payments in the past but didn't apply. To check, meticulously review your financial history:

- Review your Universal Credit online journal: This online record details all your Universal Credit transactions and communications with the DWP. Look for any mentions of hardship payments or opportunities you may have missed.

- Check your bank statements: Scrutinize your bank statements for any unusual payments or deductions related to potential hardship payment applications or repayments.

- Examine all correspondence from the DWP: Check all letters and emails from the DWP for any information about hardship payments.

If you're unsure about your eligibility, seeking advice from Citizens Advice, a benefits advisor, or a similar organisation can prove invaluable. They can help you interpret your statements and assess your potential for backdated payments.

How to Apply for Universal Credit Hardship Payments (including backdated)

Applying for Universal Credit hardship payments, whether for current needs or backdated support, involves several key steps:

- Gather supporting documents: Compile all relevant documents to support your claim. This includes bills, invoices, bank statements, and any other evidence demonstrating your financial hardship.

- Complete the application form: Fill out the application form accurately and thoroughly. Provide detailed explanations of your financial situation and the reasons for needing support.

- Submit your application: You can typically submit your application online through your Universal Credit account or via post. Submitting online is usually faster but requires online access. Posting requires more time but is an option for those without online access.

- Keep a record: Maintain detailed records of your application, including the date of submission, application reference number, and any correspondence with the DWP.

The processing time for your application can vary, but it's usually within several weeks.

Appealing a Rejected Claim for Universal Credit Hardship Payments

If your application for Universal Credit hardship payments is rejected, you have the right to appeal:

- Request a written explanation: Obtain a detailed explanation of the reasons for the rejection from the DWP.

- Gather further evidence: Collect any additional evidence that might strengthen your case. This may involve contacting utility companies for further documentation or obtaining medical evidence.

- Submit a formal appeal: Submit a formal appeal within the specified timeframe. This often involves completing an appeal form and submitting it to the relevant authority.

- Seek professional help: If you're struggling with the appeal process, consider seeking advice from a benefits advisor or Citizens Advice. They can guide you through the process and help you build a strong case.

Avoiding Universal Credit Payment Problems in the Future

Proactive financial management can significantly reduce the likelihood of facing future hardship:

- Create a realistic household budget: Track your income and expenses carefully to identify areas where you can save money.

- Regularly review your spending habits: Identify unnecessary expenses and make adjustments to your budget accordingly.

- Seek advice from a financial advisor: A financial advisor can offer personalized guidance on managing your finances effectively.

- Contact the DWP early: If you anticipate facing financial difficulties, contact the DWP early to explore options for support before the situation worsens.

Conclusion

Don't miss out on potential financial support. Many people are entitled to Universal Credit hardship payments but haven't claimed them. By understanding your eligibility and following the steps outlined above, you can successfully reclaim any Universal Credit hardship payments you might be owed. If you think you might be eligible for backdated Universal Credit hardship payments, act now! Review your past statements and begin the application process today. Take control of your finances and start reclaiming what's rightfully yours. Remember to seek professional advice if you are unsure about any aspect of the process. Don't delay – check your eligibility for Universal Credit hardship payments now!

Featured Posts

-

New Movie The Life Of Chuck Gets Stephen Kings Seal Of Approval

May 08, 2025

New Movie The Life Of Chuck Gets Stephen Kings Seal Of Approval

May 08, 2025 -

El Gigante De Arroyito Un Analisis De La Salud Financiera De Central Cordoba

May 08, 2025

El Gigante De Arroyito Un Analisis De La Salud Financiera De Central Cordoba

May 08, 2025 -

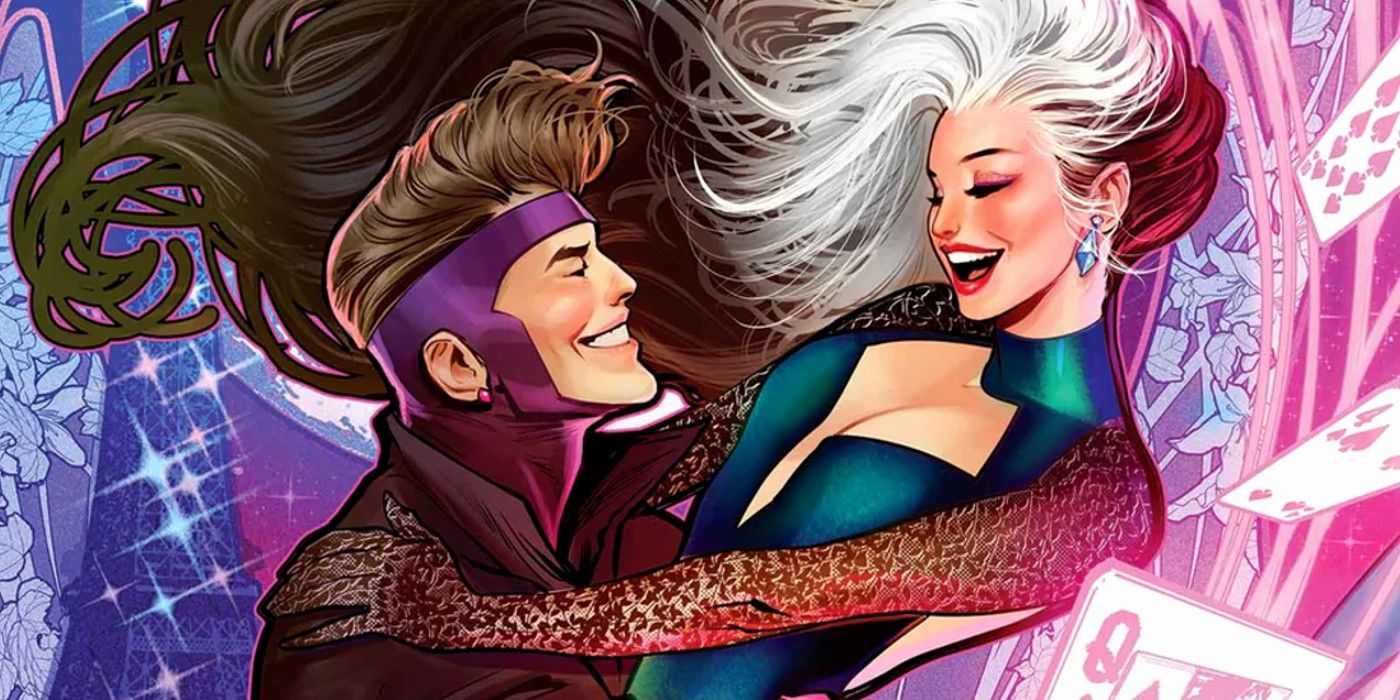

A Weapon Of Remembrance Gambits Tribute To Rogue

May 08, 2025

A Weapon Of Remembrance Gambits Tribute To Rogue

May 08, 2025 -

Arsenal Protiv Ps Zh V Evrokubkakh Polniy Obzor Vstrech

May 08, 2025

Arsenal Protiv Ps Zh V Evrokubkakh Polniy Obzor Vstrech

May 08, 2025 -

Check Daily Lotto Results For Friday 18th April 2025

May 08, 2025

Check Daily Lotto Results For Friday 18th April 2025

May 08, 2025

Latest Posts

-

Sor Norge Vinter Guide Til Trygge Fjellturer I Snorike Omrader

May 09, 2025

Sor Norge Vinter Guide Til Trygge Fjellturer I Snorike Omrader

May 09, 2025 -

Pogoda V Permi I Permskom Krae V Kontse Aprelya 2025 Prognoz Pokholodaniya I Snegopadov

May 09, 2025

Pogoda V Permi I Permskom Krae V Kontse Aprelya 2025 Prognoz Pokholodaniya I Snegopadov

May 09, 2025 -

Silniy Snegopad Paralizoval Sverdlovskuyu Oblast 45 Tysyach Bez Sveta

May 09, 2025

Silniy Snegopad Paralizoval Sverdlovskuyu Oblast 45 Tysyach Bez Sveta

May 09, 2025 -

Kjoreforhold Sor Norge Oppdatert Informasjon Om Sno Og Is

May 09, 2025

Kjoreforhold Sor Norge Oppdatert Informasjon Om Sno Og Is

May 09, 2025 -

Planlegg Vinterturen Veiinformasjon Og Snoforhold I Sor Norges Fjell

May 09, 2025

Planlegg Vinterturen Veiinformasjon Og Snoforhold I Sor Norges Fjell

May 09, 2025