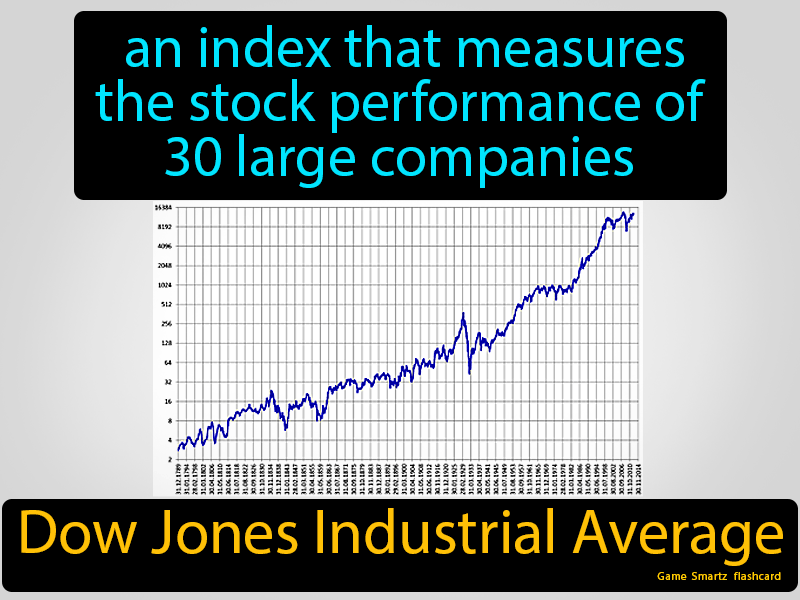

Amundi Dow Jones Industrial Average UCITS ETF (Dist): A Guide To Net Asset Value (NAV)

Table of Contents

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) Calculated?

The Net Asset Value (NAV) of an ETF, like the Amundi Dow Jones Industrial Average UCITS ETF (Dist), represents the total value of its underlying assets divided by the number of outstanding shares. This calculation reflects the intrinsic value of each share. For this specific ETF, tracking the Dow Jones Industrial Average, the NAV calculation is closely tied to the performance of the 30 constituent companies.

The process typically involves these steps:

- Determining the market value of each underlying asset: The ETF provider, Amundi, calculates the closing market price of each of the 30 Dow Jones Industrial Average components.

- Summing the total value: These individual market values are aggregated to arrive at the total market value of the ETF's portfolio.

- Accounting for dividends and expenses: Any accrued dividends received from the underlying companies are added, while management fees and other expenses are subtracted.

- Dividing by the number of shares: The resulting net asset value is then divided by the total number of outstanding shares of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) to determine the NAV per share.

This calculation is typically performed daily, providing investors with an up-to-date assessment of the ETF's value. It's important to note the difference between NAV and market price. While the NAV represents the intrinsic value, the market price reflects the price at which the ETF is actually trading on the exchange, which can fluctuate throughout the trading day.

Factors Influencing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Dist)

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) is primarily driven by the performance of the Dow Jones Industrial Average itself. Several key factors influence this performance and, consequently, the ETF's NAV:

- Market Volatility: Broad market trends significantly impact the NAV. Periods of market growth generally lead to increased NAV, while downturns result in decreased NAV. Understanding market volatility is crucial for managing investment risk.

- Economic Indicators: Macroeconomic factors such as inflation rates, interest rates, and GDP growth directly affect the performance of individual companies within the Dow Jones Industrial Average and, therefore, the ETF's NAV.

- Company-Specific News: Positive or negative news about individual companies in the Dow Jones index can cause significant price fluctuations, impacting the overall NAV of the ETF. A strong earnings report, for example, will boost the NAV, while a scandal might have the opposite effect.

- Currency Exchange Rates: If you are investing in a currency different from the ETF's base currency (USD in this case), currency fluctuations can also influence your returns, even if the NAV in USD remains stable.

Where to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Dist)

Accessing reliable NAV data for the Amundi Dow Jones Industrial Average UCITS ETF (Dist) is crucial for informed investment decisions. Several trustworthy sources provide this information:

- Amundi Website: The official Amundi website is a primary source for real-time and historical NAV data. Look for the ETF's product page.

- Major Financial News Websites: Reputable financial news websites like Yahoo Finance, Google Finance, and Bloomberg often display real-time ETF pricing, including NAV information.

- Brokerage Platforms: Most online brokerage platforms provide detailed information on the ETFs held in your portfolio, including the current NAV and historical performance.

Remember to always cross-check information from multiple reliable sources to ensure accuracy and avoid misinformation.

Conclusion: Mastering the Net Asset Value of the Amundi Dow Jones Industrial Average UCITS ETF (Dist)

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) is vital for effective investment management. This article has outlined the NAV calculation process, the key factors that influence it, and how to access reliable NAV data. Remember that while the NAV provides a crucial snapshot of the ETF's intrinsic value, market price can fluctuate. By staying informed about the NAV and its influencing factors, you can make more informed investment decisions. To learn more about the Amundi Dow Jones Industrial Average UCITS ETF (Dist) and enhance your investment strategy, visit the Amundi website [insert link to relevant Amundi product page here].

Featured Posts

-

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

Serious M56 Crash Car Overturn Paramedic Response

May 25, 2025

Serious M56 Crash Car Overturn Paramedic Response

May 25, 2025 -

Mamma Mia Unboxing The New Ferrari Hot Wheels Collection

May 25, 2025

Mamma Mia Unboxing The New Ferrari Hot Wheels Collection

May 25, 2025 -

Demna At Gucci Examining The Creative Direction

May 25, 2025

Demna At Gucci Examining The Creative Direction

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist What Investors Need To Know

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist What Investors Need To Know

May 25, 2025

Latest Posts

-

2024 Philips Annual General Meeting Financial Results And Future Plans

May 25, 2025

2024 Philips Annual General Meeting Financial Results And Future Plans

May 25, 2025 -

Report Philips Holds Annual General Meeting For Shareholders

May 25, 2025

Report Philips Holds Annual General Meeting For Shareholders

May 25, 2025 -

Philips Convenes Annual General Meeting Review And Outlook

May 25, 2025

Philips Convenes Annual General Meeting Review And Outlook

May 25, 2025 -

Royal Philips Details On The 2025 Shareholders Annual General Meeting

May 25, 2025

Royal Philips Details On The 2025 Shareholders Annual General Meeting

May 25, 2025 -

Annual General Meeting 2025 Philips Announces Agenda Updates

May 25, 2025

Annual General Meeting 2025 Philips Announces Agenda Updates

May 25, 2025