Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

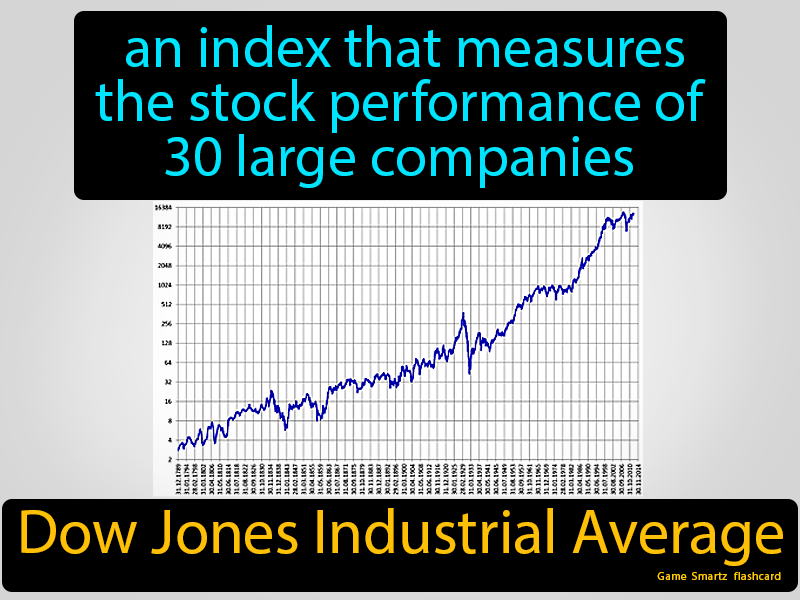

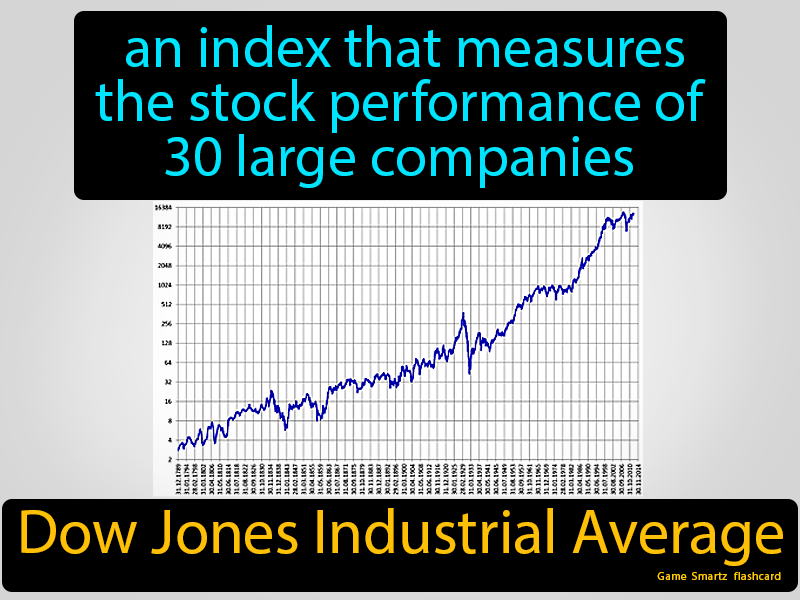

The Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV reflects the collective value of the underlying holdings that mirror the Dow Jones Industrial Average (DJIA). Understanding the NAV is essential because it provides a snapshot of the ETF's intrinsic worth, allowing investors to gauge its performance and make informed buy or sell decisions. The Amundi Dow Jones Industrial Average UCITS ETF is designed to track the performance of the DJIA, providing investors with exposure to 30 of the largest and most influential companies in the US.

Factors Influencing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF. Understanding these factors is critical for interpreting NAV changes and managing investment risk.

-

Performance of Underlying DJIA Stocks: The primary driver of the ETF's NAV is the performance of the 30 companies comprising the Dow Jones Industrial Average. An increase in the overall value of these stocks directly translates to a higher NAV, and vice versa. Individual stock price movements, earnings reports, and market sentiment all impact this.

-

Currency Fluctuations: While the ETF tracks a US-based index, currency fluctuations can affect the NAV for international investors. If the investor's currency weakens against the US dollar, the NAV expressed in their local currency will appear lower, even if the underlying asset values remain unchanged. This is a crucial consideration for diversification and risk management.

-

Expense Ratios and Management Fees: The Amundi Dow Jones Industrial Average UCITS ETF, like all ETFs, incurs expenses associated with its management and operation. These expense ratios are deducted from the assets under management, indirectly impacting the NAV. While generally small, these fees should be considered when comparing the ETF's performance to its benchmark.

-

Other Factors:

- Daily market fluctuations create constant NAV adjustments.

- Dividend payouts from the underlying companies reduce the NAV, as the dividends are distributed to shareholders.

- Corporate actions such as stock splits, mergers, or acquisitions can influence the NAV by changing the composition and value of the underlying holdings.

Where to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV

Accessing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is straightforward through several reliable sources:

-

Amundi's Official Website: The ETF provider's website is the most authoritative source for real-time and historical NAV data. Look for sections dedicated to fund factsheets or performance.

-

Major Financial Data Providers: Reputable financial news websites and data providers like Bloomberg, Yahoo Finance, Google Finance, and others will display the ETF's NAV alongside other key metrics.

-

Your Brokerage Account: Most brokerage platforms provide real-time NAV information for all ETFs held within your portfolio, offering convenient access to track your investment performance.

-

Reliable Sources:

- Amundi's official website.

- Bloomberg Terminal.

- Yahoo Finance.

- Google Finance.

- Your brokerage account (e.g., Interactive Brokers, Fidelity, Schwab).

Using NAV to Evaluate the Amundi Dow Jones Industrial Average UCITS ETF's Performance

The NAV serves as a fundamental tool for assessing the Amundi Dow Jones Industrial Average UCITS ETF's performance over time.

-

Tracking NAV Changes: Monitor NAV changes daily, weekly, and monthly to identify trends and patterns. This allows you to observe the growth or decline of your investment.

-

Benchmark Comparisons: Compare the ETF's NAV performance against its benchmark – the Dow Jones Industrial Average itself – to evaluate its tracking effectiveness. A close correlation suggests the ETF is successfully mirroring the index.

-

Peer Comparisons: Compare the NAV performance of the Amundi ETF with similar ETFs tracking the DJIA to assess relative performance and cost-effectiveness.

-

Calculating Returns: Use NAV data to calculate your returns by comparing the current NAV to your initial investment cost, accounting for any dividends received.

-

NAV vs. Market Price: Remember that the NAV represents the intrinsic value, while the market price reflects the actual trading price, with a potential bid-ask spread. The difference can be minor for highly liquid ETFs like this one, but it's crucial to understand the distinction.

Potential Risks Associated with Investing in the Amundi Dow Jones Industrial Average UCITS ETF Based on NAV Fluctuations

While the Amundi Dow Jones Industrial Average UCITS ETF offers exposure to a diversified group of blue-chip companies, fluctuations in the NAV expose investors to inherent risks:

-

Market Volatility: Market downturns directly impact the NAV, causing it to decline. The degree of decline will depend on the severity and duration of the market correction.

-

Investment Risk: It's crucial to remember that no investment is guaranteed. The NAV can fluctuate significantly, leading to potential losses.

-

Understanding Risk Tolerance: Before investing, assess your risk tolerance carefully. A long-term investment horizon typically allows for greater resilience to short-term NAV fluctuations.

-

Diversification: Diversification across different asset classes and geographies is a fundamental risk management strategy. Reliance solely on this ETF might expose you to significant risk.

-

Key Risks:

- Market downturns leading to NAV declines.

- The investment's value is not guaranteed.

- Consideration of your investment timeline.

Conclusion: Making Informed Decisions with the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF

The Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is a crucial indicator of its performance and underlying asset value. Factors such as the performance of the DJIA stocks, currency fluctuations, and expense ratios all play a role in determining the NAV. Regularly monitoring the NAV allows for effective performance evaluation and informed risk management. By understanding the factors influencing NAV and utilizing the readily available resources to track it, investors can make smart, data-driven decisions regarding their investment in the Amundi Dow Jones Industrial Average UCITS ETF and other similar exchange-traded funds. Regularly monitor the Net Asset Value (NAV) to make informed investment choices.

Featured Posts

-

Us Band Possibly Headed To Glastonbury Unofficial Confirmation

May 25, 2025

Us Band Possibly Headed To Glastonbury Unofficial Confirmation

May 25, 2025 -

Ferrari 296 Speciale Tecnologia Hibrida E Inovacao Em Alta Velocidade

May 25, 2025

Ferrari 296 Speciale Tecnologia Hibrida E Inovacao Em Alta Velocidade

May 25, 2025 -

Mathieu Avanzi Defendre Et Promouvoir Le Francais Aujourd Hui

May 25, 2025

Mathieu Avanzi Defendre Et Promouvoir Le Francais Aujourd Hui

May 25, 2025 -

L Impatto Dei Dazi Di Trump Del 20 Sull Unione Europea Analisi Del Settore Moda

May 25, 2025

L Impatto Dei Dazi Di Trump Del 20 Sull Unione Europea Analisi Del Settore Moda

May 25, 2025 -

En France La Chine Ne Recule Devant Rien Pour Reduire Au Silence Les Dissidents

May 25, 2025

En France La Chine Ne Recule Devant Rien Pour Reduire Au Silence Les Dissidents

May 25, 2025

Latest Posts

-

Ces Unveiled Europe Un Evenement Technologique Majeur A Amsterdam

May 25, 2025

Ces Unveiled Europe Un Evenement Technologique Majeur A Amsterdam

May 25, 2025 -

Amsterdam Accueille Le Ces Unveiled Europe Les Innovations Technologiques A Decouvrir

May 25, 2025

Amsterdam Accueille Le Ces Unveiled Europe Les Innovations Technologiques A Decouvrir

May 25, 2025 -

Ces Unveiled Europe 2024 Nouveautes Et Technologies De Pointe A Amsterdam

May 25, 2025

Ces Unveiled Europe 2024 Nouveautes Et Technologies De Pointe A Amsterdam

May 25, 2025 -

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 25, 2025

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 25, 2025 -

Ae Xplore England Airpark And Alexandria International Airports Initiative For Local And International Travel

May 25, 2025

Ae Xplore England Airpark And Alexandria International Airports Initiative For Local And International Travel

May 25, 2025