NAV calculation, ETF valuation, USD hedged NAV, Amundi ETF NAV, and MSCI World ETF NAV to provide a comprehensive understanding of this important metric.

NAV calculation, ETF valuation, USD hedged NAV, Amundi ETF NAV, and MSCI World ETF NAV to provide a comprehensive understanding of this important metric.

Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. It's a key indicator of the ETF's intrinsic value. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV calculation involves several steps:

(Total Market Value of Assets - Liabilities) / Number of Outstanding Shares = NAV per Share. The actual calculation is more complex, considering the currency hedging and other factors.The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is typically updated daily and can be found on Amundi's official website and major financial data providers.

Several internal and external factors can influence the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist:

NAV volatility.currency risk.ETF expenses is crucial for assessing the overall return on investment.These factors interact to create NAV volatility, meaning the NAV isn't static but changes constantly. Investors need to understand this inherent volatility when investing in this or any ETF.

Understanding the NAV is critical for informed investment decision-making. Investors can use NAV information in several ways:

premium/discount can indicate potential arbitrage opportunities (though these are rare and often quickly arbitraged away).ETF performance.It's crucial to remember that while NAV is an essential metric, it shouldn't be the sole factor considered. Factors like the ETF's expense ratio, trading volume, and overall investment strategy should also be evaluated. Using NAV in conjunction with a holistic ETF investment strategy yields the best results.

The Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is a dynamic figure influenced by various market forces and internal ETF factors. Understanding how the NAV calculation works, what influences the USD hedged NAV, and how to interpret NAV analysis is essential for investors. Regularly monitoring the NAV and using this information alongside other relevant metrics provides a more comprehensive understanding of your investment's performance and helps you make well-informed decisions. Learn more about managing your Amundi MSCI World II UCITS ETF USD Hedged Dist investment using NAV data today!

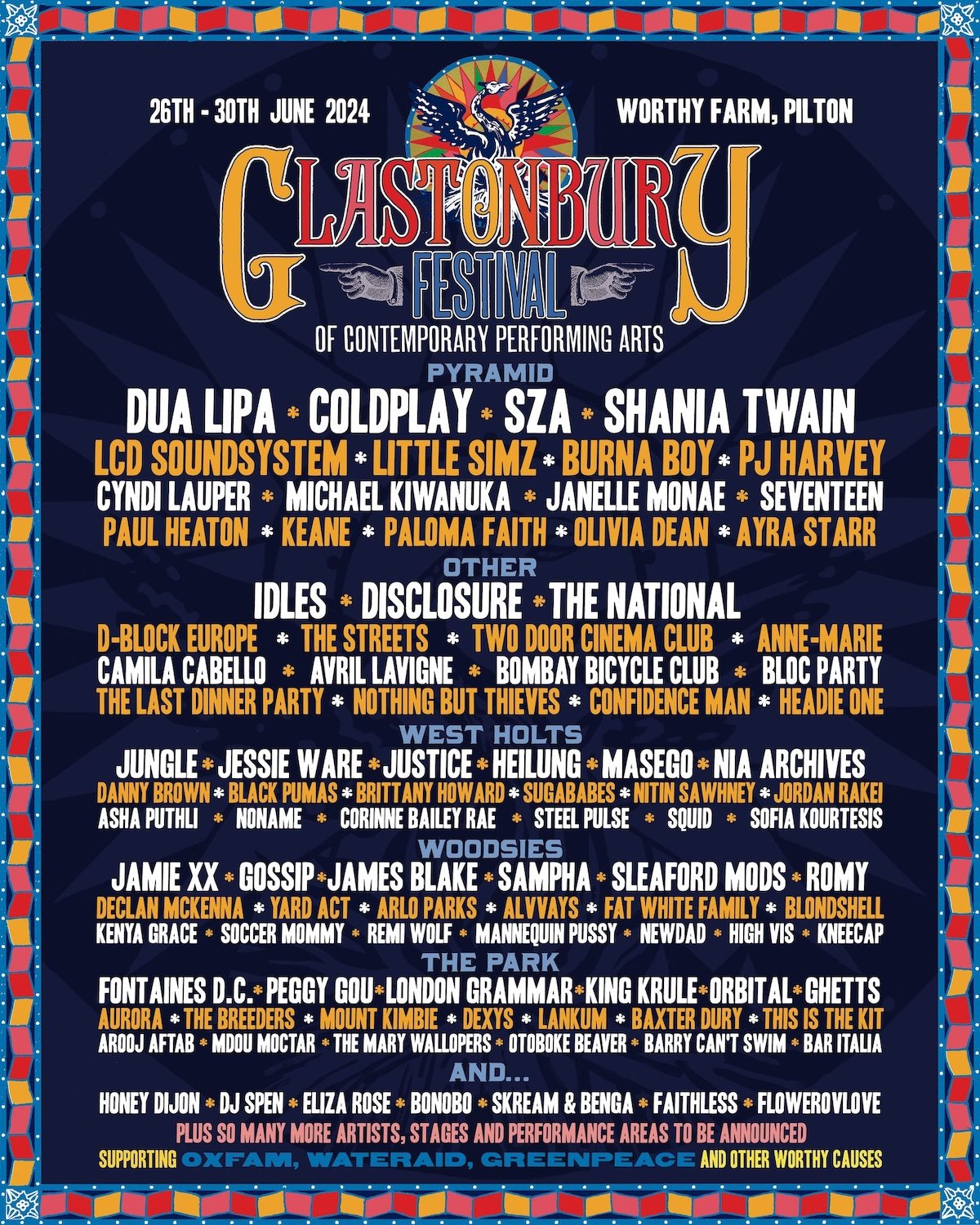

Leaked Glastonbury 2025 Lineup Confirmed Acts And How To Buy Tickets

Leaked Glastonbury 2025 Lineup Confirmed Acts And How To Buy Tickets

West Hams Pursuit Of Kyle Walker Peters Latest Transfer News

West Hams Pursuit Of Kyle Walker Peters Latest Transfer News

Negative Close For Frankfurt Stock Market Dax Under 24 000

Negative Close For Frankfurt Stock Market Dax Under 24 000

Manny Garcias Lego Workshop At Veterans Memorial Elementary School Photos

Manny Garcias Lego Workshop At Veterans Memorial Elementary School Photos

Experience The Ferrari Challenge Racing Days In South Florida

Experience The Ferrari Challenge Racing Days In South Florida

Dazi Trump Sul 20 Impatto Sul Settore Moda

Dazi Trump Sul 20 Impatto Sul Settore Moda

Frances National Rally A Look At The Le Pen Demonstrations Turnout And Impact

Frances National Rally A Look At The Le Pen Demonstrations Turnout And Impact

Stock Market Reaction European Shares Gain Lvmh Suffers Losses After Trumps Tariff Comments

Stock Market Reaction European Shares Gain Lvmh Suffers Losses After Trumps Tariff Comments

European Market Update Shares Up Lvmh Down Following Trumps Remarks

European Market Update Shares Up Lvmh Down Following Trumps Remarks

Analysis Le Pens National Rally Demonstration And Its Implications For France

Analysis Le Pens National Rally Demonstration And Its Implications For France