Net Asset Value (NAV) For Amundi MSCI World II UCITS ETF USD Hedged Dist: What You Need To Know

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

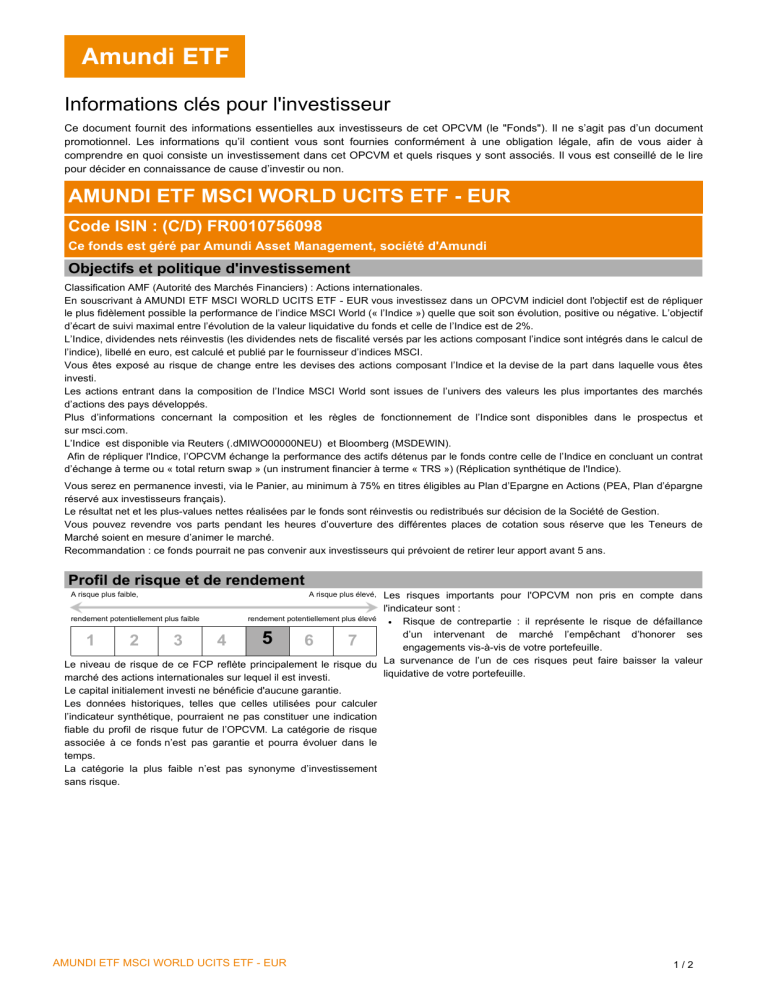

Net Asset Value (NAV) represents the net worth of an ETF's holdings. It's calculated by subtracting the ETF's liabilities (expenses, fees) from the total market value of its assets (stocks, bonds, etc.). For the Amundi MSCI World II UCITS ETF USD Hedged Dist, understanding the NAV is particularly important due to its exposure to international markets and the impact of currency hedging.

The basic formula for NAV calculation is:

NAV = (Total Asset Value - Total Liabilities) / Number of Outstanding Shares

The key difference between NAV and the market price of an ETF lies in their timing and reflection of investor sentiment. The NAV is calculated daily, usually at the market close, representing the intrinsic value of the ETF's holdings. The market price, on the other hand, fluctuates throughout the trading day based on supply and demand, potentially differing from the NAV.

The Amundi MSCI World II UCITS ETF USD Hedged Dist employs a currency hedging strategy. This means the fund uses financial instruments to reduce the impact of exchange rate fluctuations between the USD and other currencies on its underlying assets. This hedging strategy impacts the NAV calculation, potentially offering some protection against currency risk but also introducing its own complexities. The NAV will reflect the effects of these hedging strategies.

- NAV reflects the intrinsic value of the ETF's holdings.

- Calculated daily, typically at market close.

- Influenced by the performance of underlying assets.

- USD Hedged component impacts NAV differently compared to unhedged versions; hedging strategies can influence the daily changes in NAV.

How NAV Affects Amundi MSCI World II UCITS ETF USD Hedged Dist Investors

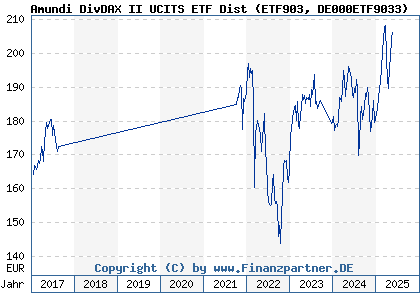

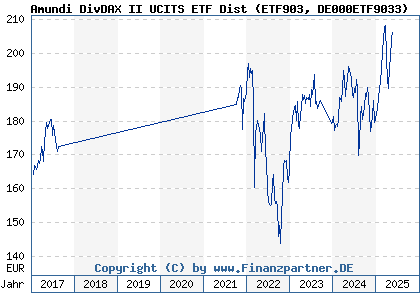

Daily NAV fluctuations directly impact your investment returns. If the NAV rises, your investment gains value. Conversely, a falling NAV indicates a loss. The ETF share price typically tracks the NAV closely, although short-term discrepancies can occur due to market forces.

Monitoring NAV changes is crucial for making informed investment decisions. A rising NAV might signal a positive trend, potentially prompting you to hold or even increase your investment. A consistently falling NAV, however, could suggest reconsidering your investment strategy.

- NAV is the basis for calculating your investment gains or losses.

- Tracking NAV helps in comparing performance against benchmarks.

- Regular NAV checks help manage risk and make informed decisions.

- Understanding NAV fluctuations is key to successfully timing your buy and sell decisions.

Where to Find the NAV for Amundi MSCI World II UCITS ETF USD Hedged Dist

Reliable sources for accessing the daily NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist include:

- Amundi's official website: Check the fund's dedicated page for daily NAV updates.

- Major financial data providers: Platforms like Bloomberg, Refinitiv, and Yahoo Finance often provide real-time or near real-time NAV data for ETFs.

- Your brokerage account statement: Your brokerage account will display the NAV of your holdings.

Always prioritize official sources to avoid misinformation. Be aware that there might be slight delays in NAV reporting, usually due to the time required to calculate the values of all the underlying assets. This delay is typically minimal, but understanding it is important for interpreting the data accurately.

Understanding the Impact of Currency Hedging on NAV

The Amundi MSCI World II UCITS ETF USD Hedged Dist uses a currency hedging strategy to mitigate the risk associated with fluctuations in exchange rates. This strategy aims to minimize the impact of currency movements on the overall return. However, hedging isn't without its own nuances. While it reduces exposure to currency risk, it can also slightly dampen overall returns during periods of favorable currency movements.

Comparing the NAV performance of this hedged ETF with unhedged versions of similar ETFs can offer insights into the effectiveness of the hedging strategy. The choice between a hedged or unhedged ETF hinges on your personal risk tolerance and investment objectives.

- Hedging mitigates risk associated with currency movements.

- Hedging may slightly impact overall returns, potentially reducing gains during periods of favorable exchange rates.

- It’s crucial to understand your risk tolerance before choosing a hedged or unhedged ETF.

Conclusion: Mastering Net Asset Value (NAV) for Informed Investing in Amundi MSCI World II UCITS ETF USD Hedged Dist

Understanding Net Asset Value (NAV) is paramount for successful investing in the Amundi MSCI World II UCITS ETF USD Hedged Dist. We've explored how NAV is calculated, its influence on your investment returns, and where to find reliable data. Regularly monitoring NAV changes, combined with a clear understanding of the impact of currency hedging, allows for better risk management and more informed investment decisions. Start monitoring your NAV today and make informed decisions about your portfolio!

Featured Posts

-

Maryland Softballs Comeback Victory 5 4 Win Over Delaware

May 24, 2025

Maryland Softballs Comeback Victory 5 4 Win Over Delaware

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist A Detailed Explanation

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist A Detailed Explanation

May 24, 2025 -

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 24, 2025

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 24, 2025 -

Pts Riviera Blue Porsche 911 S T For Sale A Collectors Dream

May 24, 2025

Pts Riviera Blue Porsche 911 S T For Sale A Collectors Dream

May 24, 2025 -

Complete Guide To The Nyt Mini Crossword March 24 2025 Answers

May 24, 2025

Complete Guide To The Nyt Mini Crossword March 24 2025 Answers

May 24, 2025

Latest Posts

-

Dax Verluste Bei Frankfurter Aktienmarkt Eroeffnung Terminmarktablauf Am 21 Maerz 2025

May 24, 2025

Dax Verluste Bei Frankfurter Aktienmarkt Eroeffnung Terminmarktablauf Am 21 Maerz 2025

May 24, 2025 -

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025 -

Glastonbury 2025 Lineup Fan Fury Over Headliners

May 24, 2025

Glastonbury 2025 Lineup Fan Fury Over Headliners

May 24, 2025 -

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025 -

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025