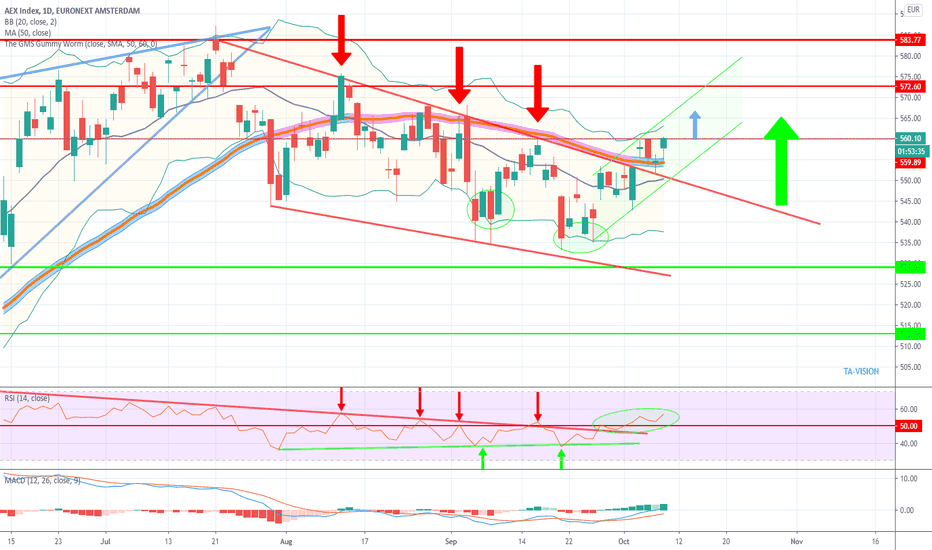

Amsterdam Stock Index Plunges: Over 4% Drop To Year-Low

Table of Contents

Key Factors Contributing to the Amsterdam Stock Index Plunge

Several interconnected factors contributed to the sharp decline in the AEX, creating a perfect storm of negative market sentiment.

Global Economic Uncertainty

Global economic headwinds played a significant role in the AEX's year-low performance. Rising inflation, persistent fears of a global recession, and ongoing geopolitical instability all contributed to investor anxieties.

- Rising Interest Rates: Central banks worldwide are aggressively raising interest rates to combat inflation, impacting borrowing costs for businesses and dampening economic growth. This has created a ripple effect across global markets.

- Energy Crisis: The ongoing energy crisis, exacerbated by geopolitical tensions, is fueling inflation and increasing uncertainty for businesses across various sectors.

- Geopolitical Risks: The war in Ukraine, ongoing trade disputes, and other geopolitical uncertainties are creating significant volatility in global financial markets. The AEX, like other major indices such as the Dow Jones and FTSE 100, shows a strong correlation with these global events.

Dutch Economic Performance

Beyond global factors, the Dutch economy faces its own set of challenges that contributed to the AEX plunge.

- Slowing GDP Growth: Recent economic indicators suggest a slowdown in Dutch GDP growth, raising concerns about the country's economic resilience.

- Rising Unemployment: While unemployment remains relatively low, there are concerns about potential job losses in sectors heavily impacted by the global economic slowdown.

- Decreased Consumer Confidence: Weakening consumer confidence, coupled with rising inflation, is impacting consumer spending, a crucial driver of the Dutch economy.

- Sector-Specific Downturns: The energy and technology sectors, significant components of the AEX, experienced particularly sharp declines, further dragging down the overall index.

Investor Sentiment and Market Volatility

Negative investor sentiment played a crucial role in exacerbating the market downturn.

- Sell-offs and Panic Selling: As the market declined, investors engaged in sell-offs and panic selling, further driving down the AEX.

- Negative News and Announcements: Several negative news events and corporate announcements contributed to the decline in investor confidence, fueling the sell-off.

Impact and Consequences of the Amsterdam Stock Index Drop

The sharp drop in the AEX has significant consequences for Dutch companies, the broader economy, and its citizens.

Impact on Dutch Companies

The AEX plunge directly impacted the market capitalization and stock prices of numerous Dutch companies.

- Reduced Market Capitalization: Many listed companies experienced substantial declines in their market capitalization, impacting their ability to raise capital.

- Potential Job Losses and Investment Cuts: Some companies may be forced to cut jobs or reduce investments to cope with the reduced revenue and investor confidence.

Wider Economic Implications

The decline in the AEX has broader implications for the Dutch economy.

- Decreased Consumer Spending: The stock market drop can negatively impact consumer confidence, leading to reduced consumer spending.

- Reduced Investments: Uncertainty in the market can lead to decreased investment, both domestically and from foreign investors.

- Government Intervention: The Dutch government may need to consider interventions to mitigate the economic impact of the AEX plunge, potentially through fiscal stimulus measures.

Conclusion: Navigating the Amsterdam Stock Index Volatility

The Amsterdam Stock Index's significant plunge to a year-low reflects a complex interplay of global economic uncertainties and specific challenges within the Dutch economy. The resulting market volatility underscores the importance of carefully monitoring the AEX and understanding the factors driving its fluctuations. This year-low position highlights the potential for continued volatility, though the situation also presents opportunities for astute investors. While risks remain, a recovery is possible. To effectively navigate this volatile market, actively monitor the Amsterdam Stock Index, track its performance, and understand the underlying economic trends. Conduct further research into Dutch stock market analysis and consider developing investment strategies suitable for volatile markets. Subscribe to our newsletter or follow us on social media to stay informed about the latest developments concerning the Amsterdam Stock Index and its impact on the Dutch economy.

Featured Posts

-

Aex Index Over 4 Drop Sends Market To 12 Month Low

May 24, 2025

Aex Index Over 4 Drop Sends Market To 12 Month Low

May 24, 2025 -

Cac 40 Weekly Performance Mixed Results For March 7 2025

May 24, 2025

Cac 40 Weekly Performance Mixed Results For March 7 2025

May 24, 2025 -

Profun A Nyja Porsche Macan Rafmagnsbilnum

May 24, 2025

Profun A Nyja Porsche Macan Rafmagnsbilnum

May 24, 2025 -

New York Times Connections Game Answers And Hints For Puzzle 646 March 18 2025

May 24, 2025

New York Times Connections Game Answers And Hints For Puzzle 646 March 18 2025

May 24, 2025 -

Analiz Proizvedeniya Gryozy Lyubvi Ili Ilicha Iz Gazety Trud

May 24, 2025

Analiz Proizvedeniya Gryozy Lyubvi Ili Ilicha Iz Gazety Trud

May 24, 2025

Latest Posts

-

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025 -

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025 -

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025 -

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025