Three-Day Slump: Amsterdam Stock Exchange Experiences Significant Losses

Table of Contents

<p>The Amsterdam Stock Exchange (AEX) has experienced a dramatic three-day slump, sending shockwaves through the financial markets. This significant downturn has left investors reeling and analysts scrambling to understand the underlying causes. This article will delve into the specifics of this recent market volatility, exploring potential contributing factors and assessing the impact on the Dutch economy. We will analyze the key factors driving this decline, explore its consequences for the Dutch economy, and offer insights from analysts regarding future market trends and strategies for investors navigating this challenging period. </p>

<h2>Key Factors Contributing to the Three-Day Slump</h2>

<h3>Global Market Uncertainty</h3>

<p>The recent slump on the Amsterdam Stock Exchange is not isolated; it reflects broader global economic anxieties. Several interconnected factors have contributed to this market uncertainty, impacting investor confidence and leading to significant losses.</p>

<ul> <li><b>Rising inflation:</b> Persistently high inflation across the globe is eroding consumer purchasing power, dampening economic growth, and prompting central banks to implement aggressive interest rate hikes.</li> <li><b>Increased interest rates:</b> Higher interest rates increase borrowing costs for businesses and individuals, reducing investment and slowing economic activity. This has a direct impact on company profits and stock valuations.</li> <li><b>Geopolitical instability:</b> Ongoing geopolitical tensions, such as the war in Ukraine and rising trade disputes, create uncertainty and risk aversion among investors, prompting them to seek safer havens for their investments.</li> <li><b>Global supply chain disruptions:</b> Lingering supply chain bottlenecks continue to impact businesses, increasing costs and hindering production, contributing to inflationary pressures and market instability. This uncertainty has directly impacted several sectors listed on the AEX.</li> </ul>

<h3>Sector-Specific Downturns</h3>

<p>The three-day slump hasn't affected all sectors equally. Some sectors within the AEX experienced far more significant losses than others. This highlights the diverse nature of the Dutch economy and its vulnerability to specific global trends.</p>

<ul> <li><b>Energy sector decline:</b> The energy sector, a significant component of the AEX, saw a particularly sharp decline, potentially driven by fluctuating oil and gas prices and concerns about future energy security. The percentage decline in this sector is currently being assessed by financial analysts.</li> <li><b>Technology sector performance:</b> The technology sector, known for its volatility, also experienced losses, influenced by global tech stock performance and concerns about slowing tech investment.</li> <li><b>Financial services sector impact:</b> The financial services sector, a cornerstone of the Dutch economy, was also affected by the general market downturn, reflecting investor anxieties and reduced market liquidity.</li> <li><b>Individual company analysis:</b> The performance of individual companies within these sectors varied, with some experiencing steeper declines than others. This highlights the importance of conducting thorough due diligence before investing in specific AEX-listed companies.</li> </ul>

<h3>Investor Sentiment and Market Psychology</h3>

<p>Market psychology played a significant role in exacerbating the decline. Investor fear and panic selling amplified the initial downturn, creating a self-fulfilling prophecy of negative market sentiment.</p>

<ul> <li><b>Trading volume surge:</b> The trading volume during the slump increased significantly, indicating heightened investor activity driven by panic selling and attempts to limit losses.</li> <li><b>Negative news and media coverage:</b> Negative news reports and media coverage further fueled investor anxieties, reinforcing the perception of a worsening market situation.</li> <li><b>Algorithmic trading impact:</b> Algorithmic trading, while often contributing to market efficiency, can also amplify volatility during periods of uncertainty, potentially accelerating sell-offs.</li> <li><b>Shift in investor confidence:</b> The overall shift in investor confidence is a key indicator of the market’s health. The recent downturn underscores the fragility of investor sentiment and the potential for rapid shifts in market direction.</li> </ul>

<h2>Impact on the Dutch Economy</h2>

<h3>Short-Term Economic Consequences</h3>

<p>The three-day slump on the Amsterdam Stock Exchange has immediate implications for the Dutch economy, affecting both businesses and consumers.</p>

<ul> <li><b>Potential job losses:</b> The decline in stock prices can lead to reduced business investment and potential job losses, particularly in sectors heavily affected by the downturn.</li> <li><b>Reduced consumer confidence:</b> A falling stock market can erode consumer confidence, leading to decreased spending and potentially hindering economic growth.</li> <li><b>Impact on government revenue:</b> Reduced corporate profits and lower tax revenues can strain government budgets and limit the government's ability to invest in crucial areas.</li> </ul>

<h3>Long-Term Economic Outlook</h3>

<p>The long-term effects of this market volatility remain uncertain, but several potential ramifications need careful consideration.</p>

<ul> <li><b>Potential for economic slowdown:</b> A prolonged period of market uncertainty could trigger a broader economic slowdown, impacting growth and employment across various sectors.</li> <li><b>Government response and policy adjustments:</b> The Dutch government may need to implement policy adjustments, such as fiscal stimulus measures, to mitigate the negative economic consequences.</li> <li><b>Impact on foreign investment:</b> The recent market volatility could impact future foreign direct investment in the Netherlands, potentially affecting long-term economic growth.</li> </ul>

<h2>Analyst Predictions and Future Market Trends</h2>

<h3>Expert Opinions on Market Recovery</h3>

<p>Financial analysts offer differing opinions on the AEX's recovery timeline and potential for further market corrections. Understanding these differing viewpoints is crucial for informed investment decisions.</p>

<ul> <li><b>Optimistic versus pessimistic outlooks:</b> Some analysts remain optimistic, predicting a relatively swift recovery based on the underlying strength of the Dutch economy and potential for government intervention. Others hold more pessimistic views, anticipating a prolonged period of market uncertainty and potential for further declines.</li> <li><b>Predicted timeline for market recovery:</b> Forecasts for market recovery vary widely, ranging from several months to a year or longer, depending on the evolution of global economic conditions and investor sentiment.</li> <li><b>Potential for further market corrections:</b> The possibility of further market corrections cannot be ruled out, given the ongoing global uncertainty and potential for unforeseen events.</li> </ul>

<h3>Strategies for Investors</h3>

<p>Navigating the current market volatility requires a cautious and strategic approach. Investors should consider the following to mitigate risks and protect their investments.</p>

<ul> <li><b>Risk mitigation strategies:</b> Investors should carefully assess their risk tolerance and diversify their investment portfolios to reduce exposure to any single sector or asset class. </li> <li><b>Diversification of investment portfolios:</b> Diversification across different asset classes (e.g., stocks, bonds, real estate) is a crucial strategy to mitigate risk during periods of market volatility.</li> <li><b>Long-term investment versus short-term trading:</b> A long-term investment horizon can help investors weather short-term market fluctuations and benefit from long-term growth potential. Short-term trading during periods of high volatility carries significantly increased risk.</li> </ul>

<h2>Conclusion</h2>

<p>The three-day slump on the Amsterdam Stock Exchange represents a significant event with potential short-term and long-term consequences for the Dutch economy. Understanding the contributing factors—global uncertainty, sector-specific weakness, and investor sentiment—is crucial for navigating this volatile market. While the future remains uncertain, careful analysis of market trends and informed investment strategies are essential. Stay informed about the latest developments on the Amsterdam Stock Exchange and consult with financial advisors to make informed decisions about your investments. Keep an eye on the Amsterdam Stock Exchange for further updates on this significant market event and its ongoing impact. Understanding the intricacies of the Amsterdam Stock Exchange is vital for investors looking to navigate these turbulent times.</p>

Featured Posts

-

Apple Stock Sell Off 900 Million Tariff Hit

May 24, 2025

Apple Stock Sell Off 900 Million Tariff Hit

May 24, 2025 -

German Stock Market Closes In Negative Territory Dax Update

May 24, 2025

German Stock Market Closes In Negative Territory Dax Update

May 24, 2025 -

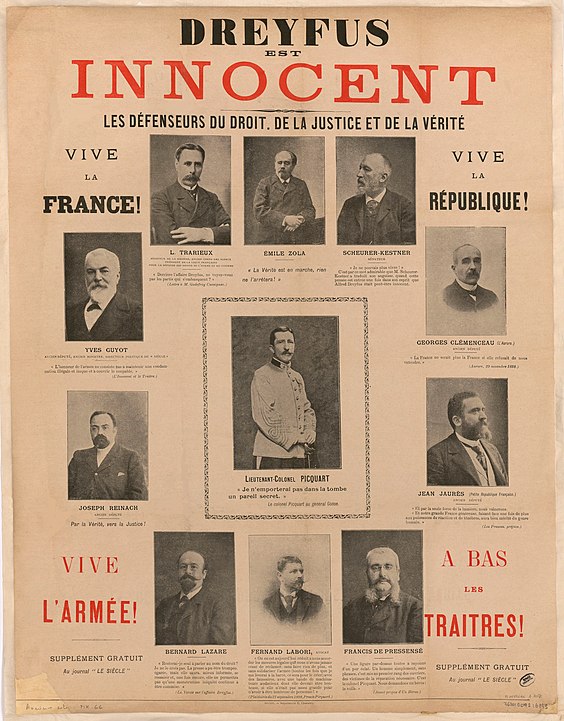

Will Dreyfus Finally Receive The Promotion He Deserved

May 24, 2025

Will Dreyfus Finally Receive The Promotion He Deserved

May 24, 2025 -

Karisik Seyir Avrupa Borsalarinin Guenluek Performansi

May 24, 2025

Karisik Seyir Avrupa Borsalarinin Guenluek Performansi

May 24, 2025 -

Alastthmar Fy Daks 30 Thlyl Adae Almwshr Bed Tjawz Dhrwt Mars

May 24, 2025

Alastthmar Fy Daks 30 Thlyl Adae Almwshr Bed Tjawz Dhrwt Mars

May 24, 2025

Latest Posts

-

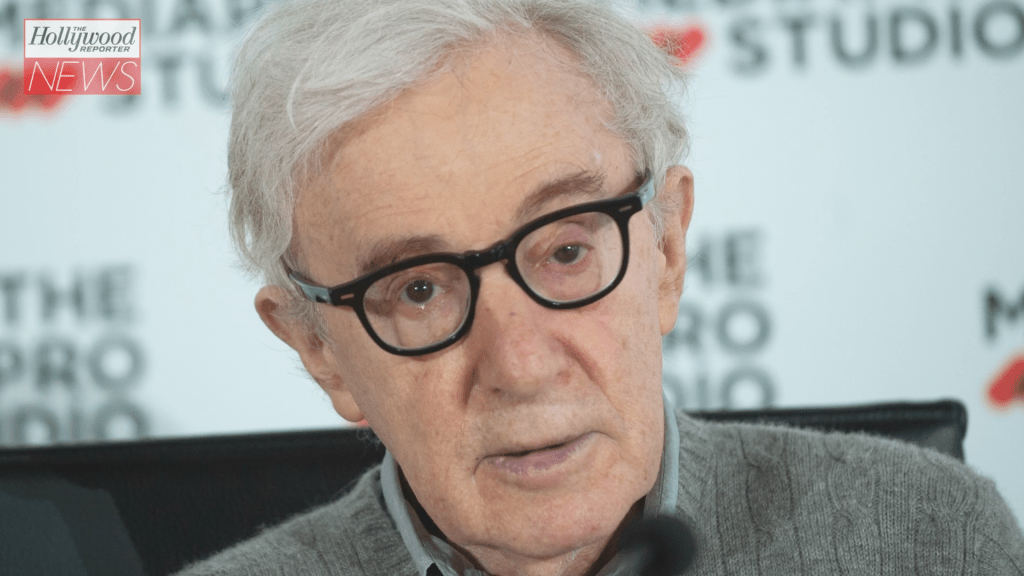

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025 -

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025 -

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025 -

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025