Amsterdam Market Opens Down 7%: Trade War Fears Weigh Heavily

Table of Contents

Trade War Fears as the Primary Catalyst

The current downturn in the Amsterdam market is undeniably linked to intensifying global trade tensions. The ongoing US-China trade dispute, coupled with simmering EU trade disputes, has created a climate of uncertainty that is severely impacting Dutch businesses. Increased tariffs on Dutch agricultural exports to China, for example, are directly impacting the profitability of key industries. Similarly, disputes concerning intellectual property rights and unfair trade practices are creating significant headwinds for Dutch companies operating in international markets.

The value of impacted exports and imports runs into the billions of euros, further underscoring the gravity of the situation. This uncertainty is eroding investor confidence and triggering a sell-off in the Amsterdam stock exchange (AEX).

- Increased tariffs on Dutch goods: Higher tariffs imposed by trading partners significantly reduce the competitiveness of Dutch exports.

- Uncertainty surrounding future trade agreements: The lack of clarity regarding future trade relations creates significant risk for businesses planning long-term investments.

- Disruption to supply chains: Trade wars often lead to disruptions in global supply chains, impacting production and delivery timelines.

- Reduced consumer confidence: The uncertainty surrounding the economy translates into reduced consumer spending, further dampening economic growth.

Impact on Key Sectors of the Amsterdam Stock Exchange (AEX)

The 7% drop in the Amsterdam market hasn't been uniform across all sectors. The technology sector, highly reliant on global supply chains, has experienced some of the sharpest declines. Financial institutions, sensitive to market volatility and investor sentiment, have also been significantly impacted. The energy sector, often vulnerable to geopolitical risks, has also shown signs of weakness.

Visual representations of the market performance (charts and graphs) would be included here in a published article.

- Sharp declines in technology stocks: Global supply chain disruptions have directly impacted the profitability of Dutch tech companies.

- Reduced investor confidence in financial institutions: The uncertainty surrounding future economic prospects has led to a cautious approach among investors.

- Energy sector vulnerability to geopolitical risks: The energy sector is particularly sensitive to global political instability and trade disputes.

Investor Sentiment and Market Volatility

The prevailing sentiment among investors in the Amsterdam market is one of caution and uncertainty. Market volatility has increased dramatically, reflecting the heightened risk aversion among investors. Many are employing risk-mitigation strategies, such as shifting investments towards safe-haven assets like government bonds.

- Increased demand for safe-haven assets: Investors are seeking shelter from the storm by investing in less volatile assets.

- Reduced trading volumes: The uncertainty is causing many investors to adopt a wait-and-see approach, reducing trading activity.

- Increased market uncertainty: The overall outlook remains uncertain, leading to increased market volatility and price fluctuations.

Potential Long-Term Economic Consequences

The current market downturn in Amsterdam poses significant risks to the Dutch economy. The potential for job losses in affected sectors is a serious concern. Reduced consumer spending, a direct consequence of decreased consumer confidence, will further dampen economic growth. The Dutch government is likely to implement policy responses to mitigate the impact, but the long-term consequences remain uncertain.

- Potential job losses in affected sectors: Businesses facing reduced demand and increased costs may be forced to lay off employees.

- Slower economic growth: The downturn could significantly reduce overall economic growth in the Netherlands.

- Reduced consumer spending: Uncertainty and fear of job losses lead to reduced consumer spending.

- Government policy responses to mitigate the impact: The Dutch government is expected to announce measures to support businesses and stimulate economic growth.

Conclusion: Analyzing the Amsterdam Market Downturn and Looking Ahead

The 7% drop in the Amsterdam market is largely attributable to escalating trade war fears, creating significant uncertainty and impacting key sectors. Investor sentiment is understandably subdued, and the potential long-term economic consequences for the Netherlands are considerable. Staying informed about developments in the Amsterdam stock market and the evolving global trade landscape is crucial. For further insight into the implications of trade wars and their impact on Amsterdam market performance, consult resources from reputable financial news outlets and economic analysis firms. Continuously monitor for updates regarding Amsterdam market fluctuations to make informed decisions. Understanding the complexities of the Amsterdam market and its vulnerability to global trade dynamics is key to navigating this period of uncertainty.

Featured Posts

-

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Their Significance

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Their Significance

May 25, 2025 -

Escape To The Country Choosing The Right Location For You

May 25, 2025

Escape To The Country Choosing The Right Location For You

May 25, 2025 -

News Corp A Deeper Look At An Underappreciated Media Giant

May 25, 2025

News Corp A Deeper Look At An Underappreciated Media Giant

May 25, 2025 -

Investment Opportunity Apple Stock Projected To Hit 254 Buy At 200

May 25, 2025

Investment Opportunity Apple Stock Projected To Hit 254 Buy At 200

May 25, 2025 -

Bengalurus Newest Destination The Official Ferrari Service Centre

May 25, 2025

Bengalurus Newest Destination The Official Ferrari Service Centre

May 25, 2025

Latest Posts

-

The 3 Billion Question Understanding Sses Spending Reduction Strategy

May 25, 2025

The 3 Billion Question Understanding Sses Spending Reduction Strategy

May 25, 2025 -

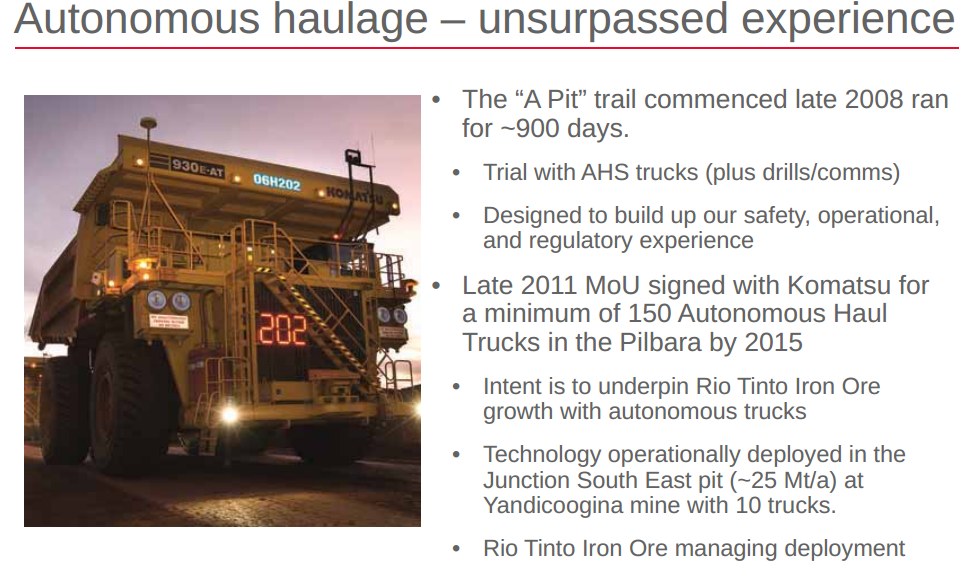

Pilbaras Future Rio Tintos Response To Environmental Concerns Raised By Andrew Forrest

May 25, 2025

Pilbaras Future Rio Tintos Response To Environmental Concerns Raised By Andrew Forrest

May 25, 2025 -

Andrew Forrests Pilbara Claims Rio Tintos Defence And Environmental Strategy

May 25, 2025

Andrew Forrests Pilbara Claims Rio Tintos Defence And Environmental Strategy

May 25, 2025 -

Rio Tintos Pilbara Operations A Response To Environmental Criticism

May 25, 2025

Rio Tintos Pilbara Operations A Response To Environmental Criticism

May 25, 2025 -

Sse Announces Significant Spending Cuts Amidst Economic Slowdown

May 25, 2025

Sse Announces Significant Spending Cuts Amidst Economic Slowdown

May 25, 2025