SSE Announces Significant Spending Cuts Amidst Economic Slowdown

Table of Contents

Scale and Scope of SSE's Spending Cuts

SSE's spending cuts represent a substantial reduction in capital expenditure. Reports indicate a decrease of approximately X% (or £Y billion), marking a significant shift in the company's investment strategy. This reduction primarily affects several key areas:

- Renewable Energy Projects: Several planned wind and solar farm developments are facing budget cuts or delays. For example, the proposed "Greenfield Wind Farm" project has seen its budget slashed by Z%, potentially delaying its completion by several months. This impacts the company's renewable energy targets and its commitment to sustainable energy solutions.

- Network Infrastructure Upgrades: Investment in upgrading and maintaining the electricity grid is also being scaled back. This could lead to potential bottlenecks and reduced grid efficiency in the long term. Budget cuts in this area also hinder the ability to handle increased demand for electricity.

- Research and Development: Funding for research into new energy technologies and efficiency improvements has been significantly reduced. This long-term investment reduction could hamper innovation and competitiveness within the sector.

These "budget cuts," impacting capital expenditure, reflect a wider trend of investment reduction across the energy sector.

Reasons Behind SSE's Decision to Reduce Spending

SSE's decision to implement these drastic spending cuts is primarily driven by the current economic downturn. Several factors contribute to this challenging environment:

- Inflationary Pressures: Soaring inflation has increased the cost of materials, labor, and other essential resources, making projects more expensive to undertake. This significantly impacts project profitability and necessitates cost-cutting measures.

- Interest Rate Hikes: Increased interest rates make borrowing more expensive, increasing the financial burden of large-scale projects. This limits the company's ability to finance new initiatives through debt.

- Reduced Consumer Demand: A slowdown in economic activity has led to reduced energy consumption, impacting SSE's revenue streams and the justification for large capital expenditure projects.

- Government Policies: Changes in government policies and regulations related to energy production and investment could also influence SSE's financial decisions, adding uncertainty to future project planning.

"The current economic climate necessitates a strategic recalibration of our investment priorities," stated [Name and Title of SSE spokesperson]. "These difficult decisions are made to ensure the long-term financial stability of the company."

Potential Impacts of SSE's Spending Cuts

The "SSE spending cuts" have several potential consequences, both short-term and long-term:

- Reduced Profitability: In the short term, reduced investment may temporarily impact profitability, as fewer projects are completed and revenue streams are affected.

- Job Losses: The scaling back of projects and reduced investment in research and development could lead to job losses within the company. The exact number is yet to be announced but is a significant concern for employees.

- Energy Security: Delayed or cancelled renewable energy projects could impact the UK's energy security and its transition to more sustainable energy sources. This necessitates further consideration of alternative measures to meet energy demands.

- Market Impact: The decision could trigger wider concerns within the energy sector, potentially impacting investor confidence and the overall market performance.

Investor Reaction and Market Response to SSE's Announcement

The market reacted negatively to SSE's announcement, with the company's share price experiencing a significant drop. Investor confidence has been shaken, highlighting concerns about the company's future financial performance. Financial analysts have expressed mixed opinions, with some highlighting the necessity of cost-cutting measures in the current economic climate, while others warn about the potential long-term consequences of reduced investment. Further analysis of the "stock market" reaction is needed to fully understand the long-term implications of these announcements.

Analyzing the Long-Term Implications of SSE Spending Cuts

SSE's significant spending cuts reflect the harsh realities of the current economic slowdown and its impact on the energy sector. The scale of these "SSE spending cuts" and their potential ramifications on jobs, energy security, and future innovation are substantial. The long-term effects on the company's financial performance and its ability to meet its renewable energy targets remain uncertain. To stay informed about the evolving situation and the ongoing implications of these spending cuts, subscribe to our newsletter or follow reputable financial news sources. Understanding the ripple effects of these cuts is crucial for investors, consumers, and policymakers alike.

Featured Posts

-

Important Updates Regarding Royal Philips 2025 Annual General Meeting

May 25, 2025

Important Updates Regarding Royal Philips 2025 Annual General Meeting

May 25, 2025 -

Cayuga County Residents Urged To Prepare For Flash Flooding

May 25, 2025

Cayuga County Residents Urged To Prepare For Flash Flooding

May 25, 2025 -

The Rtx 5060 A Case Study In Graphics Card Review Transparency

May 25, 2025

The Rtx 5060 A Case Study In Graphics Card Review Transparency

May 25, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc Daily Nav Updates And Historical Data

May 25, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Daily Nav Updates And Historical Data

May 25, 2025 -

Stocks Surge 8 On Euronext Amsterdam Trump Tariff Pause Impact

May 25, 2025

Stocks Surge 8 On Euronext Amsterdam Trump Tariff Pause Impact

May 25, 2025

Latest Posts

-

Italian Open Zheng Qinwen Earns First Win Against Sabalenka

May 25, 2025

Italian Open Zheng Qinwen Earns First Win Against Sabalenka

May 25, 2025 -

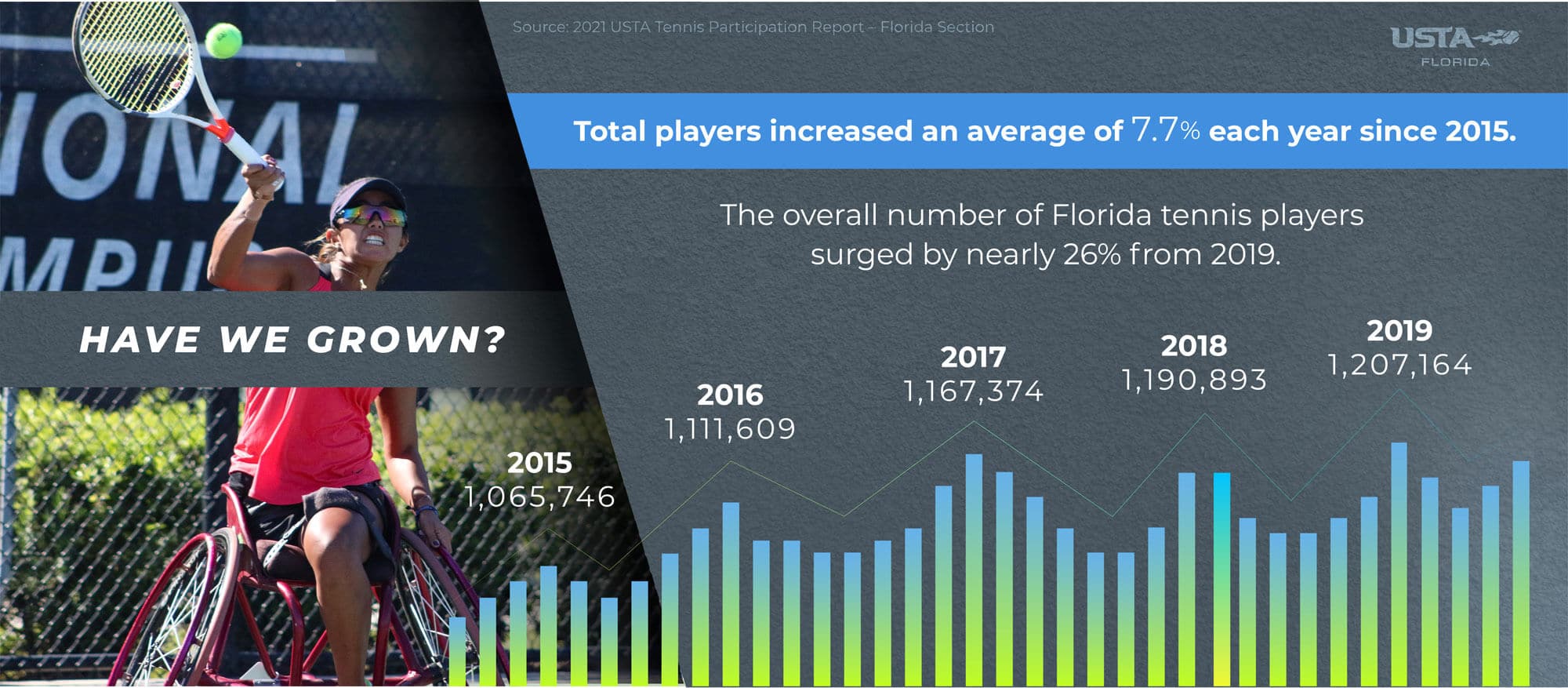

Nationwide Tennis Participation Report 25 Million Players Predicted By August 2024

May 25, 2025

Nationwide Tennis Participation Report 25 Million Players Predicted By August 2024

May 25, 2025 -

The Music Of Russell And The Typhoons An Analysis Of Their Sound And Style

May 25, 2025

The Music Of Russell And The Typhoons An Analysis Of Their Sound And Style

May 25, 2025 -

Zheng Qinwens Breakthrough Italian Open Semifinalist After Sabalenka Win

May 25, 2025

Zheng Qinwens Breakthrough Italian Open Semifinalist After Sabalenka Win

May 25, 2025 -

Projected Growth Of Nationwide Tennis Participation Reaching 25 Million By August 2024

May 25, 2025

Projected Growth Of Nationwide Tennis Participation Reaching 25 Million By August 2024

May 25, 2025