News Corp: Undervalued And Underappreciated? Examining The Investment Case

Table of Contents

A Diversified Portfolio Across Multiple Sectors

News Corp's strength lies in its strategic diversification across several key sectors, mitigating risk and offering multiple avenues for growth.

News and Information: A Foundation of Strength

News Corp's core competency remains its powerful presence in news and information. Flagship publications like the Wall Street Journal, The Times, and The Sun, coupled with digital news platforms and book publishing divisions, provide a remarkably stable revenue stream and unparalleled brand recognition.

- Strong subscription models: These publications are increasingly relying on robust subscription models, generating recurring revenue and reducing reliance on volatile advertising income.

- Digital transformation progress: News Corp has shown significant progress in its digital transformation, expanding its online presence and reaching new audiences through various digital platforms.

- Potential for further digital growth: The ongoing shift towards digital news consumption presents significant growth opportunities for News Corp to leverage its strong brands and established audience.

- Impact of changing news consumption habits: While adapting to evolving news consumption habits presents challenges, News Corp's investment in digital platforms positions it well to navigate this changing media landscape.

Television and Entertainment: Expanding Horizons

Foxtel, Fox Nation, and other entertainment assets contribute significantly to News Corp's diversification, offering substantial growth potential in the rapidly evolving streaming and digital entertainment markets.

- Competition in streaming: The fiercely competitive streaming landscape poses a significant challenge, necessitating strategic partnerships and innovative programming.

- Cord-cutting impact: The continued impact of cord-cutting requires News Corp to adapt its strategies and focus on delivering engaging content through various digital platforms.

- Potential for strategic partnerships: Collaborations with other media companies or tech giants could unlock significant growth opportunities and expand market reach.

- Growth in niche programming: Focusing on niche programming and targeted content can help News Corp carve out a unique position in the crowded streaming market.

Real Estate: A Hidden Asset

News Corp's ownership of substantial real estate assets adds another layer to its diversified portfolio, providing an additional revenue stream and potential for future appreciation.

- Value of properties: The intrinsic value of these properties provides a solid foundation and a potential hedge against market volatility in other sectors.

- Potential for future development: Opportunities exist for future development or strategic real estate transactions that could enhance profitability.

- Risk assessment of real estate investments: As with any real estate investment, thorough risk assessment is crucial to mitigate potential downsides.

Financial Performance and Valuation: A Deep Dive

Analyzing News Corp's financial performance and valuation is crucial to assess its investment potential.

Dividend Yield and Share Buybacks: Returning Value to Shareholders

News Corp has a consistent history of returning capital to shareholders via dividends and share buybacks, making it particularly attractive to income-oriented investors.

- Dividend payout ratio: A healthy dividend payout ratio demonstrates the company's commitment to rewarding investors.

- History of dividend increases: A track record of dividend increases indicates a strong financial position and confidence in future performance.

- Share repurchase program: Share buybacks reduce the number of outstanding shares, potentially increasing earnings per share and boosting the stock price.

- Impact on share price: The combination of dividends and share buybacks can significantly impact the stock price and overall investor returns.

Profitability and Growth Prospects: Looking Ahead

Examining News Corp's recent financial performance – revenue, profits, and cash flow – alongside its strategic initiatives, reveals its growth potential.

- Revenue growth: Consistent revenue growth indicates a healthy and expanding business.

- Profit margins: Strong profit margins demonstrate efficient operations and profitability.

- Debt levels: Maintaining manageable debt levels is essential for long-term financial health.

- Potential for acquisitions: Strategic acquisitions could accelerate growth and expand market share.

- Expansion into new markets: Entering new markets provides opportunities for diversification and increased revenue streams.

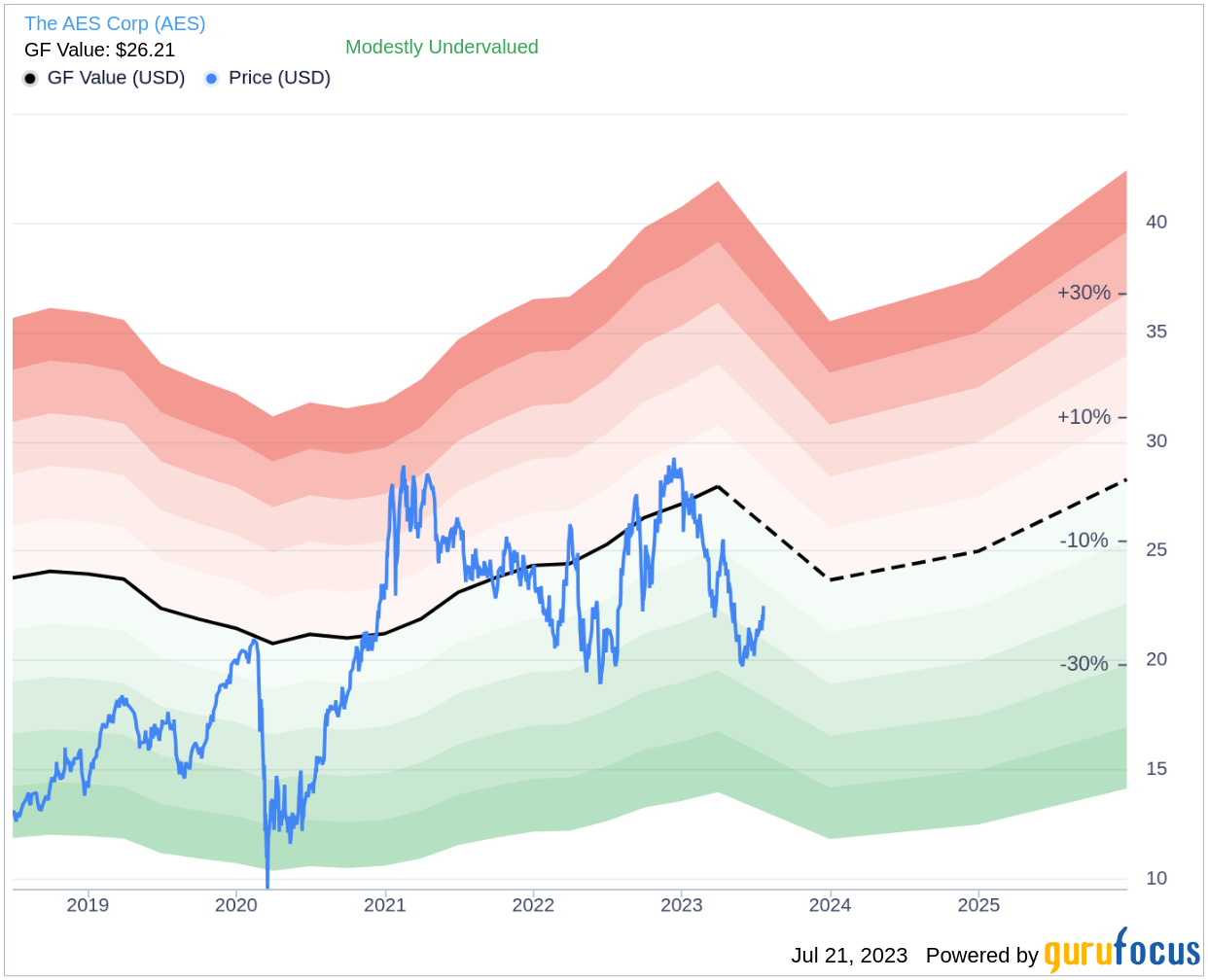

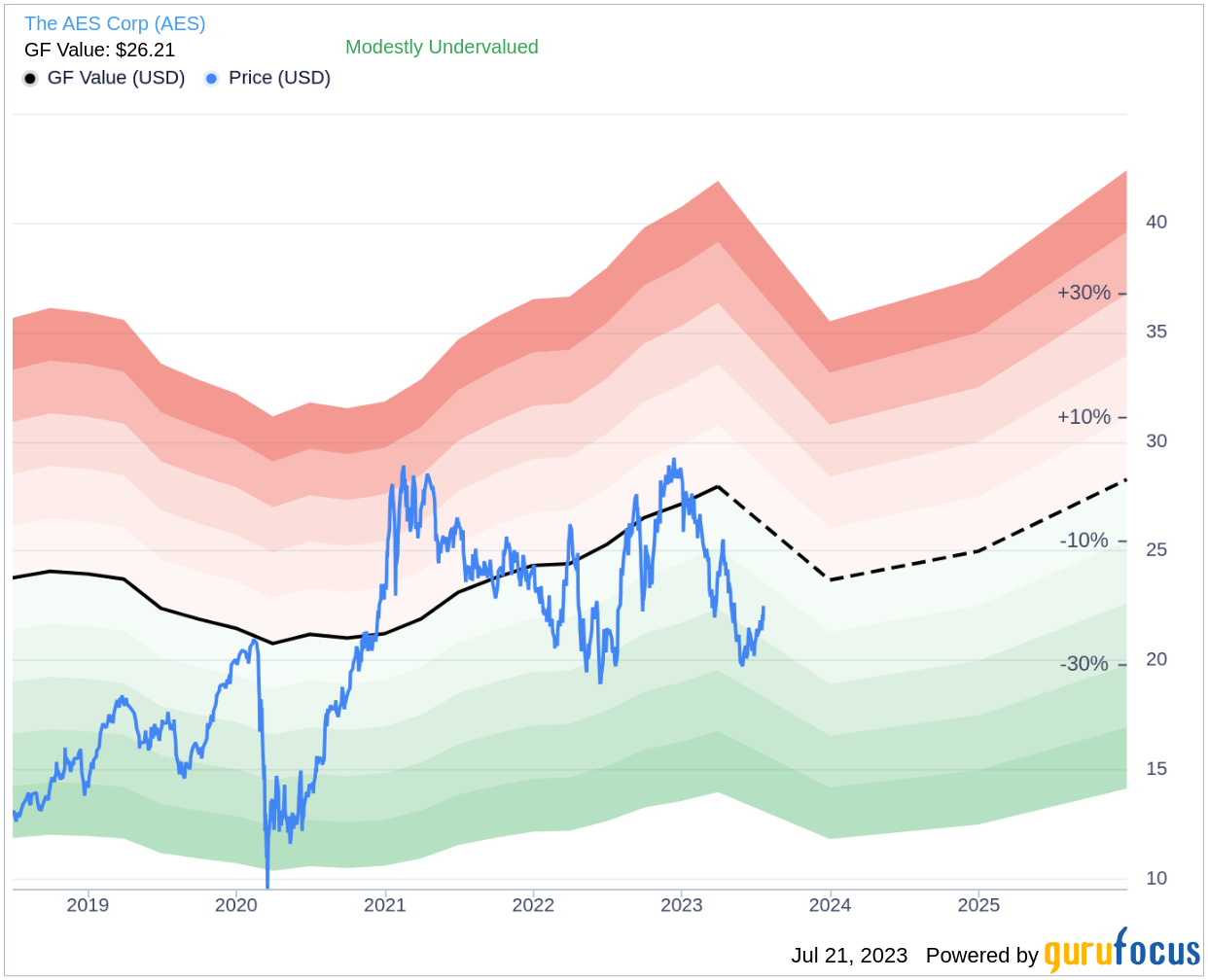

Current Valuation Metrics: Is it Undervalued?

Evaluating News Corp's valuation through metrics like the Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and discounted cash flow (DCF) analysis helps determine if it's trading below its intrinsic value compared to its peers.

- Comparison with industry peers: Benchmarking News Corp against its competitors provides valuable insights into its relative valuation.

- Discounted cash flow analysis: A DCF analysis provides a more comprehensive valuation based on projected future cash flows.

- Sensitivity analysis of key assumptions: Testing the robustness of the valuation by varying key assumptions helps assess the range of possible outcomes.

Risks and Challenges: Navigating the Headwinds

Despite its strengths, News Corp faces several significant risks and challenges.

Economic and Political Factors: A Shifting Landscape

Global economic conditions, political instability, and regulatory changes significantly impact News Corp's operations.

- Impact of inflation: Inflationary pressures can affect production costs and consumer spending, impacting revenue and profitability.

- Recession risks: Economic downturns can severely impact advertising revenue and consumer spending on media products.

- Political polarization: The current political climate can create uncertainty and affect media consumption patterns.

- Regulatory scrutiny of media companies: Increased regulatory scrutiny can lead to higher compliance costs and potential restrictions on operations.

Competition and Technological Disruption: Adapting to Change

The media landscape is highly competitive and constantly evolving, with technological advancements transforming consumption habits.

- Competition from other media companies: Intense competition requires News Corp to continuously innovate and adapt to maintain its market position.

- Impact of digital platforms: The rise of digital platforms necessitates News Corp's continued investment in digital capabilities and content creation.

- Adoption of new technologies: Adapting to and leveraging new technologies is crucial for staying competitive and reaching new audiences.

- Challenges of adapting to evolving consumer preferences: Understanding and catering to the ever-changing preferences of consumers is essential for success.

Conclusion: Is News Corp a Worthy Investment?

News Corp presents a multifaceted investment case. Its diversified portfolio, established brands, and dividend payouts are certainly attractive. However, investors must carefully weigh the inherent risks within the media industry and the company’s exposure to various economic and political factors. A thorough due diligence process, including a detailed analysis of its financial performance, valuation, and future growth prospects, is absolutely essential. Ultimately, whether News Corp is indeed undervalued and underappreciated depends entirely on individual investment objectives and risk tolerance. Conduct thorough research before making any investment decisions regarding News Corp stock. Further analysis of News Corp's financial reports and strategic plans will ultimately help determine if this media giant is the right fit for your investment portfolio.

Featured Posts

-

Imcd N V Agm All Resolutions Passed By Shareholders

May 25, 2025

Imcd N V Agm All Resolutions Passed By Shareholders

May 25, 2025 -

Escape To The Country The Pros And Cons Of Country Life

May 25, 2025

Escape To The Country The Pros And Cons Of Country Life

May 25, 2025 -

Yevrobachennya 2025 Peredbachennya Konchiti Vurst Chotirokh Peremozhtsiv

May 25, 2025

Yevrobachennya 2025 Peredbachennya Konchiti Vurst Chotirokh Peremozhtsiv

May 25, 2025 -

Inside Ferraris First Official Bengaluru Service Centre A Closer Look

May 25, 2025

Inside Ferraris First Official Bengaluru Service Centre A Closer Look

May 25, 2025 -

Analyzing The Net Asset Value Nav Of The Amundi Djia Ucits Etf

May 25, 2025

Analyzing The Net Asset Value Nav Of The Amundi Djia Ucits Etf

May 25, 2025

Latest Posts

-

The Impact Of Buffetts Retirement On Berkshire Hathaways Apple Investment

May 25, 2025

The Impact Of Buffetts Retirement On Berkshire Hathaways Apple Investment

May 25, 2025 -

Berkshire Hathaways Future Analyzing The Apple Stock Holding Post Buffett

May 25, 2025

Berkshire Hathaways Future Analyzing The Apple Stock Holding Post Buffett

May 25, 2025 -

Buffetts Departure Whats Next For Berkshire Hathaways Apple Investment

May 25, 2025

Buffetts Departure Whats Next For Berkshire Hathaways Apple Investment

May 25, 2025 -

Ces Unveiled Europe Un Evenement Technologique Majeur A Amsterdam

May 25, 2025

Ces Unveiled Europe Un Evenement Technologique Majeur A Amsterdam

May 25, 2025 -

Amsterdam Accueille Le Ces Unveiled Europe Les Innovations Technologiques A Decouvrir

May 25, 2025

Amsterdam Accueille Le Ces Unveiled Europe Les Innovations Technologiques A Decouvrir

May 25, 2025