BOE Rate Cut Odds Fall: Pound Climbs On Higher-Than-Expected UK Inflation

Table of Contents

Higher-Than-Expected Inflation Figures Shock Markets

CPI Data Exceeds Forecasts

The latest Consumer Price Index (CPI) data released by the Office for National Statistics (ONS) sent shockwaves through financial markets. The headline CPI figure for [Insert Month, Year] came in at [Insert Percentage]% – significantly higher than the [Insert Percentage]% predicted by analysts. This unexpected surge in UK inflation was driven by several factors:

- Soaring Energy Prices: Energy costs continued their upward trajectory, contributing significantly to the overall inflation increase.

- Elevated Food Prices: Food prices also rose sharply, impacting household budgets and contributing to inflationary pressures.

- Persistent Core Inflation: Even excluding volatile energy and food prices, core inflation remained stubbornly high, indicating broader inflationary pressures within the UK economy. The core CPI was reported at [Insert Percentage]%.

This unexpectedly high UK inflation rate represents a considerable challenge for the Bank of England.

Market Reaction to Inflation Data

The immediate market response to the higher-than-expected inflation figures was swift and dramatic.

- Pound Sterling Surge: The Pound Sterling experienced a significant rally against major currencies, including the US dollar (USD) and the Euro (EUR). GBP/USD rose by [Insert Percentage]%, while GBP/EUR increased by [Insert Percentage]%.

- Gilt Yields Rise: Yields on UK government bonds (gilts) increased, reflecting investor expectations of higher interest rates in the future to combat inflation.

- Stock Market Volatility: The stock market experienced increased volatility as investors reacted to the implications of higher inflation for corporate earnings and economic growth.

Reduced Probability of BOE Rate Cuts

Shift in BOE Monetary Policy Expectations

The higher-than-expected inflation data has significantly diminished the market's expectations of a near-term BOE interest rate cut. Many analysts previously predicted that the BOE might lower interest rates to stimulate economic growth and combat a potential recession. However, the persistent inflationary pressures now make a rate cut far less likely.

- Analyst Predictions Shift: Following the inflation data release, many analysts revised their forecasts, predicting that the BOE is more likely to maintain or even increase interest rates in the coming months.

- Market Pricing of Future Rate Hikes: Market pricing of future interest rate changes now reflects a higher probability of rate hikes rather than cuts.

Potential Impact on the UK Economy

Sustained higher inflation and the BOE's response will have significant consequences for the UK economy:

- Dampened Consumer Spending: Higher prices and increased borrowing costs are likely to reduce consumer spending, potentially slowing economic growth.

- Reduced Business Investment: Businesses might postpone investment plans due to uncertainty about future economic conditions and higher borrowing costs.

- Economic Growth Forecasts Revised Downward: Many economists have already begun revising their UK economic growth forecasts downward in light of the higher inflation figures.

Pound Sterling Strengthens Against Major Currencies

Pound's Response to Inflation Data

The unexpectedly strong inflation data has had a positive impact on the Pound Sterling. Investors are now less concerned about the prospect of a BOE rate cut, which previously had been putting downward pressure on the currency.

- Significant Exchange Rate Gains: The Pound has strengthened significantly against many major currencies, reflecting increased investor confidence.

- Increased Trading Volumes: The surge in the Pound has also led to an increase in trading volumes, as investors adjust their portfolios.

Outlook for the Pound

The long-term outlook for the Pound Sterling remains dependent on several factors, including future inflation data, the BOE's monetary policy decisions, and global economic conditions.

- Analyst Forecasts Vary: Analyst forecasts for future Pound movements vary, with some predicting further gains while others caution against complacency.

- Geopolitical Risks Remain: Geopolitical risks and global economic uncertainty could also impact the Pound's future performance.

Conclusion

The unexpectedly high UK inflation figures have significantly reduced the odds of a BOE rate cut, leading to a strengthening of the Pound Sterling. This shift in market expectations underscores the complex interplay between inflation, interest rates, and currency values. Staying informed about BOE rate cut predictions and UK inflation updates is crucial for investors and businesses operating in or with exposure to the UK economy. Continue monitoring developments related to the BOE rate cut and UK inflation for a comprehensive understanding of the evolving economic landscape. Regularly check reputable financial news sources for the latest information on BOE interest rate decisions and UK inflation data. Understanding the dynamics of the BOE rate cut and its impact on the UK inflation rate is key to navigating the current economic climate.

Featured Posts

-

The Trump Factor Influencing Republican Negotiations

May 25, 2025

The Trump Factor Influencing Republican Negotiations

May 25, 2025 -

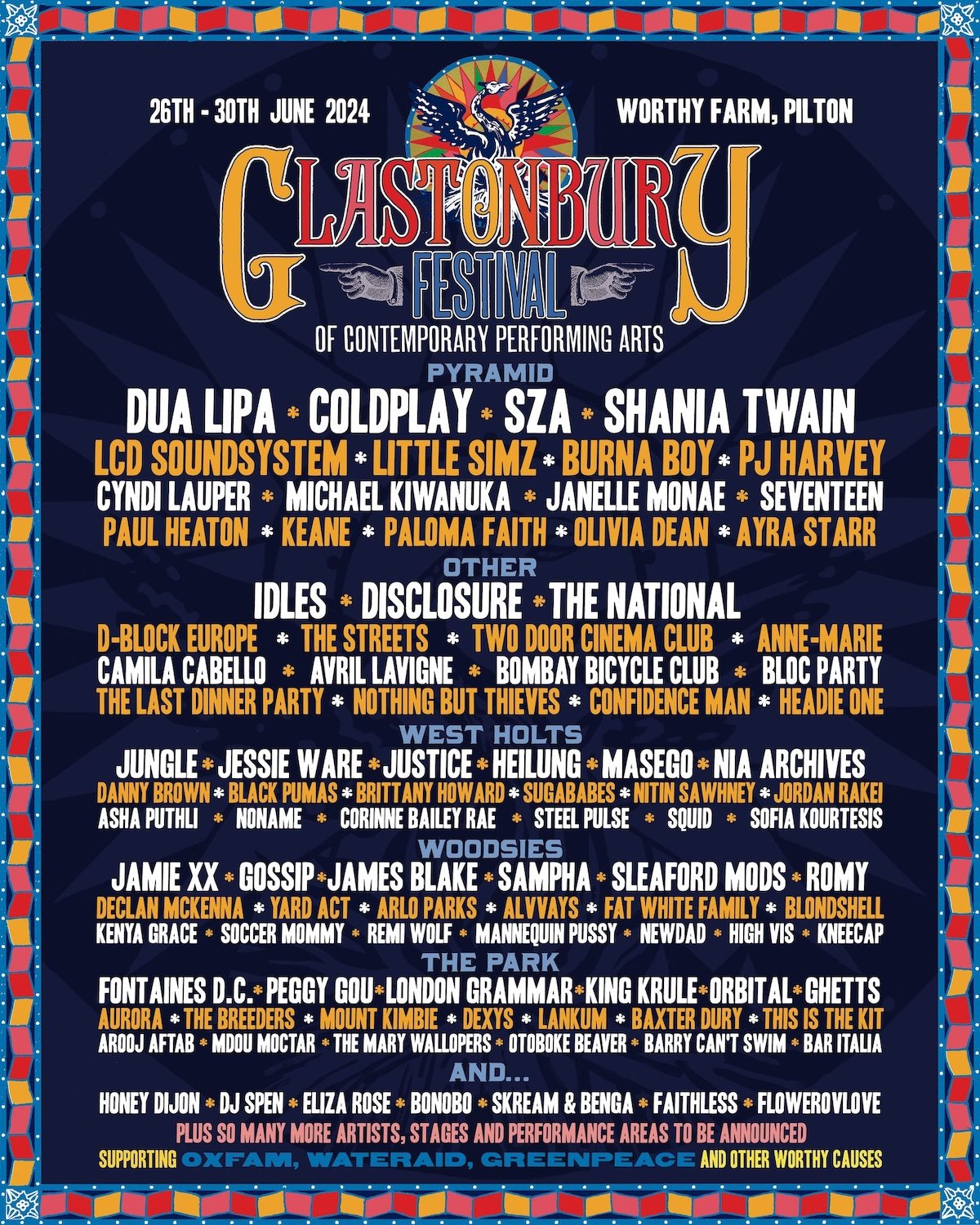

Leaked Glastonbury 2025 Lineup Confirmed Acts And How To Buy Tickets

May 25, 2025

Leaked Glastonbury 2025 Lineup Confirmed Acts And How To Buy Tickets

May 25, 2025 -

Porsche 356 Zuffenhausen Riwayat Produksi Dan Warisan

May 25, 2025

Porsche 356 Zuffenhausen Riwayat Produksi Dan Warisan

May 25, 2025 -

Teenager Arrested After Darwin Shop Owners Fatal Stabbing In Nightcliff

May 25, 2025

Teenager Arrested After Darwin Shop Owners Fatal Stabbing In Nightcliff

May 25, 2025 -

Blue Origin Rocket Launch Abruptly Halted Subsystem Problem

May 25, 2025

Blue Origin Rocket Launch Abruptly Halted Subsystem Problem

May 25, 2025

Latest Posts

-

Myrtle Beach Newspaper Honored With 59 Sc Press Association Awards

May 25, 2025

Myrtle Beach Newspaper Honored With 59 Sc Press Association Awards

May 25, 2025 -

Sled Investigating Myrtle Beach Shooting One Fatality Eleven Injuries

May 25, 2025

Sled Investigating Myrtle Beach Shooting One Fatality Eleven Injuries

May 25, 2025 -

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Local News

May 25, 2025

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Local News

May 25, 2025 -

Volunteer For The Myrtle Beach Cleanup Make A Difference

May 25, 2025

Volunteer For The Myrtle Beach Cleanup Make A Difference

May 25, 2025 -

Flood Alerts Explained Protecting Your Home And Family From Flooding

May 25, 2025

Flood Alerts Explained Protecting Your Home And Family From Flooding

May 25, 2025