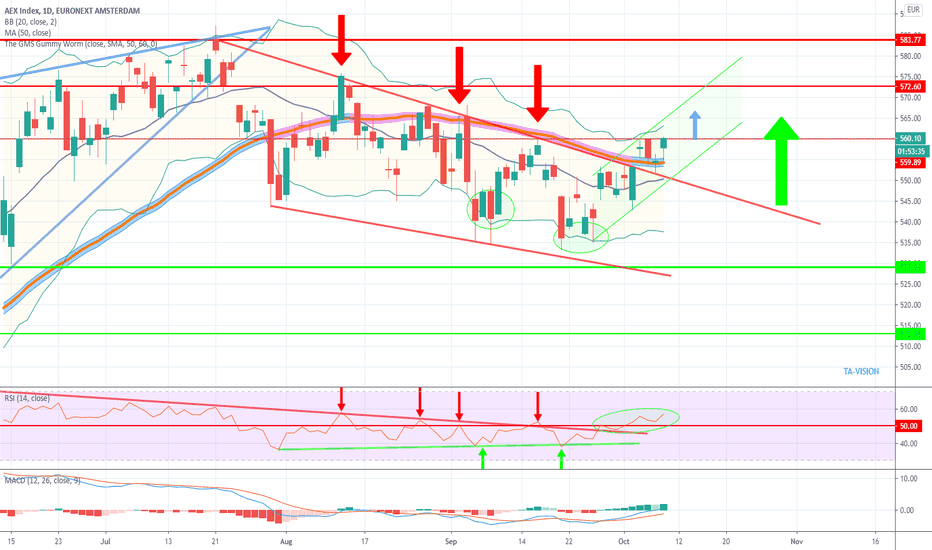

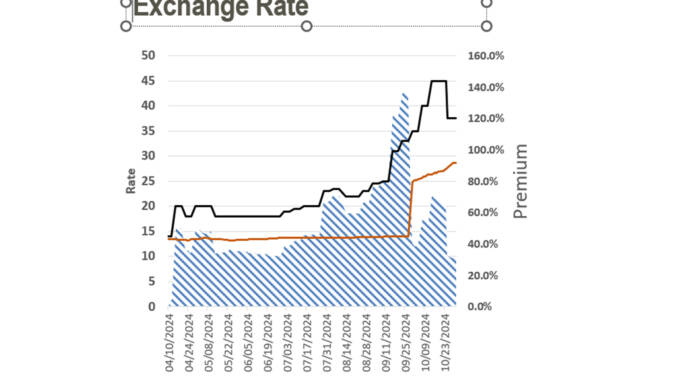

AEX Index: Over 4% Drop Sends Market To 12-Month Low

Table of Contents

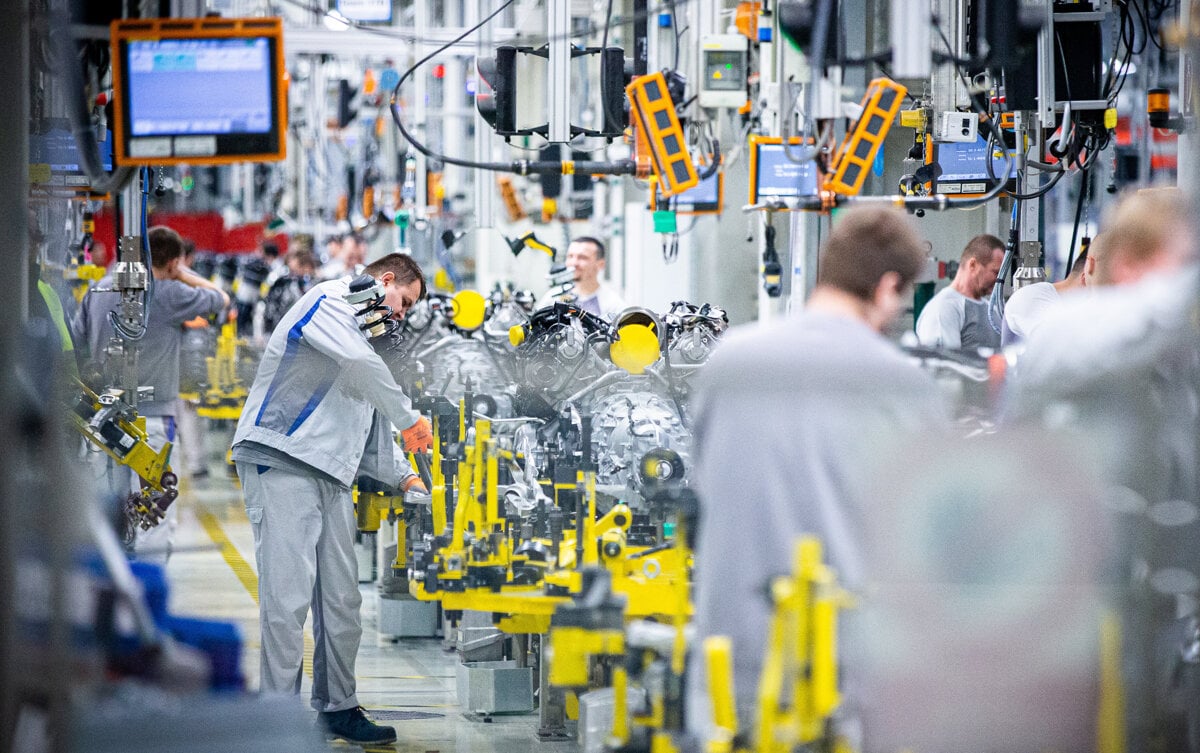

Causes of the AEX Index Decline

Several interconnected factors contributed to the sharp decline in the AEX Index. Understanding these underlying causes is crucial for investors seeking to navigate the current market climate.

Global Economic Uncertainty

Global economic headwinds significantly impacted the AEX Index. Rising inflation, aggressive interest rate hikes by central banks worldwide, and ongoing geopolitical instability created a perfect storm for market uncertainty. These factors dampened investor confidence, leading to widespread sell-offs.

- Examples of global events influencing the AEX: The ongoing war in Ukraine, persistent inflation in major economies like the US and Eurozone, and supply chain disruptions all played a role.

- Analysis of their impact: These events fueled uncertainty about future economic growth, prompting investors to move towards safer assets, thereby reducing demand for riskier investments like stocks listed on the AEX.

- Specific companies affected: Companies heavily reliant on international trade or exposed to commodity price fluctuations were particularly vulnerable, experiencing steeper declines than others.

Sector-Specific Weakness

The decline wasn't uniform across all sectors within the AEX. Certain sectors experienced significantly more pronounced drops than others.

- Examples of underperforming sectors: The technology sector, often sensitive to interest rate changes, saw substantial losses. The energy sector, while initially benefiting from high energy prices, also faced some corrections due to price volatility and concerns about future demand.

- Reasons for their decline: Decreased consumer spending in response to inflation impacted technology companies reliant on discretionary spending. Fluctuations in energy prices created uncertainty for energy companies, impacting investor confidence.

- Relevant data: Tracking the performance of individual sectors within the AEX provides a clearer picture of the market's specific vulnerabilities. Analyzing trading volumes and price changes can pinpoint the most impacted areas.

Investor Sentiment and Market Volatility

Negative investor sentiment and heightened market volatility amplified the AEX Index decline. Fear and uncertainty drove panic selling, further exacerbating the downward trend.

- Statistics on trading volume: Increased trading volumes during the downturn indicate heightened activity and potential panic selling.

- Analysis of investor behavior: Many investors adopted risk-averse strategies, shifting their portfolios away from equities and towards safer investments like bonds or cash.

- Significant news events influencing sentiment: Negative economic reports, announcements from major companies, and escalating geopolitical tensions all contributed to the negative sentiment.

Impact of the AEX Index Drop

The sharp fall in the AEX Index has significant implications for both the Dutch economy and individual investors.

Effect on the Dutch Economy

The decline in the AEX Index reflects broader concerns about the Dutch economy's health. A prolonged downturn could have several negative consequences.

- Potential consequences for businesses: Reduced investor confidence can lead to decreased investment in businesses, potentially impacting job creation and economic growth.

- Implications for economic growth forecasts: The AEX decline necessitates downward revisions of economic growth forecasts for the Netherlands.

- Potential government responses: The government may need to implement fiscal or monetary policies to mitigate the economic impact of the market downturn.

Implications for Investors

The AEX Index drop presents both challenges and opportunities for investors, depending on their investment horizon and risk tolerance.

- Strategies for managing risk: Diversification of investment portfolios, risk assessment, and potentially adjusting asset allocations are crucial.

- Opportunities for investors: The downturn may present opportunities for long-term investors to acquire quality assets at discounted prices.

- Importance of diversification: A well-diversified portfolio can mitigate losses during market downturns.

- Long-term vs. short-term investment perspectives: Long-term investors should focus on their overall strategy, while short-term investors may need to adjust their strategies based on the current volatility.

Potential Recovery and Future Outlook

While the current situation is challenging, there are potential factors that could contribute to an AEX Index recovery.

Factors that Could Drive Recovery

Several factors could trigger a rebound in the AEX Index.

- Positive economic indicators: Improvements in inflation rates, stronger-than-expected economic data, and easing geopolitical tensions can boost investor confidence.

- Potential policy changes: Government interventions or supportive central bank policies can help stabilize the market.

- Changes in investor sentiment: A shift towards optimism could lead to increased investment and higher demand for AEX-listed stocks.

- Sector-specific recoveries: Strong performances from specific sectors could pull up the overall index.

Expert Opinions and Market Predictions

Financial analysts offer diverse perspectives on the AEX Index's future.

- Quotes from analysts: While some predict a prolonged period of volatility, others anticipate a recovery driven by positive economic indicators or policy changes.

- Market predictions: Forecasts vary widely, reflecting the inherent uncertainty in market predictions.

- Potential scenarios for the coming months: A range of scenarios, from a slow, gradual recovery to a more rapid rebound, are possible.

Conclusion

The over 4% drop in the AEX Index, pushing it to a 12-month low, highlights the impact of global economic uncertainty, sector-specific weakness, and volatile investor sentiment. This decline has significant implications for the Dutch economy and investors. While the outlook remains uncertain, potential catalysts for recovery exist, including positive economic data, policy changes, and shifting investor sentiment. However, navigating this volatility requires careful risk management and a long-term investment perspective. Stay updated on the AEX Index and its movements for informed investing, and consider seeking professional financial advice to adapt your investment strategy accordingly. Understanding the fluctuations of the AEX Index is key to effective investment in the Dutch stock market.

Featured Posts

-

Nemecky Pracovny Trh V Krize Prepustanie V Rozsiahlej Miere

May 24, 2025

Nemecky Pracovny Trh V Krize Prepustanie V Rozsiahlej Miere

May 24, 2025 -

A Realistic Escape To The Country What To Expect

May 24, 2025

A Realistic Escape To The Country What To Expect

May 24, 2025 -

Cac 40 Weekly Close Down Despite Stability March 7 2025

May 24, 2025

Cac 40 Weekly Close Down Despite Stability March 7 2025

May 24, 2025 -

Dreyfus Affair Lawmakers Push For Posthumous Military Promotion

May 24, 2025

Dreyfus Affair Lawmakers Push For Posthumous Military Promotion

May 24, 2025 -

Escape To The Country Nicki Chapmans Profitable Property Investment

May 24, 2025

Escape To The Country Nicki Chapmans Profitable Property Investment

May 24, 2025

Latest Posts

-

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025 -

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025 -

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025 -

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025