Steady DAX Opening: Frankfurt Stock Market Update

Table of Contents

Key Factors Influencing the Steady DAX Opening

Several macroeconomic factors and market sentiments contributed to the steady DAX opening. Understanding these influences provides a clearer picture of the current market dynamics.

-

Global Economic News: Positive (or neutral) news regarding US interest rate hikes and inflation data influenced investor sentiment positively. Lower-than-expected inflation figures often reduce anxieties about aggressive monetary policy tightening. Conversely, unexpectedly high inflation figures could have triggered a sell-off.

-

Eurozone Economic Indicators: Recent GDP growth figures for the Eurozone, while not spectacular, demonstrated resilience against global headwinds. Similarly, stable (or slightly improved) unemployment numbers contribute to a more positive investor outlook. Fluctuations in these key indicators directly impact the DAX's performance.

-

Geopolitical Events and their Market Impact: The absence of significant geopolitical shocks today contributed to the market's relative calm. However, ongoing tensions in various global regions always cast a shadow over market sentiment and can lead to increased volatility. This includes factors like the ongoing war in Ukraine and trade disputes.

-

Sector-Specific Performance within the DAX: The technology sector showed notable gains this morning, fueled by positive earnings reports from several key companies. The automotive sector, on the other hand, experienced relatively flat performance. This varied performance across sectors illustrates the nuanced nature of the DAX's movement.

-

Investor Sentiment: Overall investor sentiment appears cautiously optimistic, reflecting a degree of confidence in the resilience of the German and broader European economies. This cautious optimism, however, remains sensitive to any sudden shifts in the global economic landscape. A shift towards greater risk aversion could quickly impact the DAX.

DAX Performance Compared to Other Major European Indices

A comparison of the DAX's performance with other major European indices, such as the FTSE 100 (London) and the CAC 40 (Paris), reveals a degree of convergence. While the DAX experienced a steady opening, the FTSE 100 and CAC 40 showed similar trends, suggesting a relatively synchronized movement across major European stock markets. [Insert visually appealing chart/graph showing DAX vs. FTSE 100 vs. CAC 40 performance.] This correlation highlights the interconnectedness of European economies and their shared response to global events.

Individual Stock Movers and Shakers within the DAX

Several individual companies within the DAX experienced notable price changes. For example, [Company A] saw a significant share price increase, driven by [reason for increase – e.g., strong earnings report, positive product launch]. Conversely, [Company B] experienced a decline due to [reason for decline – e.g., disappointing sales figures, regulatory concerns]. Tracking these individual stock performances provides a granular understanding of the forces at play within the broader DAX index. Paying close attention to "top gainers" and "top losers" lists can provide valuable insights into market trends.

Looking Ahead: Predictions and Outlook for the DAX

The short-term outlook for the DAX remains cautiously optimistic, assuming that no major unexpected economic or geopolitical events occur. Potential catalysts for future market movement include upcoming earnings reports from major DAX companies, further developments in the Eurozone economy, and the overall global economic environment. It's important to note that market predictions are inherently uncertain, and this outlook is subject to change based on evolving market conditions. Understanding the nuances of the DAX forecast requires monitoring a multitude of factors.

Conclusion: Steady DAX Opening Points to Continued Market Stability

The steady DAX opening today suggests a degree of continued market stability. Key influencing factors include positive (or neutral) global economic news, steady Eurozone indicators, and a relatively calm geopolitical environment. While sector-specific performance varied, the overall trend reflected a cautious optimism among investors. The DAX's performance largely mirrored that of other major European indices, highlighting the interconnectedness of these markets.

Stay updated on the latest DAX movements and Frankfurt Stock Exchange news by regularly checking back for our daily market updates. Understand the nuances of the DAX and its influence on the German and European economies with our expert analysis. Keep track of the DAX and other relevant stock market updates for informed investment decisions.

Featured Posts

-

Kyle Walker And Annie Kilner A New Ring Sparks Engagement Speculation

May 25, 2025

Kyle Walker And Annie Kilner A New Ring Sparks Engagement Speculation

May 25, 2025 -

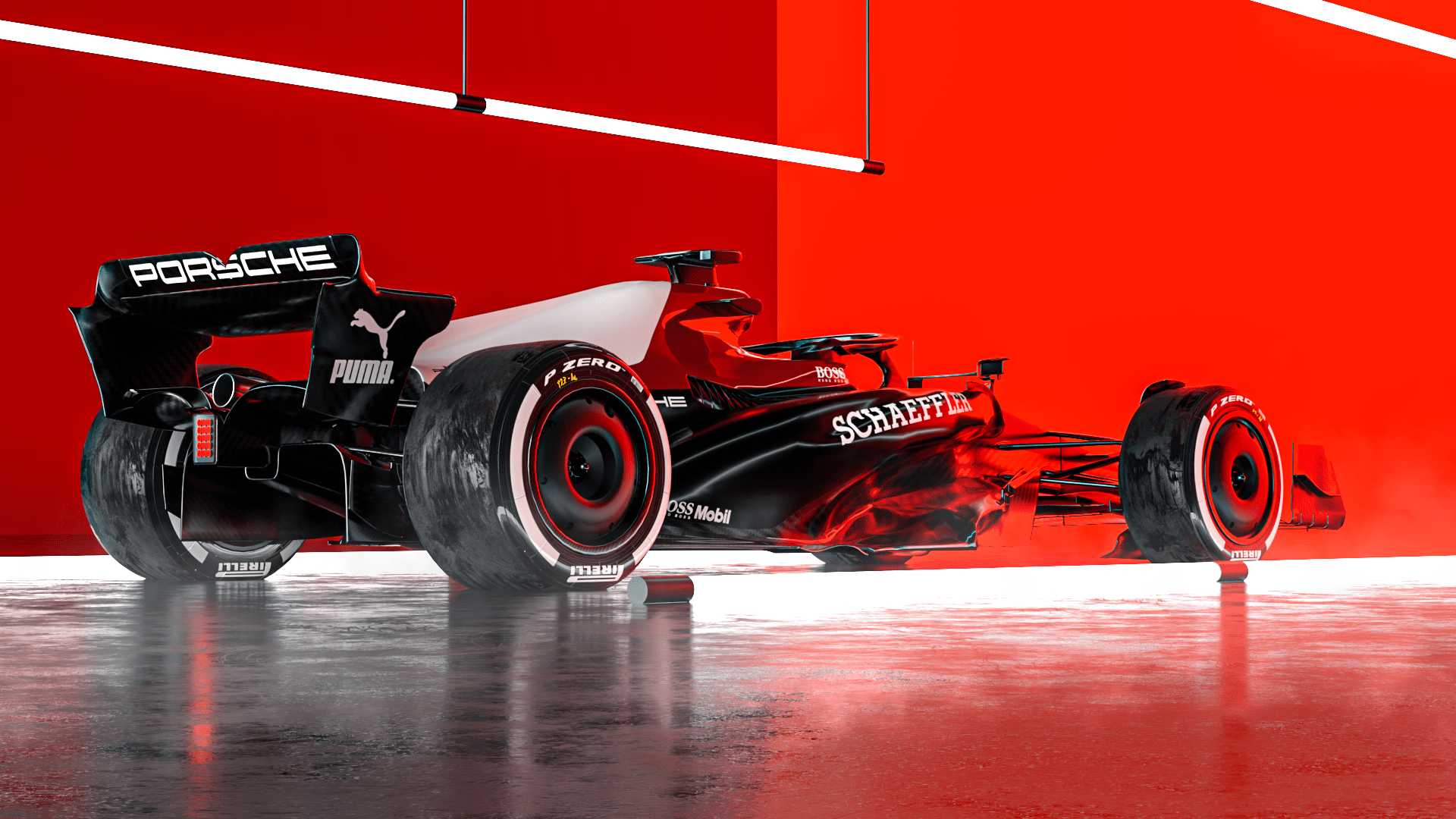

Porsche F1 Motorral Egyeduelallo Koezuti Teljesitmeny

May 25, 2025

Porsche F1 Motorral Egyeduelallo Koezuti Teljesitmeny

May 25, 2025 -

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 25, 2025

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 25, 2025 -

Escape To The Country A Comprehensive Relocation Checklist

May 25, 2025

Escape To The Country A Comprehensive Relocation Checklist

May 25, 2025 -

How To Interpret The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025

How To Interpret The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025

Latest Posts

-

Amsterdam Exchange Plunges Three Days Of Heavy Losses Totaling 11

May 25, 2025

Amsterdam Exchange Plunges Three Days Of Heavy Losses Totaling 11

May 25, 2025 -

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Losses Down 11

May 25, 2025

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Losses Down 11

May 25, 2025 -

The Philips Future Health Index 2025 How Ai Will Reshape Global Healthcare

May 25, 2025

The Philips Future Health Index 2025 How Ai Will Reshape Global Healthcare

May 25, 2025 -

Le Borse Crollano L Ue Pronta A Reagire Ai Nuovi Dazi

May 25, 2025

Le Borse Crollano L Ue Pronta A Reagire Ai Nuovi Dazi

May 25, 2025 -

Waarom Stijgt De Aex Terwijl De Amerikaanse Beurs Daalt

May 25, 2025

Waarom Stijgt De Aex Terwijl De Amerikaanse Beurs Daalt

May 25, 2025