Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated for the Amundi Dow Jones Industrial Average UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. For the Amundi Dow Jones Industrial Average UCITS ETF, this means the total value of its holdings, mirroring the composition of the Dow Jones Industrial Average (DJIA), minus any liabilities. Understanding this calculation is crucial for assessing the ETF's performance and value.

The NAV calculation involves several key steps:

-

Market Value of Underlying Assets: This is determined by calculating the total market value of all 30 components of the DJIA held by the ETF. Each stock's closing price is multiplied by the number of shares the ETF owns.

-

Deduction of ETF Expenses and Liabilities: The ETF incurs expenses like management fees and operational costs. These, along with any other liabilities, are subtracted from the total market value of the assets.

-

Division by Outstanding Shares: The resulting net asset value is then divided by the total number of outstanding shares of the Amundi Dow Jones Industrial Average UCITS ETF to arrive at the NAV per share.

Example: Let's assume the total market value of the DJIA components held by the ETF is €100 million, and the ETF's expenses and liabilities total €1 million. If there are 10 million outstanding shares, the NAV per share would be (€100 million - €1 million) / 10 million shares = €9.90. This simplified example omits complexities like currency conversions (if applicable). The actual calculation is far more intricate, involving real-time data and sophisticated valuation techniques. Keywords: NAV calculation, ETF valuation, Amundi Dow Jones Industrial Average UCITS ETF NAV, asset valuation.

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF's NAV

Several factors influence the daily fluctuations in the Amundi Dow Jones Industrial Average UCITS ETF's NAV. Understanding these factors is key to interpreting NAV movements and making informed investment choices.

-

Performance of Dow Jones Industrial Average (DJIA) Components: The primary driver of NAV changes is the collective performance of the 30 companies comprising the DJIA. Positive performance in these stocks generally leads to an increase in the ETF's NAV, while negative performance results in a decrease.

-

Currency Fluctuations: If the ETF invests in companies outside the investor's base currency, currency exchange rate fluctuations can impact the NAV. A strengthening US dollar (if the ETF is denominated in Euros, for example) would reduce the NAV denominated in Euros.

-

Dividend Payouts from Underlying Stocks: When the underlying DJIA companies pay dividends, the ETF receives these payments, which are then usually distributed to ETF shareholders or reinvested. Dividend payouts can temporarily increase the NAV prior to the distribution.

-

Expense Ratio of the ETF: The ETF's expense ratio, which covers management and operational costs, indirectly affects the NAV. Higher expense ratios will gradually reduce the NAV growth compared to an ETF with a lower expense ratio. Keywords: NAV fluctuation, DJIA performance, currency risk, ETF expense ratio, Amundi Dow Jones Industrial Average UCITS ETF factors.

Where and How to Find the Amundi Dow Jones Industrial Average UCITS ETF's NAV

Access to real-time or end-of-day NAV information for the Amundi Dow Jones Industrial Average UCITS ETF is readily available through various sources:

-

Brokerage Platforms: Most brokerage accounts providing access to the ETF will display the current NAV alongside the ETF's trading price.

-

Amundi's Official Website: Amundi, the ETF provider, typically publishes NAV information on its website, usually with a slight delay compared to real-time trading data.

-

Financial News Websites: Many reputable financial news websites and data providers offer real-time or delayed NAV quotes for ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF.

It is crucial to use reliable sources for NAV information, as inaccuracies can lead to misinformed investment decisions. The NAV is typically updated daily, reflecting the closing prices of the underlying assets. Keywords: Amundi Dow Jones Industrial Average UCITS ETF NAV data, real-time NAV, end-of-day NAV, NAV sources.

Using NAV to Make Informed Investment Decisions

Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is a powerful tool for making informed investment decisions:

-

Track ETF Performance: Monitoring NAV changes over time helps investors track the ETF's performance and assess its growth or decline.

-

Compare with Other ETFs: Comparing the NAV performance of the Amundi Dow Jones Industrial Average UCITS ETF with similar ETFs allows for a relative performance assessment.

-

Assess Investment Returns: By tracking the NAV, investors can calculate their investment returns, considering both capital appreciation and dividend distributions.

-

Time Investments Strategically: While not the sole determinant, understanding NAV trends can help in timing investment decisions, although other factors like trading volume and market sentiment should be considered.

However, it's vital to remember that NAV alone is insufficient for complete investment analysis. Factors such as trading volume, expense ratios, and market conditions also play crucial roles. Keywords: Investment strategy, ETF performance analysis, Amundi Dow Jones Industrial Average UCITS ETF investment, NAV analysis.

Conclusion: Mastering the Amundi Dow Jones Industrial Average UCITS ETF through NAV Understanding

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is essential for any investor seeking to leverage this popular ETF. This article has highlighted the NAV's calculation, the key factors that influence it, and the various reliable sources for accessing this crucial data. By actively monitoring the NAV and considering it alongside other market indicators, investors can make more informed decisions about their investment in the Amundi Dow Jones Industrial Average UCITS ETF. Further research into the Amundi Dow Jones Industrial Average UCITS ETF and a diligent utilization of NAV information will empower you to make strategic investment choices and optimize your portfolio. Mastering the Amundi Dow Jones Industrial Average UCITS ETF NAV is key to successful investing.

Featured Posts

-

Dissidents Chinois En France Face A La Repression De Pekin

May 24, 2025

Dissidents Chinois En France Face A La Repression De Pekin

May 24, 2025 -

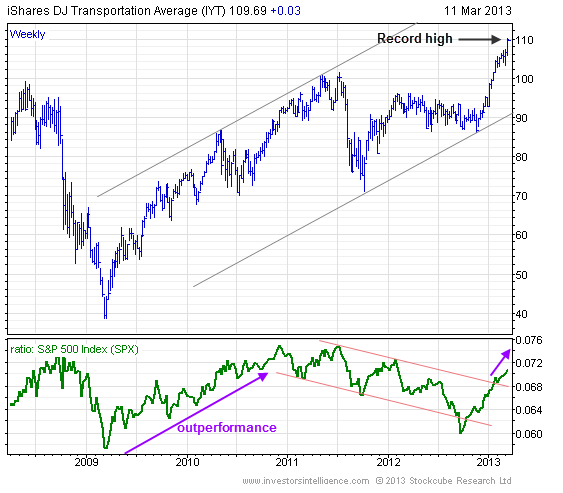

Memorial Day Flights 2025 When To Book For The Best Prices And Least Crowds

May 24, 2025

Memorial Day Flights 2025 When To Book For The Best Prices And Least Crowds

May 24, 2025 -

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School

May 24, 2025

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Interpreting And Using Nav Data

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Interpreting And Using Nav Data

May 24, 2025 -

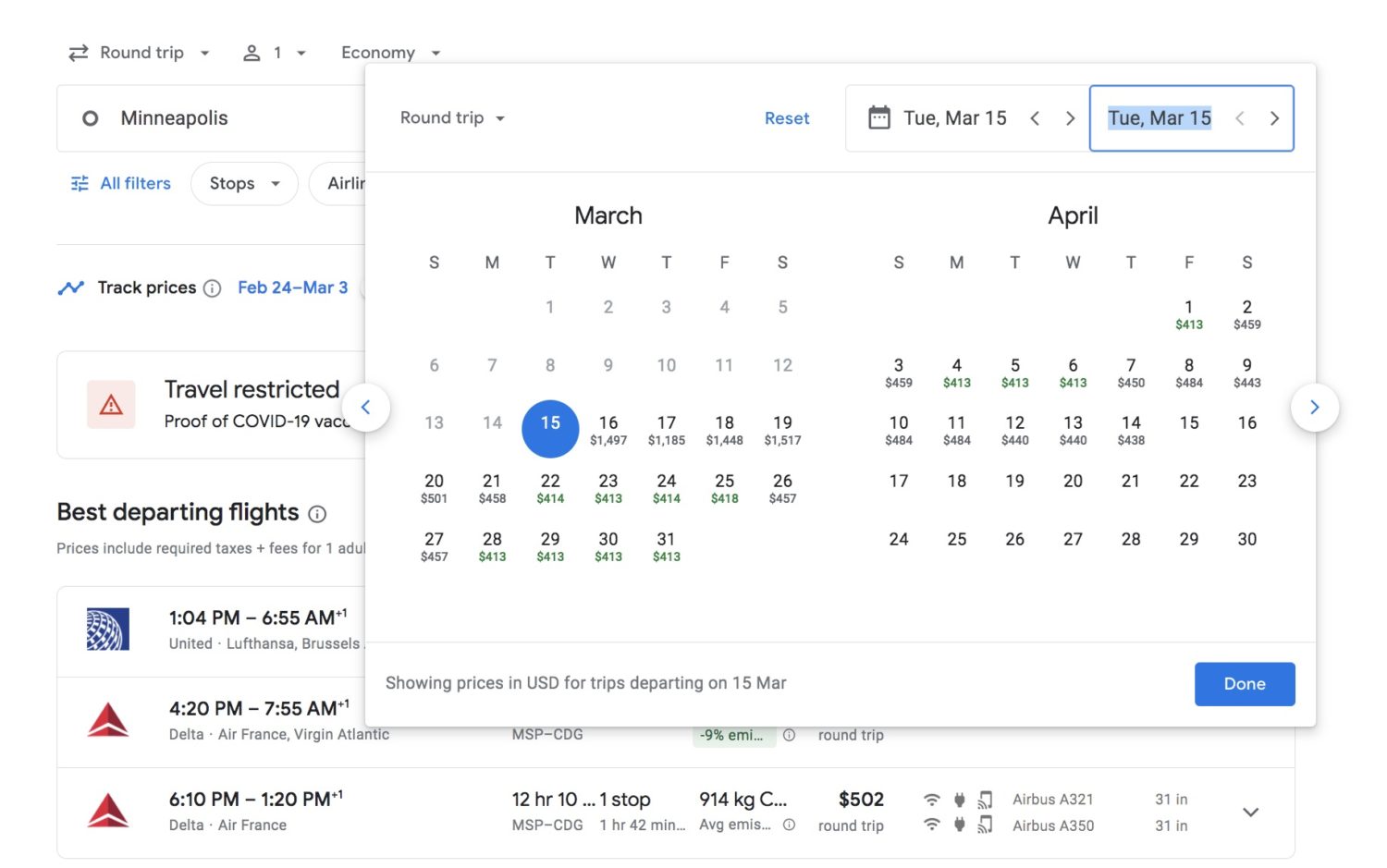

Gucci Industrial And Supply Chain Leadership Change Vians Exit

May 24, 2025

Gucci Industrial And Supply Chain Leadership Change Vians Exit

May 24, 2025

Latest Posts

-

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025 -

Demnas Influence Reshaping Guccis Identity And Brand Image

May 24, 2025

Demnas Influence Reshaping Guccis Identity And Brand Image

May 24, 2025 -

Three Day Slump Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025

Three Day Slump Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025 -

Demna Gvasalias First Gucci Collection Review And Analysis

May 24, 2025

Demna Gvasalias First Gucci Collection Review And Analysis

May 24, 2025 -

Pamyati Sergeya Yurskogo Trogatelniy Vecher V Teatre Mossoveta

May 24, 2025

Pamyati Sergeya Yurskogo Trogatelniy Vecher V Teatre Mossoveta

May 24, 2025