Amsterdam Stock Index Plunges Over 4%, Hits Year-Low

Table of Contents

Causes of the Amsterdam Stock Index Plunge

Several interconnected factors contributed to the dramatic plunge in the Amsterdam Stock Index. Understanding these underlying causes is crucial for navigating the current market volatility.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty. Factors such as persistent inflation, fears of a looming recession, and ongoing geopolitical instability are impacting global markets, and the AEX is no exception. The ripple effects of these global challenges are acutely felt in the Dutch economy.

- Increased Interest Rates: Central banks worldwide are raising interest rates to combat inflation, increasing borrowing costs for businesses and dampening economic growth. This negatively impacts investor confidence and stock valuations.

- Energy Crisis Impact: The ongoing energy crisis, exacerbated by the war in Ukraine, is driving up energy prices across Europe, impacting businesses and consumer spending, directly affecting the performance of energy-related companies listed on the AEX.

- Weakening Euro: The weakening Euro against the US dollar increases import costs and reduces the purchasing power of Dutch consumers and businesses, further contributing to economic uncertainty.

- Global Supply Chain Disruptions: Lingering disruptions to global supply chains continue to hinder economic activity, adding to the overall instability. The impact on Dutch businesses reliant on international trade is significant. For example, inflation in the Eurozone reached 10% in October 2022, according to Eurostat, highlighting the scale of the challenge.

Sector-Specific Weakness

The AEX plunge wasn't uniform across all sectors. Some sectors experienced significantly sharper declines than others.

- Technology Sector: The technology sector, often sensitive to interest rate hikes and economic downturns, witnessed a particularly steep drop. Companies like ASML Holding, a major player in the semiconductor industry, experienced significant percentage drops.

- Energy Sector: While energy prices remain high, concerns about future demand and regulatory changes led to a decline in the performance of energy companies listed on the AEX.

- Financial Sector: Banks and financial institutions also felt the pressure, reflecting broader concerns about economic stability and potential loan defaults. You can find further details on specific company performances in reports from leading financial news outlets like [link to relevant financial news article].

Investor Sentiment and Market Volatility

Negative investor sentiment and increased market volatility played a crucial role in amplifying the AEX's decline.

- Decreased Investor Confidence: Fears about a global recession and persistent inflation led to a decrease in investor confidence, resulting in significant sell-offs.

- Increased Market Volatility: The heightened uncertainty translates into increased market volatility, with sharp price swings creating a climate of panic selling.

- Analyst Comments: Leading financial analysts have expressed concerns about the outlook for the AEX, further contributing to the negative sentiment. [link to analyst report].

Implications of the Amsterdam Stock Index Decline

The decline in the Amsterdam Stock Index has significant implications for the Dutch economy, individual investors, and the government's response.

Impact on Dutch Economy

The AEX plunge is likely to have a knock-on effect on the wider Dutch economy.

- GDP Growth: A weakened stock market can negatively impact GDP growth, as businesses may reduce investment and hiring. Experts predict a slowdown in GDP growth for the Netherlands. [link to economic forecast].

- Consumer Spending: Lower confidence and potential job losses could lead to a decrease in consumer spending, further dampening economic activity.

- Unemployment Rates: A slowing economy could lead to an increase in unemployment rates.

Effect on Individual Investors

The AEX decline directly affects individual investors holding Dutch stocks.

- Portfolio Losses: Investors have experienced significant portfolio losses due to the market downturn.

- Potential for Further Losses: The potential for further losses remains, depending on the future trajectory of the AEX.

- Risk Mitigation Strategies: Diversification and a long-term investment strategy are crucial for mitigating risk in volatile markets. (Disclaimer: This is not financial advice. Consult a financial advisor for personalized guidance.)

Government Response and Potential Measures

The Dutch government may need to implement measures to mitigate the impact of the AEX decline.

- Potential Government Interventions: The government might consider measures to support businesses and boost investor confidence.

- Economic Stimulus Packages: Stimulus packages aimed at boosting economic activity may be considered.

- Monetary Policy Adjustments: The Dutch central bank may adjust its monetary policy to address the situation.

Looking Ahead: Predictions and Analysis for the Amsterdam Stock Index

Predicting the future performance of the AEX is challenging, but analyzing analyst forecasts and potential catalysts for recovery can provide some insight.

Analyst Forecasts

Financial analysts offer a range of opinions on the AEX's future performance. Some predict a continued downward trend, while others see potential for a recovery depending on global economic developments. [Link to various analyst reports and forecasts].

Potential for Recovery

Several factors could influence the AEX's future trajectory and potential for recovery.

- Global Economic Stabilization: A stabilization of the global economy and easing of inflationary pressures could boost investor confidence.

- Sector-Specific Growth: Strong performance in key sectors within the AEX could drive a recovery.

- Government Policies: Effective government policies aimed at stimulating economic growth can positively impact the AEX.

Conclusion

The sharp decline in the Amsterdam Stock Index represents a significant challenge for the Dutch economy and individual investors. The causes are multifaceted, stemming from global economic uncertainty, sector-specific weaknesses, and negative investor sentiment. The implications are widespread, potentially affecting GDP growth, consumer spending, and unemployment. While uncertainty remains, understanding the factors influencing the Amsterdam Stock Index is crucial for navigating this volatile period. Stay informed about fluctuations in the Amsterdam Stock Index and the broader Dutch market by regularly checking reputable financial news sources. Monitoring the AEX closely for further updates and potential recovery is essential for making informed investment decisions.

Featured Posts

-

Poor Glastonbury 2025 Headliners Leave Fans Disappointed

May 24, 2025

Poor Glastonbury 2025 Headliners Leave Fans Disappointed

May 24, 2025 -

Glastonbury 2025 Lineup Confirmed Artists And How To Buy Tickets

May 24, 2025

Glastonbury 2025 Lineup Confirmed Artists And How To Buy Tickets

May 24, 2025 -

Fallout From Kyle Walker Night Out Annie Kilners Poisoning Allegations Examined

May 24, 2025

Fallout From Kyle Walker Night Out Annie Kilners Poisoning Allegations Examined

May 24, 2025 -

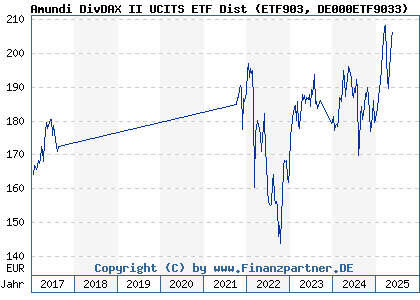

Net Asset Value Nav For Amundi Msci World Ii Ucits Etf Usd Hedged Dist What You Need To Know

May 24, 2025

Net Asset Value Nav For Amundi Msci World Ii Ucits Etf Usd Hedged Dist What You Need To Know

May 24, 2025 -

Konchita Vurst Prognoz Peremozhtsiv Yevrobachennya 2025 Vid Unian

May 24, 2025

Konchita Vurst Prognoz Peremozhtsiv Yevrobachennya 2025 Vid Unian

May 24, 2025

Latest Posts

-

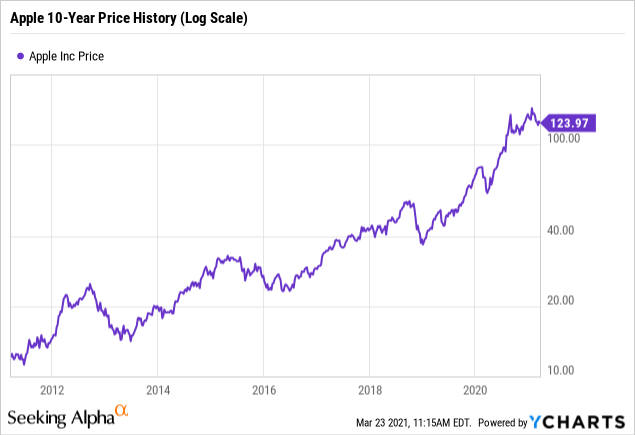

Apples Stock Price Should You Buy At 200 With A Potential 254 Target

May 24, 2025

Apples Stock Price Should You Buy At 200 With A Potential 254 Target

May 24, 2025 -

Woody Allen And The Resurgence Of Sexual Abuse Claims The Impact Of Sean Penns Statement

May 24, 2025

Woody Allen And The Resurgence Of Sexual Abuse Claims The Impact Of Sean Penns Statement

May 24, 2025 -

Is Apple Stock A Buy At 200 One Analyst Predicts 254

May 24, 2025

Is Apple Stock A Buy At 200 One Analyst Predicts 254

May 24, 2025 -

Apple Stock Prediction 254 Analysts Outlook And 200 Buy Recommendation

May 24, 2025

Apple Stock Prediction 254 Analysts Outlook And 200 Buy Recommendation

May 24, 2025 -

Whats Wrong With Sean Penn Fans Respond To His Latest Statements

May 24, 2025

Whats Wrong With Sean Penn Fans Respond To His Latest Statements

May 24, 2025