DAX Index Soars: Frankfurt Equities Open Higher, Record High Nears

Table of Contents

Factors Contributing to the DAX Index Surge

Several interconnected factors have contributed to the remarkable rise of the DAX index. Understanding these elements is crucial for interpreting the current market dynamics and anticipating future trends in German equities.

Strong Corporate Earnings

Positive earnings reports from major DAX companies have been a key driver of the index's surge. Many companies have exceeded expectations, boosting investor confidence and creating a positive market sentiment.

- Increased profitability in key sectors: The automotive, technology, and industrial sectors have shown particularly strong earnings growth.

- Positive revenue growth exceeding expectations: Several DAX 40 companies reported revenue growth significantly higher than analysts' predictions, indicating strong underlying demand.

- Upgraded future outlook by several leading DAX companies: Increased confidence in future economic prospects has led several prominent companies to upgrade their earnings guidance, further fueling investor optimism. For example, [insert example of a company and its earnings report].

Global Economic Optimism

The positive momentum in the DAX is not isolated; it reflects broader global economic optimism. Improving global trade and reduced geopolitical uncertainty have contributed significantly to the positive market sentiment.

- Easing inflation concerns in major economies: A slowdown in inflation in key global economies has reduced concerns about aggressive interest rate hikes, creating a more favorable investment environment.

- Stronger-than-expected growth in key export markets: Robust growth in major export markets for German goods has positively impacted the performance of German companies, particularly those in the automotive and industrial sectors.

- Positive sentiment from global financial institutions: Leading financial institutions have expressed increased confidence in the global economic outlook, supporting the positive sentiment reflected in the DAX's performance.

Low Interest Rates and Monetary Policy

The European Central Bank's (ECB) monetary policy plays a crucial role in the DAX's performance. Low interest rates stimulate investment and borrowing, creating favorable conditions for stock market growth.

- Continued accommodative monetary stance by the ECB: The ECB's continued low interest rate policy makes borrowing cheaper for companies, encouraging investment and expansion.

- Low borrowing costs stimulate corporate investment: Reduced borrowing costs allow companies to invest in new projects, expand operations, and increase profitability, all of which positively impact stock prices.

- Attractive yields compared to other asset classes: Low interest rates make equities a more attractive investment compared to other asset classes such as bonds, driving capital flows into the stock market.

Sector-Specific Performance within the DAX

The DAX's surge is not uniform across all sectors; some sectors are outperforming others.

Leading Sectors

The technology sector, driven by strong innovation and demand, has been a significant contributor to the DAX's rise. The automotive sector has also shown impressive growth, benefiting from increased global demand and technological advancements in electric vehicles. Industrial companies have also performed well, benefiting from increased global trade. [Insert data points on sector-specific gains, e.g., percentage increase for each sector].

Lagging Sectors

While most sectors are performing well, certain sectors might show comparatively weaker performance. This could be due to specific industry challenges or headwinds. For instance, [mention a lagging sector and reason]. Analyzing these lagging sectors offers a balanced perspective on the overall market conditions.

Impact on Individual Stocks

The broader market trend is reflected in the performance of individual DAX stocks. Companies like Volkswagen, Siemens, and Allianz have all seen significant gains, demonstrating the positive sentiment driving the overall index. [Insert data on specific stock performance].

Implications and Outlook for the DAX Index

The current surge raises questions about the future trajectory of the DAX.

Potential for Record High

Given the current positive momentum, the DAX has a strong potential to reach a new all-time high. However, this will depend on the continued strength of the underlying factors mentioned above.

Risk Factors

Despite the positive outlook, several risk factors could impact future DAX performance. Geopolitical instability, unexpected inflation spikes, and potential interest rate hikes by the ECB are all potential headwinds.

Investment Strategies

Investors considering investing in the DAX should carefully analyze the market conditions and diversify their portfolios to mitigate risks. While the potential returns are attractive, the inherent volatility of the stock market requires a prudent approach.

Conclusion

The DAX index's impressive surge reflects a confluence of positive factors, including robust corporate earnings, global economic optimism, and supportive monetary policy. While the potential for a record high is strong, investors should remain aware of potential risks. The sustained growth of the DAX offers exciting opportunities, but careful analysis and diversification are crucial for any investment strategy. Stay informed about the latest developments in the DAX Index and the Frankfurt Stock Exchange to make informed investment decisions. Understanding the nuances of the German stock market is key to navigating this dynamic landscape successfully. Monitor the DAX 40 and related equities for further insights into the evolving market conditions. Invest wisely in the DAX Index!

Featured Posts

-

Carmen Joy Crookes Latest Single

May 25, 2025

Carmen Joy Crookes Latest Single

May 25, 2025 -

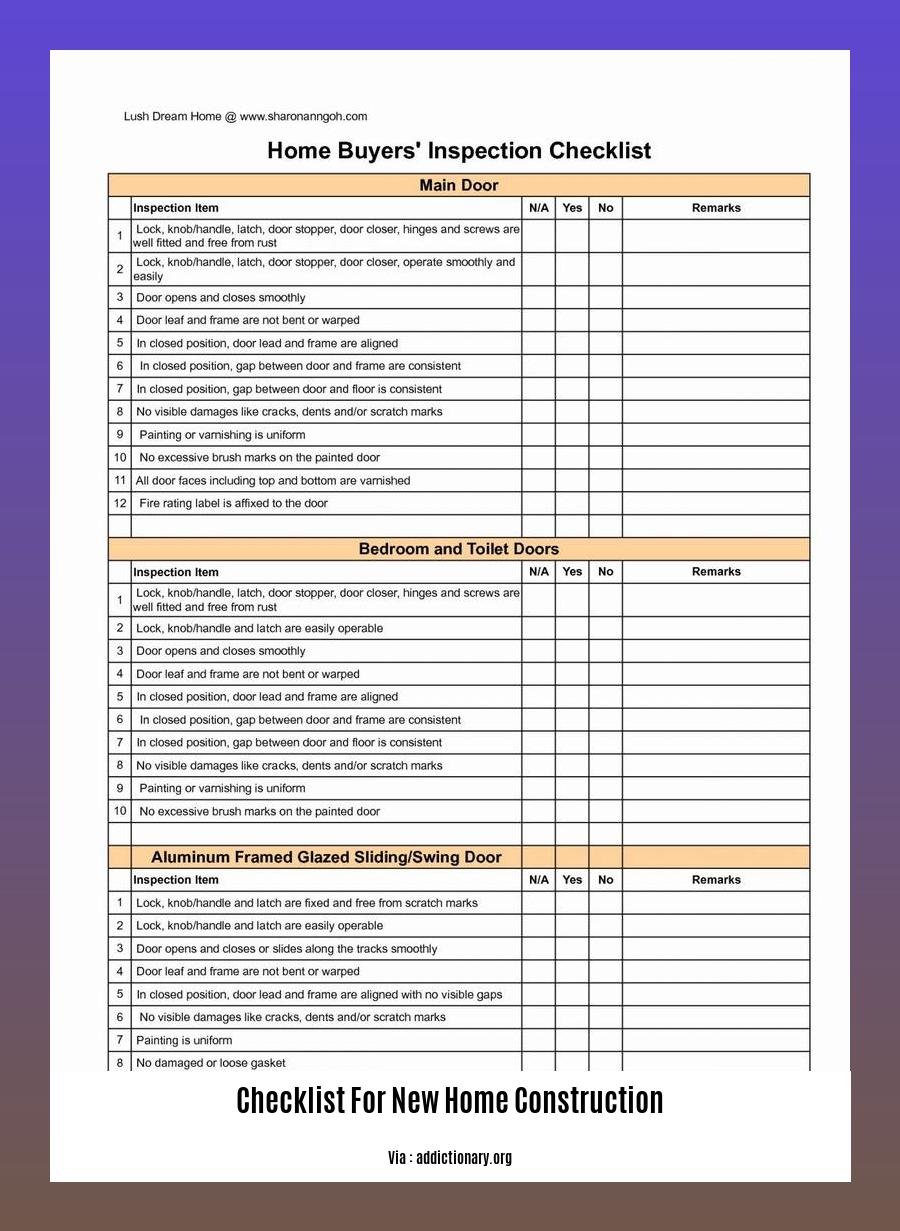

Your Escape To The Country A Step By Step Checklist

May 25, 2025

Your Escape To The Country A Step By Step Checklist

May 25, 2025 -

Sejarah Porsche 356 Di Zuffenhausen Evolusi Mobil Sport Ikonik

May 25, 2025

Sejarah Porsche 356 Di Zuffenhausen Evolusi Mobil Sport Ikonik

May 25, 2025 -

How To Interpret The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025

How To Interpret The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025 -

Philips Future Health Index 2025 Urgent Call To Action On Ai In Healthcare

May 25, 2025

Philips Future Health Index 2025 Urgent Call To Action On Ai In Healthcare

May 25, 2025

Latest Posts

-

2024 Philips Annual General Meeting Financial Results And Future Plans

May 25, 2025

2024 Philips Annual General Meeting Financial Results And Future Plans

May 25, 2025 -

Report Philips Holds Annual General Meeting For Shareholders

May 25, 2025

Report Philips Holds Annual General Meeting For Shareholders

May 25, 2025 -

Philips Convenes Annual General Meeting Review And Outlook

May 25, 2025

Philips Convenes Annual General Meeting Review And Outlook

May 25, 2025 -

Royal Philips Details On The 2025 Shareholders Annual General Meeting

May 25, 2025

Royal Philips Details On The 2025 Shareholders Annual General Meeting

May 25, 2025 -

Annual General Meeting 2025 Philips Announces Agenda Updates

May 25, 2025

Annual General Meeting 2025 Philips Announces Agenda Updates

May 25, 2025