Investment Opportunity: Apple Stock Projected To Hit $254 - Buy At $200?

Table of Contents

Apple's Current Market Position and Future Projections

Apple's continued success hinges on its strong financial performance and exciting product pipeline. Let's delve into the details.

Strong Financial Performance

Apple consistently delivers impressive financial reports. Recent quarters have shown record-breaking revenue, driven by several key factors:

- Record-breaking iPhone sales: Despite market saturation concerns, Apple continues to dominate the premium smartphone market, generating substantial revenue.

- Growth in services revenue: Apple's services ecosystem, including Apple Music, iCloud, Apple TV+, and Apple Arcade, is a significant and rapidly growing revenue stream, demonstrating the company's ability to generate recurring income.

- Expanding wearables market: Apple Watch and AirPods sales continue to surge, showcasing Apple's success in expanding into new product categories and creating a strong ecosystem of connected devices.

[Insert chart showing Apple's revenue growth over the past 5 years, clearly labeled and sourced] This data clearly illustrates Apple's Apple revenue growth and its strong financial position, bolstering its Apple stock performance. Analyzing Apple financial reports reveals a company well-positioned for continued growth.

Innovation and Product Pipeline

Apple's commitment to innovation is a key driver of its future growth. The company's product pipeline hints at exciting possibilities:

- New iPhone models: Annual iPhone releases continue to generate significant excitement and drive sales. Expected improvements in camera technology, processing power, and features will likely maintain strong demand.

- Advancements in AR/VR technology: Rumors and speculation around Apple's entry into the augmented and virtual reality markets suggest significant potential for future growth. This new product category could significantly impact Apple stock performance.

- Potential for new product categories: Apple consistently surprises the market with new product categories and innovations. The potential for future breakthroughs represents considerable upside for Apple stock investment. This continuous Apple innovation ensures a robust Apple product pipeline.

Analyst Predictions and Price Targets

Several reputable analyst firms have issued bullish predictions for Apple's stock price. While these are not guarantees, they provide valuable insight:

- Goldman Sachs: (Insert Goldman Sachs's price target and rationale)

- Morgan Stanley: (Insert Morgan Stanley's price target and rationale)

- JPMorgan Chase: (Insert JPMorgan Chase's price target and rationale)

These varying Apple stock price predictions, while spanning a range, collectively point towards a positive outlook for the Apple stock target price. Analyzing Apple stock analyst ratings gives a broader perspective on investor sentiment.

Risks and Considerations Before Investing in Apple Stock

While the outlook is positive, it's crucial to acknowledge potential risks before investing in Apple stock.

Market Volatility and Economic Factors

External factors can significantly impact Apple's stock price. It's important to be aware of:

- Inflation: Rising inflation can impact consumer spending and reduce demand for Apple products.

- Recessionary fears: Economic downturns can negatively affect consumer confidence and spending, potentially impacting Apple's sales.

- Geopolitical instability: Global events can disrupt supply chains and negatively impact Apple's operations.

These factors represent potential risks to Apple stock and highlight the importance of monitoring broader market trends. Understanding the economic impact on Apple stock is crucial for informed investment decisions. The inherent Apple stock risk should be carefully considered.

Competition and Market Saturation

Apple faces competition from established players and emerging challengers:

- Samsung: Remains a major competitor in the smartphone market.

- Google: Google's Android operating system and its Pixel phones represent a significant competitive threat.

- Other tech companies: Other companies continually strive to innovate and challenge Apple’s market dominance.

This Apple competition, coupled with potential market saturation, could put pressure on Apple's future growth and Apple market share.

Diversification and Investment Strategy

Never put all your eggs in one basket! Relying solely on one stock, even a seemingly strong performer like Apple, is risky.

- Diversify your portfolio: Spread your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to reduce risk.

- Develop a long-term investment strategy: Don't panic sell during market downturns. A long-term perspective is crucial for weathering market volatility.

Effective risk management and a sound investment strategy are vital for any investor. Portfolio diversification is essential for mitigating the risks inherent in any single stock investment.

Determining Your Investment Strategy for Apple Stock

Investing in Apple stock requires careful consideration of your personal circumstances and investment goals.

Evaluating Your Risk Tolerance

Before investing, honestly assess your risk tolerance:

- Long-term vs. short-term investment: Are you investing for retirement, or do you need the money in the near future? Your investment timeline directly impacts your risk tolerance.

- Comfort level with potential losses: Understand that stock prices fluctuate, and you could lose some or all of your investment.

Your risk tolerance should guide your investment timeline for your Apple stock long-term investment or short-term trading strategy.

Setting Realistic Financial Goals

Define clear, measurable, achievable, relevant, and time-bound (SMART) financial goals:

- Investment objectives: What are you hoping to achieve with this investment? (e.g., retirement savings, down payment on a house).

- Return on investment expectations: What rate of return do you realistically expect?

Your financial goals and investment objectives should shape your Apple stock return on investment expectations.

Research and Due Diligence

Before making any investment, conduct thorough research:

- Analyze financial statements: Review Apple's financial reports and understand its performance.

- Read analyst reports: Consult reputable financial news sources and analyst reports.

- Use investment tools: Utilize online tools and resources to track Apple's stock price and performance.

Thorough investment research and careful due diligence are critical for making informed Apple stock analysis and investment decisions.

Conclusion

The projected rise of Apple stock to $254 presents a compelling Apple stock investment opportunity, but it's crucial to carefully weigh the potential rewards against the inherent risks. Thorough research, understanding your risk tolerance, and a well-defined investment strategy are essential before investing in Apple stock or any other asset. Remember to diversify your portfolio to mitigate risk. Make informed decisions based on your individual circumstances and consult with a financial advisor if needed. Is Apple stock the right investment for you? Begin your due diligence on this potential Apple stock investment today!

Featured Posts

-

Escape To The Country A Comprehensive Relocation Checklist

May 25, 2025

Escape To The Country A Comprehensive Relocation Checklist

May 25, 2025 -

Growth And Partnership Bangladeshs Renewed Presence In Europe

May 25, 2025

Growth And Partnership Bangladeshs Renewed Presence In Europe

May 25, 2025 -

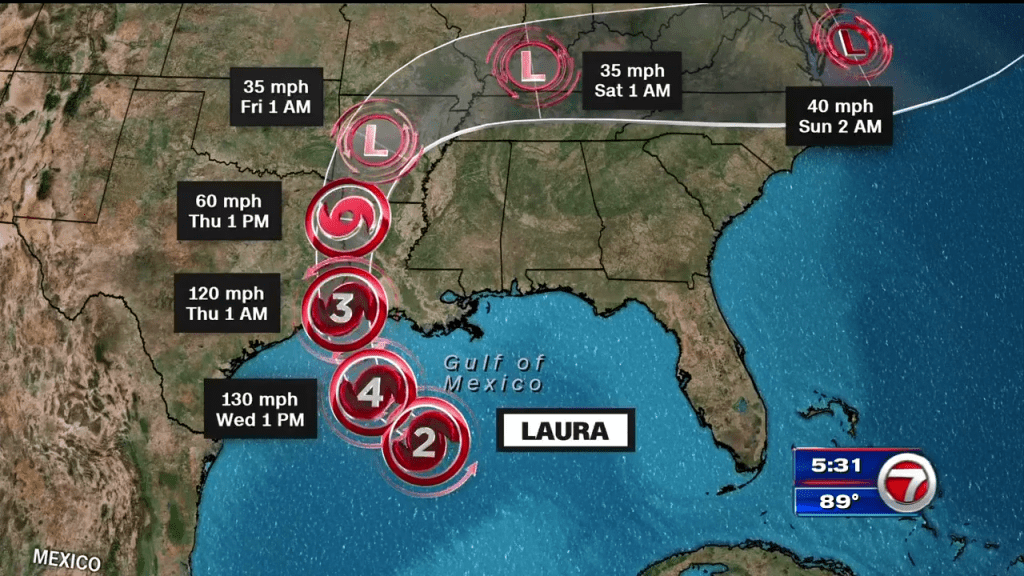

Flash Floods Recognizing The Signs Heeding The Warnings And Staying Safe

May 25, 2025

Flash Floods Recognizing The Signs Heeding The Warnings And Staying Safe

May 25, 2025 -

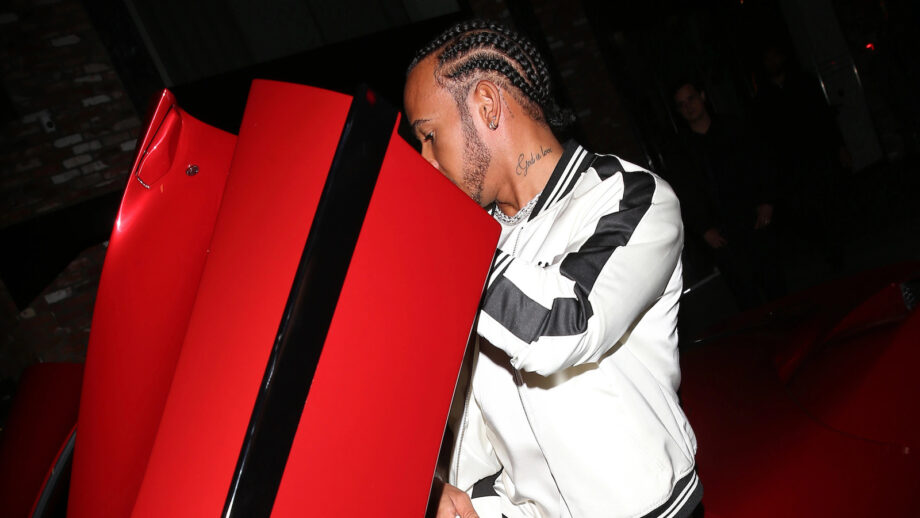

Ferrari Boss Condemns Lewis Hamiltons Controversial Statements

May 25, 2025

Ferrari Boss Condemns Lewis Hamiltons Controversial Statements

May 25, 2025 -

Frances National Rally Assessing The Impact Of Le Pens Sunday Demonstration

May 25, 2025

Frances National Rally Assessing The Impact Of Le Pens Sunday Demonstration

May 25, 2025

Latest Posts

-

Canada Post Strike Threat A Warning For Customers

May 25, 2025

Canada Post Strike Threat A Warning For Customers

May 25, 2025 -

Flash Flood Safety Understanding Alerts And Protecting Yourself And Your Family

May 25, 2025

Flash Flood Safety Understanding Alerts And Protecting Yourself And Your Family

May 25, 2025 -

Preparing For Flash Floods A Guide To Flood Warnings And Emergency Response

May 25, 2025

Preparing For Flash Floods A Guide To Flood Warnings And Emergency Response

May 25, 2025 -

Is A Canada Post Strike Imminent The Customer Perspective

May 25, 2025

Is A Canada Post Strike Imminent The Customer Perspective

May 25, 2025 -

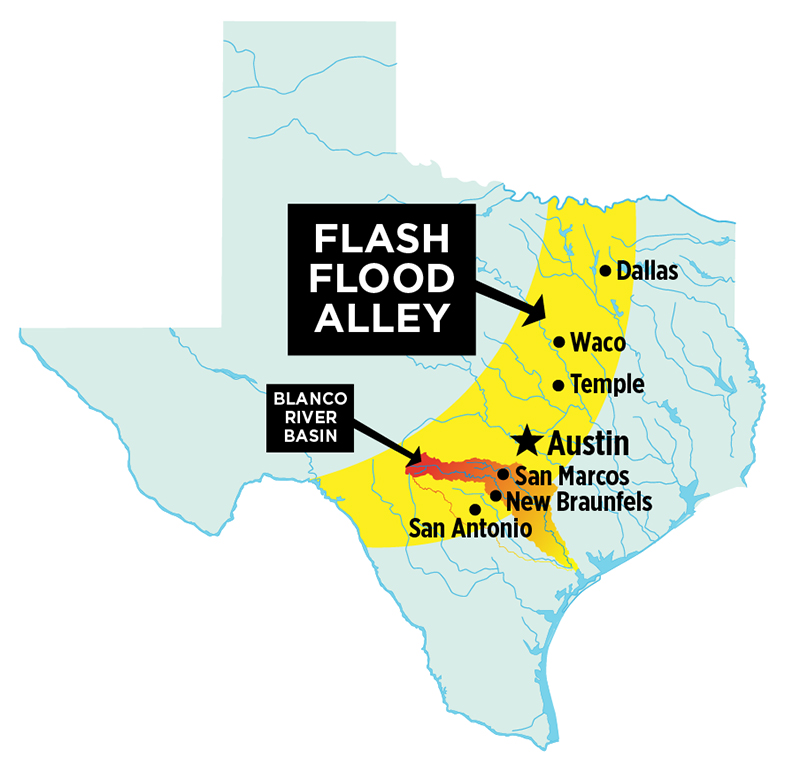

Texas Flash Flood Warning Urgent Alert For North Central Region

May 25, 2025

Texas Flash Flood Warning Urgent Alert For North Central Region

May 25, 2025